U.S. Tensions for China: Protected by BRICS and BRI?

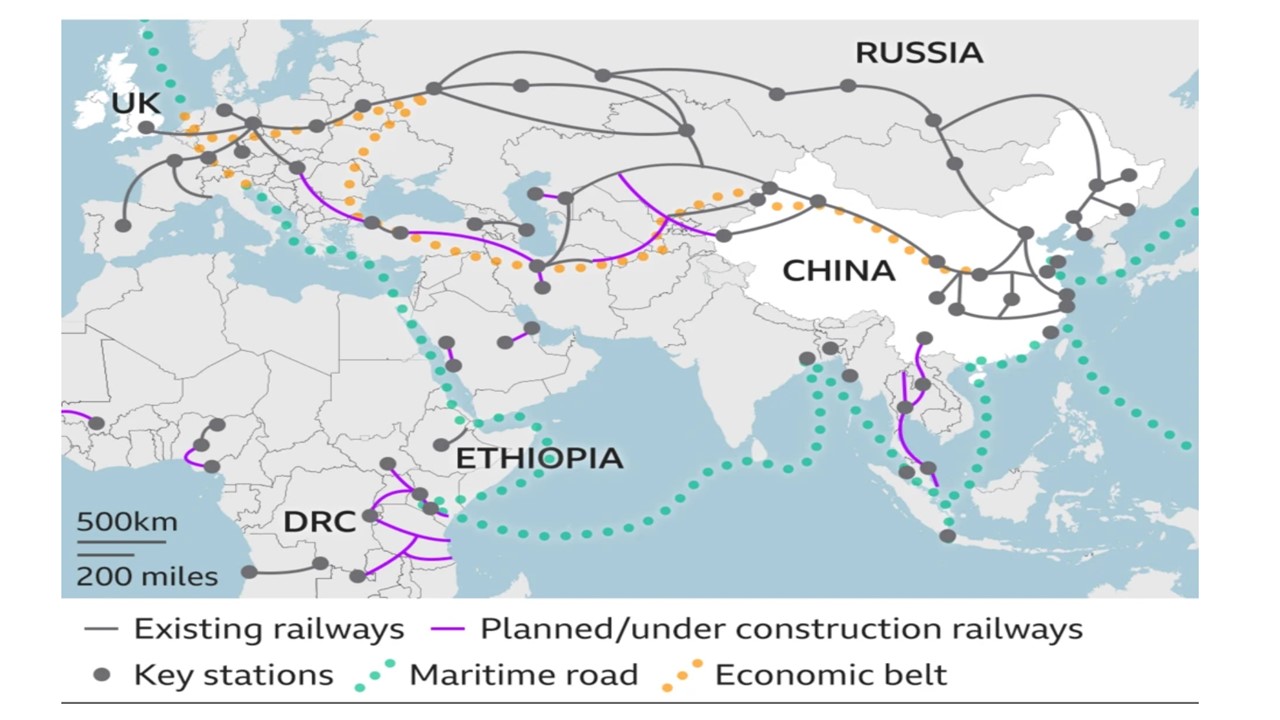

BRICS can provide a political buffer but not economic, as BRICS are still searching for practical areas for cooperation. However, Donald Trump universal tariffs threats could focus BRICS on more intra EM trade. BRI has already helped to redirect China exports to EM countries, despite the slowdown in new lending to BRI countries.

The BRICS Summit in Russia (October 22-24) and G20 summit in Rio (November 18-19), sit either side of the crucial U.S. presidential election. Will BRICS and Belt and Road Initiative (BRI) protect China or not if geopolitics worsens between China/U.S. into 2025.

Figure 1: Belt and Road Expansion Plans

Source: BBC/Merics Can

The BRICS and G20 summits are somewhat overshadowed by the outcome of the U.S. presidential elections. If Kamala Harris is elected president then she would likely maintain the strategic attempts to slow China rise and access to technology, but would provide stability in U.S. trade relations with most other countries. Additionally, the U.S. security role with many countries would likely sustain the path set by Biden, with strong support for NATO and Ukraine but perhaps less pro-Israel. In contrast if Donald Trump is elected, then disruption could be seen for global trade via the threat of universal and China specific tariffs (though we feel the risk is greater of implementation in 2026); anti-Iran/pro-Israel policies and a likely withdrawal of funds for Ukraine to end the Ukraine/Russia war. Does BRICS and BRI provide protection for China if geopolitics worsen significantly in 2025?

