Asia/Pacific (ex-China/Japan) Outlook: Growth Momentum but Delayed Rate Cuts

• Economic activity in emerging Asian economies is forecast to remain strong. Despite several challenges, including a tight oil market, constrained liquidity conditions, and delayed rate cuts, the region's economic activity is expected to show resilience. Other potential obstacles include unbalanced growth in China, climate change-related incidents, and supply chain disruptions resulting from the Red Sea crisis.

• The resurgence in global demand for electronics is expected to be sustained over 2024 and 2025, boosting regional trade. Additionally, the anticipated easing of monetary policies in the U.S. and Europe is expected to create room for policy adjustments in Asia in Q4-2024, fostering optimism toward emerging markets in the region.

• With elections now concluded across major emerging Asian economies, the policy focus is expected to turn to fiscal consolidation and infrastructure growth. Business policy continuity is expected across Asian emerging markets, especially as Prime Minister Narendra Modi returned to power for a third term. In the second half of 2024, growth is expected to be driven by interest rate cuts, private investment, government spending and consumer spending.

• A significant decline in inflation is unlikely due to persistent pressures from food prices, which could dampen consumer confidence. Renewed currency vulnerabilities may exacerbate this situation. Furthermore, global supply chain disruptions resulting from Middle East conflicts are likely to hinder Asia's exports, leading to escalating transportation costs and delayed orders, posing a modest downside risk to the region's economic performance.

• Central banks are likely to exercise caution in implementing monetary easing measures early or rapidly due to concerns about currency depreciation and potential inflation risks stemming from disruptions in global shipping and other geopolitical events. Consequently, it is expected that interest rate cuts will commence across the region in Q4-2024, with any adjustments being gradual.

• Forecast changes: Higher-than-expected growth in India has prompted an upward revision to our forecast. Meanwhile, Indonesia is expected to face slightly lower inflation than previously forecasted. On the policy front, we now expect only one policy cut in both India and Indonesia of 25bps each.

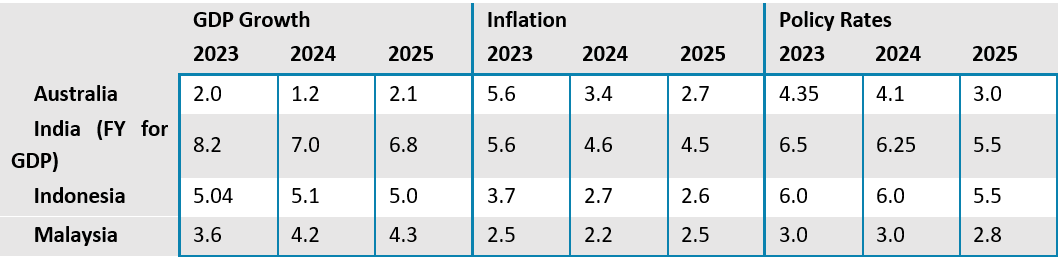

Our Forecasts

Source: Continuum Economics

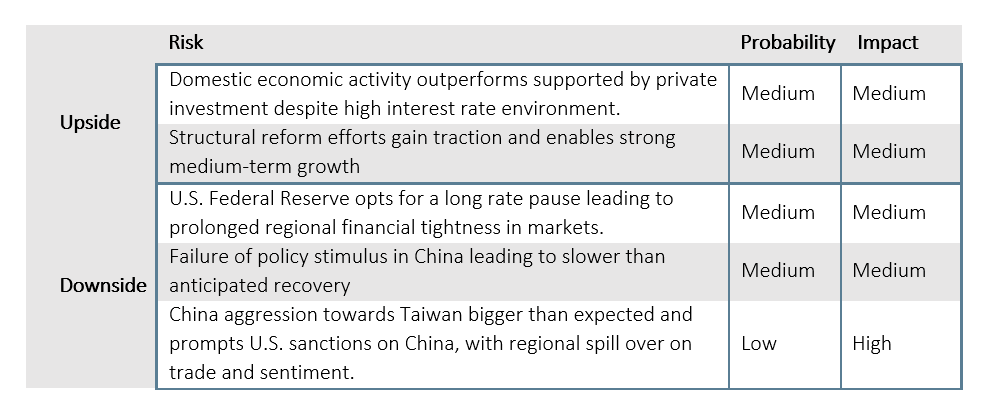

Risks to Our Views

Source: Continuum Economics

Asia is set to experience significant economic shifts in 2024 and 2025. The region is expected to record the fastest growth as it includes some of the world's fastest-growing economies and is home to a variety of industrial and technological powerhouses. As we look ahead, several emerging trends will shape the economic landscape of Asia over the medium term.

Figure 1: Real GDP Growth Forecast 2024 (% change, yr/yr)

Source: Continuum Economics

Asian economies are projected to maintain robust growth trajectories, albeit at varying paces. Countries like India and Indonesia will lead with strong growth rates due to their large domestic markets and ongoing structural reforms. India's GDP growth is expected to be around 7% in FY25, while Indonesia’s economic activity is projected to experience a modest increase, with a stable GDP growth rate around 5% in 2024 and 5.1% in 2025, supported by sustained investment in industries related to hard commodities and tourism. In contrast, other economies such as Bangladesh and Pakistan may see slower growth rates, reflecting economic challenges. Meanwhile, Vietnam and South Korea will see sustained growth. Overall, these countries will continue to play pivotal roles in global supply chains and technological innovation. With elections now over across Asian economies (with the exception of Sri Lanka), the government’s focus will turn towards economic policy and ensuring domestic growth.

