Equities Outlook: Choppy U.S. and Outperformance Elsewhere

• U.S. equities are overvalued and waiting for earnings growth to catch-up, which leaves the market choppy, directionless and vulnerable to intermittent 5% corrections. Our forecast slowing of the U.S. economy before Fed rate cuts or nervousness about the post-election prospects are potential catalysts, alongside fiscal stress in H1 2025 under either Joe Biden or Donald Trump (here). We see 5250 on the S&P500 by end 2024 and this uncertain environment could stretch into H1 2025. H2 2025 should be better with persistent Fed rate cuts and a soft landing, with an end 2025 forecast of 5500.

• EZ equities can benefit from an economic recovery that will broaden with consistently quarterly rate cuts from the ECB until at least end 2025 and cash rates falling below dividend yields. Reasonable valuations and cheapness versus real bond yields should also help. However, French political uncertainty will be prolonged and this will restrain optimism in 2024. Thus, we would see EZ equities soft and choppy alongside the U.S. by end 2024. Cumulative ECB rate cuts, plus a broadening of the EZ recovery in 2025, should see 5% outperformance by end 2025 versus the S&P500. For UK equities we also see a 5% outperformance in 2024 and further 2.5-5% in 2025 versus the U.S. Labour’s post-election policy will likely follow the path of fiscal consolidation similar to the Conservatives. The equity market will also likely become optimistic about a better trade deal with the EU multi year.

• China has 5-10% upside in the next 6 months given undervaluation and the news flow getting less negative, but strategically we are not bullish due to the cyclical and structural headwinds. Elsewhere, India can outperform the U.S. by 5-7.5% in the remainder of 2024. Indian nominal GDP growth and infrastructure/manufacturing momentum will remain post-election and uncertainty about the NDA coalition stability will recede and we see a further 15% upside in 2025.

Risks to our views: Larger than expected lagged effects from DM monetary tightening could cause downside surprises on U.S./EZ growth and hurt the global economy and earnings outlook. Equities would see a more volatile 2024, with downside and then a rebound (on more aggressive policy easing).

