Eurozone Outlook: The Last (Disinflation) Mile

· Our still soft EZ GDP outlook remains only a little below consensus and ECB thinking as we still suggest ECB 2022-23 policy has caused a clear increase in the cost of credit alongside a fall in supply of credit. The result is that while the economy is now growing afresh but is doing so timidly, with downside risks persisting through 2024 and 2025.

· This triggers our still-below consensus HICP outlook in which headline inflation is seen easing below target in H2 2024, with the core rate (still worrying the ECB) likely to follow and a sustained drop then occurring through 2025. This picture has persuaded the ECB to start easing and we forecast a further 50 bp of official rate cuts in H2 and more (100 bp) to follow in 2025.

· Given the growing likelihood of even lower official rates, a banking crisis is a low to modest risk save for a possible fresh fiscal crisis. Perhaps the main risk is that interest rates cuts may be larger and/or faster than we have assumed as the monetary policy transmission mechanism proves even more persistent than we have estimated and fiscal policy prove more restrictive.

· Forecast changes: Compared to the last outlook, we have (yet again) largely retained the overall EZ growth outlook, with a fragile recovery for 2024 that may result in nothing better than trend-type growth in 2025. More notable, is the hardly-revised and still-soft EZ HICP inflation outlook in which the target is undershot on a sustained basis into 2025. As a result, we have again retained our ECB policy rate forecasts.

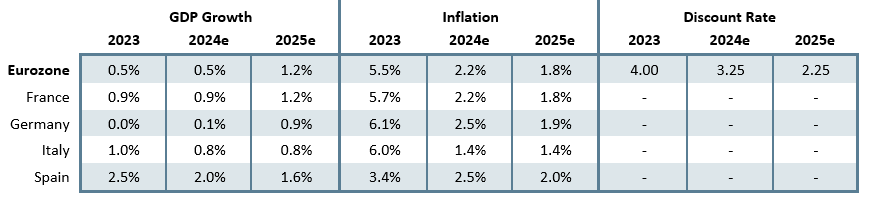

Our Forecasts

Source: Continuum Economics, Eurostat

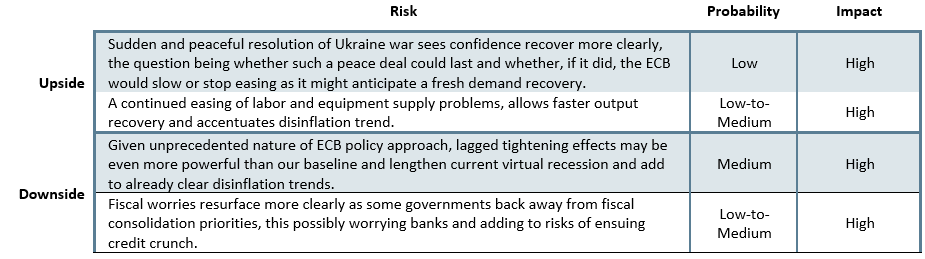

Risks to Our Views

Source: Continuum Economics

Eurozone: Activity Diverging Geographically?

At least among the larger EZ economies, there seems to be some divergence in terms of activity momentum. Economies more to the west and south geographically have out-performed, led by Spain (see below). This may be attributable to being furthest away the Ukraine War-related energy shock. It may also be that these economies have benefitted from the recovery in the tourist industry of the last year. Regardless, it does seem as if the overall EZ has emerged from the shallow recession seen in H2 last year. Indeed, Q1 GDP exceeded expectations but this masked fresh and clear weakness in domestic demand. One key cause of this domestic weakness into 2024 has been an inventory drawdown. This may reverse in coming quarters posing upside risks to our EZ GDP outlook as may the activities of multinational enterprises in Ireland, following a negative EZ impact during 2023 of almost 0.5 ppt. However, it is more likely that the inventory drawdown is a reflection of running down precautionary stocks built up amid supply problems in 2022. Indeed, if anything, business survey data suggest further inventory drawdowns which means we see a weaker q/q Q2 outcome before a clearer but still only moderate recovery occurs in H2. Even so, there are also probably more downside risks, not least as government spending is reined in. Thus, our still somewhat gloomy outlook where we see an anticipated rise of 0.5% (revised higher by 0.2 ppt after the better Q1 reading) but where 2025 GDP prospects remains at 1.2%. This below-consensus outlook is actually consistent with only a return to trend-type growth for 2025.

