SNB Review: June 2024 Rate Cut?

The SNB are trying to dampen early rate cut talk, but the 1.6% projection for 2025 inflation should really be viewed as an undershoot of the inflation target and arguing for a rate cut in H1 2024. Given our forecast for 2024 inflation is 1.5%, we now see the SNB deliver the first 25bps cut in June 2024 and then a 2nd in December 2024. The SNB also removed the paragraph on FX sales and SNB Jordan indicated that this was no longer a focus, which is a signal that balance sheet reduction and tightening will slow and stop.

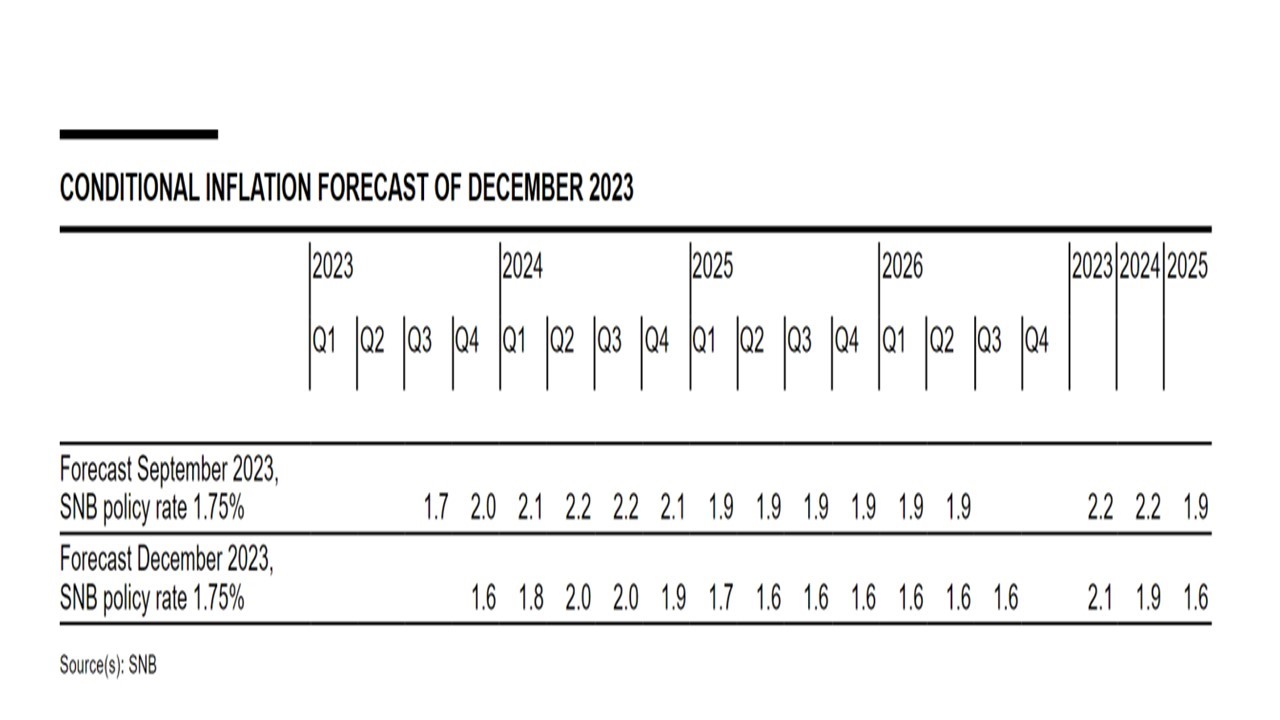

Figure 1: SNB Inflation Projections

Source: SNB

Peak SNB and Inflation Undershoot

The December SNB policy assessment points to a peak in the policy rates having already been achieved, which is really just a reinforcement of the conclusion after the forecast 2025 marginal inflation undershoot in the September assessment. Since then inflation has undershoot the SNB 2023 projections and this has prompted a downward revision from 2.2% to 2.1% this time around. More importantly, the SNB has lowered the 2024 and 2025 inflation forecasts conditioned on the policy rate remaining at 1.75% (Figure 1). The SNB explain that short term electricity price increase will hold up 2024 inflation, but as the year progress disinflation globally and less domestic 2 round effects have also prompted the downward revision. On the economy, the 2024 GDP forecast has been lowered to between 0.5-1.0%, due to the lagged feedthrough of tightening on domestic sectors (e.g. property) and the global slowdown that has occurred and that it is forecast for 2024. The 2023 GDP forecast has been kept at 1%, but real sector data suggests that Switzerland could struggle to achieve enough Q4 momentum as it would require a 5% annualised gain!

In terms of future interest policy, the SNB statement noted sensitivity to the global growth picture. Though the statement also noted that the inflation forecasts were broadly consistent with price stability, we would feel that this is referring more to the 2024 forecast and we see that as being too optimistic (we forecast 1.5%). The 2025 projection of 1.6% is far enough away to merit rate cuts at some stage over the horizon, while we also feel that this projection is too high as well (we forecast 1.3%). The Swiss government is forecasting 1.9% for 2024 inflation, but a low 1.1% for 2025. Thus the SNB December message appears to be aimed at trying to restrain easing speculation perhaps. Meanwhile, the SNB dropped the paragraph on FX sales at the end of the statement, which suggests an end to the systematic FX sales. This is both a signal that policy is tight enough and the SNB are likely to pivot to rate cuts in 2024.

We now pencil in a 25bps cut at the June 2024 meeting and a further 25bps in December. The main reason it is not three cuts is that the SNB has not swung as much too restrictive territory as the ECB. Also SNB policy tightening was also coming through balance sheet reduction that now appears to be slowing or stopping.