Published: 2025-08-06T12:34:27.000Z

Preview: Due August 19 - U.S. July Housing Starts and Permits - Negative underlying trend

3

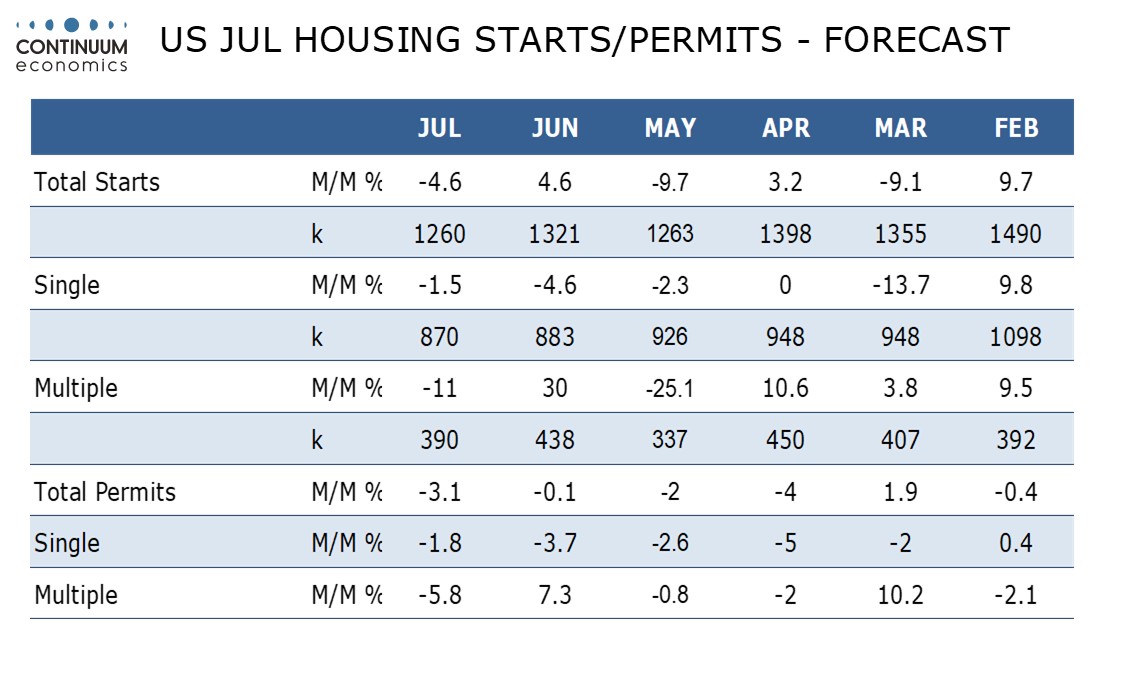

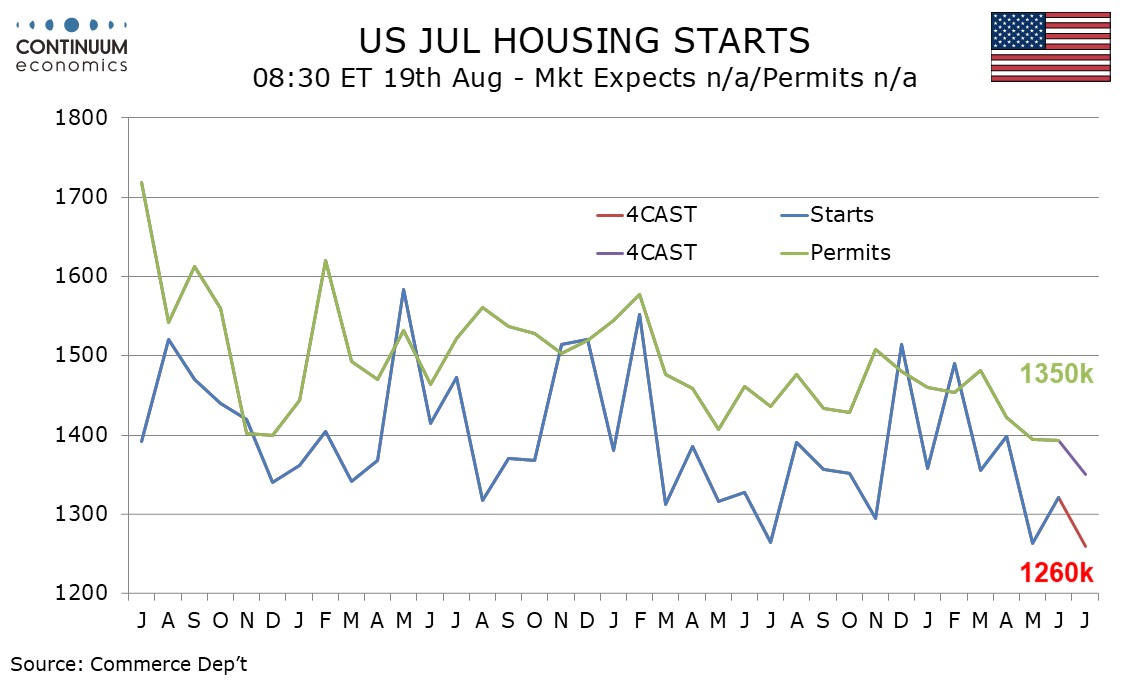

We expect July housing starts to fall by 4.6% to 1260k, reversing a similar rise in June which corrected a 9.7% decline in May. We expect permits to confirm a slipping trend with a fourth straight decline, by 3.1% to 1350k. A soft trend is likely to persist unless Fed easing commences.

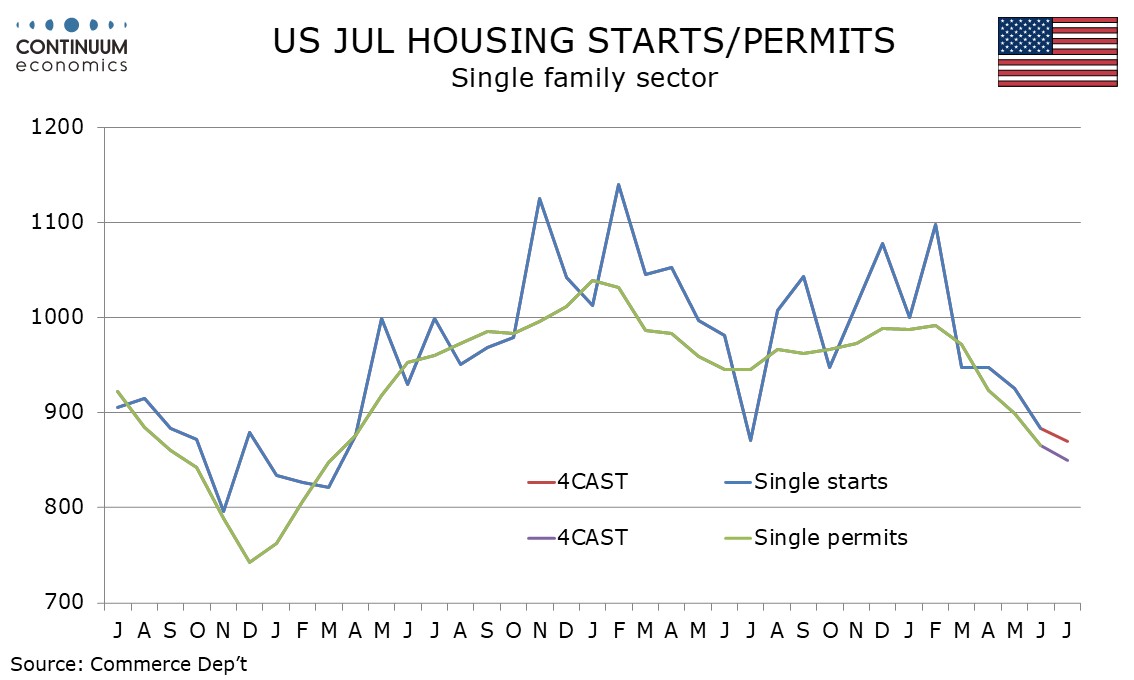

We expect the single family sector to see a 1.5% decline in starts after a 4.6% fall in June, while permits see a fall of 1.8% after falling by 3.1% in June. Neither series has seen an increase since February, showing a now negative underlying trend.

We expect the more volatile multiple sector to see starts falling by 11.0% after a bounce of 30.0% in June while permits see a fall of 5.8% after rising by 7.8% in June.

The starts fall is likely to be led by the Northeast which was the only region to rise in June, and sharply so, while permits see modest gains in the Northeast and West after sharp June declines, while the Midwest and South see renewed weakness.