Eurozone Flash GDP Preview (Jan 30): Are Surveys Too Gloomy?

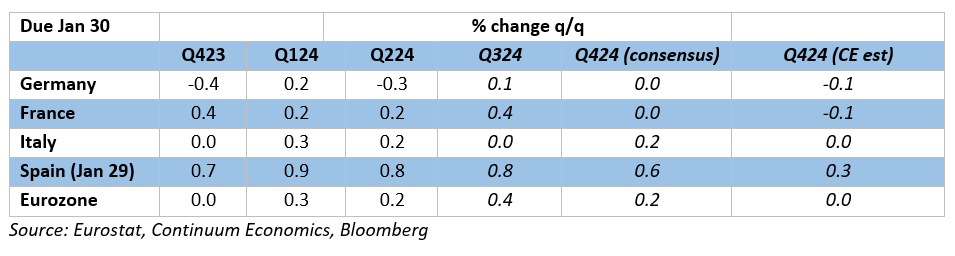

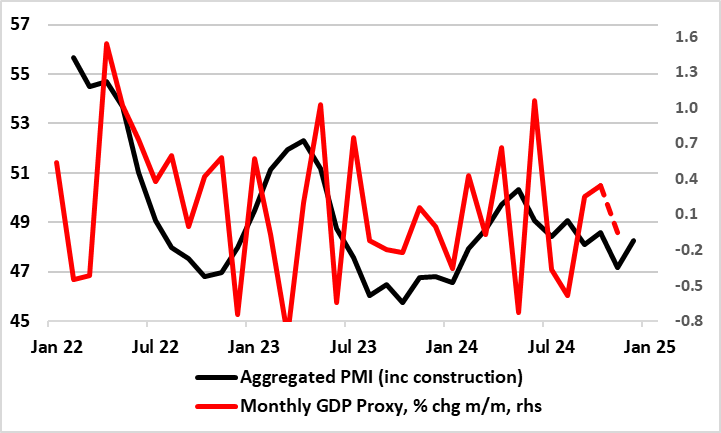

There is certain irony that for an ECB Council that has evidently shifted its main concern away from broadly falling inflation to real economy weakness, its next policy decision arrives on the day of the next GDP release. We see the ECB cutting a further 25 bp but with some Council members again calling for a larger move but with clear pointers that additional easing is on the cards. Regardless, it is unlikely that the Q4 GDP outcomes will make much difference to the ECB’s thinking, not least as the figure will come with no breakdown and will be liable to marked revision. Even so, we see a below ECB and consensus outcome of zero in q/q terms (Figure 1), thereby chiming with what have been weak business survey results (Figure 2). But despite the latter, there are upside risks as actual output data have actually been firmer into mid Q4. But if the data is perkier, the relevant question would be the extent to which any solid GDP figure may reflect (involuntary) inventory building (Figure 3) and/or import weakness. What is likely however, is that the GDP numbers will continue to suggest an EZ economy that is still diverging as Germany stutters while Spain prospers, although somewhat softer activity is likely even for the latter.

Figure 1: Divergent EZ GDP Picture Still Clear in Q3?

Gauging Economic Reality

Despite what is evident in the hard data of late, the risks are that the whole of the EZ is weakening given the possibly gloomier messages from business survey data. Admittedly, there were some upside surprises in the Q3 numbers, albeit with the unexpected rise in German GDP offset by downward revisions and where the omens are that Germany contracted afresh last quarter. Even so, the Q3 data were better than both ECB and consensus thinking, but still very much with the various economies still seeing contrasting fortunes (Figure 1). This contrast reflects the varying size of the industrial sectors in these economies with those with the larger services (eg Spain) prospering more than those more reliant on recession-bound manufacturing (eg Germany). But the message from surveys is that hitherto solid services (which have been the main support to growth of late seems to be slowing). Indeed, the extent and breadth of the slowing in PMI survey data, now including European Commission numbers, has clearly perturbed the ECB, both by signalling downside risk to real activity that may actually be materializing but also in highlighting softer cost and price pressures. Survey data due in the next week will thereby be more important than the GDP flash!

But the ECB may have drawn some comfort from signs of a Q3 recovery in consumer spending, possibly a hint that disinflation has persuaded households to run down what seem to be elevated savings. However, this may mean that the recovery the continued consumer recovery the ECB sees through the coming year may falter as the declines in household savings it is partly based upon may already have occurred.

Figure 2: Surveys Question GDP Resilience

Source: Eurostat, European Commission; dash is CE projection

GDP Flash Shortcomings

Amid a paucity of reliable data, it is important to recognize that there are clear shortcomings to the flash estimate for EZ GDP. No details come with these flashes and they are prone to clear revisions, where even a 0.1 ppt change can be very meaningful when the economy is hardly growing. They are based on incomplete activity numbers with usually only one monthly value for services and two for construction and manufacturing. Moreover, while aggregating these three output sectors allows the construction of a monthly GDP proxy, even this is volatile and far from tallies with actual GDP outcomes. This may be why the ECB is openly more focused on survey data, especially as it is more timely. Time will tell whether the Q4 flash numbers will tell any more authoritative a story! The lack of a breakdown is also troubling as without this it is impossible to get a firm idea of where momentum may be building or ebbing. Notably, the fact that that EZ GDP has risen for six quarters masks a persistent drop in domestic demand. Admittedly, the latter recovered in Q4 partly due to the consumer (as suggested above) but mainly due an inventory swing (Figure 3), the question being whether this proves to be voluntary or not as this will deter mine how durable any such boost proves to be. But the continued weak signs regarding capex (even in Spain) will be casting policy shadows.

At face value, the Q4 0.2% q/q ECB forecast does make the central bank’s 0.7% 2024 projection more attainable, but even amid tentative better consumer signs, the question is whether momentum is ebbing, questioning (as we do) whether the recently pared-back 1.3% official 2025 forecast is still too optimistic. While business survey data such as the PMIs have their shortcoming too, given the relative lack of geographical and sector coverage, the data from the European Commission may be somewhat more authoritative. These showed overall economic sentiment a nine-month low and very much a reading even more below par, very much questioning the apparent pick-up in GDP growth actually occurred or will persist. This is partly why we see 2025 growth of just 0.8%!

Figure 3: Inventory Swing Now Boosting Growth?

Source: Eurostat, % chg q/q

Regardless, the apparent resilience in overall GDP makes the sharp and broad fall in inflation all the more likely to have been driven more by supply factors than demand, although the weakness in the domestic economy has certainly been influential. The disinflation process may have much further to run.