An agenda for the BRICS summit is yet to arrive, though reports have suggested that Turkey request to join is still outstanding – though some see this as an attempt to pressure the EU into accelerated Turkey accession talks and Turkey is not really committed to BRICS. However, BRICS is still searching for practical issues for cooperation, with some countries wanting to remain neutral on the Ukraine war and use U.S./China tensions to their advantage. BRICS could develop further in the coming years, but for now is a political rather than economic buffer for China.

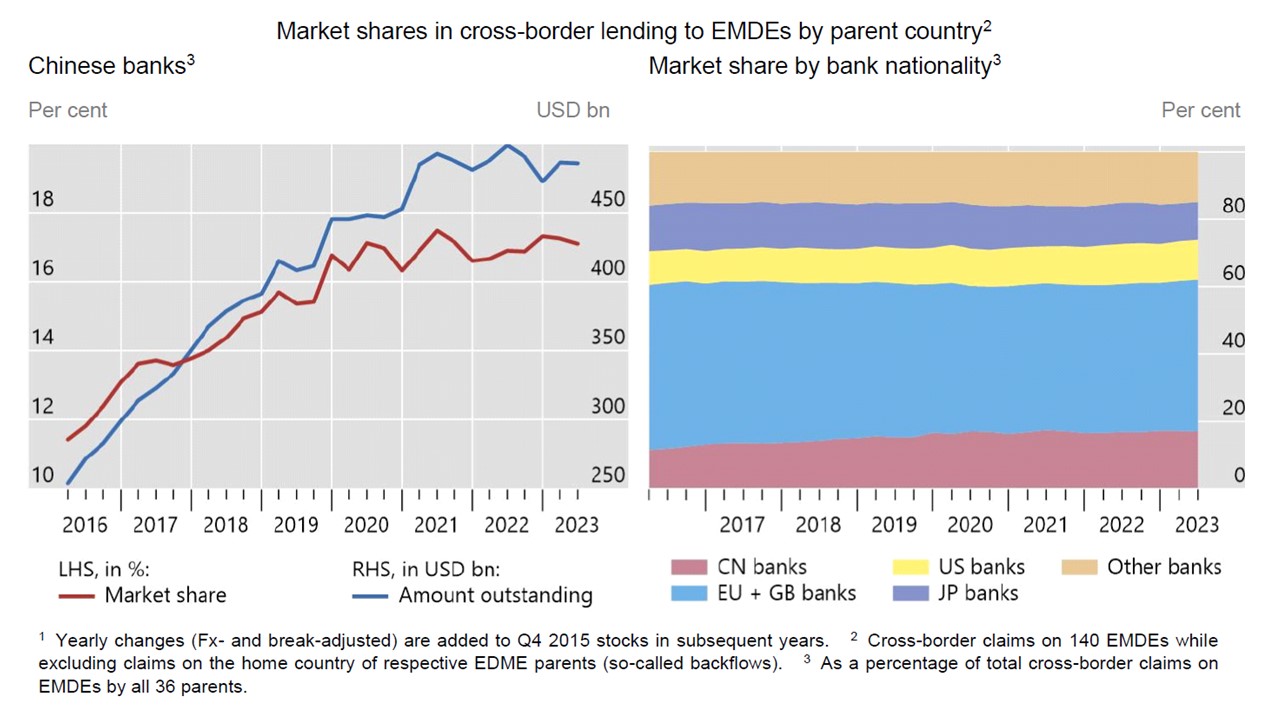

In terms of the BRI, lending momentum has slowed noticeably, both due to domestic residential investment banking problems in China and also as some BRI borrowers have run into difficulties. A recent IMF working paper shows this clear (Figure 2 LHS) for China three policy banks and four largest state owned commercial banks covered by BIS data. Nevertheless, China banks and affiliates are still the largest outstanding lender for 65 out of 140 EM countries, especially low to middle income EM’s outside the larger EM countries. The IMF finds that a lot of lending was directed by trade flows prior to the pandemic, but has become more linked to countries with FDI flows from China since then – especially BRI countries.