Despite some improvement in some business and consumer surveys our wariness remains very much based around the unprecedented slump in private sector credit and deposits, all of which we think stem from the aggressive ECB tightening still to reverberate fully. This continued domestic weakness includes soft consumer spending. Undermined by fragile confidence and higher interest rates, consumption growth will largely match overall GDP both this year and next, with the better 2025 outlook reflecting more durable lower inflation letting wages grow slightly in real terms. But other aspects of private demand will also restrain growth into and through 2024, not least construction spending which may fall more notably and broadly on a geographic basis, something still hinted at by surveys. Moreover, the anticipated recovery in imports into 2025 will also mean that the return to a current account surplus seen last year (at almost 2% of GDP) may actually be partly reversed in 2024.

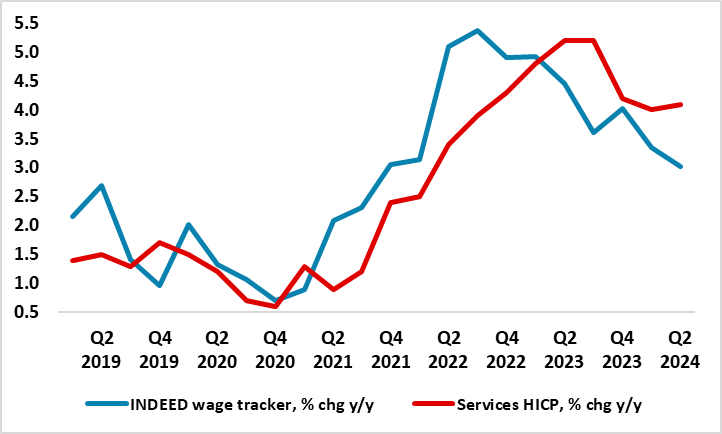

Notably, this domestic weakness is yet to cause a reversal in what has hitherto been a solid labor market, with current jobless rates at record lows. This partly reflects companies hoarding labor, which suggests that recovery will not be as employment rich as otherwise. There has also been healthy rise in the workforce (actually to both higher and faster levels than pre-COVID), this being somewhat unique to the EZ. More notable is that the rise is very much dominated by an increase in the supply of younger workers, these much more likely to seek new jobs in pursuit of better remuneration, this possibly explaining the slowing in advertised wages (Figure 1).

Figure 1: Easier Wage Trends Suggest Resilient Service Inflation Will Buckle?

Source: Eurostat, Indeed

Amid what has been a disinflation process so far very much supply driven, it is very difficult to assess the likely full damage to demand from current tight financial conditions let alone the extent to which depleted spending power may rein in pricing power. But encompassing what has already been a marked softening underlying inflation, we still envisage headline HICP moving below 2% temporarily later this year and durably next with the core not far behind, this 2024 picture being a little higher than envisaged in the March Outlook, partly due to some fiscal measures and energy price rises and service price resilience. The latter has served to heighten worries about price persistence and the so-called ‘Last Mile’ problem. But such concerns gloss over the fact that core goods prices have undergone the opposite trend, this divergence enough to mean that overall HICP inflation has been averaging just over 0.1% m/m in adjusted terms in the last few months. In addition, the omens from wages point to services inflation succumbing in due course. (Figure 1).

Fiscally, policy is projected to tighten significantly though this year, mainly due to the withdrawal of a large part of the energy support measures. A further but more modest tightening of the fiscal stance may occur for 2025-26, on the back of the scaling down of the remaining energy support, slower growth in subsidies and other fiscal transfers, and some measures on the revenue side. These effects are expected to be partly compensated by limited increases in government investment. Thus the headline EZ budget gap may fall to around 3% of GDP this year from 3.6% last year but will not fall much further in to 2025 without more consolidation measures which do seem to be under active consideration, possibly pressured by new EU fiscal rules where member states with excessive deficit or debt ratios will face a more ambitious budgetary objective, mainly though spending reductions. But these are likely to act as a drag on overall EZ growth into 2025 over and beyond the reversal of energy support measures. Thus with headline budget gaps that may stay around 3% of GDP this year and next, the fall in the EZ government debt ratio to 88.5% of GDP last year may even now reverse.

