Eurozone Outlook: ECB Finger on Easing Trigger?

· Our GDP outlook remains somewhat less below consensus and ECB thinking than envisaged three months ago, as other forecasters have reduced projections! Regardless, ECB policy has caused an increase in the cost of credit, alongside a fall in supply of credit. The result is that the economy has been in a modest recession and with downside risks superimposed over the fragile recovery we envisage through 2024 and 2025.

· This triggers our still-below consensus HICP outlook in which headline inflation is seen easing below target in H2 2024, with the core rate (still worrying the ECB) likely to follow and a sustained drop then occurring through 2025, this chiming with an array of signs of already-softer underlying price pressures. This backdrop has persuaded the ECB to flag easing and we forecast 75 bp of official rate cuts from Q2 in 2024 and more (100 bp) to follow in 2025.

· Given the growing likelihood of lower official rates, it is still the case that a banking crisis is a low to modest risk. Perhaps the main risk is that interest rates cuts may be larger and/or faster than we have assumed as the monetary policy transmission mechanism proves even more powerful than we have estimated and fiscal policy prove more restrictive.

· Forecast changes: Compared to the last outlook, we have (yet again) retained the overall EZ growth outlook, with a gloomy picture for 2024, albeit this masking a fragile recovery through the year that may lead to a return to nothing better than trend-type growth in 2025. More notable is the hardly-revised and still soft EZ HICP inflation outlook in which the target is undershot on a sustained basis into 2025. As a result, we have retained our interest rate forecast wholeheartedly.

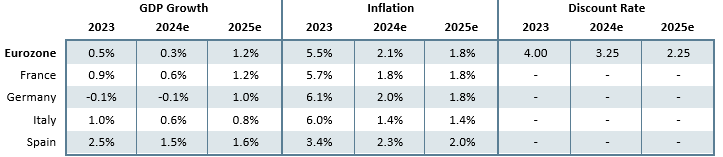

Our Forecasts

Source: Continuum Economics, Eurostat

Risks to Our Views

Source: Continuum Economics

Eurozone: Fiscal Questions Returning

As monetary easing draws into sight, the issue of fiscal policy is raising its head more clearly. Very clearly, the EZ headline budget gap is going to narrow this year as energy price support measures are withdrawn, this likely to mean a tighter cyclically adjusted primary balance this year and maybe a little more in 2025. But the headline budget gap may be higher than the likes of the ECB have assumed, not least given the marked upward revisions to 2023 fiscal gaps being admitted by several countries – those from just Italy and France result in a collective budget gap of two thirds the 3.2% ECB estimate. As a result, further government spending reductions are being considered and implemented, these likely to act as a drag on overall EZ growth into 2025 over and beyond the reversal of energy support measures. Thus with headline budget gaps that may stay around or above 3% of GDP this year and next , the fall in the EZ government debt ratio to 88.3% of GDP last year may now reverse. This maybe more of an issue as the Economic and Financial Affairs Council has agreed on new regulations concerning the EU’s fiscal rules, mean that member states with excessive deficit or debt ratios envisage a more ambitious budgetary objective necessitating a structural deficit ratio of no more than 1.5% over the medium term, mainly though spending reductions.

That the EZ economy has been in recession, albeit a mild one, misses the point as the zero growth of the last year would have been clearly negative were it not for government spending. This is important as it not only highlights the weakness in final private demand but a likely slowing on the government side explains one of the downside risks for GDP growth we seen into 2024 (and even 2025) alongside the impact of a likely recovery in imports. Thus, our still gloomy outlook, as for this year, we still see an anticipated rise of 0.3% but where 2025 GDP prospects have been pulled back a notch to 1.2%. This below-consensus outlook does mask an anticipated recovery through 2024, albeit a fragile and feeble one and one that comes after a more pronounced but still relatively shallow recession in H2 this year. But we do envisage return to trend-type growth for 2025 as a result of the easing in monetary policy that we predict (see below).

Despite some improvement in some business and consumer surveys our wariness is very much based around the unprecedented slump in private sector credit and deposits, all of which we think are a result of extensive (if not excessive) ECB tightening that we think will continue to reverberate through the coming year at least. This continued domestic weakness includes weak consumer spending. Undermined by fragile confidence and higher interest rates, consumption growth will largely map with overall GDP both this year and next, with the better 2025 outlook shaped as inflation eases durably and wages grow slightly in real terms. But other aspects of private demand will also restrain growth into and through 2024, not least construction spending may fall more notably and broadly on a geographic basis, something also hinted at by surveys. Moreover, the anticipated recovery in imports into 2024 will also mean that the return to a current account surplus see last year (at around 2% of GDP) may actually be partly reversed in 2024.

