Swiss National Bank

View:

June 23, 2025

Western Europe Outlook: The First Shall be Last…

June 23, 2025 7:46 AM UTC

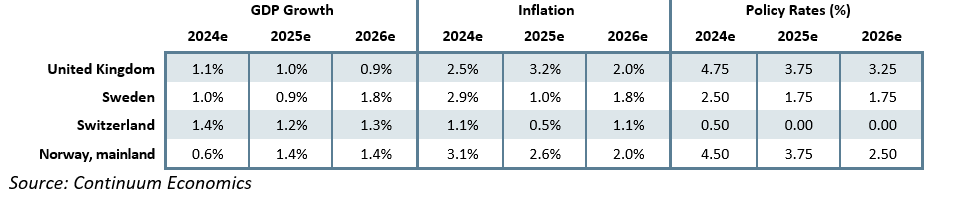

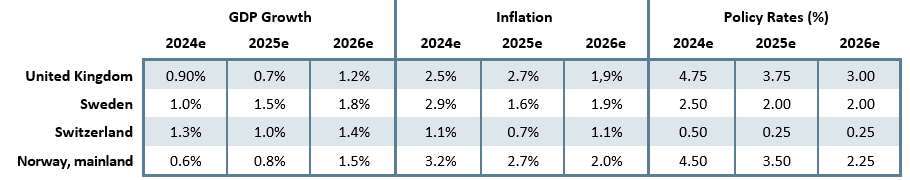

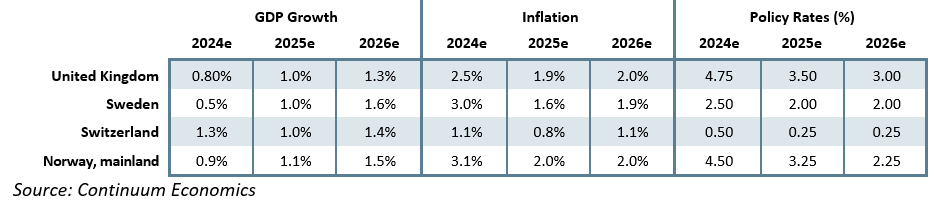

· In the UK, we have upgraded 2025 growth by 0.3 ppt back to 1.0%. But this is purely a result of the Q1 front-loading and instead masks what we think will be essentially a flat GDP profile into 2026. The BoE will likely ease further in H2 by at least 50 bp and maybe faster and then i

June 19, 2025

SNB: Cut to Zero, But Negative Rates an Option

June 19, 2025 8:00 AM UTC

The SNB would probably prefer to consolidate the effects of previous rate cuts, but the low inflation forecast and downside risk to inflation means that a cut to -0.25% is feasible at the September or December meetings. The SNB will also hope that the threat of negative rates restrains the CHF s

June 11, 2025

SNB Preview (Jun 19): Toying With Being Negative?

June 11, 2025 9:23 AM UTC

A further 25 bp cut (to zero) in the SNB policy rate on Jun 19 now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing and this is before key Swiss pharmaceutical exports come under fire. Meanwhile, there is the strong currency where FX int

May 07, 2025

Switzerland: A Triple Disinflationary Threat?

May 7, 2025 1:30 PM UTC

A further 25 bp cut (to zero) in the SNB policy rate on June 19 now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing. Meanwhile, there is the strong currency where FX intervention on aby major scale could provoke US retaliation against a

March 25, 2025

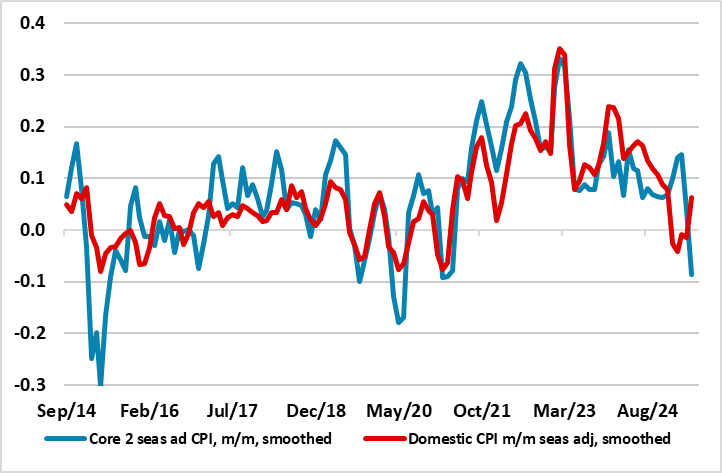

Western Europe Outlook: Price Pressures - Puzzling or Possibly Persistent!

