Congress Struggles Over Budget Bill

The House is struggling to reach consensus on the beautiful huge 10yr budget bill, as GOP budget hawks want to see multi trillion expenditure cuts, though eventually the 10yr expenditure cuts will likely compromise around USD 0.5-1.0trn. Tax cuts are also unlikely to match President Trump campaign promises, though tariff revenue is unlikely to match that under a universal tariff. The current situation is fluid and uncertain, with the Senate pushing for leadership under a two-bill strategy (immigration funding first). This struggle in Congress suggests the eventual fiscal stimulus will likely be modest for the economy and implementation coming in 2026 rather H2 2025. However, bond issuance will still be sufficiently large to keep bond yields elevated into 2026.

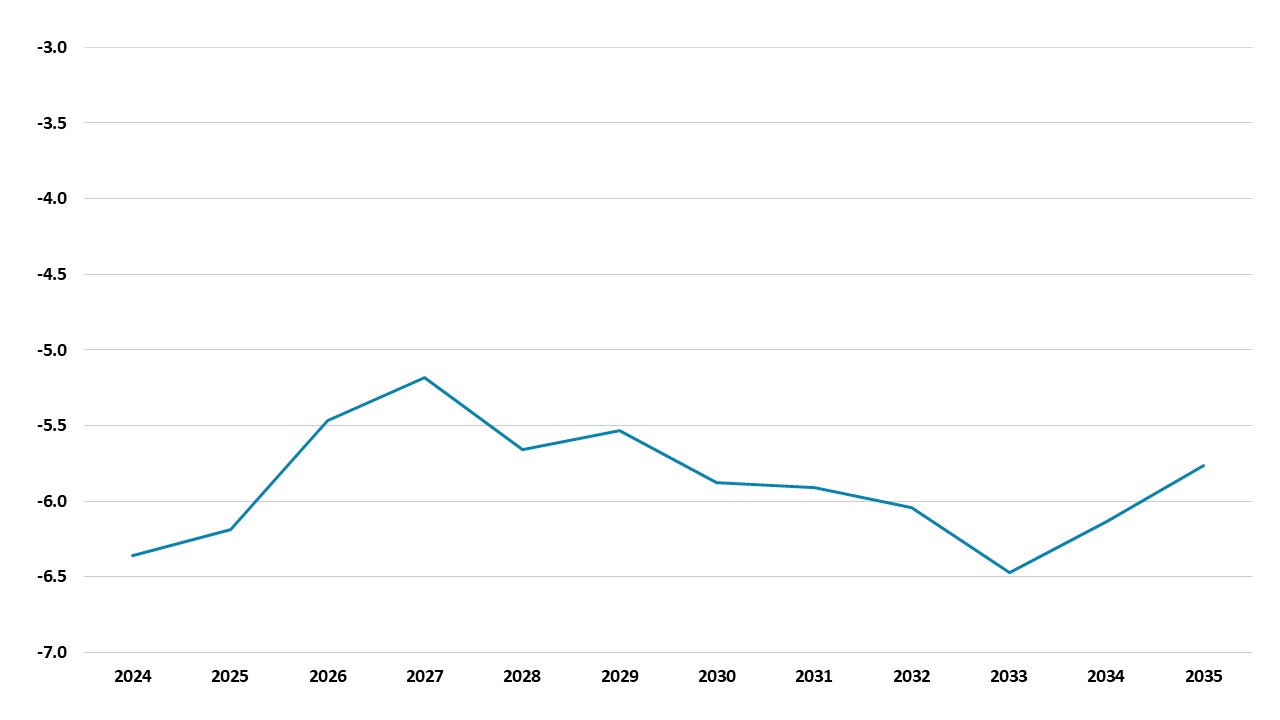

Figure 1: Estimates of President Elect Trump Budget Plans (USD Blns)

Source: Committee for a Responsible Budget

Reports suggest that the Republicans in the House are struggling to reach consensus on the minimum level of expenditure cuts and the maximum level of the budget deficit for President Trump’s one beautiful 10yr budget bill. The biggest split at the moment is on the scale of expenditure cuts over the next 10 years. A lot of Republicans with an eye on the mid-term congressional election want no net spending cuts or modest cuts. However, enough budget hawks still exist among House Republicans that the GOP does not currently have a majority in the House to progress speaker Johnson’s desired bill. The budget hawks have two concerns. Firstly, they do not want to see an increase in the budget deficit/GDP to avoid medium-term fiscal instability risks. Secondly, they see the opportunity to cuts expenditure in a structural manner, with both the House and Senate controlled by the GOP. This is producing demand for multi trillion USD cuts over the 10yr period.

