Published: 2025-12-23T09:17:40.000Z

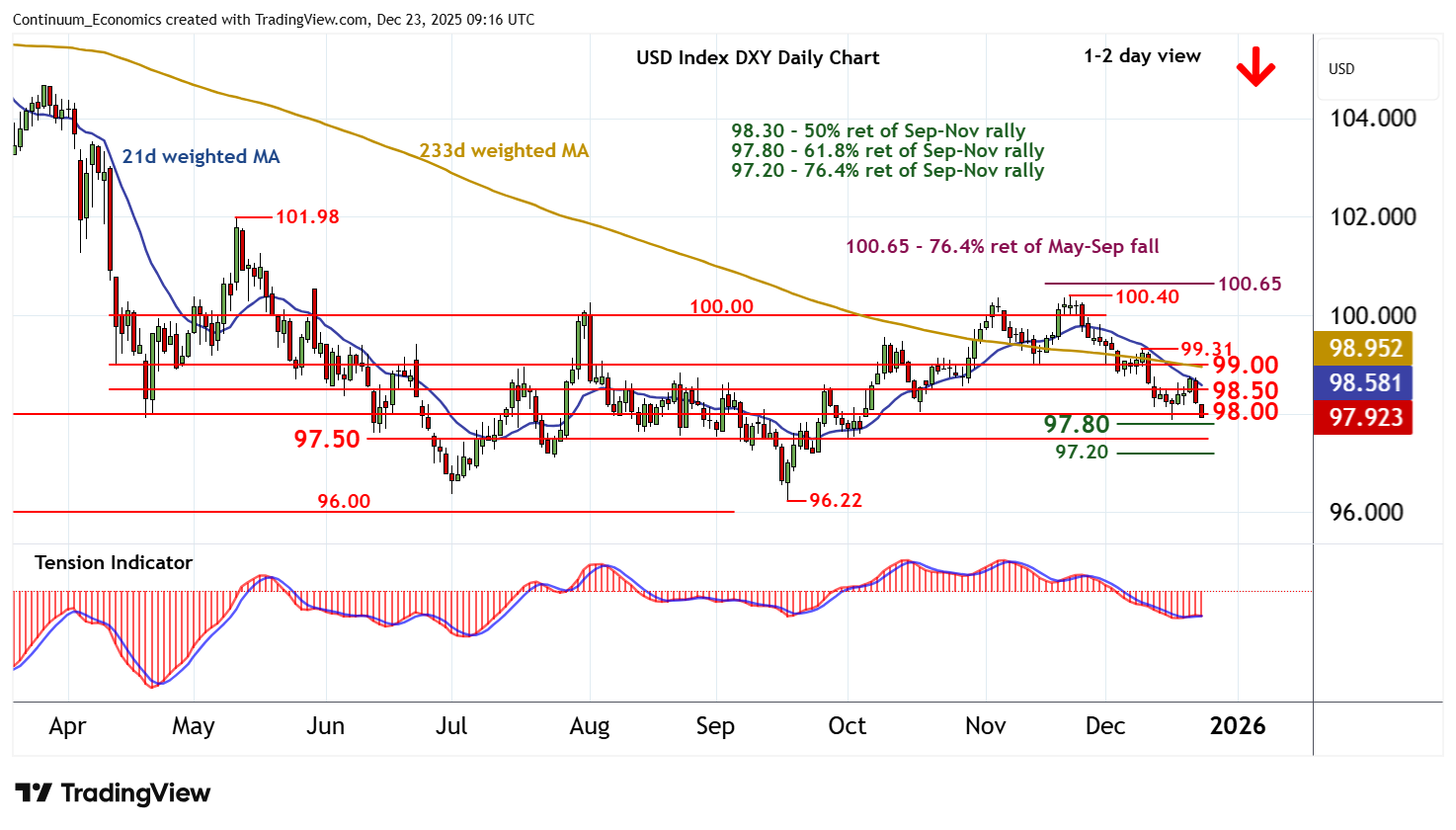

Chart USD Index DXY Update: Extending November losses

1

Cautious trade has given way to anticipated losses

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 99.50 | * | break level | S1 | 98.00 | * | congestion | |

| R3 | 99.31 | * | 9 Dec (w) high | S2 | 97.80 | ** | 61.8% ret of Sep-Nov rally | |

| R2 | 99.00 | * | congestion | S3 | 97.50 | congestion | ||

| R1 | 98.50 | * | congestion | S4 | 97.20 | ** | 76.4% ret of Sep-Nov rally |

Asterisk denotes strength of level

09:05 GMT - Cautious trade has given way to anticipated losses, with prices currently pressuring support within the 97.80 Fibonacci retracement and congestion around 98.00. Daily readings have turned down and broader weekly charts are also under pressure, highlighting room for further losses in the coming sessions. A close beneath here will add weight to sentiment and extend November losses initially towards congestion around 97.50. Meanwhile, resistance is lowered to congestion around 98.50. An unexpected close above here will help to stabilise price action and prompt consolidation beneath further congestion around 99.00.