Structural Reforms and Infrastructure Investment

Emerging Asia's economic growth will be underpinned by continued structural reforms and infrastructure investments. Indonesia, for example, will focus on infrastructure development and the downstream expansion of heavy industry, particularly in the production of batteries for electric vehicles (EVs). However, stronger growth in Indonesia is contingent on China’s economic performance. Stronger than expected performance in China will bolster Indonesia’s prospects over the medium term.

India's government will prioritise infrastructure development to bolster manufacturing growth, with significant investments in transport, logistics, and digital infrastructure. Government initiatives like the Production Linked Incentive (PLI) schemes will promote key sectors such as electronics, pharmaceuticals, and automotive parts, supporting industrial growth. The government’s focus on building roads and providing housing for the poor will also see construction sector growth sustain over the two years. India’s focus on logistic development will also be instrumental in supporting growth. But given a weaker mandate in the latest elections, the government will find it challenging to pass critical reforms pertaining to land and agriculture. Land acquisition continues to be a major impediment to industrial and infrastructure growth and a reform on this end will be difficult for the government to pass.

Meanwhile, Malaysia is also poised for steady growth, driven by a recovery in the global electronics cycle. The implementation of the New Industrial Master Plan 2030 (NIMP2030) will also enhance the manufacturing sector's value-added. However, a large part of Malaysian government’s focus will be on the fiscal policy reform. The government will undertake subsidy rationalisation, which could free funds for infrastructure development, in our view.

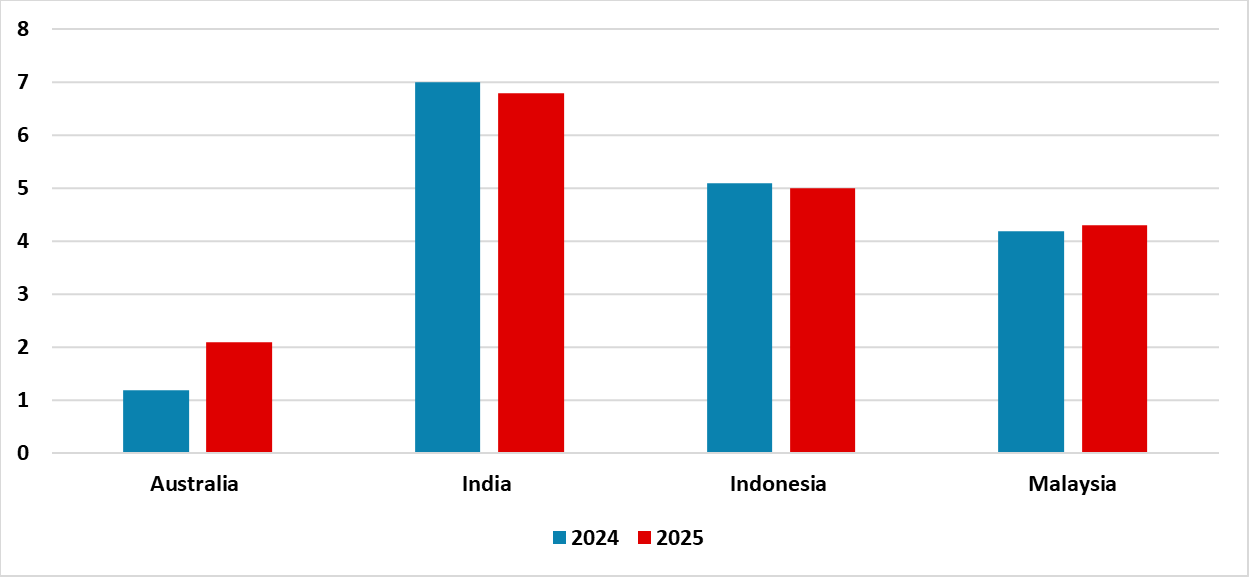

Figure 2: Tourist Arrival Trends In Asia (persons)

Source: Continuum Economics

A large part of emerging Asia’s growth will also stem from strong services growth. Tourism will be a key performance area. Latest statistics from across Asian economies suggest a revival in tourism. Indonesia has seen strong international tourist arrivals over Q1-2024, while India’s air passenger traffic continues to be rising steadily. Similar trends have been observed in Malaysia and Vietnam. Malaysia saw foreign tourist arrival growth of 32.5% yr/ yr in Q1-2024. Various countries across Asia are also providing visa-free / visa on arrival benefits to boost tourism, which appear to be yielding tangible benefits. Tourists from China continue to recover, though this remains a multi-year process for foreign travel.

