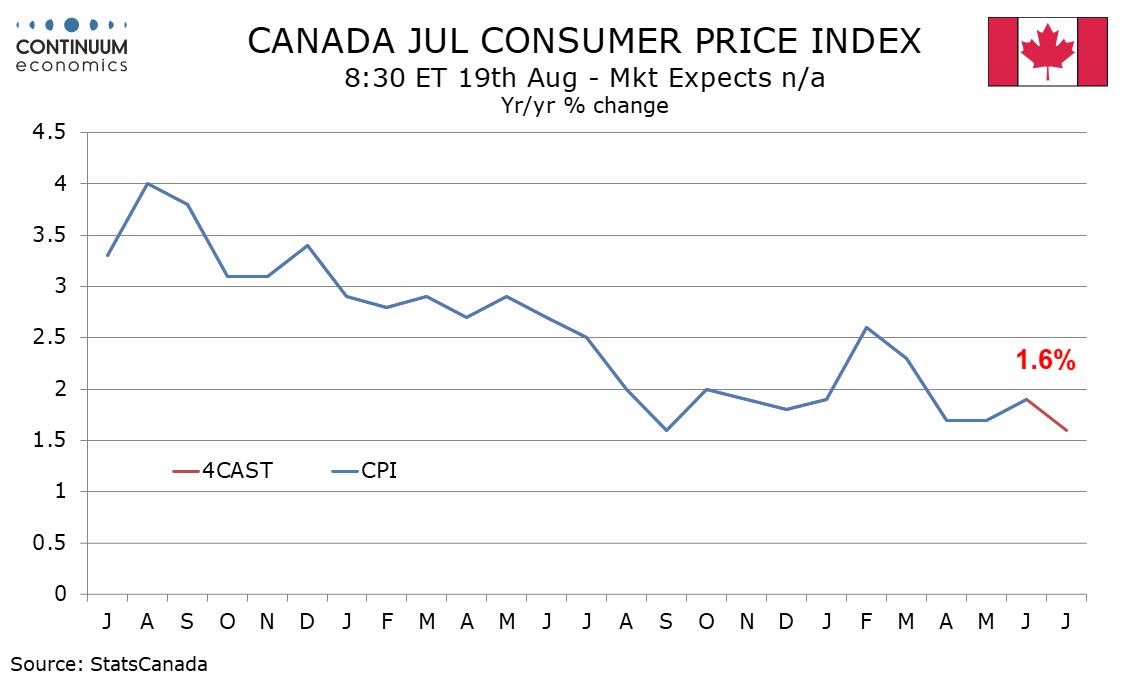

Preview: Due August 19 - Canada July CPI - Lower on gasoline but core rates to remain firm