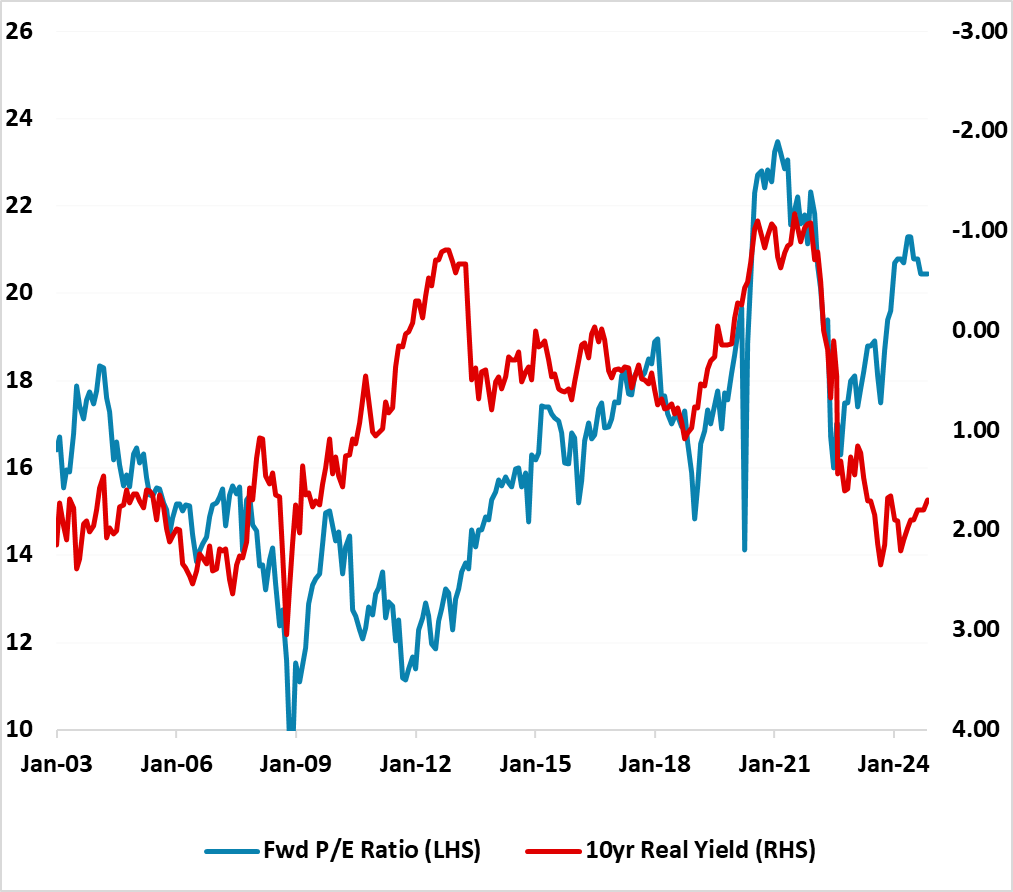

Figure 1: 12mth Fwd S&P500 P/E Ratio and 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2024

The U.S. equity market has entered a consolidation phase, which will likely last for the remainder of 2024. The market remains overvalued in equity only terms, while also being expensive versus real 10yr U.S. Treasury yields (Figure 1). Meanwhile, though earnings growth expectations are healthy for 2024 and 2025, uncertainty over the earnings outlook will likely increase as the economy slows into H2 (due to the lagged effects of Fed tightening and as household pandemic savings have been rundown). We are not looking for a hard landing in the economy and so the earnings deterioration is likely to be modest, but could well be enough to cause a modest temporary correction in the coming 3 to 6 months.

Additionally, the equity market has not taken a view on the outcome of the U.S. elections, due to the close presidential race. As summer swings to fall, the focus will switch to post-election policies. However, if Joe Biden is re-elected then Republicans will make it difficult to raise the debt ceiling, while the election of Donald Trump would see an early push to avoid expiry of some of the 2017 tax cuts by end 2025. This means U.S. fiscal stress under either president (here), with a high risk of a downgrade from one of the rating agencies. Meanwhile, though a president Trump was equity positive in 2017 due to the tax cuts, it would likely be more mixed to negative in H1 2025 – the other priority would likely be reducing immigration, which in turn could risk slow employment growth. Trump policies could also involve top civil servants being replaced by Trump appointees and undermining Fed independence. The main positive is that we see Fed easing starting in September and we see a total of 75bps of cuts in 2024, which will underpin the market. Overall, we still forecast 5250 for the S&P500 by end 2024.

For H1 2025, the U.S. equity market will likely remain choppy, but will depend on who is president and the outcome of the congressional elections (our baseline is Democratic victory in the House and Republicans in the Senate, but these are also currently close calls). For now, we would look for the U.S. equity market to remain choppy. However, cumulative Fed easing should help the market in H2 2025 and we see a further 100bps of cuts in 2025. This can build expectations of a recovery back to trend growth and help corporate earnings expectations. This can be enough to point to a better market and we look for 5500 by end 2025.