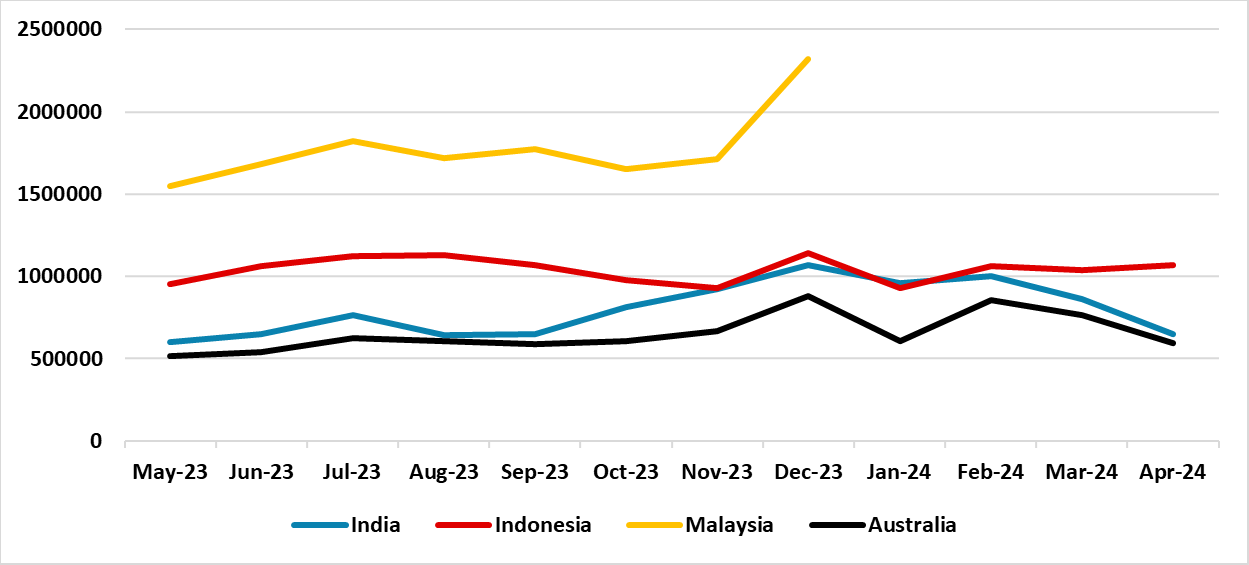

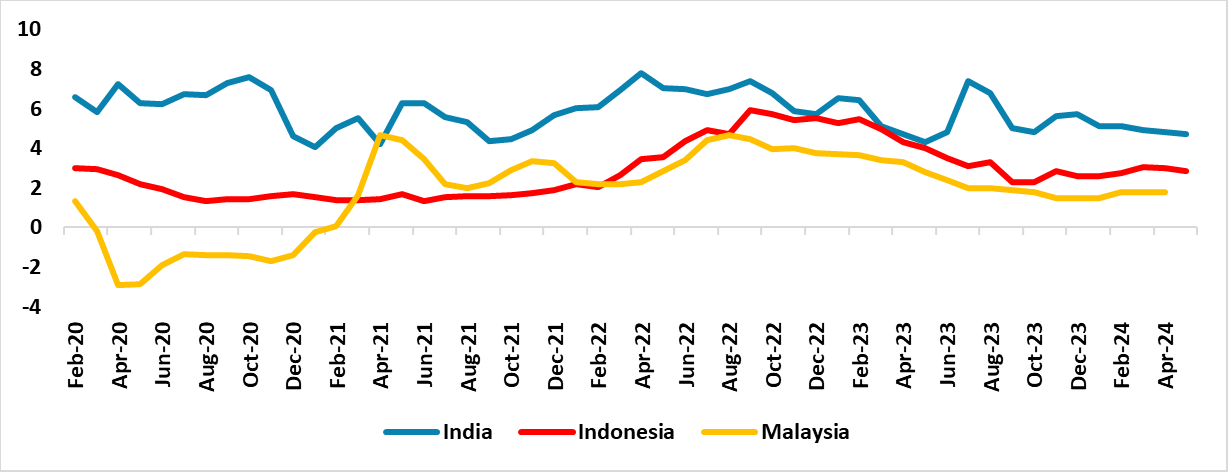

Figure 3: Asia Inflation Trajectory (% change, yr/yr)

Source: Continuum Economics

Inflation will remain a critical concern across Asia, influencing monetary policy decisions. Indonesia and India are expected to see inflation within manageable ranges, but both countries will remain watchful. India’s consumer prices remain sticky, while Indonesia lacks foreign exchange reserves to defend the Indonesian Rupiah as emerging market currencies come under pressure. In Australia too, inflation pressures persist. Therefore across these economies the central banks will likely delay any significant monetary easing until late 2024. Meanwhile, elsewhere in Asia, Sri Lanka is already on a monetary easing path to support economic recovery from its worst financial crisis. Malaysia, on the other hand, will hold rate steady over 2024, as inflation remains benign and it attempts to support both its currency and growth.

Figure 4: Benchmark Policy Rate (%)

Source: Reserve Bank of India, Bank Indonesia, Reserve Bank of Australia, Bank Negara Malaysia

Trade Dynamics and Global Integration

Asia's integration into the global economy continues to deepen, driven by strong trade linkages and participation in global supply chains. However, geopolitical tensions and shifts in global trade policies pose risks. For instance, Australia's commodity exports, particularly coal, remain strong, with demand from regional partners like Japan and China. However, slower global growth and subdued demand from China could impact export performance.