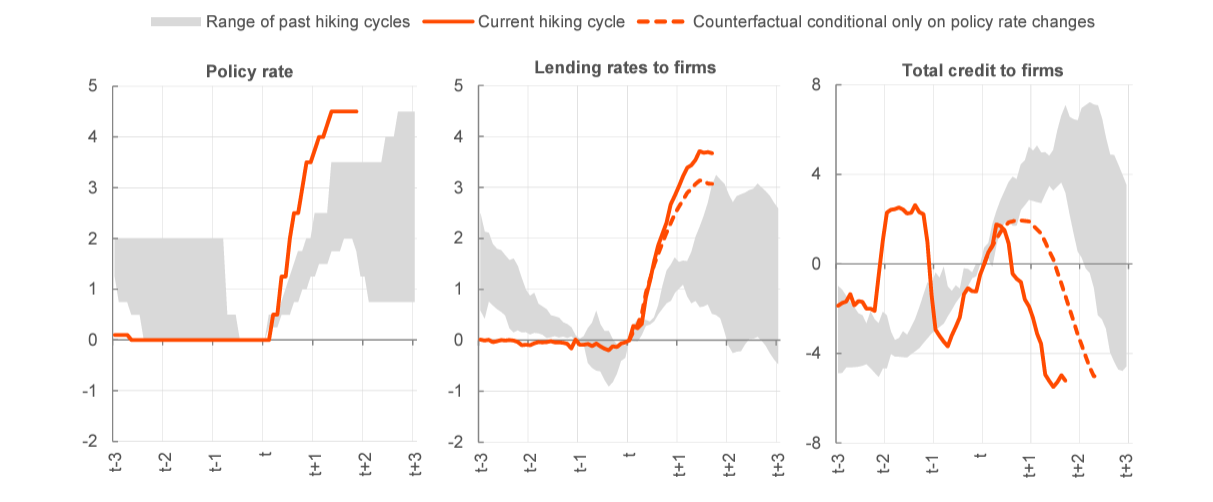

Figure 2: Unprecedented ECB Hiking in Terms of Speed and Results?

Source: ECB, monetary policy transmission in previous hiking cycles (horizontal axis: years; vertical axis: cumulative changes in ppt)

ECB: Policy into a New Phase?

Chiming with the almost unanimous hints from Council members, all policy rates were cut by the expected 25 bp earlier this month, with the key deposit rate falling from at an unprecedented 4.0% for the first reduction since 2019. But it was no surprise that no formal guidance about the size and timing of future policy was forthcoming, save to underline that policy will be data dependent and clearly no pre-commitment to a particular rate path not least alongside upgraded forecasts for this year. But the updated and possibly (optimistic on growth) forecasts do corroborate market thinking of rates falling well below 3% into late 2025, even given the slightly later but still clear undershoot of the inflation target being flagged. We still see two more 25 bp moves this year and even the anticipated four further cuts in 2025 will hardly take policy out of a restrictive stance.

We also still feel that neither Fed policy, nor the US$, are likely to delay any further ECB move(s). Perspective is needed. Despite the stronger US dollar, the EZ is not getting any competitive gain as the euro effective exchange rate is almost at record highs, partly a result of the weak yen, the net impact adding to tighter EZ financial conditions. This is all more notable as we have suggested that policy has been tightened relatively extensively, if not excessively in both speed and extent (Figure 2).

Perhaps the main risk is that interest rates cuts may be larger and/or faster than we have assumed as the monetary policy transmission mechanism proves even more powerful than we have estimated reflecting as ECB balance sheet reduction adds to tighter financial conditions. This is all the more important as the ECB has no plans (yet) to slow, let alone stop, its unconventional tightening regardless of what and when its reduces official rates. It could be argued that if the ECB purses further balance sheet reduction, then larger/faster conventional easing may be needed!

Germany: Recession Over But Will It Be Evident?