Regardless there are risks which may mean a deeper and/or longer recession that could potentially extend into 2024. Much of these risks emanate from gauging how and when tighter financial conditions will have bitten fully. Furthermore, mounting climate risks, where this year has already see more extreme weather conditions also weigh on the outlook. There are upside risks too, most notably around households reducing what are still apparently elevated savings rates!

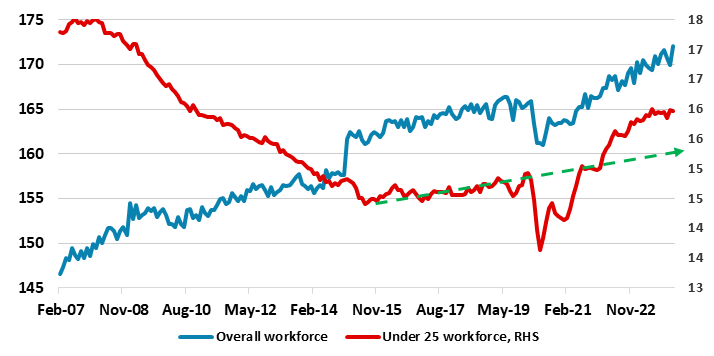

Notably, this domestic weakness is yet to cause a reversal in what has hitherto been a solid labor market, with a healthy rise in the workforce (actually to both higher and faster levels than pre-COVID), this being somewhat unique to the EZ. More notable is that the rise is very much dominated by an increase in the supply of younger workers (Figure 1), these much more likely to pursue better remuneration. But this is now occurring alongside what we think will be a small rise in unemployment through 2024.

Figure 1: Workforce Still Rising Clearly, Led by the Young

Source: Eurostat, millions, green dashed line is pre-pandemic trend

Given the unprecedented nature of the current tightening in financial conditions, it is very difficult to assess the likely full damage to demand and thus how significantly depleted spending power may rein in pricing power. But encompassing what has already been a marked softening underlying inflation (Figure 2) we now envisage headline HICP moving below 2% by H2 this year, with the core not far behind, this 2024 picture being a little higher than envisaged in the December Outlook, partly due to some fiscal measures and energy price rises. However, while there may be some H2 volatility, HICP inflation should fall more durably below target through 2025 where we adhere to 1.8% projection. Admittedly, an added obvious note of caution is that, amid a central assumption that the Ukraine War continues to simmer over into, if not beyond 2024, energy supplies will continue to be compromised into next winter and will only materially improve in 2025. Even so, we do note some signs of the sharp fall in core inflation slowing if not reversing when measured using various seasonally adjusted m/m data (Figure 2), including one that the ECB has begun to flag more frequently. We think this is more noise than fresh trend but will continue to monitor closely.

Figure 2: Adjusted Core HICP inflation Has Been Falling Clearly But May be Stalling?

Source: ECB, % chg

ECB: Bowing to Markets, Cuts Flagged for June?

With the ECB forecasts now pointing to headline inflation below target before and then through 2026 and the core rate at target on the basis of market rate pricing of future official rates two years hence some 150 bp below current levels, this implies a tacit Council endorsement of that rate profile. The rejigged rhetoric in the last statement probably reflects remaining divisions within the Council but where the doves may be getting the upper hand after the inflation surprises on the downside. We continue to envisage rate cuts of 75-100 bp this year starting in June with something similar though 2025. Indeed, President Lagarde’s comments were consistent with a June move, provided no upside surprises are seen. But notably, this rate cut acknowledgment has come alongside hardly any changes in the ECB’s real economy outlook, with the ECB pointing to the economy picking up and growing above trend at 1.5% in 2025 and 1.6% in 2026, supported initially by consumption and later also by investment. We think this is optimistic. But the point is that the ECB still accepts that even this real economy outlook delivers price stability, if not a slight target undershoot.

