Preview: Due August 14 - U.S. June PPI - Pattern of weak monthly data but upward back month revisions

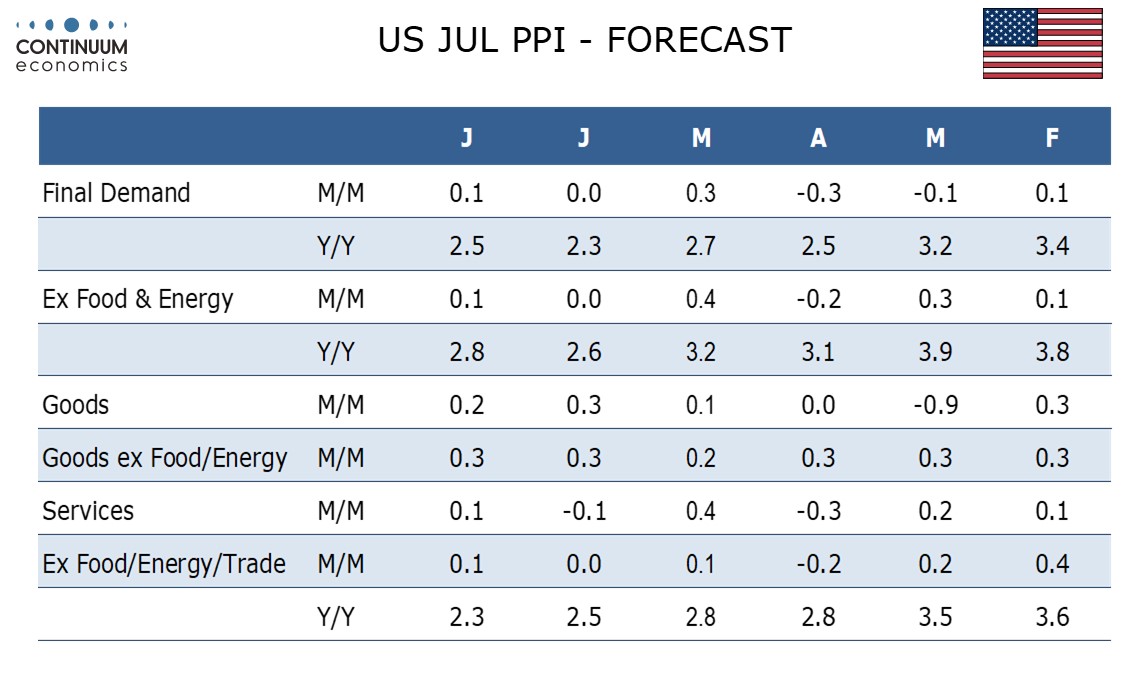

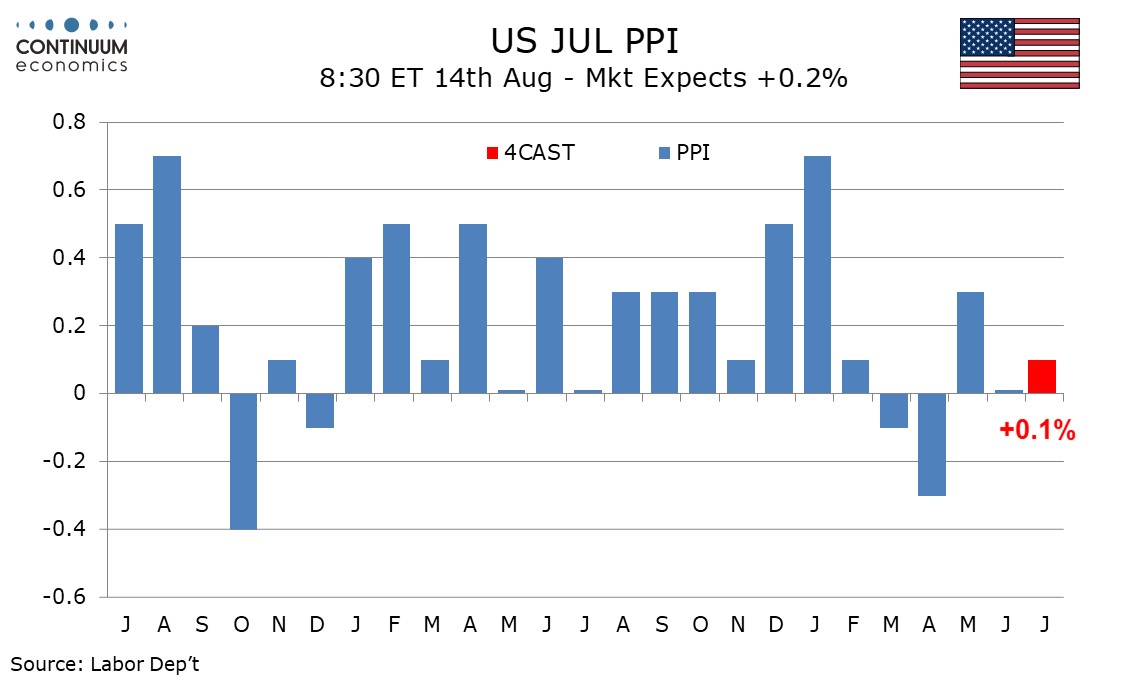

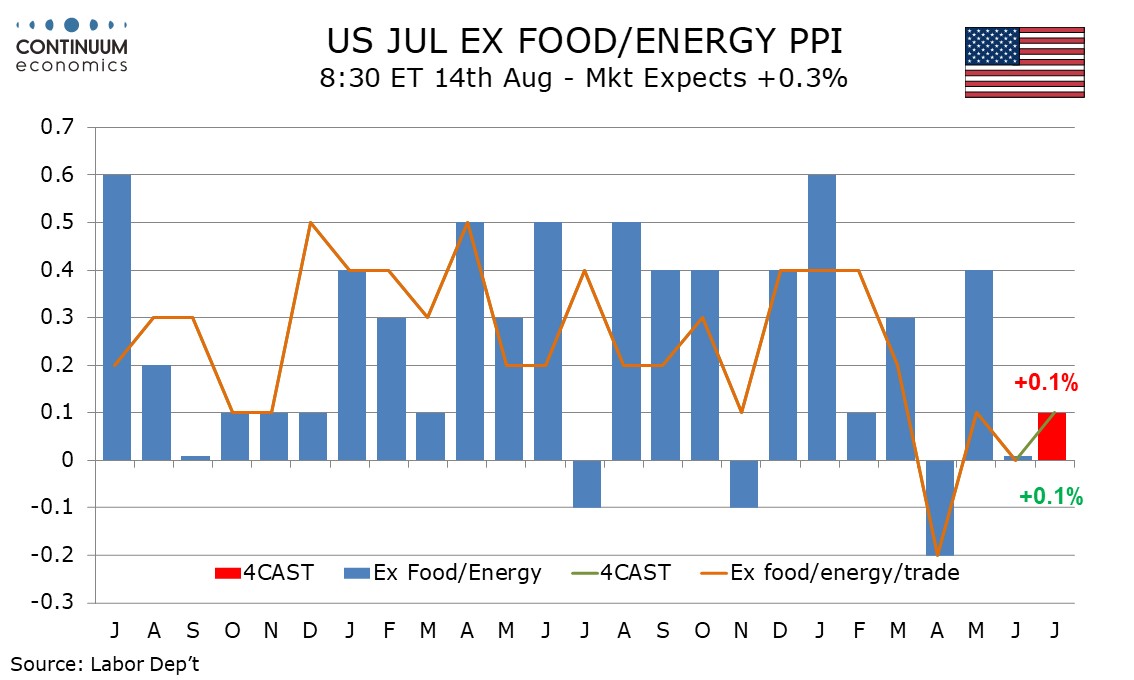

We expect July PPI to rise by a modest 0.1% overall and in each of the core rates, ex food and energy and ex food, energy and trade. This would follow unchanged outcomes in all three indices in June, but risk is that those indices will be revised higher, offsetting weakness in July.

In the first six months of 2025, PPI ex food and energy has seen an average downside surprise relative to consensus of 0.28%. However the average upward revision for the first five months of the year (June revisions will come this month) is 0.26%, almost fully offsetting the downside surprises. Cuts in Labor Department staff may be impacting data quality, which raises concerns over CPI which is only revised one a year.

Despite the confusion over revisions, PPI has been showing a fairly consistent picture of strength in core goods, impacted by tariffs, where we expect a rise of 0.3%, and weakness in services, where we expect a rise of only 0.1%. We expect a 0.4% rise in food where tariffs could have some impact to be offset by a 0.5% drop in energy, correcting a bounce in June seen during the Iran-Israel conflict.

Our forecasts imply increases in the yr/yr rates overall, to 2.5% from 2.3%, and ex food and energy, to 2.8% from 2.6%, but a slowing ex food, energy and trade to 2.3% from 2.5%, which would be the slowest since February 2021. If June data is revised up however, yr./yr rates could be 0.2%-0.3% higher than these forecasts.