India will focus on signing more Free Trade Agreements to boost its manufacturing sector and benefit from global firms looking to diversify away from China. Such agreements will be crucial in enhancing India's integration into global value chains and driving industrial growth. In a similar vein, Indonesia and other smaller economies will also attempt to sign preferential trade agreements, and seek to attract businesses. It is noteworthy that even though India has a large demographic dividend and a supportive government policy, it cannot absorb all the business looking to move out of China. This is because India currently lacks high-skilled labour and sufficient infrastructure, including power generation. Therefore, as firms look to mitigate their single supplier risk and move part of their production out of China, not only India but Indonesia, Malaysia, Vietnam and Bangladesh are likely to benefit over 2024 and 2025.

Indonesia: Tailwinds From Tourism

Indonesia, the largest and most populous economy in Southeast Asia, is heavily reliant on the production and processing of domestically sourced raw commodities such as coal, palm oil, and nickel, is poised for nuanced shifts in its economic trajectory. The recent general election in February saw Prabowo Subianto succeed Joko Widodo as president. This transition in leadership signals a blend of continuity and subtle change in economic policy. Subianto is inheriting a strong economy with favourable public finances and strong demographic dividend. Nonetheless, Indonesia, as seen elsewhere in Asia, requires policy reform to make the best of this demographic dividend. Therefore, on the policy front, changes are expected under the Subianto administration over the medium term. For now, the government will focus on near term targets.

The fiscal landscape under Mr. Prabowo's administration is poised for careful adjustments. The government’s budget deficit is expected to improve this year, supported by higher tax revenue resulting from expanded economic activity and new taxes, such as those on e-cigarettes, social housing etc. Additionally, the new government has hinted at subsidy withdrawal, particularly fuel subsidies. It is worth noting though that the government recently extended the rice distribution programme till the end of 2024. The impact of this though will likely be limited given sufficient buffer stocks. The country will prioritise food security through price stability initiatives and increased agricultural output, with Mr. Prabowo pledging to improve food affordability, including the provision of free meals to students.

In terms of economic growth, Indonesia’s economic activity is projected to experience a modest increase in 2024, particularly in the second half of the year. The GDP growth rate is forecast to remain stable over 2024 at 5% yr/yr. Key drivers of this growth include sustained investment in industries related to hard commodities and an uptick in base metal exports, despite global price adjustments.

The incoming administration under Mr. Prabowo is set to maintain a strong focus on infrastructure development and the downstream expansion of heavy industry, particularly in the production of batteries for electric vehicles (EVs). These sectors are anticipated to attract significant investment, bolstering economic growth and reinforcing policy continuity from the Jokowi administration. However, poor infrastructure and a lack of a skilled workforce could impede foreign investment, particularly in high-value manufacturing sectors. These issues could hinder Indonesia's competitiveness relative to its ASEAN peers. The capital relocation to Nusantara, Indonesia’s new capital in East Kalimantan, too will be slow. While infrastructure development remains a priority, progress is expected to be gradual, with the completion of key structures and civic buildings likely delayed until at least 2025. Jakarta will continue to be the economic hub for the foreseeable future. Nonetheless, tailwinds from tourism are expected. Tourism demand is expected to boost growth over 2024. Foreign tourists arrival growth was at 24.9% yr/yr in the Jan-Apr 2024 period. Indonesia’s tourism sector also secured US$ 3.6bn in investment in 2023. Looking ahead, Indonesia’s growth is likely to remain stable around the 5.1% yr/yr mark in 2025.