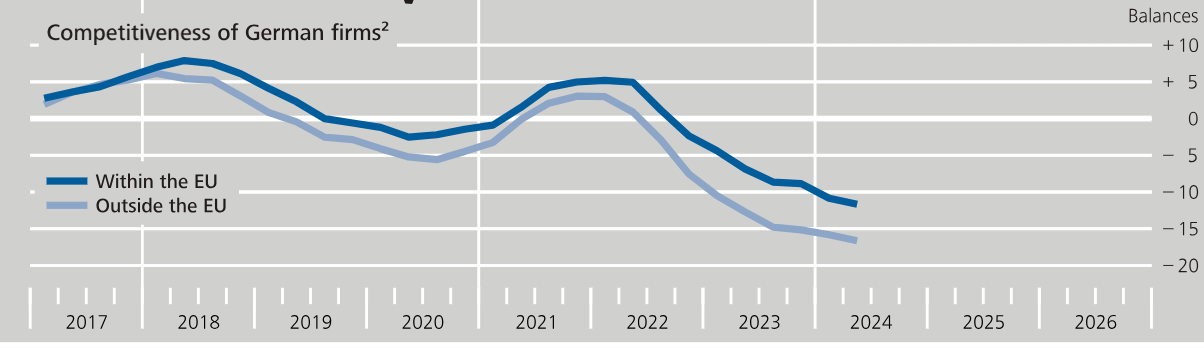

The economy has emerged from the recession of H2 last year but the question is whether the modest growth seen in Q1 and the equally soft numbers we anticipate for the rest of the year will feel any different. This is especially as the better data so far this year may more reflect fewer industrial disputes than genuine fresh momentum. Domestic demand is set to pick up but only slowly in 2024 and then into 2025, as real wage growth returns. However, investment growth is projected to remain well below pre-pandemic levels, constrained by continued high financing costs and uncertainty. Exports will remain sluggish in 2024 and only slowly recover in 2025 as competitiveness becomes an ever-clearer headwind (Figure 3) and any rise will be offset by recovering imports. Even so, the current account may be over 6% of GDP this year and next. Regardless, and partly as a result of the better Q1 outcome, we have upgraded our 2024 GDP picture to one that sees a 0.1% rise, ie as opposed to the same-sized fall seen three months ago. Notably, the scale and particularly the durability of the weakness is evident from the fact that we still do not see the recent peak in the level of GDP (ie in Q2 2022) being re-attained until end-2024 and possibly later as there are downside risks to our slightly downgraded and sub-consensus 0.9% 2025 growth projection, most clearly from the fiscal side (see below). We have highlighted the structural factors increasingly affecting the economy, including vulnerable supply chains, relatively high energy costs and adverse demographics and these remain headwinds so that as Germany’s economic malaise is far from purely a cyclical development.

All of which helps explain why the German economy is likely to remain weak out to 2025 and perhaps beyond. This reflects weakness in domestic demand as ECB policy is biting ever more clearly, offsetting what are still largely positive labor market dynamics. Indeed, the (aged 20-64) participation rate is at a record-high 83.6% while the unemployment rate is expected to remain broadly stable at under 6% over the forecast horizon. Admittedly, the job vacancy rate will remain at high levels, while the acceleration of ageing will start to weigh more on labour supply.

Partly reflecting what is still an output gap likely to remain negative into 2025, we see some respite as inflation is falling broadly and we see it falling further and actually makes us even more confident of it dropping below 2% in H2 this year, albeit with late-year volatility due to adverse energy related base effects. Even so, consumer spending is likely grow very slowly on average in 2024, not even repairing the 0.7% fall seen through 2023 as the near 10% current fall in house prices both erodes household wealth and puts added upward pressure on rents. All of which means that domestic demand weakness is likely to see the biggest damage emanating from the slumping construction sector. Indeed, building activity is falling increasingly and broadly, albeit led lower by residential construction work, and where surveys very much suggest that difficult conditions will persist for at least the coming year.

