Short-end European Government Bonds Following U.S. But June Decoupling

The Fed’s shift to higher for longer has spilled over to drag European government bond yields higher through April. This now looks overdone as a June ECB rate cut is not fully discounted and ECB officials/data clearly point towards a 25bps cut. UK money markets are more out of line, with a June cut being 50/50. UK data trends back a 25bps move in June, while key BOE officials are sounding increasingly dovish (e.g. BOE Ramsden).

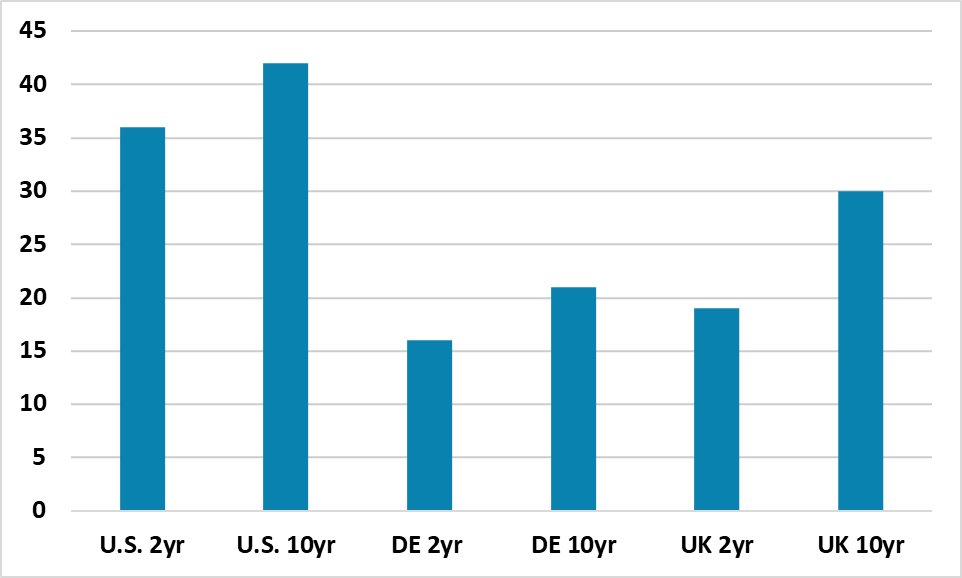

Figure 1: Change in Government Bond Yields Since End March (bps change)

Source: Bloomberg/Continuum Economics

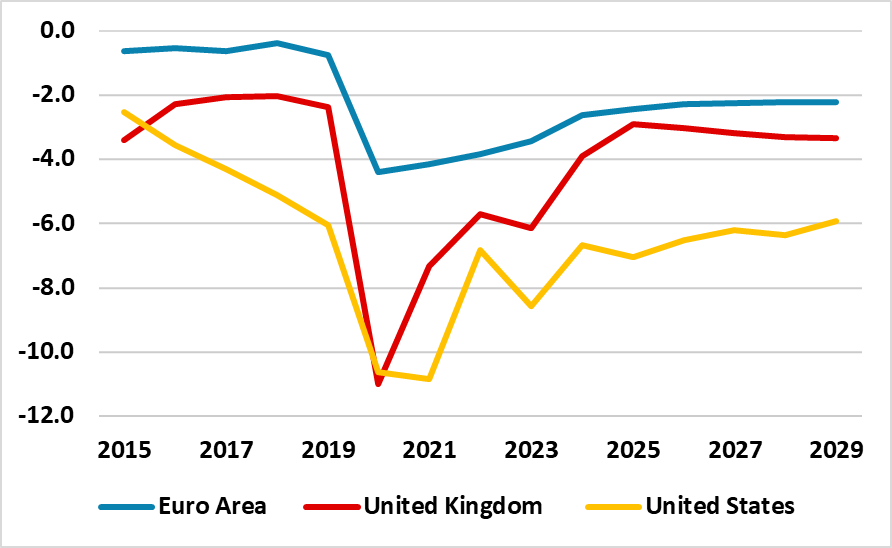

April has seen a rise in U.S. government bond yields that has spilled over to drag European government bond yields higher (Figure 1). At the long-end of the curve, this has some relevance, as the EZ and UK 10-2yr yield curves are still inverted and tend to react to a trend movement in U.S. 10yr yields. However, one difference is that the U.S. is currently and planning to run large cyclically adjusted budget deficits (Figure 2), while EZ and UK fiscal policy is to reduce cyclically adjusted budget deficits back towards more normal levels as post Ukraine war energy subsidies have been phased out and no large scale stimulus is occurring like the U.S. This will be a key area of difference in H1 2025, where we see U.S. fiscal tensions (here). The fiscal factor could be less relevant for divergence of EZ and UK 10yr in the next few months, as the last Fed minutes suggest that the Fed will likely slow the pace of QE by half, while the ECB and BOE maintain their current QE pace – we see them both slowing QE into 2025. However, short-end European yields have probably followed U.S. yields too far, given the ECB and BOE rate cutting prospects.

Figure 2: U.S./EZ/UK General Government Cyclically Adjusted Balance (% GDP)

Source: IMF April Fiscal Monitor

The ECB is moving towards a June cut of 25bps, both given a lower growth and inflation mix than the U.S. and ample signaling from ECB officials that a mid-year cut is being considered (here). Even so, money markets are not fully discounting a 25bps cut from the ECB on June 6, with around 80% probability. The spillover of Fed higher for longer is a factor in market pricing, but this has little backing from ECB speakers or the closed and relatively weaker nature of the Eurozone economy that means a huge USD rise is required before it produce an economically meaningful decline in the EUR TWI (The weak JPY/SEK is propping up EUR TWI, which is currently near a record high). SNB expectations for June are also not fully pricing in a 25bps cut, though the market is discounting a 25bps Riksbank move in June. We look for the ECB to cut in June by 25bps and the market to debate a 4 rate cut by end 2024 – three are already fully discounted.

UK rate expectations have been impacted more than the EZ by the Fed rethink and a June cut is only seen as 50/50 and a 25bps cut is only discounted at the August 1 BOE meeting. However, the UK has falling employment in contrast to the U.S. as tight monetary and fiscal policy (Figure 2) bites and current high wage inflation will slow to reflect the noticeable softening of the UK labor market. UK service inflation is certainly high, but part of this is lagged effects from the 2022-23 high inflation and will likely soften. Meanwhile, BOE officials are not following their Fed counterparts in signaling higher for longer. Indeed, BOE Ramsden on Friday went of his way to say that the inflation risks in the UK were now on the downside compared to the February Monetary policy report and that the UK was more like the EZ (here). Ramsden is one of the inner gang of 4 at the BOE including Bailey, Broadbent and Pill and remember that Bailey was dovish after the last BOE meeting. One of more of the gang 4 could actually vote for a rate cut at the May meeting, which would make a June cut a racing certainty. We look for a 25bps cut at the June BOE meeting and see four 25bps cut from the BOE in 2024 versus the mere two that are discounted in money markets.