Figure 2: The expansion of Chinese banks’ lending to EMDEs has recently slowed down

Source: IMF Working paper September 2024 (here)/BIS

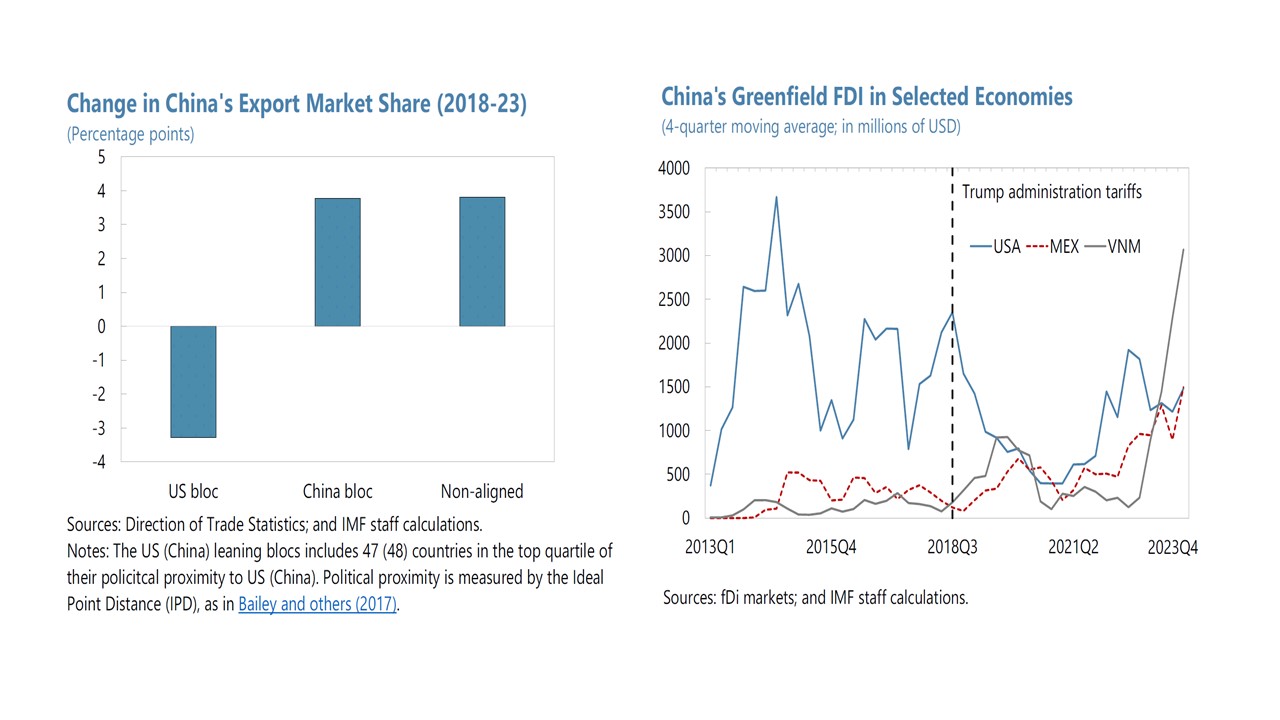

The trade and FDI dimension highlights that these are objectives of BRI, as well as ideology and security/geographic reasons. Indeed, China has achieved some success at increasing export market share with countries that are either China aligned or non-aligned, given the smaller export share that China has seen with the U.S. and DM countries (Figure 3 LHS). China has also realigned supply chains via FDI so that trade goes through connector countries (e.g. Mexico/Vietnam) rather than directly from China to the U.S. (Figure 3 RHS).

Figure 3: Change in China Export Market Share (LHS) and China FDI Redirection (RHS)

Source: IMF Article IV August 2024 (here)

The key issue for China is the scale of geopolitical change under a new U.S. president. China will likely face more pressure on the trade front from the U.S./EZ in 2025 if Kamala Harris is elected president, but China should be able to muddle through this from an economic and trade viewpoint with it increasing focus on trade with other countries. However, China technology race with the U.S. is more uncertain, given that Harris would likely strengthen restraints on this front.

A victory for Trump would likely see the top priorities being reducing immigration (that could see Trump picking a fight with Mexico) and renewing lapsing 2017 tax cuts (here). However, Trump is unpredictable and has been vocal on tariffs in recent months. Universal tariffs against all countries perversely could provide BRICS with a purpose on the trade front to protect from U.S. tariffs and drive intra EM trade and FDI. Meanwhile, a forced end to the Ukraine war by withdrawing U.S. funding could mean a ceasefire but not a peace deal that would reduce tariffs against Russia and mean global cheaper commodities – China has also already been buying at a discount from Russia. Finally, Trump has asked Taiwan to pay the U.S. for its defence and has been less committed to Taiwan in the past than the Democrats. However, China aims for Taiwan reunification are long-term, both as China military is not strong enough for a huge invasion across the Taiwan straits and as Taiwan has elected a pro-China speaker. We do not see Taiwan becoming a new geopolitical flashpoint in 2025.