Markets and Trump’s Early Days

The early days of the new Trump administration has seen lots of volatility around the on-off tariffs with Canada and Mexico, but the more stable U.S. Treasury market has helped provide an anchor. U.S. Treasuries have shift towards the view that the 10yr budget bill will be delayed until H2 and likely be only modestly stimulative in 2026. Combined with the Fed still leaving the door open to rate cuts this has helped avoid major directional movements. However, very stretched equity-bond valuations leave the U.S. equity market vulnerable to a 5-10% correction in the coming months. Trump will be a test this week with 25% steel and aluminum tariffs Monday and reciprocal tariffs later in the week, but may not be a big enough catalyst.

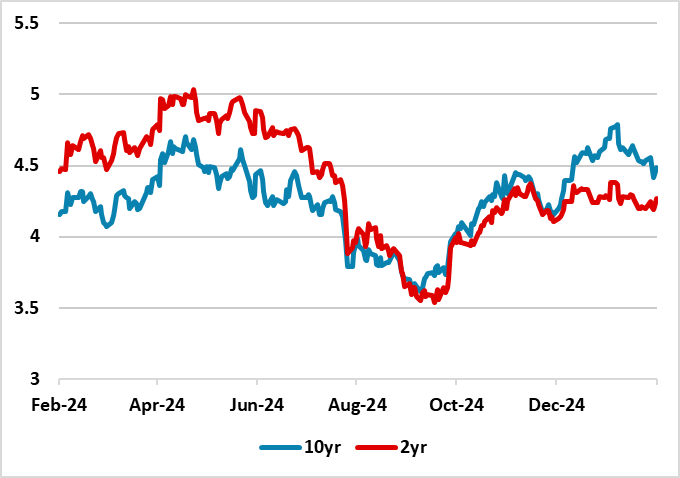

Figure 1: 10 and 2yr U.S. Treasuries (%)

Source: Datastream/Continuum Economics

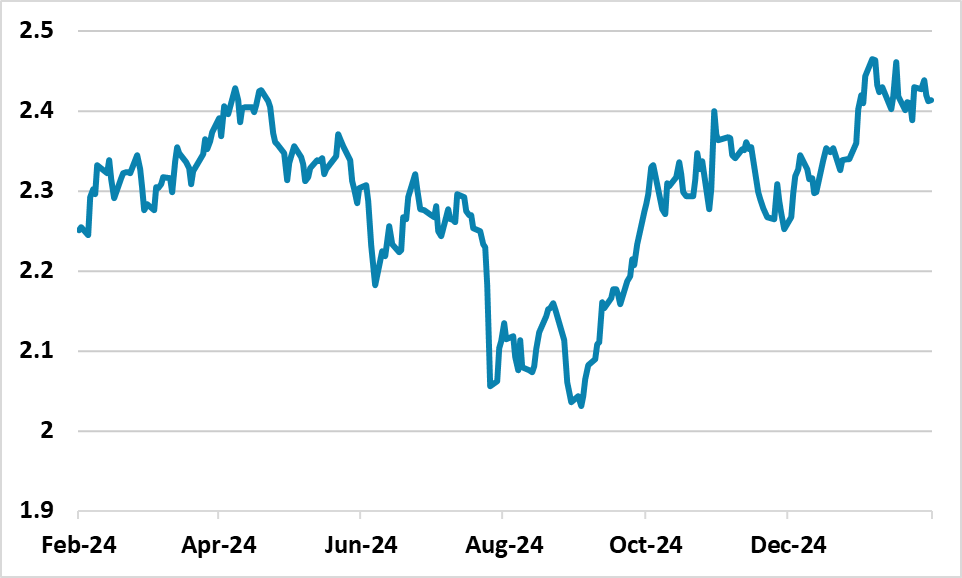

The early days of President Trump’s new administration has prompted lots of volatility in financial markets, but no clear change of direction. While the FX market has been whipsawed by the on-off tariffs for Canada and Mexico, the key U.S. Treasury market has not seen a major shift (Figure 1). Part of this is the U.S. Treasury market currently discounts that Trump will struggle to get too expansive a 10yr budget bill through congress due to a holdout of GOP budget hawks (here). Though President Trump cited his wish to end tax on social security and overtime at Thursday’s meeting with Congressional leaders, the odds remain that these expensive items will not be in the final budget bill. Though U.S. Treasury Bessant guided last week that net issuance will also remain unchanged, it is this future fiscal policy implementation that will remain key for U.S. Treasuries. Secondly, despite a reasonable growth momentum, Fed officials are still leaving the door open to modest rate cuts later in the year. FOMC officials views are partially driven by a sense that policy is still quite restrictive at the current Fed Funds rate. Fed Chair Powell testimony to the House and Senate February 11 and 12 will likely still see the door being left open to cuts, though guiding against a March cut. It will be interesting to see whether Powell follows other Fed speakers in noting a focus on inflation expectations after the jump in the 1yr UoM inflation expectations to 4.3% – though it is unclear whether this is due to the tariff threats or Democrats taking a dim view on the U.S. economy. Financial markets are somewhat more settled with stable inflation expectations (Figure 2).

