BoE Review: Persistent Price Pressures or Persistent Policy Errors?

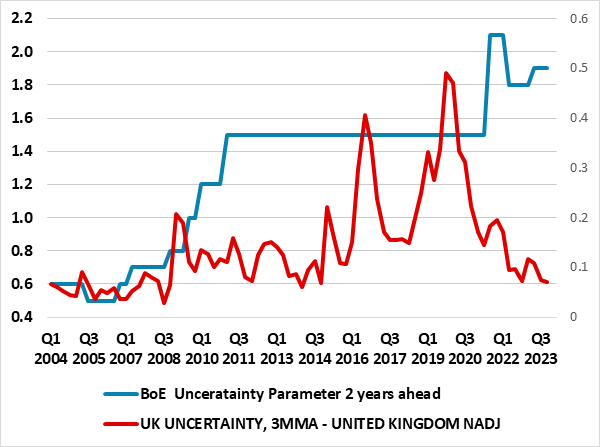

As was widely expected, the BoE kept policy on hold for a fourth successive meeting and abandoned its previous tightening bias. It even hinted that policy could be eased but more evidence was needed before this could happen. But clearly the BoE is uncertain, if not confused. The MPC vote was three ways, the first time stable policy, rate hikes and cuts were seen at one meeting since 2008. In addition, its inflation forecast continued to have a very elevated uncertainty premium (Figure 2) that basically suggest inflation 2-3 years hence could be two ppt either side of the near 2% projection, hardly an authoritative means on which to base policy. Regardless, clearly the MPC is shifting, despite two rate hike demands still. As the Governor said, it is no longer a question of how restrictive policy needs to be but one of how long current restriction needs to stay in place. Particularly given what we think is over-pessimism about so-called persistent inflation pressures, we think that this implicit easing bias will be exercised soon, with rate cuts starting in Q2 and 100 bp on the cards for the whole of this year and more to come in 2025. The QT issue, however, was not discussed and remains in the balance.

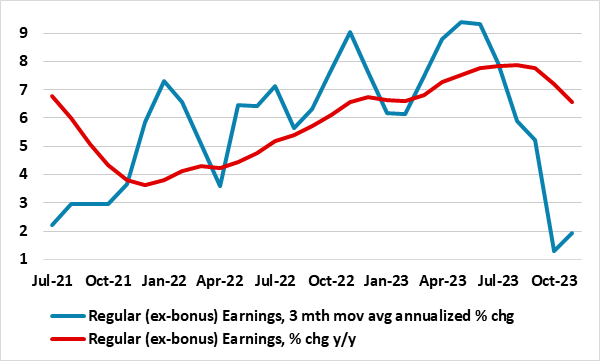

Figure 1: Wage Pressures Clearly Easing Despite BoE Reservations

Source: ONS, CE

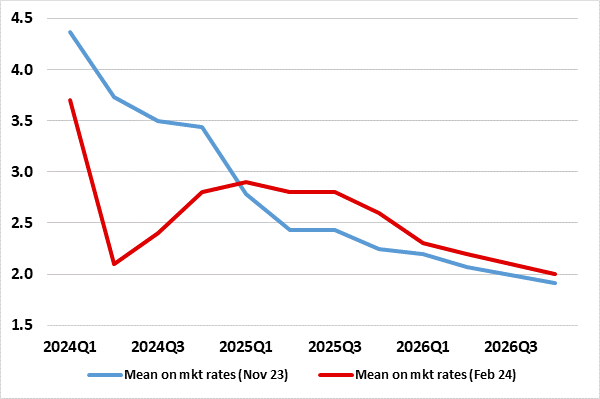

Inflation has surprised on the downside of late and to a degree that even the BoE accepts the headline CPI rate may hit the 2% target next quarter (we see a clear undershoot). But unlike ourselves, the BoE sees this being short-lived with the rate back towards 3% by year-end before then easing back below target more durably only in the third year of its projection horizon, thereby remaining above target over nearly all of the remainder of the 2-year policy forecast period. This reflects what the BoE believes are persistent price pressures something it sees is embodied in currently high services inflation, this being the best indicator of domestic pressures.

Figure 2: The BoE’s Persistent Inflation Outlook

Source: ONS, CE

But at the same time, the BoE admits that the larger than expected fall is a result of an easing in global supply problems, something with which we concur. However, unless these global pressures resume and given the still weak domestic economy (and with around a third of the impact of policy hikes yet to come) through then why should inflation rise afresh. Partly, the BoE sees, the circa-1 ppt fall in market interest rates reducing the anticipated degree of excess demand 2-3 years out, this reflecting a doubling in projected cumulative GDP growth over the next three years to some 3% compared to that envisaged three months ago. But mainly, it is the BoE view that second round effects will take more time to ease, this view coming in spite of what the BoE’s own models suggest. Instead, and with the result that inflation 2-3 years out (albeit only on market rate assumptions) is seen to be slightly higher than previous projected (Figure 2). it reflects the price pessimism of the MPC majority, albeit with this being very uncertain.

Price Pressure Persistence Dissipates

Why this pessimism persists is hard to fathom, albeit probably because the MPC is guided too much by y/y data on prices, costs, and wages. Indeed, m/m seasonally adjusted data paint a much different picture, not just for CPI data where core measures are running near 2% annualized rate but also wages (Figure 1) which are even softer.

Persistent and Elevated Uncertainty

We are therefore puzzled why the BoE has not followed the lead of the ECB in both providing seasonally adjusted data which gives it the potential to assess up-to-date inflation developments that are not dominated by base effects from a year before and/or by producing measures of what are considered to be persistent inflation pressures. After all, the ONS has. What we are as puzzled by is that the Monetary Policy Report sees even less discussion on the monetary side of the economy, this to address (or refute) recent criticism that the Bank must do more to foster a diversity of views and strengthen a culture that encourages challenge. Indeed, a lack of emphasis on the monetary side has been a criticism we have made of the BoE for some time, all the more notable given the weakness and possible cause of such marked weakness in bank deposit and lending, the latter being a key factor behind our persistent below consensus thinking.

Figure 3: Elevated Uncertainty?

Source: BoE, EPU

Moreover, as for the very elevated uncertainty parameter inherent in the inflation forecasts, this is not only something that diminishes the latter’s authority but also conflicts with just how uncertain the policy backdrop currently is (Figure 2). Even more notably, this BoE assessment of uncertainty has steadily increased even against a backdrop where policy uncertainty has been more variable and usually much lower. Indeed, an index of uncertainty is based on newspaper articles regarding policy and is compiled independently and privately by the Economic Policy Unit.