Preview: Due August 26 - U.S. July Durable Goods Orders - Aircraft to return to normal, trend marginally positive

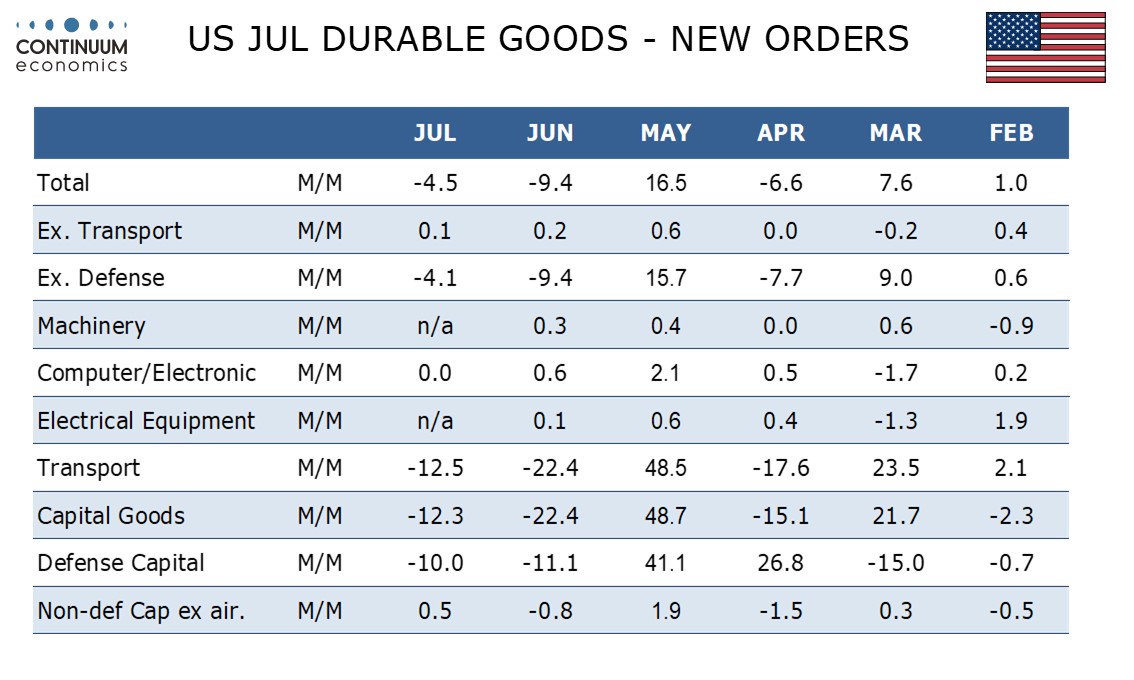

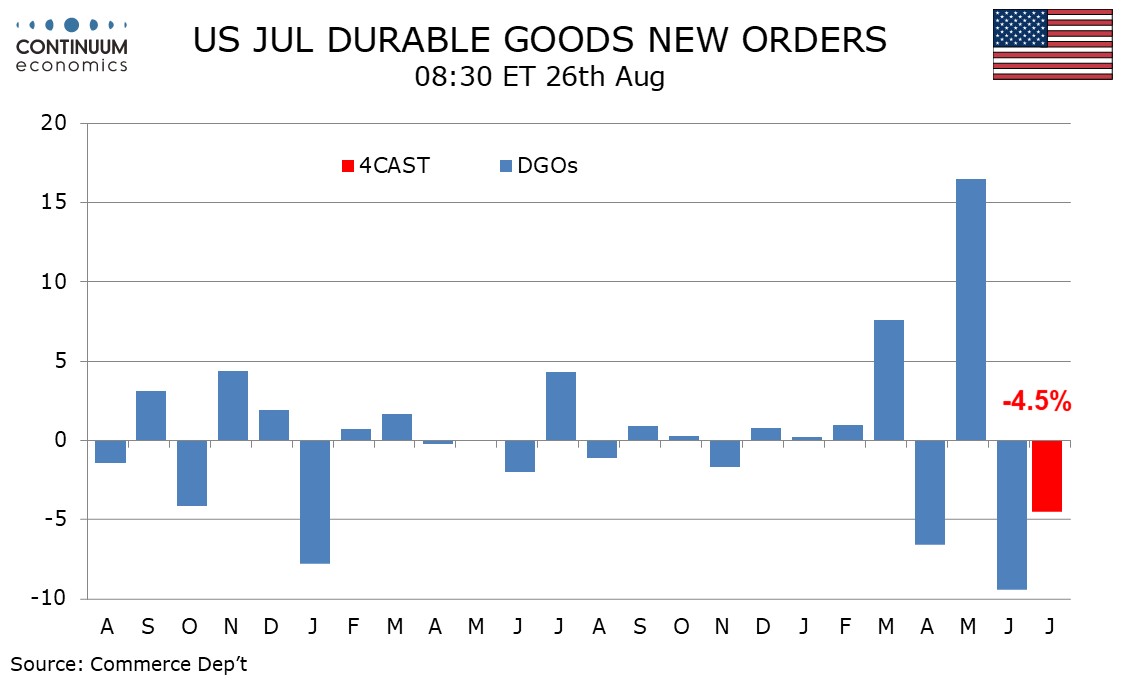

We expect July durable goods orders to fall by 4.5%, extending a 9.4% decline in June, but still not quite fully reversing a 16.5% surge in May. Aircraft will continue to lead the moves. Ex transport we expect a 0.1% increase, in line with a trend that is now marginally positive.

Aircraft have been volatile recently with an exceptionally strong May and a partial correction following in June. July data from Boeing suggests aircraft orders slipped further, to a fairly normal level.