Elon Musk’s efforts to cut expenditure under DOGE helps, but is nowhere near the scale demanded by the budget hawks in the House. One current area of focus is Medicaid, where the budget hawks want substantive cuts – President Trump however has already voiced support for Medicare and will likely be reluctant to hurt his new wider working-class base by significantly reducing funding for Medicaid. Some of the budget hawks privately have said they would settle for USD1trn on expenditure cuts versus the baseline (here). This week could be important with President Trump scheduled to meet Congressional leaders on Friday and the Senate Republicans threatening to leapfrog the House and push forward a two-bill budget strategy (Immigration funding bill and then the main budget bill). What does this mean for economic stimulation and the U.S. Treasury market?

The fight over the scale of expenditure cuts and the size of the budget deficit means that some of Trump campaign tax cut promises are getting less support, with exempting overtime income from taxes and ending taxation on social security being potentially expensive tax cuts that currently looks unlikely to move forward (Figure 1). However, on the other side tariffs policy appears primarily transactional to achieve concession after the Canada/Mexico drama and Trump reluctance to cede control over tariffs to Congress. Some tariff revenue will likely be raised in the next 10 years, but well short of the amounts from a universal tariff (Figure 1). Extending all of the 2017 tax cuts would cost around USD5.3trn over 10 year, with current discussion in the House and Senate to either extend all of the tax cuts or perhaps do around 80% of the lapsing cuts. Overall, the current fight in Congress is consistent with only a modest fiscal boost to the economy and the budget deficit to GDP.

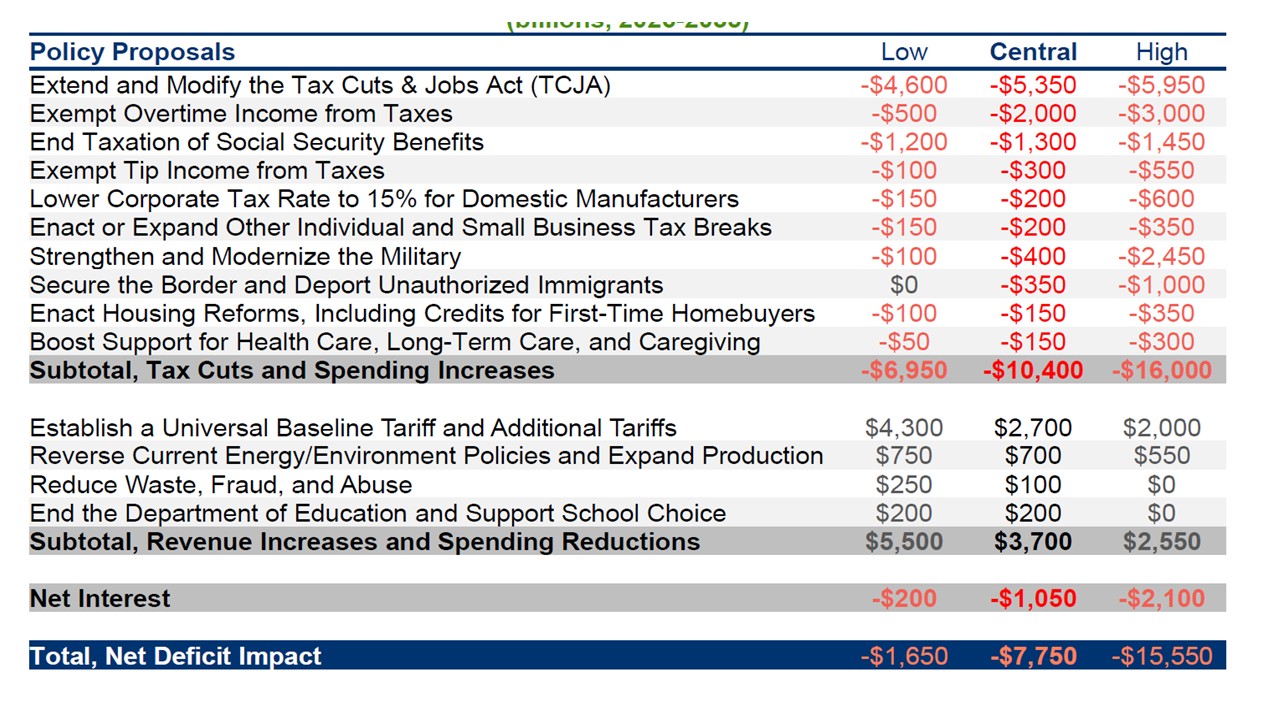

The issue over the House mega bill versus the Senate two bill strategy is also important. The latter would produce early funding for the fight on immigration, but would likely delay the main budget bill into late summer/early autumn for 2026 implementation i.e. no fiscal boost in 2025. The bulk of the extra budget deficit would also be tax hikes avoided rather than fresh tax cuts. For the U.S. Treasury market, the last stand of the budget hawks is a comfort for now. However, with the budget deficit to GDP still likely to increase in 2026 beyond the 5.5% baseline from the CBO (Figure 2), the heavy issuance from the U.S. Treasury will still be an issue that keeps long-dated yields elevated into 2026.

Figure 2: U.S Budget Deficit to GDP (%)

Source: CBO Jan 2025 (here)