Figure 2: 10yr U.S. Breakeven Inflation (%)

Source: Datastream/Continuum Economics

Over the weekend, Trump announced 25% tariffs on steel and aluminium with details on Monday and reciprocal tariffs later in the week. The 25% aluminium is higher than the existing 10%, while allies will be hit hardest as they had been given exemption from the 2018 tariffs. The reciprocal tariffs also apply to all countries and would for example see the U.S. raising tariffs on EU cars to 10% versus 2% currently to equalise with EU tariffs. The two sets of measures do show that Trump is not just using tariffs threats, but wants tariff implementation and also is stepping up tariffs be measures against all countries. This is a new challenge for U.S. inflation and the Treasury market, but may not be a strong enough catalyst in itself to produce a persistent jump in U.S. Treasury yields – though some adverse knee jerk reaction is to be expected.

The U.S. equity market short volatility bout around the Canada/Mexico tariff implementation and then delay has also been accompanied by the Deepseek volatility in the technology sector. The debate on what Deepseek means is still raging between those that sees this accelerating the movement towards AI applications versus those concerned over less bullish chip demand; reduced AI profit margins and less explosive power growth. While this looks to be settling into a consolidation phase for the U.S. equity market, we would still feel that the market remains vulnerable to a 5-10% correction on any persistently bad news. However, it is interesting that some global funds have increased weightings in Europe to take some money away from the overweight U.S. equity bets. We remain very concerned that the big divergence between equity and bond valuation means that U.S. Treasury yields in themselves are high enough to prompt a correction in U.S. equities (here). Trump’s trade war will likely see some improvement in USMCA for eventually removing the Canada/Mexico tariff threat, while China is trying to get the U.S. to the negotiating table sooner rather than later (here). The 10yr budget bill does not look like an issue that will destabilise the U.S. equity market in the next few months, but Trump extended tariffs could cause some new volatility. This leaves the economy and corporate earnings news or exists equity-bond valuations as potential major catalysts.

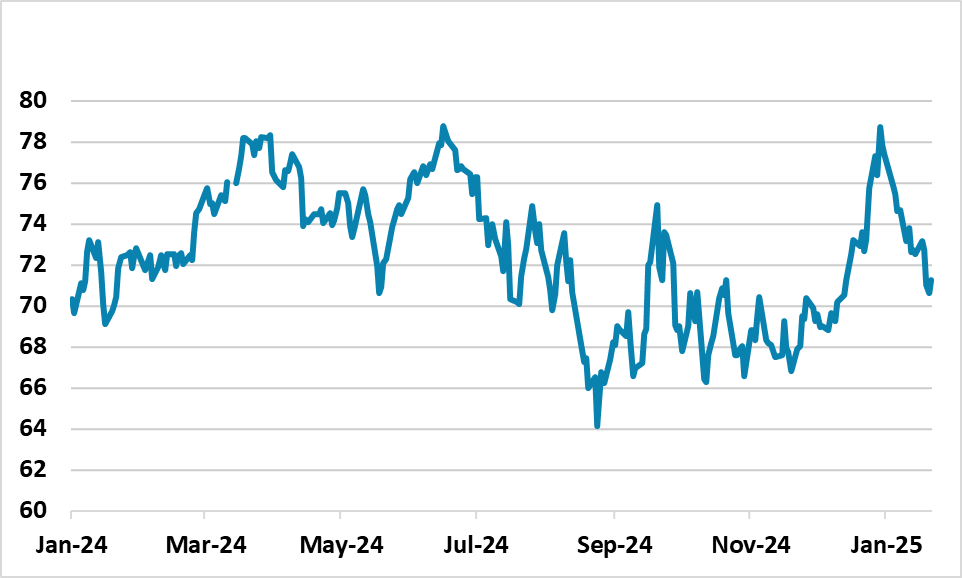

Figure 3: WTI Oil Price (USD)

Source: Datastream/Continuum Economics

WTI oil has also had volatility in the early days of the new Trump administration. Though Trump has already demanded increased output from OPEC+ to get oil prices down, we feel that OPEC+ will be slow in reversing the voluntary 2.2 million b/d cuts. We expect the progressive rollover of these barrels into the market to be further postponed at least until the third quarter of 2025, as the cartel also assesses global economic developments. Non-OPEC production will continue to rise, undermining OPEC+’s efforts to support prices. With moderate demand growth foreseen in China and the U.S., we forecast WTI to reach USD 65 by the end of 2025 (here). This helps Trump on the margin, but is not a return to the good old days of USD 50 under Trump 1.0 for WTI or the associated disinflationary forces.