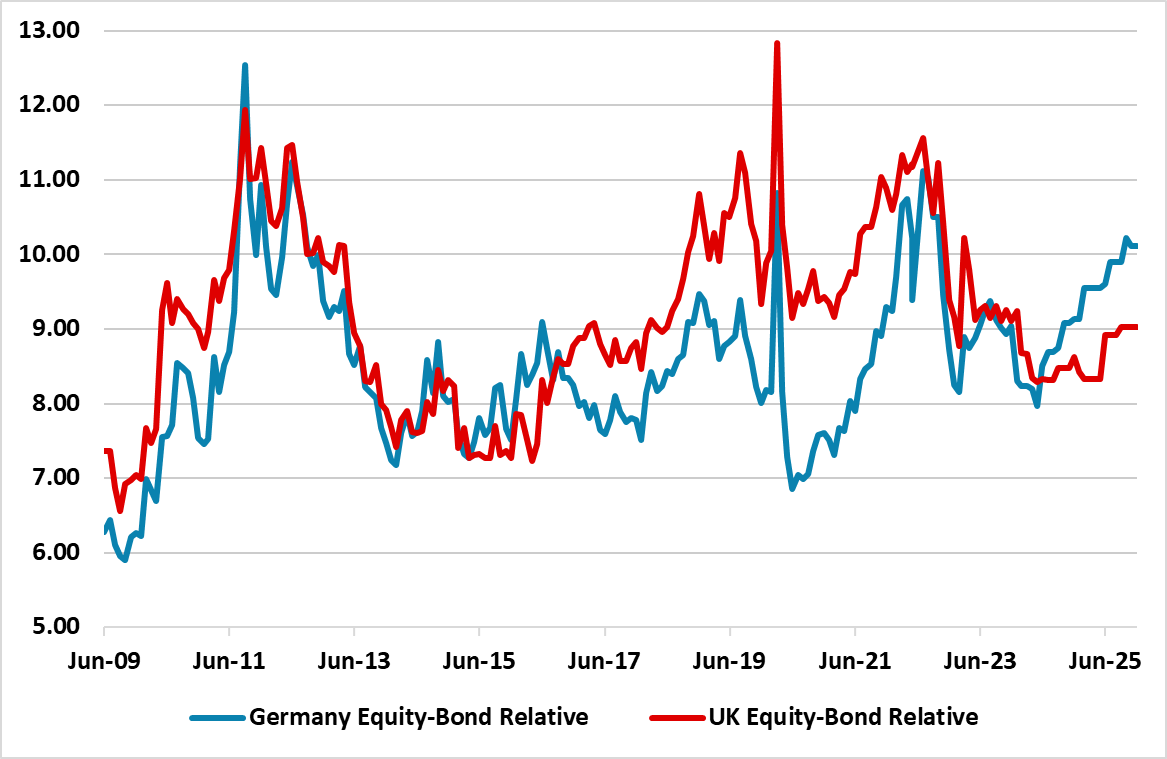

Figure 2: Germany/UK 12mth Earnings Yield minus 10yr Real Government Bond Yield (using 10yr breakeven inflation)

Source: Continuum Economics. Continuum Economics projections until end-2025 using 10yr breakeven inflation and Bund/Gilt yield forecasts.

In terms of other DM equity markets, we prefer the UK over the EZ or Japan. For the EZ, inflation will likely be back below 2% in H2 2024, albeit with volatility, which will allow the ECB to consistently ease by 25bps per quarter in the remainder of 2024 and through 2025. The EUR trade weighted exchange rate is near an all-time high (due to weak JPY/NOK and SEK), which means that the ECB has plenty of scope to diverge from the Fed. However, French political uncertainty will be prolonged and this will restrain optimism in 2024. Thus we would see EZ equities soft and choppy alongside the U.S. by end 2024. The lagged effects of ECB tightening will also still dominate to slow consumption and easing effects take time to accumulate. 2025 should be better as we expect French political tensions to not worsen further. EZ equity valuations also have room to expand, while EZ equities still have value versus EZ government bonds (Figure 2). Additionally, we see the economic recovery broadening in 2025, which will underpin corporate earnings. Thus we would see a 5% outperformance by end 2025 versus the S&P500.

The main event risk is if Donald Trump is elected and seriously threatens to withdraw from NATO (low to modest probability). A Trump inspired end to the Ukraine war would cause political outrage in Europe, but is less clear of a prolonged influence for EZ equities – Europe is not going back to buy large quantities of Russian gas and Putin needs to consolidate after a bruising war.

Elsewhere, the UK general election on July 4 is highly likely to see a healthy Labour majority. Their post-election policy will likely follow the path of fiscal consolidation similar to the Conservatives, with modest differences in the spending/tax mix. The UK will look politically stable compared to other major DM countries. The equity market will also likely become optimistic about a better trade deal with the EU multi year, though progress in 2025 will likely be modest. Some actual progress with the EU could be seen in 2025/26, but is likely to fall short of customs union or single market entry. More importantly, the BOE will likely cut by 75bps in the remainder of 2024 and 100bps in 2025, as Yr/Yr wage and CPI service inflation comes down in line with the labor market slack and lagged tightening effects continues to feedthrough. We see the UK equity market (MSCI UK) outperforming the S&P500 by 2.5-5% by end 2024 and an additional 2.5 to 5% by end 2025. The UK equity market is reasonable to cheap versus bonds (Figure 2) and on equity only valuation measures.