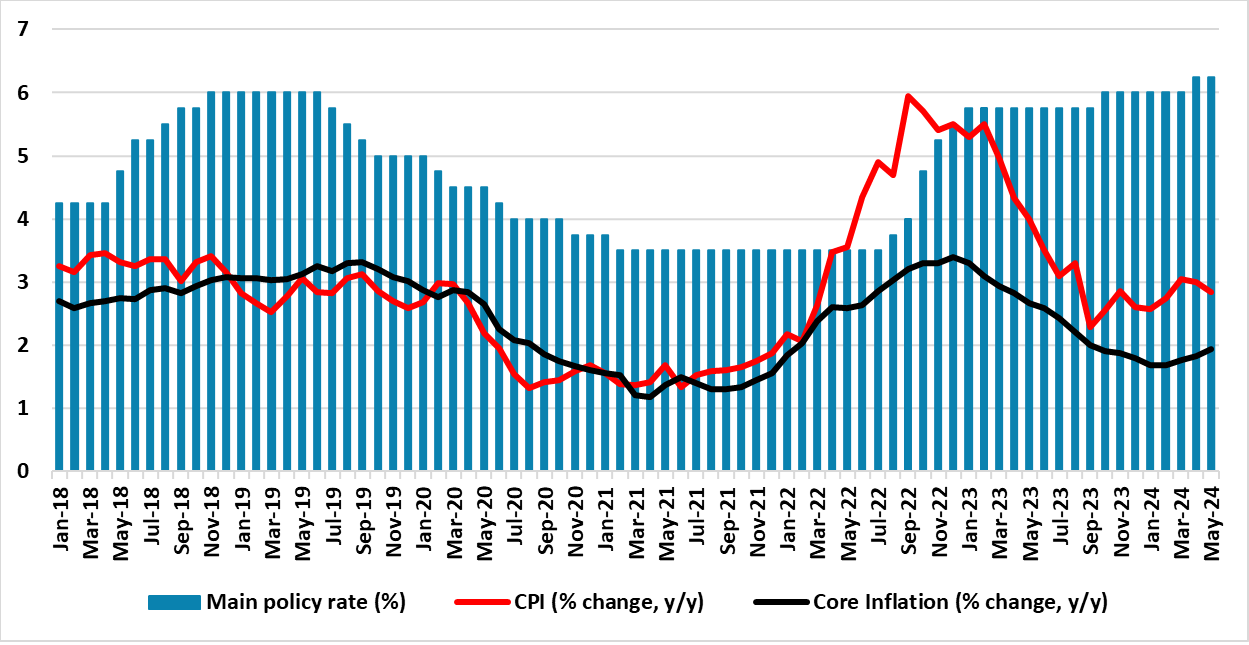

Inflation is expected to average 2.7% in 2024, within Bank Indonesia (BI's) target range of 1.5-3.5%, before stabilising around 2.6% in the medium term (2025). With the impact of the El Niño abating, food prices are expected to ease over H2 2024. The government has extended the rice distribution programme, which will also support overall price stability. Risks to inflation stem from geopolitical tensions driving up commodity prices and a weakening IDR, which could feed through as imported inflation. It is worth noting that the IDR has come under pressure in recent months, as the Federal Reserve delays its rate cuts. With Indonesia’s trade surplus declining steadily, given slow global growth and subdued Chinese demand, the IDR will continue to face pressure over 2024.

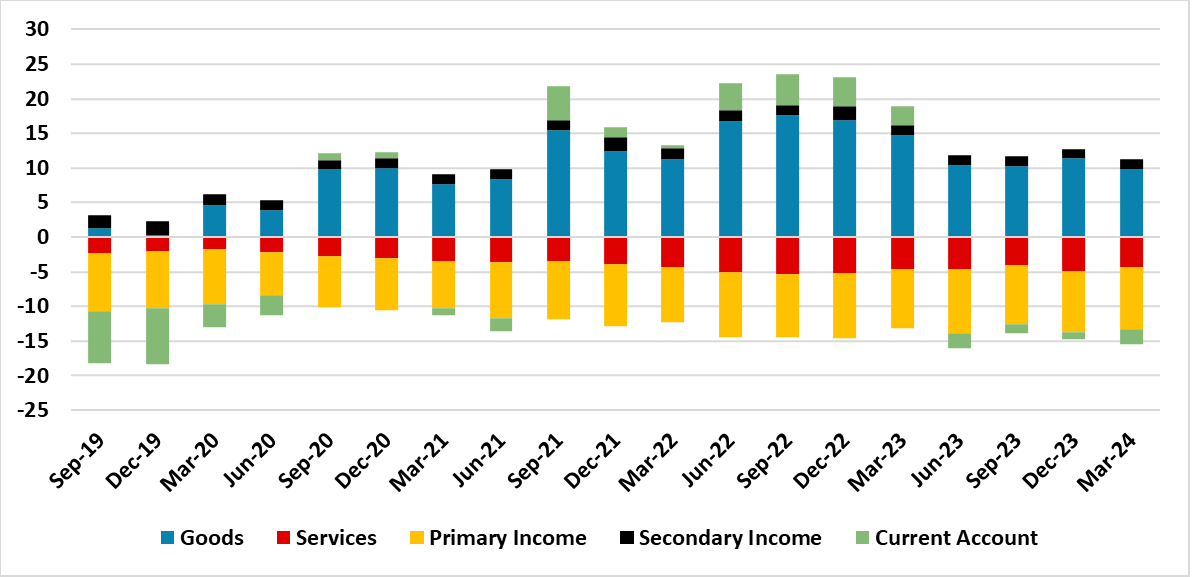

Figure 5: Indonesia Current Account (in US$ bn)

Source: Continuum Economics

Meanwhile, on the monetary policy front, Bank Indonesia (BI), the central bank, is likely to remain under pressure over 2024, as it attempts to support the Indonesian Rupiah (IDR). Following a recent rate increase in April, BI is expected to maintain its key policy rate at 6.25% until the fourth quarter of 2024. Although, inflation remains manageable, growth is likely to become a concern towards Q4-2024. With inflationary pressures easing and growth concerns rising, BI is likely to begin reducing the policy rate in late 2024 and early 2025, albeit cautiously, given the ongoing depreciation of the local currency. BI will likely cut its policy rate by 25bps in end-2024, and another small rate cut in early 2025. Policy rate is expected at 6% in end-2024 and 5.5% in 2025.