This does not mean that rate cuts are a done deal in June, but it would be hard to rule out given the earlier and sustained target undershoot: the revised projections that will accompany the June policy discussion are unlikely to see the inflation outlook change appreciably. More information is wanted by seemingly the whole of the Council. Very clearly the focus is on wages as this is seen being very much inter-related to domestic/services inflation. But while wage developments and possible labor hoarding are important in assessing the inflation outlook, wages are far from the whole story in this regard, with the role of profit margins also crucial. Sufficiently broad enough data on all these issues may take until June, chiming with the easing hints that the ECB has offered repeatedly this year, repeatedly pointing to a summer timetable. We see no further decision on the QT outlook from the ECB coming alongside any conventional easing, although we suspect that there could/should be slowing of the QT pace in 2025.

Germany: Recession Continues?

The economy entered recession in H2 last year and we think the contraction will continues at least through the current quarter, not least as activity in recent months has been hampered by transport strikes as well as weak consumer and industrial demand. But there are other ill omens, notably (according to the Bundesbank, order books German industrial goods have “recently trended down significantly”). Partly as a result, we have shaved back our 2024 GDP picture to one that sees a 0.1% contraction, ie matching the 2023 outcome and some 0.3 ppt weaker than seen three months ago. Notably, the scale and particularly the durability of the weakness is evident from the fact that we do not see the recent peak in the level of GDP (ie in Q2 2022) being re-attained until end-2024 and possibly later as there are downside risks to our unchanged 1.0% 2025 growth projection, most clearly from the fiscal side (see below). This growth outlook is below most (including our own) estimate of potential. But the latter may be waning as Germany’s economic malaise is far from purely a cyclical development. Indeed, in the last few Outlooks we have highlighted the structural factors increasingly affecting the economy, including vulnerable supply chains, relatively high energy costs and adverse demographics.

All of which not only helps explain why the German economy is likely to remain weak out to 2025 and perhaps beyond. Notably, the current account is actually improving and may be over 6% of GDP this year and next, as the weakness in exports is being offset by the astonishing fall in goods import volumes (down almost 10% in the last 18 months), without which the recession would be deeper. This reflects weakness in domestic demand as ECB policy is biting ever more clearly. We see some respite as inflation is falling broadly and we see it falling further and actually makes us even more confident of it dropping below 2% by mid-2024, albeit with volatility thereafter. Within this, consumer spending is likely to stagnate this year as the near 10% fall in house prices both erodes household wealth and puts added upward pressure on rents. All of which means that domestic demand weakness is likely to see the biggest damage emanating from the slumping construction sector. Indeed, building activity is falling increasingly and broadly, albeit led lower by residential construction work, and where surveys very much suggest that difficult conditions will persist for at least the coming year.

Figure 3: Debt Interest Jump Partly Due to Increasing Premia

Source: Bundesbank, premia are discounts on the par value of newly issued debt instruments (Euro bn)

Regardless, the fiscal picture is in a state of flux given the November German Constitutional Court ruling, which questioned the validity of so-called off-balance sheet budget financing. The ruling very much narrows fiscal room the coalition government has relied upon to sidestep German fiscal rules (ie the debt brake), effectively leaving a €60 bn hole in previous government spending plans. The debt brake could be suspended again but this would divide further an already split coalition with effective spending cuts of some 0.5% of GDP on the cards for this year instead. Regardless, and unlike some other EZ economies, the budget deficit is likely to fall again this year from around 2.5% of GDP in 2023 towards 1.5% as the volume of temporary support measures continues to decrease. However, projected initiatives on climate policy and defense are rising sharply as are debt interest costs, the latter as much reflecting sizeable contribution comes from provisions for redemptions of inflation indexed debt instruments some of which had to be sold at around half face value (Figure 3) amid very negative interest rates between 2020 and late 2021. All of which may be adding to economic uncertainties.

France: Fiscal Risks Materializing

As we hinted here months ago, fiscal worries could easily resurface. This seems to be the case, not so much in wider and/or painful sovereign spreads but in cyclical and structural budget deterioration and which have clearly been troubling rating agencies. Indeed, albeit without providing details, Finance Minister Le Maire warned earlier this month that a shortfall in tax revenues means that the budget gap for last year will be well above the 4.9% of GDP target – we estimate the outcome may be in excess of 6%! As a result, in order to get anywhere near the 4.4% budget gap target for this year, and the 3% goal for 2027, hefty spending cuts are in the pipeline, these adding to what were already a sizeable amount of cuts this year (€ 16 bn), mostly from phasing out energy subsidies. Indeed, an additional € 10 bn is on the cards for this year and maybe twice that for 2025, this a cumulative 1% of GDP. This will add to the headwinds facing the real economy and mean that the recent downgrade by the French government to its 2024 GDP projection at 1% still looks optimistic. Indeed, we (still) see 0.6% and that would have been revised lower were it not for the better than expected end-2023 numbers that provide a more favorable base effect. As a result we continue to see a budget gap this year around 5% of GDP with the risk that the government debt ratio rises further in the coming two years, not least given the lack of parliamentary majority may hamper any reform agenda.