We also expect transport orders to see some restraint from a second straight fall in defense in a continued correction from a very strong May, with defense having a large overlap with transport. Even with a third straight modest increase in autos, we expect a 12.5% decline in transport orders. Ex defense, we expect a fall of 4.1%.

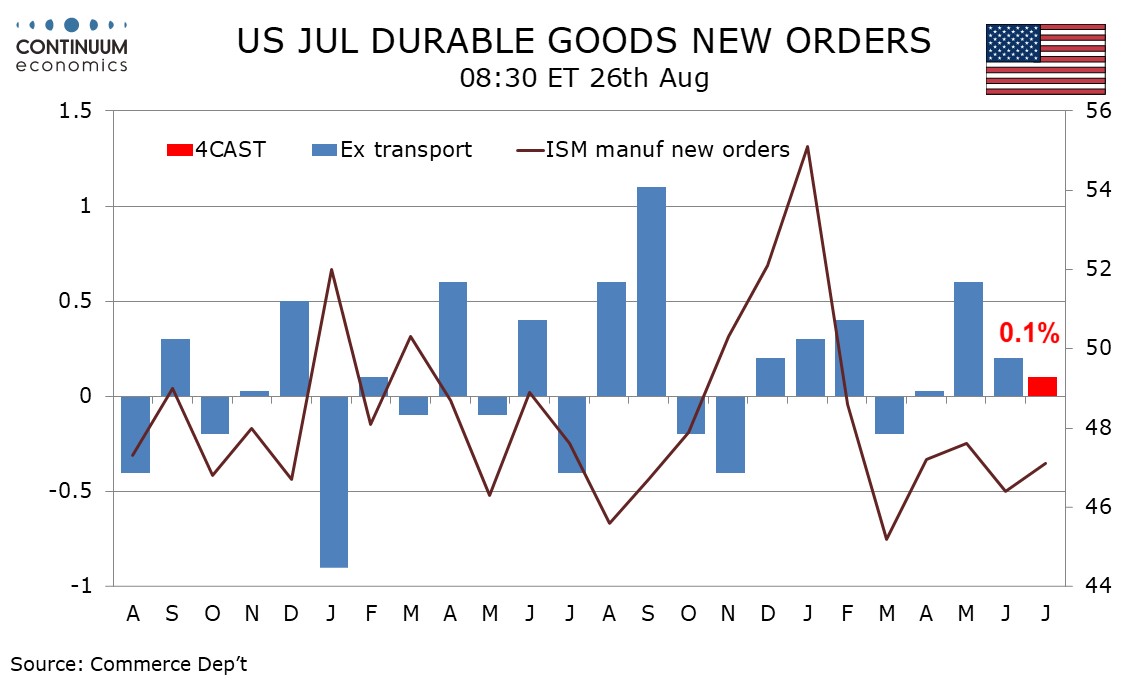

Ex transport trend is now modestly positive with only March in the year to date recording a decline, but ISM manufacturing new orders remain unimpressive and we expect only a 0.1% increase in July durable goods orders ex transport. Non-defense capital orders ex aircraft, a key indicator of business investment, are a little more volatile, but also have a modestly positive trend. Here we expect a 0.5% July increase after a 0.8% June decline.