Figure 3: German Competitiveness Dropping and Broadly So

Source: Bundesbank, % balance based on question assessing company’s competitive position chg over 3 mths

Regardless, the fiscal picture remains in a state of flux. The debt brake could be suspended again but this would divide further an already fragile coalition with effective spending cuts of some 0.5% of GDP on the cards for this year instead. Regardless, the budget deficit is likely to fall again this year from around 2.5% of GDP in 2023 towards 1.5% this year and lower still in 2025 as a result of the phase-out of measures to mitigate the impact of high energy prices dropping from 1.2% of GDP in 2023 to 0.1% of GDP in 2024. In addition, solid tax revenue and strongly increasing social contributions, due to rising salaries and social contribution rates will continue into 2025. However, projected initiatives on climate policy and defense are rising sharply as are debt interest costs, the latter as much reflecting sizeable contribution comes from provisions for redemptions of inflation indexed debt instruments. All of which may be adding to economic uncertainties.

France: Fiscal Risks Building as Political Risks Deepen

As reiterated three months ago, fiscal worries are resurfacing, now accentuated by politics. S&P downgraded France's sovereign rating last month, the first such move since 2013, but the second time in just over a year that one of the three major rating agencies has done so. Notably, the S&P moves comes despite the agency suggesting above trend growth in the next few years. Most worrisome is that the surprise snap parliamentary elections may only lead to more fiscal policy impotence. Despite the recent EU parliamentary results, the two-stage nature of the parliamentary election (first vote on June 30 and then the run-off on July 7) makes it unlikely that either the far right National Rally or the left-wing alliance will get a firm grip on power by winning a parliamentary majority. But President Macron’s party will emerge weakened. As a result, this would lessen Macron’s already fragile ability to force through some difficult structural and fiscal reforms, adding to already-growing debt sustainability questions as the debt ratio looks set to rise by over one ppt per year from the 110% set in 2023 and only partly due to higher debt servicing costs; the pass-through of higher borrowing costs will be gradual because the French government's debt is long dated, with the average maturity longer than 8.5 years.

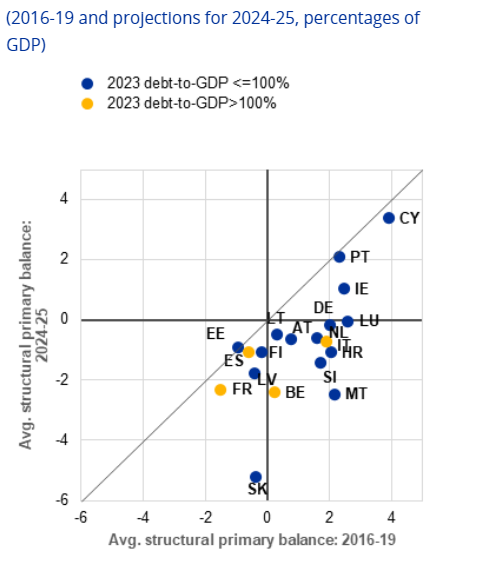

Indeed, encompassing a persistent structural gap (Figure 4), budget deficits may average around 5% of GDP out to 2026. This follows last year's higher-than-planned budgetary outcome, with the deficit at 5.5% of GDP, compared with 4.9% planned. This budgetary slippage was mainly due to lower tax revenue than budgeted, while spending as a percentage of GDP remained high; at over 57% of GDP, it was the highest in the EU. The risks are recent reforms will not be sufficient to meet budgetary targets. This risk is a vicious circle builds due to the need to make ever larger fiscal consolidation measures to suppress growing market jitters. Four months ago, €10 bn of spending cuts were put through and a second such consolidation plan is due in the coming months, as well as possible new taxes on share buybacks or on the profits of energy companies and maybe the same again for 2025, this a cumulative 1% of GDP.

