Preview: Due August 12 - U.S. July CPI - Tariff impact slowly building

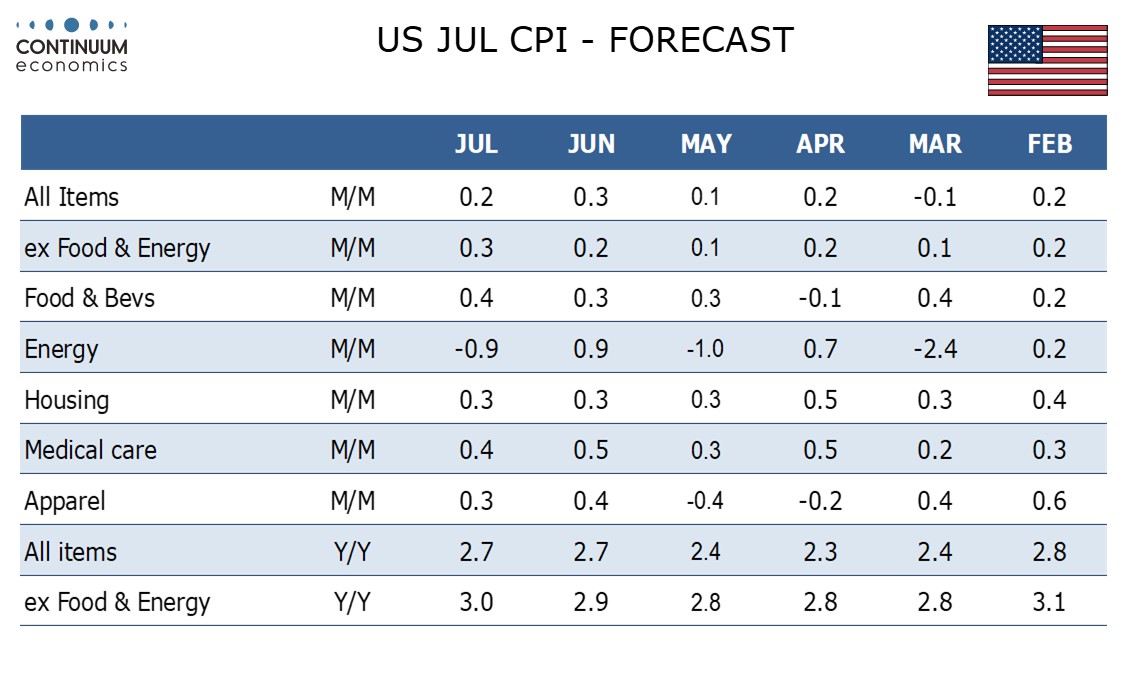

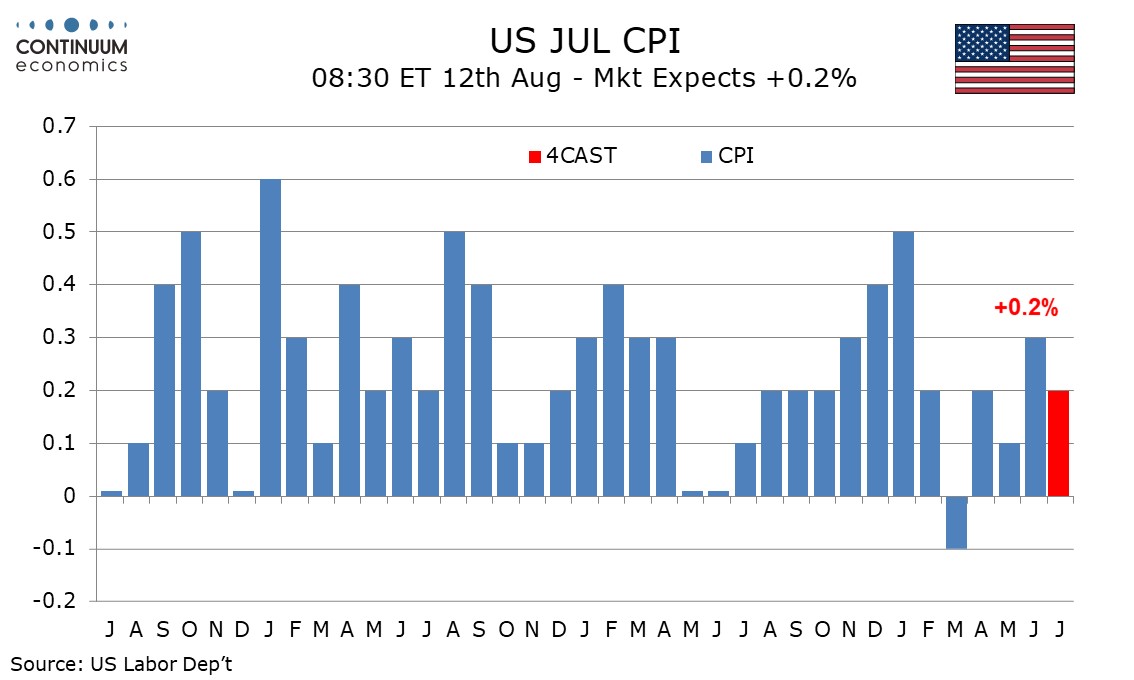

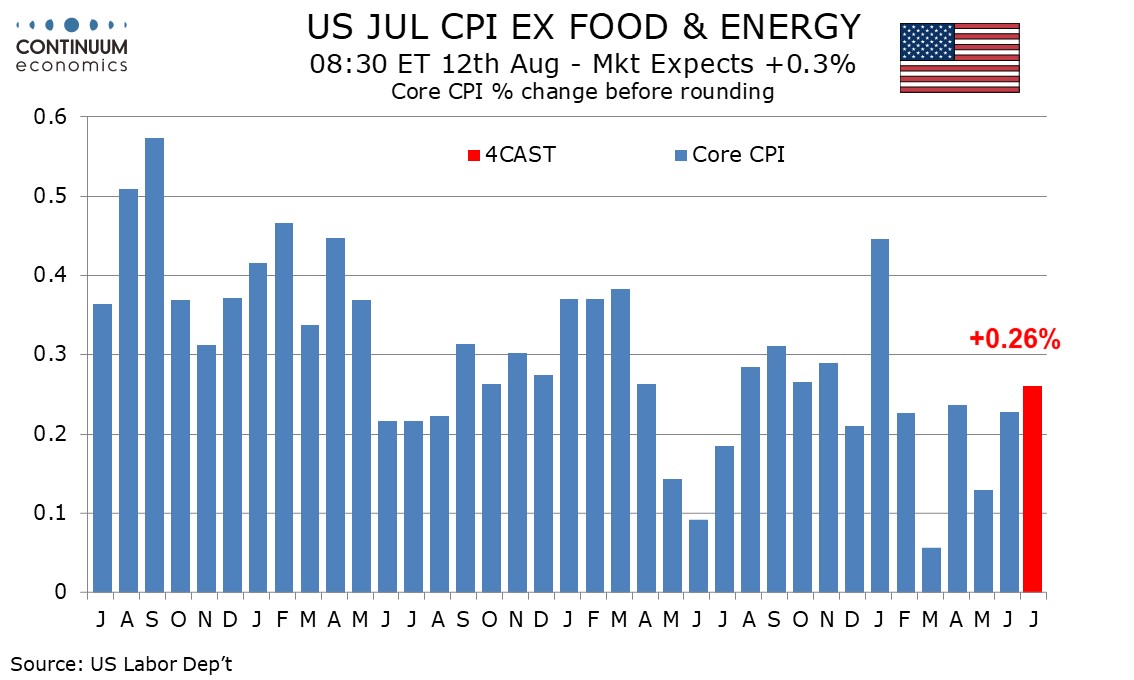

We expect July CPI to increase by 0.2% overall and by 0.3% ex food and energy, with the overall pace close to 0.2% even before rounding but the core rate rounded up from 0.26%. This would still be the strongest core rate since January and reflect a further feed through of tariffs, something that is likely to continue in the coming months.

We expect commodities excluding food and energy to increase by 0.3%, up from 0.2% in June which saw strength in several components partly offset by weakness in autos, with new vehicles down by 0.3% and used vehicles down by 0.7%. Autos are likely to be less weak in July but acceleration elsewhere is likely to persist, if not sharply. There may be a stronger feed through from tariffs in August with the passing of the August 1 deadline likely to give companies more confidence that tariffs will persist.

We expect services less energy to rise by 0.25%, after a 0.3% increase in June and a 0.2% increase in May. Tariffs will have less impact here. Hotels may correct from a weak June but we expect this to be outweighed by renewed weakness in air fares.

We expect food to see a rise of 0.4% with tariffs having some impact but this to be outweighed by a 0.9% decline in energy, reversing a rise in June as the Israel-Iran confrontation brought a brief spike. Yr/yr CPI is likely to remain at June’s 2.7% pace but we expect the ex food and energy rate to edge up to 3.0% from 2.9%, reaching its highest since February.