Switzerland: Disinflation - Fanned by the Franc

It is somewhat ironic that the sharp and surprising slump in CPI inflation in January resulted in a weakening of the Franc, the currency’s recent and still clear strength actually the major factor behind this seemingly clearer disinflation. Indeed, the CPI details showed the major factor was even more negative import price inflation. In contrast, while still soft (and certainly consistent with price pressures very much in line if not below the SNB 2% inflation target), core and domestic price pressures largely moved sideways, at least in seasonally adjusted terms. Admittedly, the January data also undershot SNB thinking, but we do not see the data as being a policy game changer. Instead, we continue to see at least two SNB (25 bp) rate cuts this year, starting in Q2 but driven as much by currency and ECB shadowing rational than inflation.

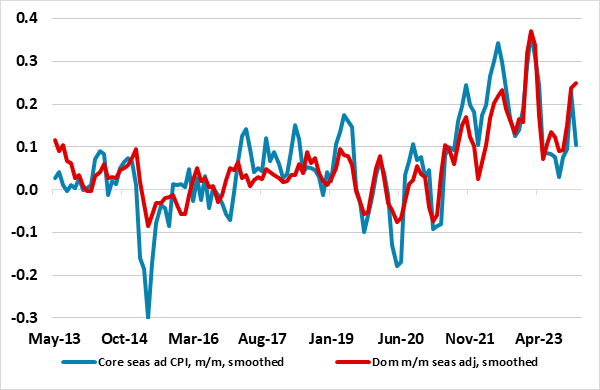

Figure 1: Core and Domestic Price Pressures Low But Not Lower

Source: SNB, Continuum Economics; smoothed is 3 month mov avg

Amid a modest hike in utility prices and alongside a rise in VAT, it was expected that Swiss CPI inflation would at best stay at what was the existing 1.7% y/y rate. Instead, the headline rate slumped 0.4 ppt to a 27-month low, also encompassing almost as marked a fall in the core rate to two-year low of 1.2%. This drop will have surprised the SNB, and suggests its downwardly revised Q1 CPI projection made in December looks too high at 1.8% - our long-standing view envisages a 1.3% average this quarter.

But the weakness needs perspective as it largely reflects the impact of the strong Franc, which has caused import-led CPI inflation to turn negative (to -0.8% y/y in January), actually the softest reading in three years and an ever-sharper contrasts to the almost double digit rises posed some 18 months ago. In contrast, domestic inflation slowed a little in y/y terms but at 1.9% is hardly a challenge to the SNB inflation remit. That is also the case is assessing recent trends in underlying and domestic price pressures which have been subdued for some time, this very much evident in m/m seasonally adjusted data. Thus we do not think the CPI data is a policy game changer, merely yet another trigger for the SNB inflation pessimism to be ratcheted down!

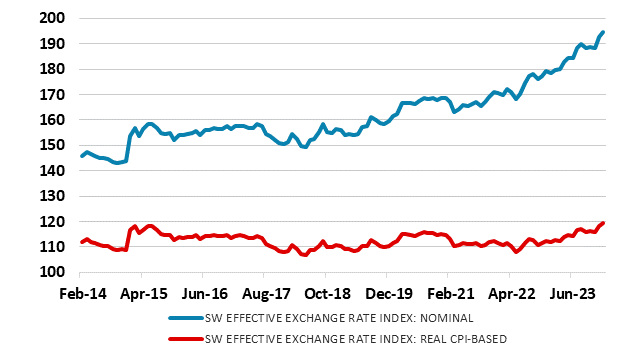

Figure 2: A Tale of Two Trade-Weighted Francs

Source: SNB

Of course, the strength in the Franc is also a headache for the SNB as well as a clear price pressure safety valve. It is worried about the competiveness repercussions, although the manufacturing and services based exports industries are so specialized that price is a secondary issue. Moreover, the competitiveness issue of the string Franc is tempered by low inflation itself – the CPI adjusted trade weighted currency index has risen far less than its nominal counterpart (Figure 2). Regardless, the SNB does seem to have been conduction some FX intervention, given the rise in FX reserves reported for the last two months. This may mean that the SNB is the first DM central bank to have started to rebuild its balance sheet after such concerted efforts to shrink it hitherto – NB: the balance sheet situation is clouded by the possible impact that the annual loss made through 2023 may have caused.