This will add to the headwinds facing the real economy and mean that the recent downgrade by the French government to its 2024 GDP projection at 1% still looks optimistic. Admittedly, we have upgraded this year’s forecast to 0.9% from 0.6% but solely due to the better than expected Q1 outcome. Even so, we see a gradual recovery this year, but still a weak one not least given the still soft (ie below-par) messages from the various business surveys. We still see a better 2025 growth picture of 1.2%, albeit a notch lower than envisaged three months ago. But this comes with downside risks, not only from the budget cuts, but also the lagged impact of the rise in interest rates and the economic and possibly more persistent political uncertainty. Notably, private consumption will be weak as those energy support measures are fully revised into 2025 and what still seems to be high savings are locked up in illiquid assets, so the boost will be modest and that consumer spending will grow no more in 2024 than overall GDP, this also the case for 2025. Investment is projected to recover progressively into 2025 but only after fresh drops in coming quarters. Meanwhile, over the forecast horizon, net exports are set to have a minimal and possibly negative contribution to growth. Exports growth, which traditionally relies on a few specialized sectors such as aeronautics and other transport equipment, is expected to be offset by rising imports mirroring the recovery of household consumption. Hence, a still clear current account deficit will persist into next year, albeit staying at around 1% of GDP. But France still faces pressure in terms of its competitiveness, judging by its persistent trade deficit.

However, this soft growth outlook will reinforce the broad disinflation already very much evident. Thus we still envisage CPI inflation at 1.8% next year even though there is some upward revision to that for this year (to 2.2%). This is backed up by business surveys very much suggesting that expected price cost pressures are back to pre-pandemic levels generally. All of which, however, reflects the growing impact of the marked recent damage to spending power alongside tight(er) financial conditions. These are which are likely to lead to a further reining in pricing power and arise in the jobless rate back above 7.5% into 2024 and where companies are likely to see profit margins fall.

Figure 4: France Structural Budget Gap Persists

Source: ECB, Past and projected structural primary balances across all EZ countries

Italy: Further Fiscal Focus

Fiscal worries about Italy have lessened somewhat of late, at least that is the message from the fall in sovereign spreads to around 140 bp vs Germany at a 10-year horizon prior to French political problems. However, we feel this current spread is too low given the still unfavorable debt dynamics Italy faces in coming years, where an average nominal growth rate is likely to undershoot slightly higher average interest rates into 2025. In order to restrain debt, this means that Italy needs to start running a primary budget surplus: Finance Ministry figures suggests this will occur from next year. But we are doubtful, meaning that the recent drop in the debt to GDP ratio (to 137% in 2023) is likely to be short-lived. The question is how fast it may start rising, most see a circa-two ppt rise both this year and next. This is something that seems discounted by markets, they partly reassured by what seems to be an Italian government not willing entirely to dispense with fiscal consolidation. But even though it is less likely that the ECB will decide on a more aggressive QT option for APP, the risk of a fiscal crisis in coming years remains, and the resulting spread premium ironically only adds to such risks.

But the fact that the economy may have surprised on the upside in the last few quarters and to a degree that solid GDP numbers late last year have spilled over into early 2024 is encouraging. Indeed, this explains the 0.2 ppt upgrade we have made to 0.8% GDP growth. But this is still below the 1% penciled in by the Italian government and given debt dynamic arithmetic this is partly offset by what we think will be CPI inflation rates this year and next (at 1.4%) will undershoot official forecast of near 2%.

Moreover, the growth picture (possibly more to our unchanged 2025 outlook of 0.8%) still has some downside risks, the latter mitigated somewhat of late by what are slightly less negative business surveys. But the main risk remains the extent to which fiscal policy is reined in as the government attempts to unwind the so-called Superbonus scheme (a generous tax incentive for housing renovation, which should be entirely phased out by next year). As we have stressed before, its impact has been marked in two crucial ways. It has boosted GDP growth but it has also damaged the fiscal situation to degree that the budget gap for last year was over two ppt higher than the official 5.3% of GDP target. Its removal will help, but we still see budget deficits of just under 5% if GDP persisting this year and next, with upside risks not least given a structural gap of over 5%.

Thus the real activity picture is both a reflection of and a cause of the increasingly soft inflation backdrop and outlook. Regardless, the soft inflation picture is not likely to foster much recovery in what has recently been falling real disposable incomes. The very gradual increase in nominal wages (contractual hourly earnings rising by around 2.5% next year), together with less positive employment conditions, will keep private consumption growing by less than GDP into 2024, with activity undermined further by the planned expiry of all temporary income-support measures. Capital spending may pick up only moderately in 2024, as the fall in housing construction is offset by Recovery and Resilience Facility (RRF)-supported increases in investment in infrastructure and equipment. Net exports may provide a little support to growth in 2024, following a likely positive contribution in 2023, but where the return to a current account surplus seen last year will at best be consolidated in 2024 at around 1% of GDP.

