View:

February 20, 2026

Reciprocal Tariffs: Supreme Court Strike Down

February 20, 2026 4:31 PM UTC

· The 6-3 vote by the Supreme court and full ruling against reciprocal tariffs means that the Trump administration will likely resort to other tariffs for negotiating leverage. However, the Trump administration will also pressure to codify existing trade framework deals that have be

Q4 U.S. GDP: Lower Than Expected

February 20, 2026 2:13 PM UTC

Lower than expected Q4 GDP was mainly caused by the temporary government shutdown (-5.1% annualised), while consumer spending remained reasonable at 2.4% and AI related spending helping parts of fixed investment. However, income growth remains lower than consumption and we see this slowing the U.S.

Switzerland: An Alternative Insight into Current Franc Strength!

February 20, 2026 11:14 AM UTC

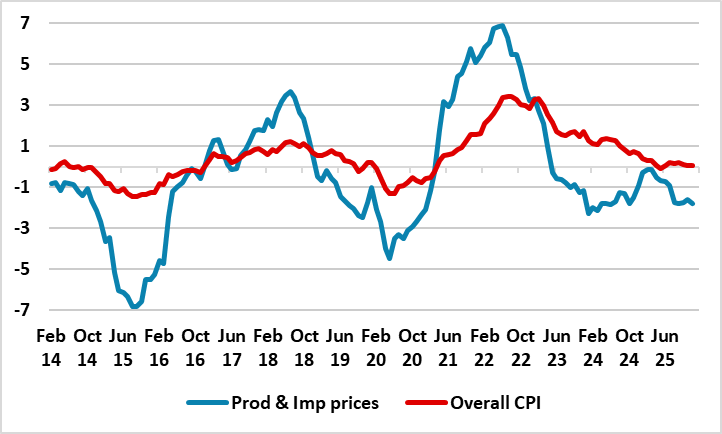

The increasing strength in the Swiss France is causing reverberations. More a reflection of U.S. dollar weakness than that of the euro, the nominal trade weighted Franc is hitting new highs (Figure 1). But while this strength in impairing competitiveness – vital to an economy where exports acc

This week's five highlights

February 20, 2026 10:00 AM UTC

U.S. January Yr/yr ex food and energy CPI slowest since March 2021

FOMC Minutes Shows Splits, But Rate Cuts Should Still Arrive

RBNZ Keeping Their Cool

UK CPI Fresh and Marked Fall Resumes as Core Slips to Cycle-Low?

Washington and Delhi Recalibrate

February 19, 2026

Preview: Due February 20 - U.S. November and December New Home Sales - Improvement in trend to continue

February 19, 2026 3:02 PM UTC

November and December new home sales data will be released on February 20. We expect moderate continuations of a recent improvement in trend, with November rising by 1.1% to 745k and December rising by 1.3% to 755k. This would be the highest level since February 2022.

Preview: Due February 20 - U.S. December Personal Income and Spending - Firmer prices matching income and spending

February 19, 2026 2:49 PM UTC

December’s personal income and spending report may be overshadowed by Q4 GDP data released at the same time, but is likely to see a strong core PCE price index increase of 0.4%, the highest since February. We expect personal income to rise by 0.3%, underperforming a 0.4% rise in spending, with bot

Preview: Due February 20 - U.S. February S and P PMIs - Manufacturing significantly stronger, Services marginally so

February 19, 2026 2:47 PM UTC

We expect improvement in February’s S and P PMIs, more significantly in manufacturing, to 53.5 from 52.4, with services seeing only a modest increase to 53.0 from 52.7.