March 25, 2025 10:47 AM UTC

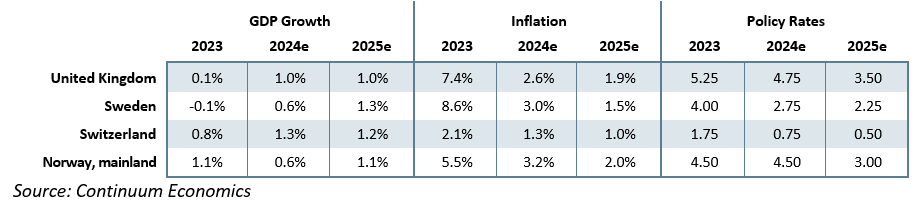

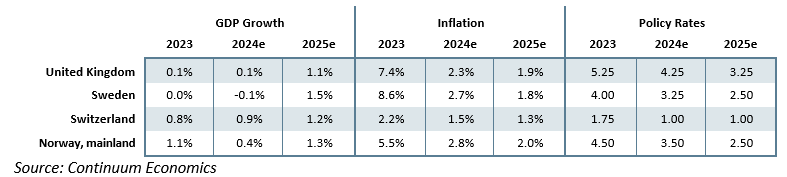

· In the UK, we continue to retain our below-consensus GDP picture for this year, with growth actually downgraded and with downside risks that may actually be both increasing and materializing. The BoE will likely ease further through 2025 by at least 75 bp and maybe faster and into 202

December 19, 2024

Western Europe Outlook: Divergent Policy Thinking

December 19, 2024 2:12 PM UTC

· In the UK, perhaps the main story in our outlook is that we retain our below-consensus GDP picture for next year, with growth of 1.0% and with downside risks. The BoE will likely ease further through 2025 by at least 100 bp and maybe faster and beyond.

· As for Sweden, d

September 26, 2024

Western Europe Outlook: Gradualism vs Reality

September 26, 2024 10:45 AM UTC

· In the UK, while headline GDP numbers look firmer, the real economy backdrop and outlook remains no better than mixed. This should improve a disinflation process driven mainly by friendlier supply conditions. The BoE will likely ease in Q4 and continue doing so through 2025 (we look

June 24, 2024

Western Europe Outlook: Easing Cycles Diverge?

June 24, 2024 7:48 AM UTC

· · In the UK, while downside economic risks may have dissipated, the real economy backdrop and outlook is still no better than mixed. This should accentuate a disinflation process hitherto driven mainly by friendlier supply conditions. The BoE will likely ease in Q3 and

June 20, 2024

SNB: 25bps Cut and Next Cut in September

June 20, 2024 8:34 AM UTC

The SNB cut by 25bps to try and stop inflation undershooting. We look for a further 25bps cut in September, as the new inflation forecasts remains too far below target for SNB comfort. CHF strength will also not ebb quickly given the prospect of prolonged French political uncertainty.

March 22, 2024

Western Europe Outlook: Easing Cycle Underway?

March 22, 2024 11:26 AM UTC

· In the UK, downside economic risks may have dissipated but the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already weak domestic backdrop into 2025 that will complement friendlier supply conditions in easing inflation. The BoE will likely e

March 21, 2024

Switzerland: SNB Surprise with 25bps Rate Cut

March 21, 2024 9:01 AM UTC

The SNB became the first DM central bank to cut rates with a 25bps reduction to 1.50%, which reflects an even larger forecast inflation undershoot and to counterbalance the strong Swiss Franc (CHF). The inflation forecasts for 2024 and 2025 were significantly lowered even with the new 1.50% policy

March 12, 2024

SNB Preview: Preparing to Ease?

March 12, 2024 3:11 PM UTC

It is noteworthy that the SNB has already started to the reverse the policy course it initiated some two years ago, having dropped formally in December plans of further FX sales. But now it is seemingly doing the opposite to a degree that is seeing its balance sheet re-expand. Moreover, having als

February 14, 2024

Markets: ECB/BOE/SNB Before the Fed?