Even so, we see a gradual recovery this year, but a weak one given the still soft (ie below-par) messages from the INSEE-compiled business climate which remains below its long-term average. We still see a better 2025 growth picture of 1.3%, albeit a notch lower than envisaged there months ago. But this comes with downside risks, not only from the budget cuts, but also the lagged impact of the rise in interest rates and the economic uncertainty that has clearly perturbed the French consumer and now the business community. Notably, private consumption will be weak as those energy support measures are being ironed out and what still seems to be high savings are locked up in illiquid assets, so the boost will be modest and that consumer spending will grow no more in 2024 than overall GDP, this also the case for 2025. Investment is projected to recover progressively into 2025 but only after fresh drops in coming quarters. Meanwhile, over the forecast horizon, net exports are set to have a minimal and possibly negative contribution to growth. Exports growth, which traditionally relies on a few specialized sectors such as aeronautics and other transport equipment, is expected to be offset by rising imports mirroring the recovery of household consumption. Hence, a still clear current account deficit will persist into next year, albeit staying at around 1% of GDP.

However, this below-par growth outlook will reinforce the broad disinflation already very much evident. Thus we still envisage CPI inflation at 1.8% both this and next year. This is backed up by business surveys very much suggesting that expected price cost pressures are back to pre-pandemic levels generally (Figure 4), something that suggests that the recent downside CPI surprises are no statistical quirk. All of which, however, reflects the growing impact of the marked recent damage to spending power alongside tighter financial conditions. These are which are likely to lead to a further reining in pricing power and arise in the jobless rate back above 7.5% into 2024 and where companies are likely to see profit margins fall.

Figure 4: French Price Pressures back to ‘Normal’?

Source: INSEE, balances of opinion on changes in selling prices next 3 months

Italy: Further Fiscal Focus

The economy may have surprised on the upside in the last few quarters and to a degree that solid GDP numbers late last year have created favorable base effects for 2024 growth, hence the modest 0.2 ppt upgrade we have made to 0.6%. But this is still well below the 1% penciled in by the Italian government and still has evident downside risks, the latter highlighted by what are still soft business surveys (Figure 5). But the main risk is the extent to which fiscal policy is reined in as the government attempts to unwind the so-called Superbonus scheme (a generous tax incentive for housing renovation). Thus has been taken up much more sizably and durably than was expected when launched in 2020 amid political fragilities. It is being phased out, but not totally until after 2025 and this could change. Its impact has been marked in two crucial ways. It has boosted GDP growth by a full ppt in according to Bank of Italy estimates. But it has also damaged the fiscal situation to degree that the budget gap for last year was almost two ppt higher than the official 5.3% of GDP target. To date this has not alarmed markets: indeed the key sovereign spread with Germany has actually fallen of late reflecting concerns about Germany but also a demand for high-yielding debt and the fact that the budget gap still fell by 1.2 ppt and that the debt ratio has fallen to 137%, just three ppt above pre-pandemic levels.

There must be severe doubts whether there will be any further fall this year and/or into 2025, this being somewhat unlikely as even existing official fiscal projections suggest nothing better than a drift sideways (NB: new forecasts are due by mid-April) but will be based on what we think will be optimistic assumptions envisaging nominal growth of around 4% into 2025. We think may the budget gap this year may be some one ppt above the official 4.2% projection and are wary about official forecast. We now see CPI inflation averaging 1.4% both this and next (the former some 0.4 ppt below what we thought three months ago). This very much reflecting the marked falls seen of late and relatively soft wage pressures despite a tight labor market that may not see much of the recent drop in the jobless rate reverse into 2024. This is going to both reflect and be reinforced by weak real activity as amid the phasing out of the Superbonus, GDP growth next year may be only 0.8%, this being very much below consensus thinking.

