EZ HICP Review: Headline Rises Amid Still Friendly Core Messages?

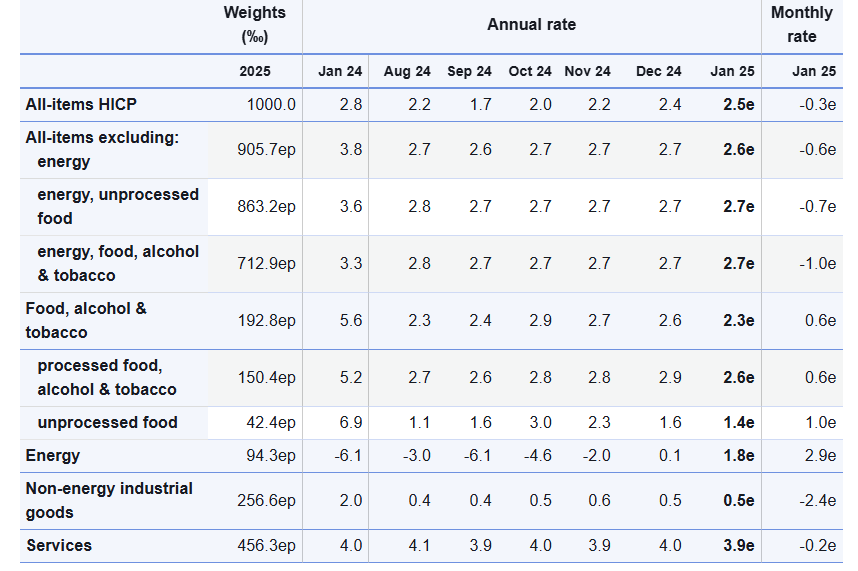

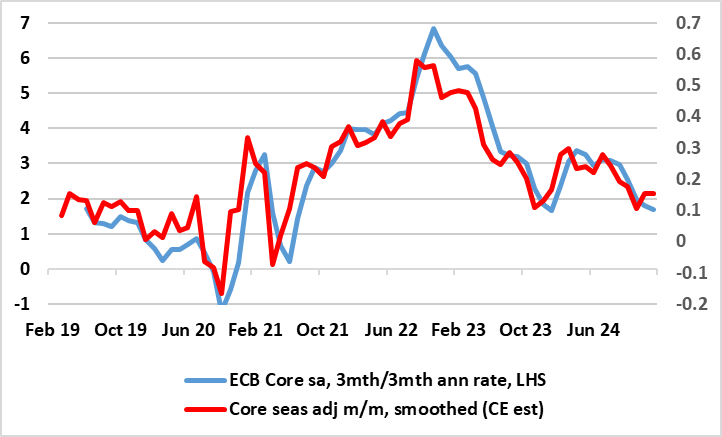

There were mixed messages in the higher-than-expected January flash HICP numbers. For a third successive month, the headline but this time by ‘only’ 0.1ppt, to a six-month high of 2.5%, but where the core (again) stayed at 2.7%, partly due to what is seemingly relatively stable services inflation. Once again, higher energy costs, partly base effects (Figure 1). However, shorter-term price momentum data already suggest that core and even services inflation have slowed and are running around target (Figure 2) and given sharp falls in wage tracker data (an update due later this week), we think headline y/y services inflation is succumbing, something backed up by surveys for the sector.

Figure 1: Headline Rises Again as Services Resilience Persists

Source: Eurostat

However, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target and b) a fresh and more demand driven disinflation could be triggered by what seems to be weaker real economy backdrop that could also exacerbate financial stability risks.

Figure 2: Core Inflation Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

Admittedly, the January headline HICP was a notch higher than expected, but this still sits easily with ECB thinking as set out after last week’s Council meeting. This was explicit in suggesting that the Council saw inflation fluctuating around its current level in the near term but then settling sustainably at around target. And with a stable core reading this time around, and consistent with target already in terms of adjusted short0term data (Figure 2), this also sits with ECB thinking that noted most underlying inflation indicators have been developing in line with a sustained return of inflation to target. It pointed to recent signals point to continued moderation in wage pressures and to the buffering role of profits.

But surely the dominant ECB issue now is the extent to which downside growth risks have turned into reality with it clear that growth worries have risen. Indeed, preserving growth does seem to have become the ECB policy priority and such worries may only be accentuated by the growing threat of tariffs and an ensuing trade war and possible dumping of goods to Europe by China. Moreover, these downside risks have other aspects, equally worrying, especially as, they could fan financial instability issues.