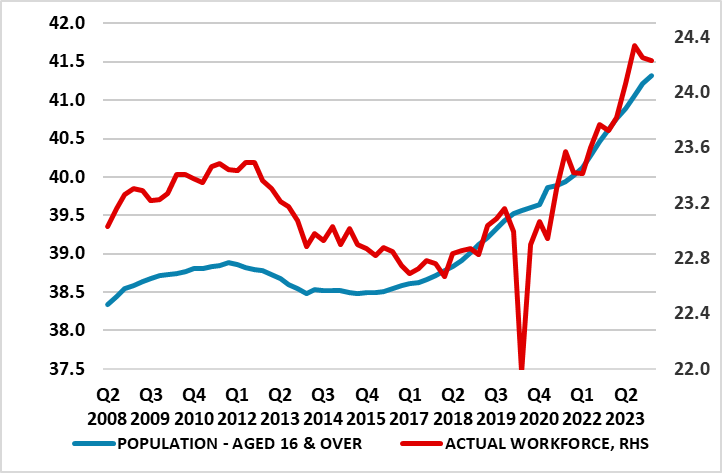

Spain: Workforce Boost Moderating

Very much part of the divergence in growth performance across the EZ, Spain was the fastest growing major EZ economy last year at 2.5% with clear momentum into this year. Indeed, this was something very much evident by the strong showing in Q1 GDP. As a result, we have (again) upgraded the GDP outlook for this year and clearly so, by 0.5 ppt to 2.0%, but we still believe a slowing is on the cards, albeit the unchanged 1.6% projection for 2025 still leaving the economy atop of the EZ growth tree, certainly for the larger economies. The recent momentum has been underpinned by robust labour market developments which sustained private consumption, as well as by the contribution from net exports and public consumption. Amid the higher interest rates environment and general uncertainty, overall investment growth has been subdued, particularly in the second half of the year. This has notably been the case for equipment and machinery as well as residential construction but where a pick-up the implementation of the RRF and the now unfolding easing of financing conditions will act as a bulwark through this year and into next. But at the heart of that robust labor backdrop has been a marked rise in the Spanish workforce (largely a reflection of returning emigration) enough to have effectively increased the economy’s potential growth rate. But as Figure 5 also shows, that workforce rise has started to reverse and it our expectation that this may continue that explains the underlying reason we envisage growth slowing. This slowdown will also reflect less impetus from tourism, which has seemingly hit new highs last year, led by international tourist arrivals. In addition, there is still the marked and lagged impact of ECB policy tightening and the external sector will be hampered further by the relative weakness of Spain’ European trading partners. Thus we see a largely unchanged current account balance of just over 2% of GDP both this year and through 2025.

Figure 5: Surge in Workforce Unwinding

Source: INE, million

Regardless, domestic demand is expected to be the driver of growth, despite slower private consumption, but with some upside risk if still high savings rates are pruned further.

On the inflation side, we expect the underlying trend to be one of more modest moderation. Indeed, we see inflation slowing to an average of 2.5% this year (a small upgrade due energy prices and fiscal measure reversals) but with the projection of 2.0% for 2025 intact. This reflects some slowing in terms of services inflation, reflecting a limited impact of the so-called second-round effects, not least given the strong rise in the working population and thus labor supply). Recent wage agreements data already support this, with a slowing to 2.8% in January. Regardless, the unemployment rate may continue to fall, although its reduction will be moderate from 12.1% in 2023 to 11.8% in 2024 and to 11.6% in 2025.

Spanish PM Pedro Sánchez has managed to maintain a minority coalition administration amid ever clearer political divides. However, amid the need to pander to minority parties asks whether this may have a fiscal cost as Sanchez is likely to have to buy support, this having budget consequences, enough to mean that the budget gap may start to rise into 2025, as this year’s deficit will be pulled back to just over 3% of GDP (from 3.6% in 2023) by the phasing out of measures to mitigate high energy prices. Instead, weaker growth will take a toll with the clear risk that the debt to GDP ratio may fall no further into 2025.