Published: 2025-08-06T15:16:10.000Z

Preview: Due August 21 - U.S. August S&P PMIs - Weaker but not shockingly so

4

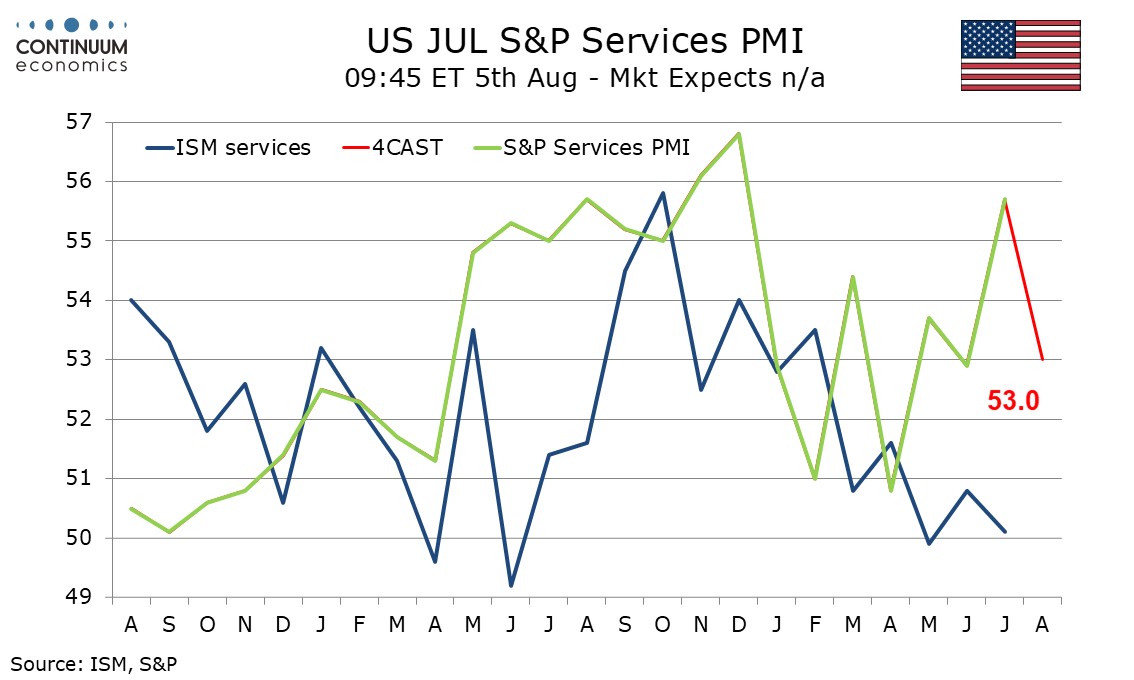

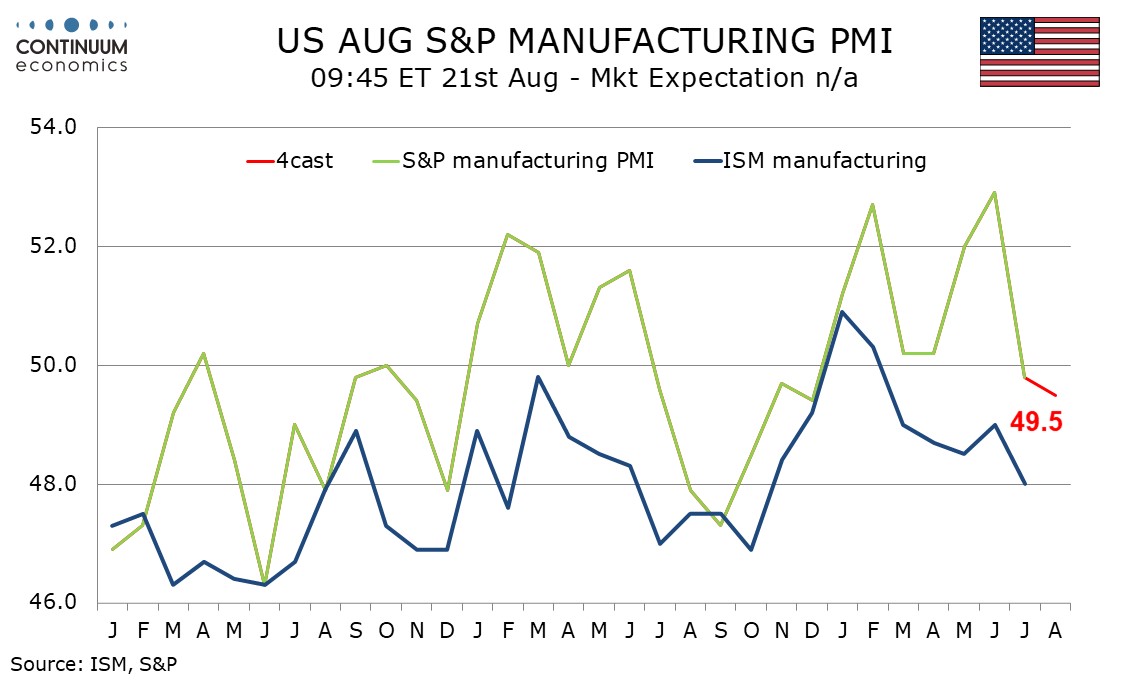

We expect August’s S and P PMIs to show manufacturing only marginally extending a July dip, to 49.5 from 49.8, while services reverse a surprising July bounce, falling to 53.0 from 55.7.

July’s manufacturing dip from June’s 52.9 was significant and the first reading below 50 since December 2024. A weaker ISM manufacturing index in July supported the S and P’s message, but with several regional manufacturing surveys having improved in July, a further sharp dip in the S and P manufacturing index looks unlikely.

The strength of July’s S and P services index was in stark contrast not only to a near neutral ISM services index but also weakness in employment growth. This suggests that July’s bounce is unlikely to be sustained, but with the correlation between ISM and S and P services data being poor we are not expecting a very weak August outcome from the latter. Our forecast is similar to June’s index of 52.9.