Figure 5: Survey data Highlights Continued Downside Growth Risks

Source: Bank of Italy and ISTAT

Thus the real activity picture is both a reflection of and a cause of the increasingly soft inflation backdrop and outlook. Regardless, the soft inflation picture is not likely to foster much recovery in what has recently been falling real disposable incomes. The very gradual increase in nominal wages alluded to above (contractual hourly earnings rising by around 2% next year), together with less positive employment conditions, will keep private consumption growing by less than GDP into 2024, with activity undermined further by the planned expiry of all temporary income-support measures. Capital spending is now contracting and may pick up only moderately in 2024, as the fall in housing construction is offset by RRF-supported increases in investment in infrastructure and equipment. Net exports may provide a little support to growth in 2024, following a likely positive contribution in 2023, but where the return to a current account surplus see last year will at best be consolidated in 2024 at just under 1% of GDP.

But of course higher interest rates are the main negative, enough to have triggered overt ECB criticism from a government where policy priorities are in a state of flux given the splits within the coalition. But to date PM Meloni has pursued a relatively fiscally prudent stance, despite the budget overshoot, also keeping a good working relationship with the EU generally. Indeed, the country’s sovereign rating outlook was upgraded late last year, this decision as much a reflection of the more positive outlook for the banking sector. Regardless fiscal risks are clear in Italy, which may resurface should Italy suffer a major recession and/or if the ECB decided on an aggressive QT option for APP that included outright sales as well as not reinvesting redemptions.

Spain: Growth Boost From Workforce Jump to Moderate

It is clear that Spain’s economy exceeded expectations in late-2023, this creating a clear positive momentum into the current year. Regardless, growth rates in H2 were similar to those in H1, this making the softer profile we anticipate for this year all the more notable, albeit a view consistent with still soft business surveys. This largely reflects what we think will be a slowing in private consumption, this already partly visible at the end of last year. This will reflect diminished strength in the labour market and less of a moderation of inflation than the circa-5 ppt drop seen though 2023. There is also likely to be much slower growth in public consumption (after the 4.4 % surge seen through last year) alongside continued weakness of investment (including now sliding construction). In addition, it is unlikely that the tourism sector can replicate the boost seen through the last year which seemingly hit new highs last year, not only in nominal expenditure but also in real terms, led by international tourist arrivals. In addition, there is still the marked and lagged impact of ECB policy tightening and the external sector will be hampered further by the relative weakness of Spain’ European trading partners. Thus we see a largely unchanged current account balance of around 2% of GDP

Thus after growing by 2.5% in 2023, we expect GDP growth to moderate in 2024, this also reflecting less of a boost from the flow of NGEU funds. Overall, we expect GDP to grow by 1.5% in 2024, this some 0.5 ppt above what we envisaged three montsh ago. As for 2025 we are seeing a slight acceleration to 1.6% (previously 1.4%). Regardless, domestic demand is expected to be the driver of growth, despite slower private consumption, albeit the risk (on both sides) beign the extent to which population growth (closely linked to higher immigration flows) slows or keeps up recent momentum. The consumer side could also see an upside risk if still high savings rates are pruned further, although the latest readings are not far from the pre-pandemic average of 8.6%

On the inflation side, we expect the underlying trend to be one of more modest moderation. Indeed, we see inflation slowing to an average of 2.3% this year (a small upgrade due enegy prices and fiscal measure reversals) but with the projection of 2.0% for 2025 intact. This reflects some slowing in terms of services inflation, reflecting a limited impact of the so-called second-round effects, not least given the strong rise in the working population and thus labor supply). Recent wage agreements data already support this, with a slowiing to 2.8% in January. Regardless, the unemployment rate may continue to fall, although its reduction will be moderate due to the upward revision of the growth of the labour force, greatly influenced by the higher immigration flows observed since last year. Thus, we expect the unemployment rate to moderate from 12.1% in 2023 to 11.8% in 2024 and to 11.6% in 2025.

Spanish PM Pedro Sánchez has managed to maintain a minority coalition administration. However, amid the need to pander to minority parties asks whether this may have a fiscal cost as Sanchez is likely to have to buy support, this having budget consequences, enough to mean that the budget gap may start to rise into 2025, as this year’s deficit will be pulled back to just over 3% of GDP (from around 4% in 2023) by the phasing out of measures to mitigate high energy prices. Instead, weaker growth will take a toll with the clear risk that the debt to GDP ratio may fall no further after next year and even rise afresh into 2025.