For Japan, our March view that the equity rally was overdone and needed a correction followed by consolidation has played out. The hype about Japan entering a new growth and higher inflation era is overdone, which has pumped up corporate earnings expectations too much. The reality is that Japan consumers are in recession as they cutback volumes to resist higher inflation. 2025 will likely see CPI lower than BOJ estimates and a low wage settlement than 2024. We would see some scope for Japan to outperform the U.S. in the next 18 months on the 2nd story of TSE reforms boosting profit margins and buybacks, but we only see 5-10% outperformance versus the S&P500.

Emerging Markets

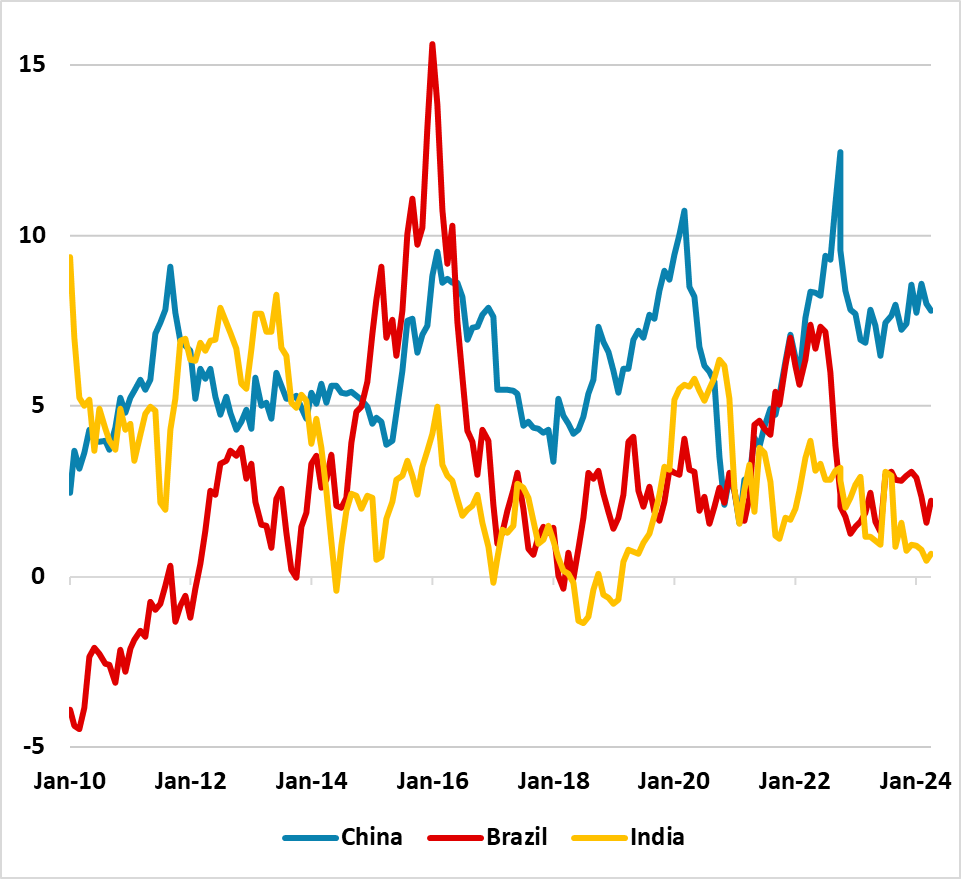

China’s equities have an opportunity for a further 5-10% upside in H2 (here). China is undervalued in equity only terms, but also against real government bond yields (Figure 3) and the earnings yield-10yr nominal yield is even more compelling. More importantly, July’s third plenum should reinforce the view that the authorities are stepping up policy support. Finally, overall economic momentum is sufficient to hit the 2024 growth goal of 5%. However, we would see this as a tactical rather than strategic opportunity. Underneath the surface, policy support will likely remain targeted rather than aggressive. Additionally, trend growth will likely slow to 4% in 2025 and 3% by 2027, which is likely to drag corporate earnings growth into single digit given ultra-low inflation. Residential property investment will likely remain a negative drag; exports held back by shifts of supply chains away from China and private investment/employment/income growth sluggish. Add in population aging and slowing productivity growth and the prospects into 2025 are that the equity rally will likely slow.

