EUR/USD flows: EUR Modest Gains for 2026?

EUR/USD has scope to 1.20 by end 2026.

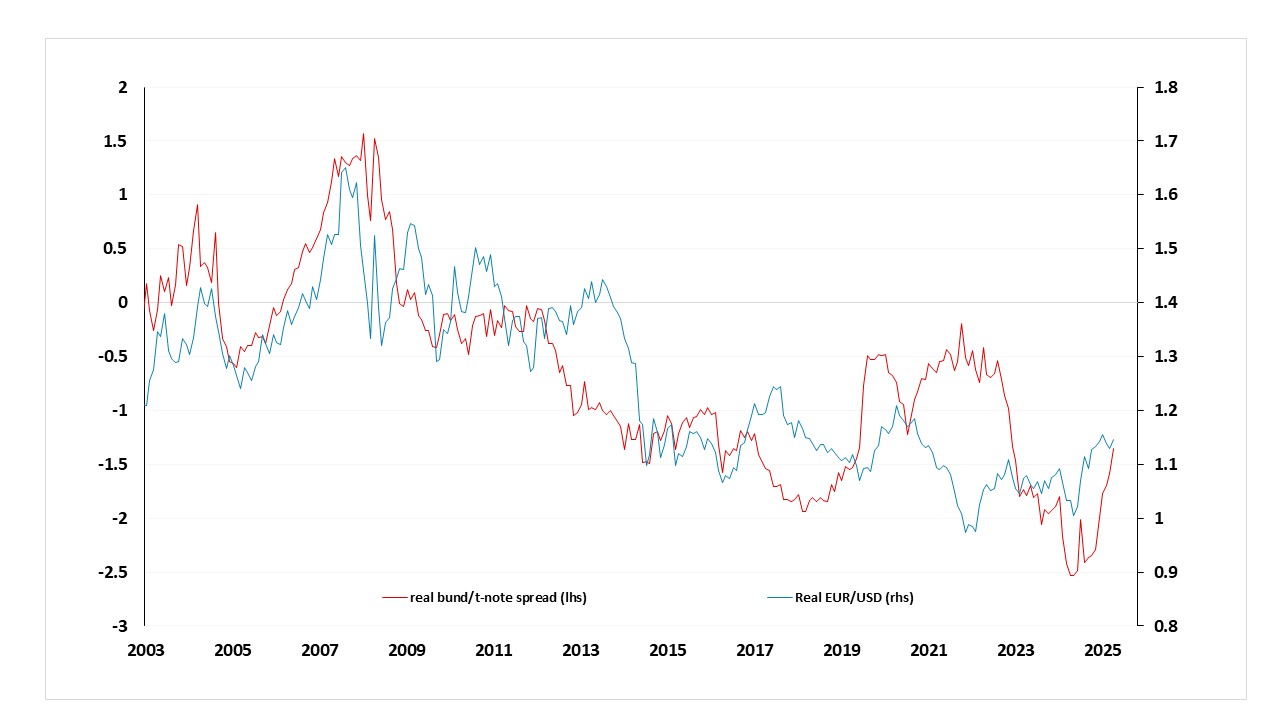

Figure 1: Real EUR/USD and the real 10 year US/Germany yield spread

Source: Datastream, CE

There have been some big swings in EUR/USD in recent years, particularly around the pandemic, which have not necessarily correlated with moves in yield spreads, but have reflected various risks around the sustainability of the Eurozone and the impact of Trump’s tariffs. While the EUR has moved a little ahead of short term yield spreads through 2025, it is now broadly in line with the long term relationship between real yields and the real EUR/USD. From here, we still expect to see some narrowing of real yield spreads between the U.S. and the Eurozone, but relatively little, so scope for EUR gains now looks much more limited. Indeed, if we see some further easing from the ECB there is a risk that the recent EUR strength goes into reverse. But we would expect any ECB easing to come in tandem with some decline in Eurozone inflation, sustaining real EUR yields. This can deliver 1.20 on EUR/USD end 2026.

There could be some volatility due to any U.S. equity market correction. We do expect to see a significant correction in U.S. equities due to the extended valuations, and the positive correlation of EUR/USD to equity indices suggests this could have some initial negative impact on the EUR. But the EUR also tends to benefit from any outperformance of European equities over the U.S., and there is less case for a major correction in European equity indices, which are more sensibly valued. But any correction in U.S. equities is likely to trigger a similar correction in Europe, at least in the short term, so we would expect to see some short term EUR decline on any equity correction, but one that is unlikely to last.

From a big picture perspective, it could be argued that the EUR is too weak relative to PPP, and has been for most of its life, and this could contribute to some EUR strengthening in general. Some of this weakness relates to distrust of the structure of the EUR. The concerns around Greece and some of the other peripheral Eurozone countries has faded a little, but budget problems are still significant in many of the Eurozone countries. France is probably the greatest concern, given its size, its debt dynamics and the inability of the government to pass significant budget reforms. For the moment, the can is being kicked down the road, but as long as these concerns persist it will be hard to argue for a structural EUR appreciation. We thus only look for 1.24 at end 2027.