Figure 6: Indonesia Inflation, Core Inflation and Main Policy Rate (%)

Source: Continuum Economics

India’s Policy to Pivot Towards Current Spending

India, one of the world's fastest-growing emerging economies, is set for robust growth in 2024-25. The coalition government led by the Bharatiya Janata Party (BJP) will ensure political stability and policy continuity. Nevertheless, the influence of regional parties at the state level could lead to occasional policy disputes, as the BJP no longer enjoys a complete single party majority. Therefore, while business policies are expected to remain the same under this government, the fiscal policy is likely to pivot towards current spending, directing a portion of funds away from infrastructure.

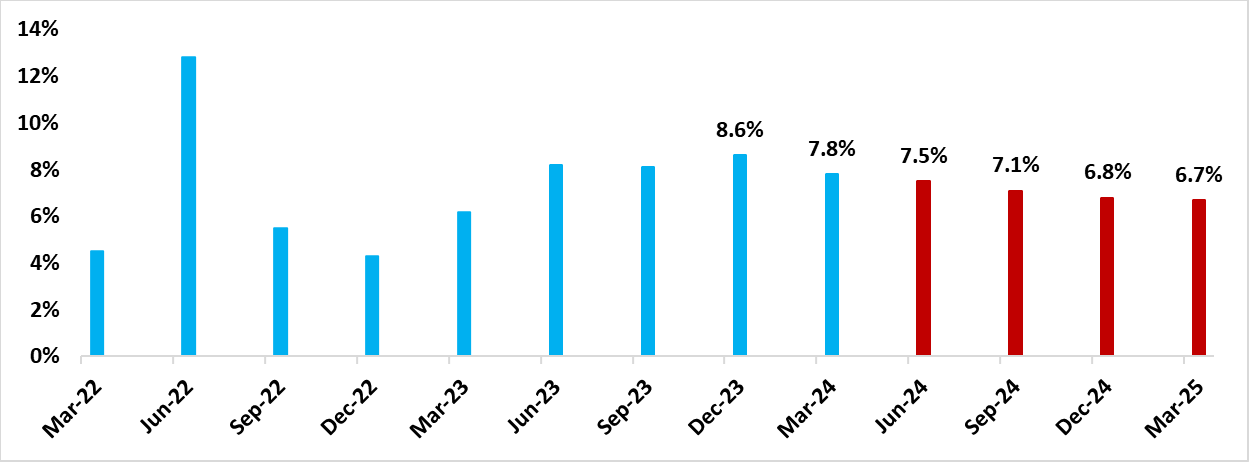

Figure 7: India GDP Forecast (% change, y/y)

Source: Continuum Economics, MOSPI

On the growth front, real GDP in India is forecast to decelerate to 7% yr/yr in FY25 (Apr 24-Mar 25) from 8.2% yr/yr in FY24. This slowdown is attributed to normalising consumption patterns, higher borrowing costs dampening investment and weakened external demand. Despite this, the government's substantial capital expenditure will provide a floor under growth. The services and industry sectors will continue to be the primary drivers of this economic expansion. In particular, the services sector will remain resilient, fuelled by high demand in retail trade, telecommunications, software services, commercial property, and travel. Meanwhile, manufacturing will see support from easing commodity prices, though rising crude oil prices and elevated freight costs may pose challenges, especially in electronics, automotive, and capital goods.

The government’s focus on infrastructure development is expected to bolster manufacturing growth. Priorities include enhancing transport, logistics, and digital infrastructure. Government initiatives, such as the Production Linked Incentive (PLI) schemes, will promote sectors like electronics, pharmaceuticals, batteries, solar panels, automotive parts, and specialty steel. Growth is expected to moderate further to 6.8% yr/yr in FY26. However, trends in India’s industrial growth are concerning. Although India’s industrial growth in April was recorded at 5% yr/yr, this was mainly supported by mining and electricity output. Manufacturing sector growth eased to 3.9% yr/yr during the month. We anticipate this trend to reverse over Q2-FY25. Industrial growth also remained disrupted in April given elections across India and a persisting heatwave.

Weakening private consumption will see government policy pivot towards current spending over the remainder of FY25 and through FY26. However, this is unlikely to impact fiscal consolidation efforts in the ongoing year, especially as the Reserve Bank of India has provided the government a huge INR 2.1trn surplus transfer this fiscal year. The government’s ambitious infrastructure plans include constructing 20 million rural houses between 2024 and 2028, is expected to generate employment opportunities in construction and related sectors. On the external front, the government will focus on signing more Free Trade Agreements to boost its manufacturing. India will benefit from global firms looking to diversify away from China.

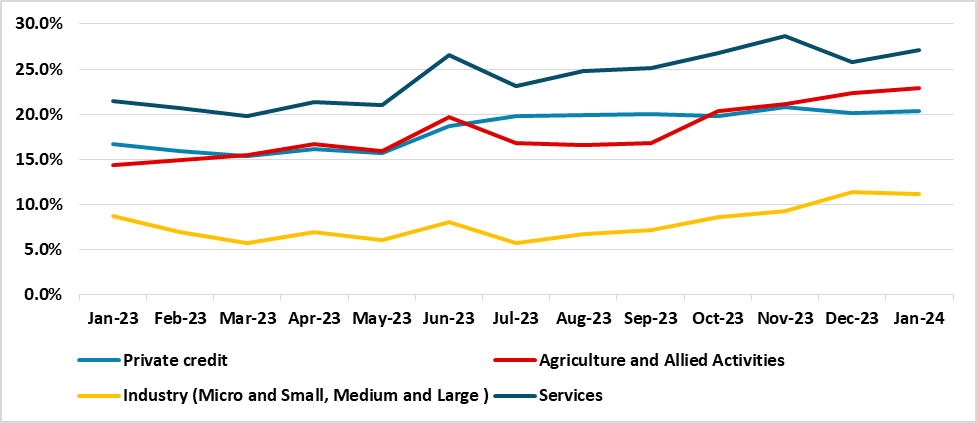

Figure 8: India private credit growth (%yr/yr)