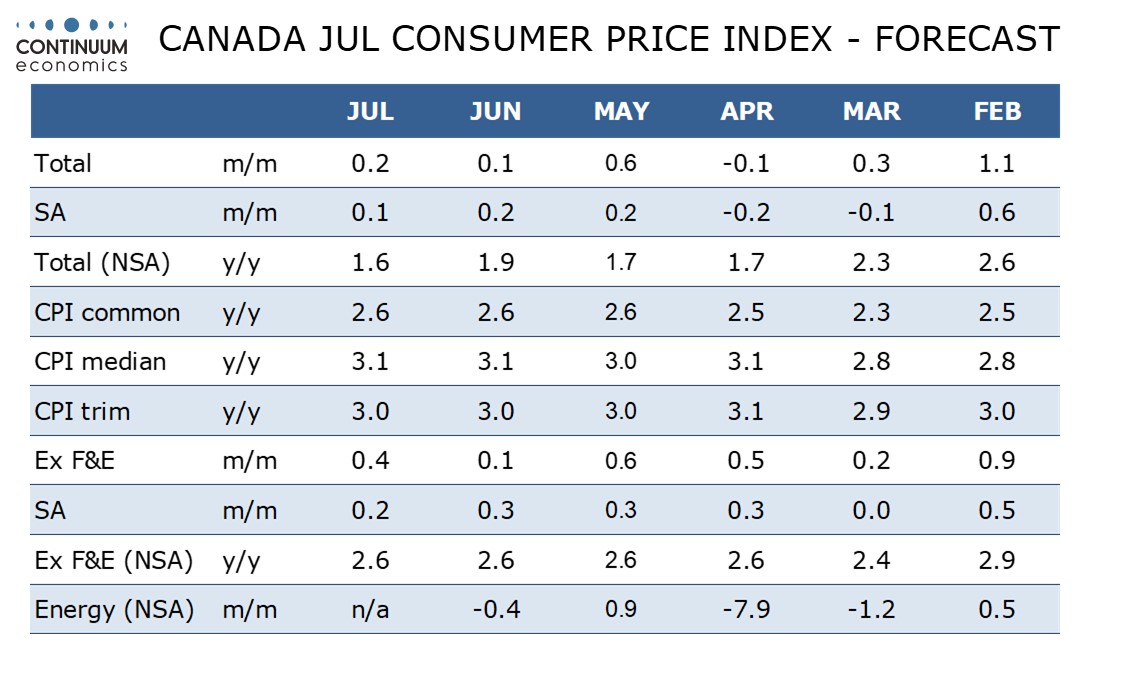

We expect July Canadian CPI to fall to 1.6% yr/yr from 1.9%, taking the pace to the slowest since September 2024, though April’s abolition of the carbon tariff is still depressing yr/yr growth by around 0.6%. July’s dip will be largely on gasoline and we expect little change in the BoC’s core rates.

On the month we expect CPI to rise by 0.2% overall, and by 0.4% ex food and energy. Seasonally adjusted we expect a 0.1% rise overall with a 0.2% increase ex food and energy. The latter would hint at some loss of momentum in Q3 after three straight gains of 0.3%.

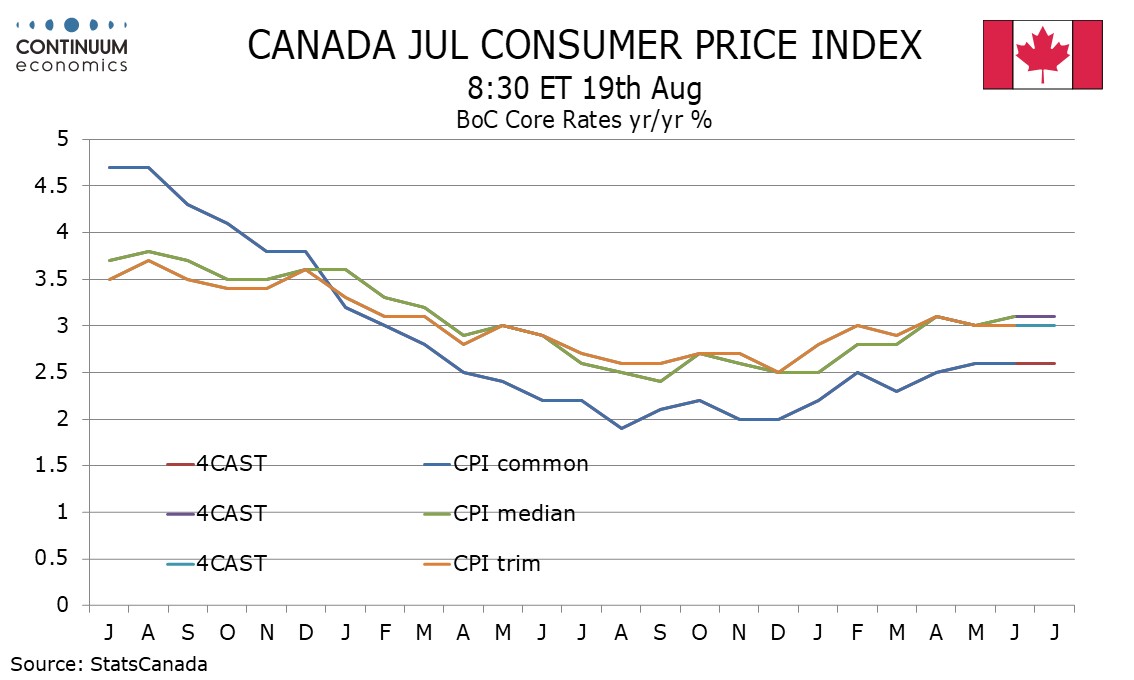

Despite the slowing of the overall pace, Subdued year ago data will see the yr/yr ex food and energy rate remain at 2.6% for a fourth straight month. The ex food and energy rate is not one of the Bank of Canada’s core rates, but these are also likely to see little change, remaining well above the BoC’s 2.0% target.

We expect unchanged yr/yr rates for CPI-Common, at 2.6%, CPI-Median, at 3.1%, and CPI-Trim, at 3.0%. August and September will also see subdued year ago data dropping out, making near term progress on the yr/yr core rates difficult.