February 14, 2024 11:35 AM UTC

Bottom Line: We do see 25bps cuts arriving from the ECB/BOE and SNB and most likely these will all be in June. Whether this is before the Fed will likely be a function of the Fed, as we see these interest rate moves as being driven by domestic fundamentals rather than the Fed being an influence.

December 15, 2023

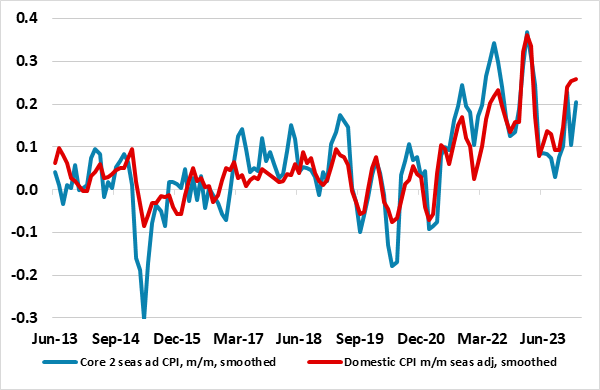

Western Europe Outlook: Inflation Succumbing?

December 15, 2023 2:44 PM UTC

· In the UK, downside economic risks may still be materializing as the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already negative domestic backdrop that may now stretch into 2025. The BoE has already paused and will likely ease next year an

December 14, 2023

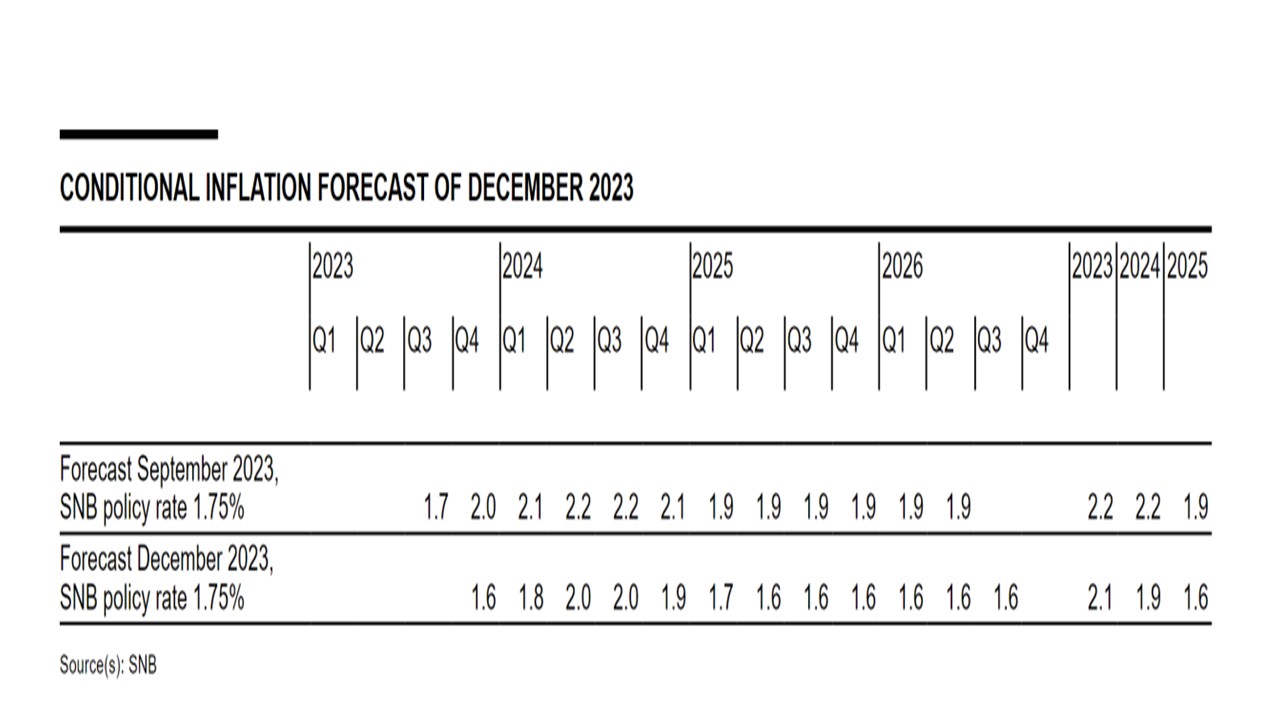

SNB Review: June 2024 Rate Cut?