Source: Reserve Bank of India

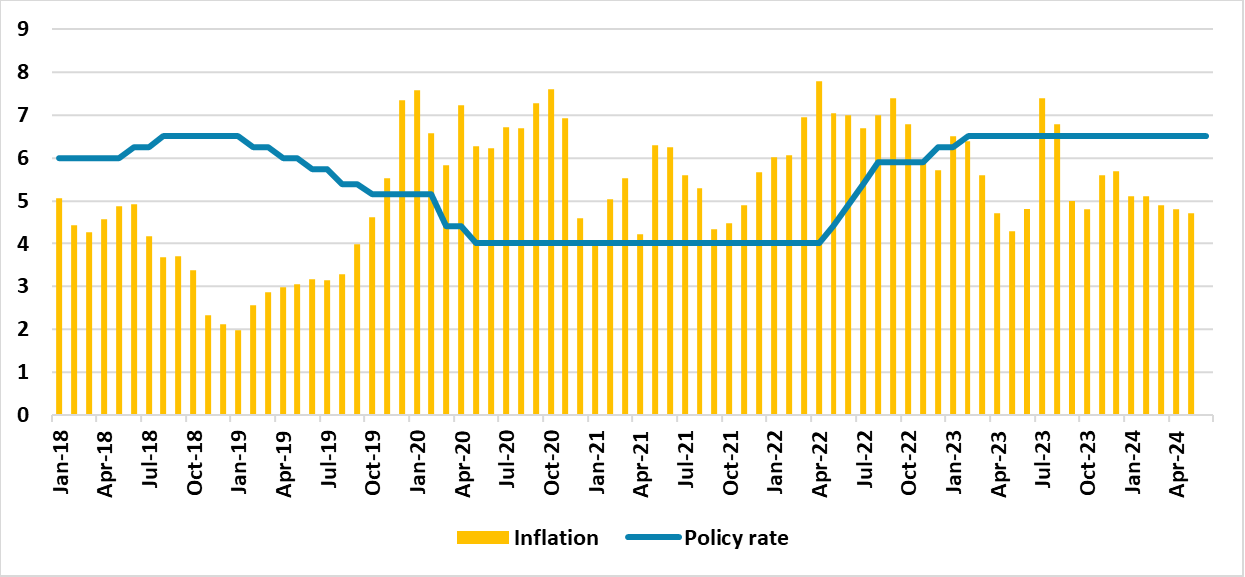

The Reserve Bank of India (RBI) is expected to maintain its policy interest rate at 6.5% until late 2024, despite weather-related inflation surges. While consumer price inflation is projected to remain elevated in 2024, primarily driven by food prices, it is anticipated to stay below the RBI’s 6% target, negating the need for further monetary tightening. Normal monsoon rains should help mitigate high food inflation in the second half of 2024, providing room for policy rate reductions starting in the last quarter of 2024. Inflation is expected to average 4.6% yr/yr in 2024, and decline to 4.5% yr/yr in 2025. India’s private credit growth also remains robust averaging 20% yr/yr in Jan-Apr 2024, which too will allow the RBI to continue to hold rates steady over Q3. In line with easing inflation and dimming growth impulse, we project the RBI to cut its policy rate by 25bps in Q4-2024, and thereafter two more rate cuts are expected over 2025. By the end of 2025, the policy rate is expected to decrease to 5.5%, alleviating some pressure on households and businesses.

Figure 9: India Inflation and Policy Rate Trajectory (%)

Source: Continuum Economics

Australia: Stubborn Inflation Pushes Easing Later

Domestic demand in Australia has begun to show signs of weakness as household savings have depleted (fell to 0.9% from 1.6% in Q1 2024) and inflationary pressure persists. Household spending has softened to 0.4% with recent import data also pointing towards weak domestic demand. However, the strength of Australian labor market has exceeded expectations and continue to be solid but it is hard to see a continuous uptrend. The still tight labor market has kept the wage price index inch close to its highest level at 4.1% y/y, but the pace of growth is expected to moderate in the coming quarter. Household balance sheets would remain restrained by mortgage payment in 2024, despite house prices recover after a brief correction from the peak, as RBA hints at keeping current rates longer to tame stubborn inflation. Real wage has moved to positive with Q1 CPI moderated to 3.6% y/y from 4.1% yet preliminary monthly CPI suggest the pace of further moderation would be much slower than expected and will limit the rebound in consumption if any. Although solid commodity prices are still supporting the Australian economy, short-term commodity export are seeing a slower growth after the boom in previous quarters. The RBA highlighted the uncertainty in global economic outlook and acknowledged the pace of moderation in CPI is much slower than anticipated. The RBA are trying to balance between inflation and economic growth with data dependency guiding their path but is going to have a hard time as the Australian economy weakens while CPI remains above target range in 2024. Our central economic forecast is unchanged and believe the Australian economic growth will tread lower till Q3 2024 when household consumption fares better on positive real wage and we now see the RBA only ease once in Q4 2024 to make sure inflation is back to target range in mid-2025.