Figure 3: China Earning-Bond Yield Relative Cheap Compared to Other Big EM’s (%)

Source: Continuum Economics. CAPE Earnings Yield-10yr Real government bond yield

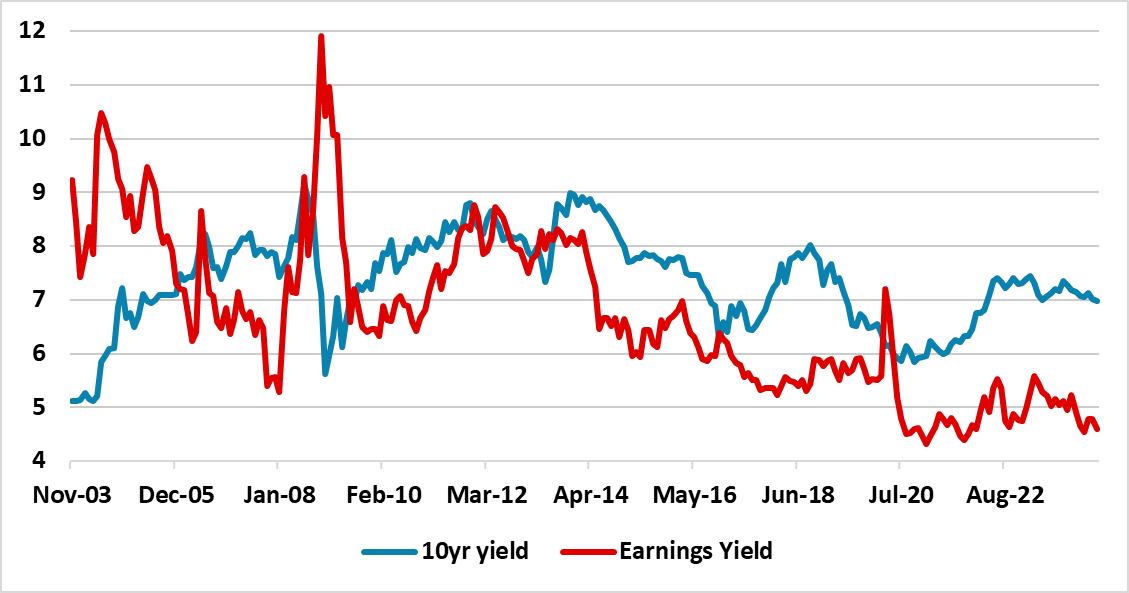

Figure 4: India 12mth Fwd Earnings Yield and 10yr Government Bond Yield (%)

Source: DataStream/Continuum Economics

Indian equities exceptionalism is being questioned however in the wake of the disappointing result for the BJP in the latest election that leaves PM Modi dependent on coalition partners. The inability to undertake major reforms (e.g. land reform) to accelerate India growth multi-year is an issue. Even so, we would see the coalition lasting the full 5 years until 2029 and still being reform positive. Additionally, nominal GDP of around 10-12%, plus some reforms, should mean that long-term corporate earnings should still be circa 15%. This is high compared to other major equity markets and will likely mean that India remains overvalued in equity only terms and against government bonds (Figure 4). The inclusion of India in bond indices should also cap government bond yields and help risk sentiment. The market will likely remain volatile near-term, but we would still see 5% upside in the remainder of 2024 and a further 15% in the remainder of 2025.

Brazilian equities have had a disappointing 2024 so far, with fiscal fears in the domestic market and a slowing central bank easing cycle. However, we still see the SELIC policy rate coming down to 10.0% by end 2024 and 9.0% by end 2025, as inflation continued to converge towards the target. This will mean a still more positive yield curve, but also some decline in 10yr yields – the shakeout after the Mexican election has gone too far. The 10yr real yield now looks to be excess risk premia and can likely come down modestly. However, with the government aim for zero central government budget deficit rather than 0.5% surplus of GDP and a rising general government debt/GDP ratio, the decline in 10yr yields will likely be modest rather than large. Thus we scale back the upside on Brazilian equities for the remainder of 2024 to 5% and a further 7.5% in 2025 (in line with expected corporate earnings growth).