BoE Review: Data Dependent Easing Bias Clearer?

There was little surprise that Bank Rate was kept at 5.25% for the sixth successive MPC meeting, nor that the dissent in favor of an immediate rate cut doubled to two as a result of Dep Gov Ramsden confirming more dovish leanings. The updated projections at least validated the rate path discounted by markets, with below target inflation, this possibly suggesting larger easing than the two moves this year, something that chimed with Governor Bailey remarks that market rate pricing may be too cautious. He also accepted that a rate cut at the next MPC verdict on June 20 was a distinct possibility, but underscored the key new phrase in the Monetary Policy Summary, which highlighted the importance of the data due in the interim. We think that forthcoming CPI and labor market data will help unlock a rate cut in June, thinking that the less-clear disinflation seen in recent adjusted numbers is more noise than trend. Indeed, we stick with a cumulative reduction of 100 bp by year end.

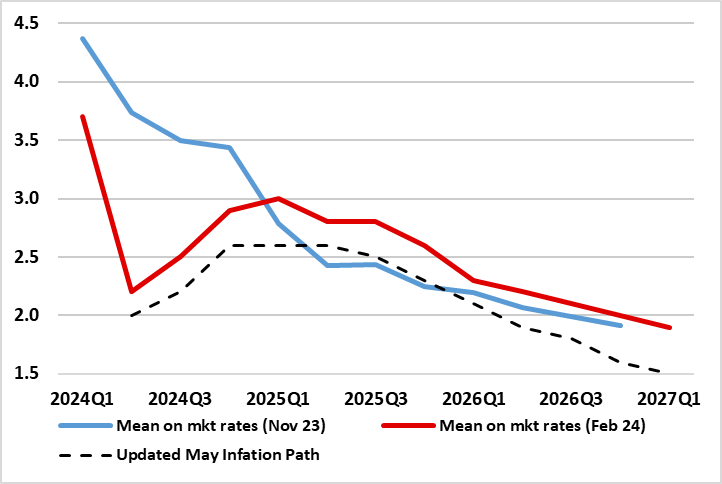

Figure 1: A Softer Inflation Profile and to Below-Target?

Source: BoE

More Excess Supply

We think that even such a rate cut profile would still leave policy restrictive and thus bearing down on inflation further. Ii is notable that despite modest upgrades to the real GDP outlook, the BoE has actually revised up its assessment of excess supply over the coming 2-3 years. Thus, it is not surprising that the BoE inflation profile has been revised down. Basically, with the main path based around two 25 bp cuts this year, this results in marked downward revisions to the price outlook and actually sustained below target inflation two years hence (Figure 1), this at least validating that rate path, if not suggesting markets may be a little behind the curve – as Bailey hinted at.

Key Inflation Reassessments

However, two key MPC reassessments have added to this softer inflation outlook. Firstly, came an acknowledgement that the feed-though from the recent surge in import prices has occurred faster than previously assumed and thus is now likely to have less of a further potential inflationary impact ahead. Secondly, the BoE seems to think any second-round effects from high CPI inflation into wages may now fade faster than previously thought. All of which helps explain the overall greater overall confidence in a softer inflation outlook and with risks much more balanced.

MPC Divisions Continue

But especially in regard to these reassessments, it is clear that MPC thinking is in state of flux with the minutes to the May meeting suggesting that, over and beyond the 7:2 overall vote, there were continued and clear differences in the assessment of persistent inflation risks. Indeed, dominating BoE thinking still is this focus on assessing how ‘persistent’ are price pressures. In this regard we do note better inflation indicators even for seemingly resilient services. Indeed, while not matching the slump in non-energy industrial goods inflation, the pace of the recent fall is actually much greater when looked at using more short-term dynamics (Figure 2) which exclude current marked adverse base effects. Using a 3-month annualized seasonally adjusted rate (ie a measure that the BoE seems to be embracing increasingly of late), services inflation is now running at just over 4%, having halved in the last year, encompassing an average m/m drop of 0.5 ppt, around twice the rate at which services rose to the May 2023 peak. Admittedly, there have been hints of a somewhat less-clear disinflation seen in recent adjusted numbers but regard this (at least at the current juncture) as more noise than trend. Notably, is assessing how high the bar is for a possible rate cuts, the BoE is projecting that current services inflation (at 6% in y/y terms) falls to 5.3% in the May data due just before the next policy verdict!

Figure 2: Current Fall in Services Inflation Faster than the Surge

Source; ONS, CE

Downside Growth Risks Remain

We remain cautious about the economic outlook and note the much gloomier assessment of the consumer side outlined by the BoE agents in the MPR. This was candid in stressing subdued current consumer demand that is widespread across the retail and service sectors. While some of the weakness in spending in 2024 Q1 owed to poor weather, the Agents pointed to a sense that underlying demand has weakened, although contacts are unsure as to the reason. We think that this may (at least partly) reflect a further and also sizeable –and possibly more prolonged – hit to spending power now hitting those renting as rent inflation has risen to a 30-year high of over 7% and may remain elevated. We also note still weak monetary data as a threat or symptom of weak demand. Notably the MPR has a special section on the monetary side. It concluded that the historical relationships between money growth and nominal spending could suggest that the recent weakness in money growth could potentially result in weakness in nominal spending and inflation!