Global long-term demand for Australian commodity remains solid with strong demand for Australian coal. Coal export has exceeded iron ore for the first time in decades. Regional DM (Japan and China) are the biggest customers and EM (Vietnam, Philippines and Thailand) are providing growing demand. While the Chinese property sector acquire less iron ore, other sectors within China seems to have covered the gap and create solid demand for Australian iron ore. However, the growth in demand is showing a certain level of softening as export contracted two months in a row after consecutive quarters of expansion. Overall, our GDP growth in 2024 has been revised slightly lower at 1.2% as domestic demand in Q1 2024 is softer than expected and will only be compensated by the consumption rebound in H2 2024 when real wage turning more positive. We forecast in 2025 Australia will have an average growth at 2.1%, benefiting from RBA rate cuts and inflationary pressure easing.

We forecast headline y/y CPI to ease throughout Q1-3 2024 and tilt higher in Q4 2024 as wage growth filters into the economy, then we expected it to resume its course of moderation throughout 2025. 2024 CPI has been revised higher from 3.1% to 3.4% as service inflation, led by education service, remains stubbornly high. RBA has also revised the short term inflation forecast higher due to energy prices (Q1 2024 3.8% from 3.2%) but continue to expect inflation to be back to target range by mid-2025, which seems to suggest they are looking towards rates to be restrictive for longer. The COVID era transitionary inflation factors have mostly dissipated but the latest leg in higher energy prices are yet to be digested. Service inflation is expected to moderate gradually while rent inflation is not expected to ease.

The pace of moderation has been slower than anticipated on recent rise in energy price and the unwinding of electricity rebates, so has elevated service inflation. Food inflation, the largest inflationary factor in 2022 has rotated lower. The RBA also acknowledges that limited spare capacity in the labour market and has kept wages higher so far. Wage growth in private sector has begun to slow and should soon become broad based yet its pace would be slow, given the labour market constraints. Thus, the RBA is seeing disinflation to continue, along with subdued consumption.

The RBA has kept the door open by suggesting the rate path is dependent on data. But realistically, there is little room for the RBA to tighten especially after the soft Q1 Australian GDP, showing that domestic demand, the pillar of strong 2023 growth, is dissipating on inflationary pressure. Unless there is a structural shift in the global inflationary picture, the headline inflation should return to target range by year 2025 despite occasional spike in CPI by transitory factors. It is wise for the RBA to be cautious with its tightening step as the potential crash in the housing market from aggressive interest rate increase would create more trouble for the central bank. We believe RBA will hold cash rate at 4.35% before cutting in Q4 2024 as inflation inch closer to 3%. We see 25bps of cut in 2024 and the RBA moving back towards neutral policy rates of 3.0% rates by end 2025.

Malaysia: Fiscal Policy To Dominate

Malaysia is poised for steady growth in 2024-25, bolstered by a diversified industrial product mix that includes electronic goods, refined petroleum products and palm oil. Malaysia's real GDP growth is projected to accelerate to 4.2% in 2024, driven by a recovery in the global electronics cycle. This growth is expected to further increase to 4.3% in 2025, facilitated by benign inflation and monetary easing, which will boost private consumption and investment. Throughout 2024-2025, private consumption will remain the primary driver of economic growth, supported by resilient household purchasing power, real wage growth, targeted government subsidies, and low consumption taxes. However, high household debt levels will slightly temper this consumption growth compared to historical averages. Benign inflation will also be supportive of growth.

On the production side, the construction and the services sector will continue to be the largest contributor to GDP, benefiting from government spending, robust wholesale and retail trade, information and communications, and financial services. The implementation of the New Industrial Master Plan 2030 (NIMP2030) will promote digitalisation and prioritise sectors like chemicals, electric vehicles, pharmaceuticals, and aerospace, enhancing the manufacturing sector's value-added and narrowing the gap with services over the forecast period. Malaysia’s industrial output trends are choppy, industrial activity appeared to be recovering in April. Industrial output grew 6.1% yr/yr in April, reflecting improving manufacturing production and strong mining output.

Fiscal consolidation will be a major focus area for Malaysia. The government is already implementing its subsidy rationalisation plan. Blanket subsidy for diesel has already been withdrawn this year, and petrol subsidy is likely over H2-2024. Subsidy withdrawal on other items is also likely over 2024 and this could stoke price pressures. Inflation is expected to average 2.2% yr/yr in 2024 and 2.5% yr/yr in 2025 with risks tilted to the upside.

Bank Negara Malaysia (BNM) is expected to maintain its key policy rate, the overnight policy rate (OPR), at 3% in 2024 to balance inflation control with economic growth support. Malaysia’s credit growth remains stable at The OPR is projected to be cut to 2.8% by end 2025.