December 14, 2023 9:16 AM UTC

The SNB are trying to dampen early rate cut talk, but the 1.6% projection for 2025 inflation should really be viewed as an undershoot of the inflation target and arguing for a rate cut in H1 2024. Given our forecast for 2024 inflation is 1.5%, we now see the SNB deliver the first 25bps cut in June

November 16, 2023

September 27, 2023

Western Europe Outlook: Policy Peaking

September 27, 2023 9:50 AM UTC

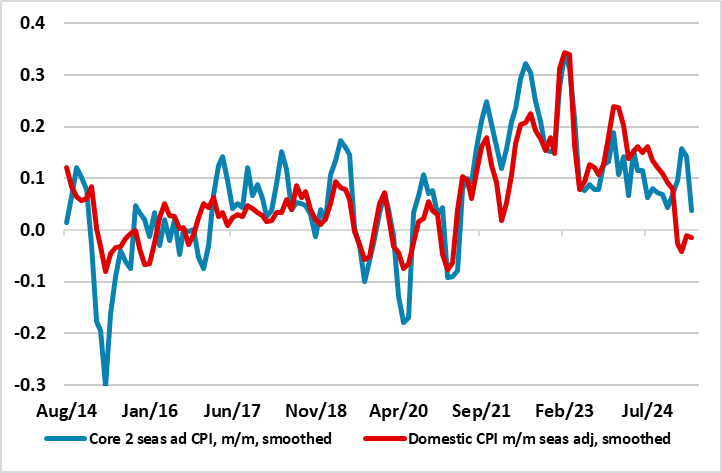

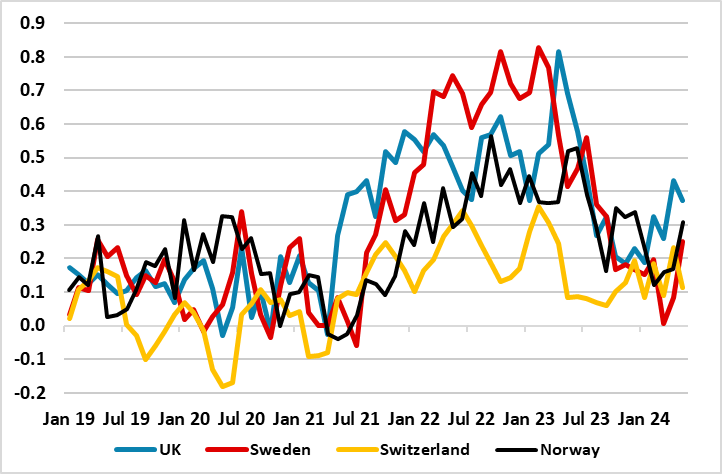

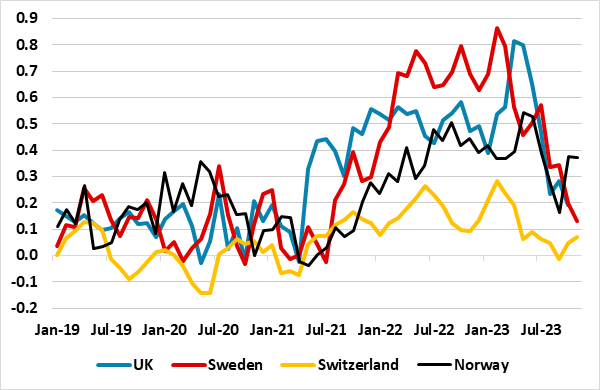

Forecast changes: Compared to our June Outlook, GDP growth forecasts have again seen mixed developments, slightly less poor for the UK and Norway for this year, but with 2024 downgrades seen across the board. But it is the upgraded current year inflation projections that explain the more significant

February 22, 2023

In-Depth Research: Quick Roadmap Central Bank Forecast/Rationale - February 2023

February 22, 2023 10:44 AM UTC

M/T Quick Roadmap – Fundamental MMKT/CB Roadmap and Rationale

February 2023

US FEDERAL RESERVE

The February 1 December FOMC meeting saw the pace of tightening slowed to 25bps. Inflation has slowed, but January's CPI details still show broad based inflationary pressures at a pace well above the Fed's