Trump Policies Awaited

We see a transactional approach on trade, with tariff threats translating into actual tariffs on China initially and Trump rather than Congress having control on tariffs. On the budget, we see scope for more tax cuts than expanding the lapsing parts of the 2017 tax cuts and expenditure cuts being modest rather than large (due to Trump’s reluctance to cut Social Security, Medicare and Defense). This will likely mean budget deficits in the 8% plus region of GDP, which will also boost 10yr yields from a supply and budget deficit viewpoint.

President elect Donald Trump has made maximist threats on a number of fronts to soft up negotiations, but what will be the incoming administration policies?

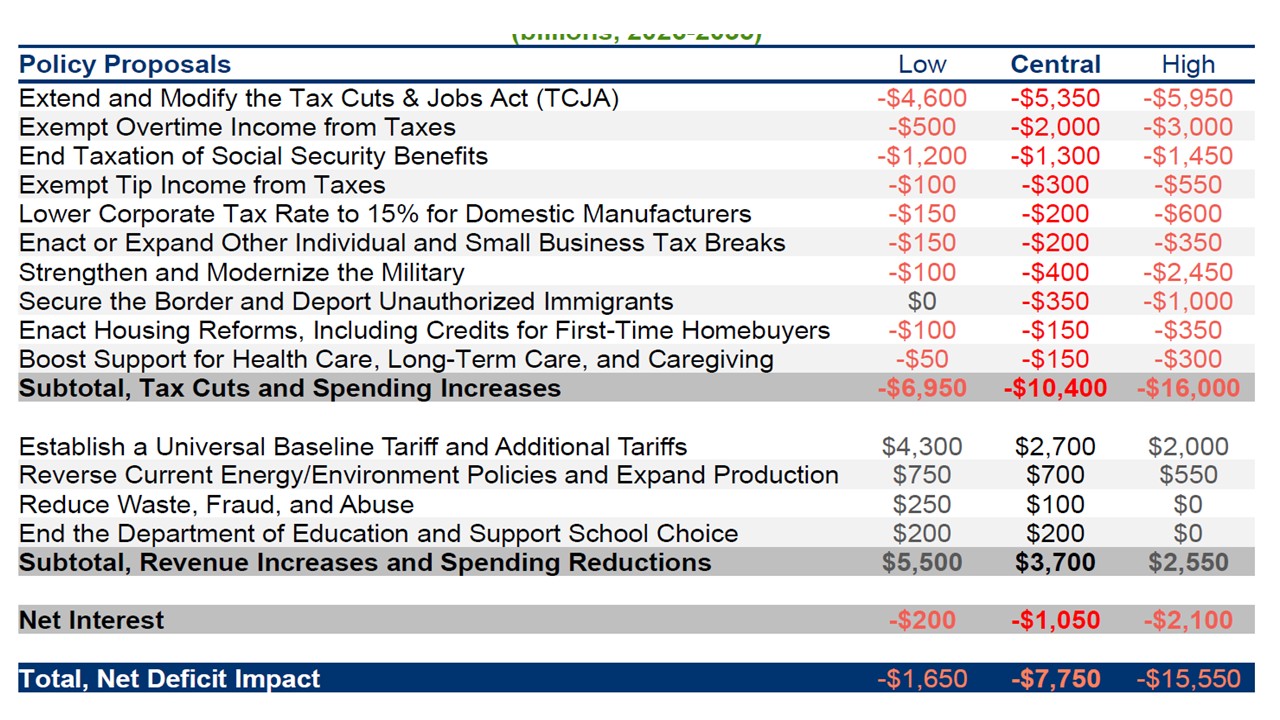

Figure 1: Estimates of President Elect Trump Budget Plans (USD Blns)

Source: Committee for a Responsible Budget

Trump threats of a 25% tariff against Mexico and Canada suggest a transactional approach to achieving concessions on the border or enhancing a trade deal. A willingness to discuss issues by both Mexico and Canada has pleased Trump and supports the transactional approach of threats more than tariff action. After the January 20 inauguration, the focus will be on whether this transactional approach is expanded. Reports suggest some Trump supporting economists favor an across the board tariff for certain sectors, which could be more economically damaging to trade and boost inflation. However, the odds remain that Trump will not cede tariff decisions to congress and will remain in control via executive orders. We still feel that China will be the first target starting with demands for an enhanced trade deal and then an average 30% tariffs being implemented against the current 20%. China will be reluctant to quickly capitulate to the U.S., which will mean a H1 2025 trade war with China. We also feel that Germany and the EU are at high risk of tariff threats and actual tariffs in 2025 (here), alongside Vietnam (here).

The main policy area of interest is tax cuts and the 2025 budget bill. The GOP is currently split between the House wanting one bill covering the budget/immigration and energy and the Senate favoring immigration getting priority. Trump on Sunday signaled support for one mega bill, but then on Monday noted he was open to two bills! A mega bill would likely be implemented only in H2 2025, whereas the GOP in keen to tackle immigration early and executive orders will need associated funding.

Reports also suggest differences of opinion within the GOP over the scale of tax cuts and budget deficit, especially in the House where the GOP have a thin majority. Some favor a conservative approach that focuses mainly on renewing lapsing 2017 tax cuts and expenditure cuts to fund other measures. Others want a wider range of tax cuts. The U.S. Treasury market could get some comfortable from these budget deficit tensions within the GOP, alongside initial GOP optimism that large expenditure cuts are feasible (here).

However, large scale expenditure cuts remain unlikely, as Trump is against cuts in Social Security, Medicare and Veterans’ benefits, which make up the bulk of mandatory spending, and defense, which makes up the majority of discretionary spending. Excluding tariff revenue, the Committee for a Responsible Budget estimate USD1trn of feasible expenditure cuts over 10 years (Figure 1). We also feel across the board tariffs are unlikely as noted above and so tariff revenue will likely be modest. On tax cuts beyond renewing the lapsing 2017 measures, Trump on Sunday did place emphasis on no taxes on tips, which is relatively cheap (Figure 1). What Trump and Congress does on other campaign tax promises is a key uncertainty, but 2025 is the only budget bill likely in the Trump presidential term given that the GOP are likely to lose the House majority in November 2026. We are of the view that more tax cuts will be evident. This is more than currently discounted in U.S. Treasuries. This will likely mean budget deficits in the 8% plus region, which will also boost 10yr yields from a supply and budget deficit viewpoint (here).