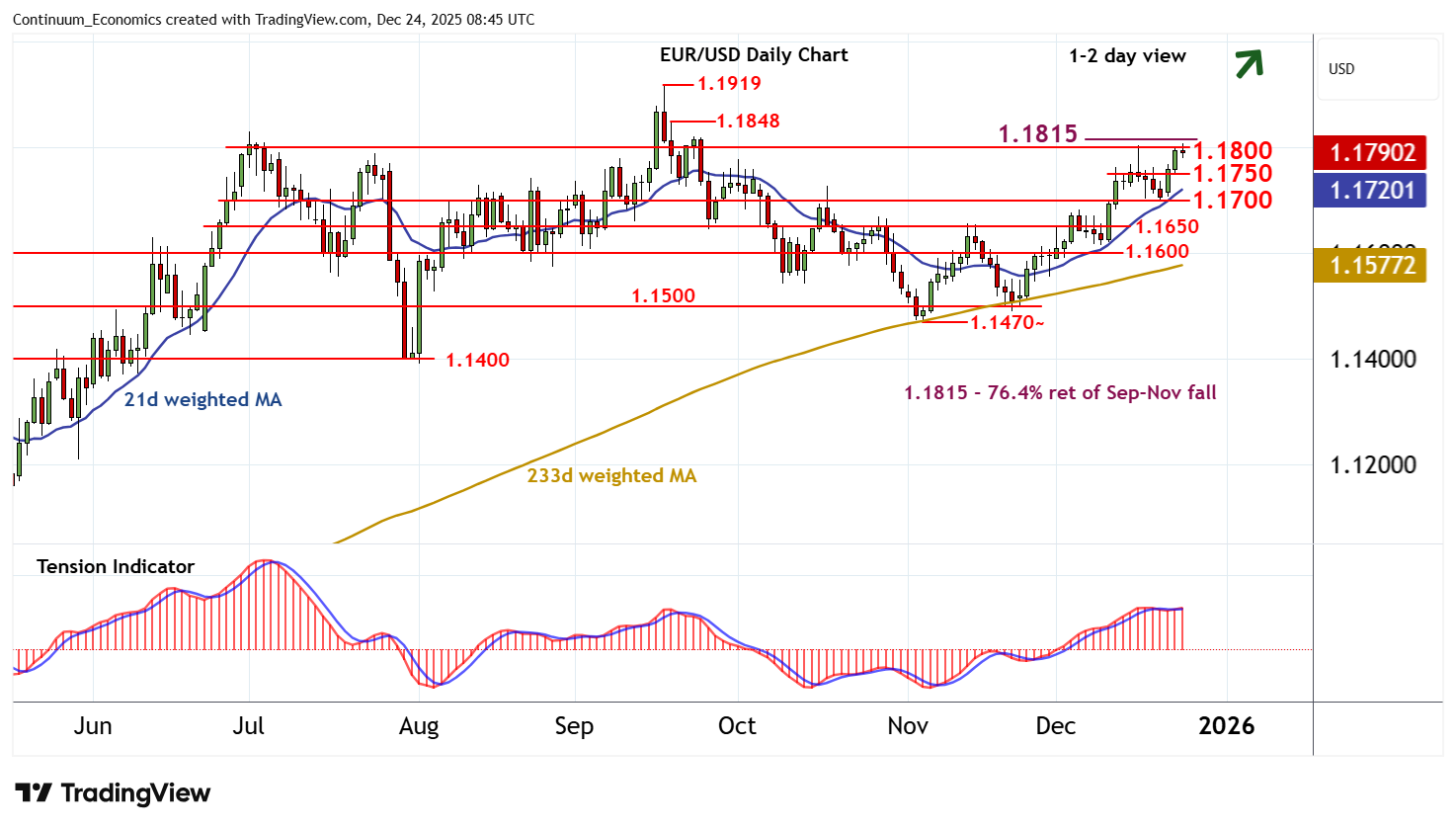

Chart EUR/USD Update: Consolidating test of 1.1800/15 - studies improving

Little change, as the anticipated test of strong resistance at congestion around 1.1800 and the 1.1815 Fibonacci retracement gives way to consolidation

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.1919 | ** | 17 Sep YTD high | S1 | 1.1750 | * | congestion | |

| R3 | 1.1848 | 18 Sep high | S2 | 1.1700 | * | congestion | ||

| R2 | 1.1815 | ** | 76.4% ret of Sep-Nov fall | S3 | 1.1650 | * | congestion | |

| R1 | 1.1800 | * | congestion | S4 | 1.1600 | * | congestion |

*Asterisk denotes strength of level

08:30 GMT - Little change, as the anticipated test of strong resistance at congestion around 1.1800 and the 1.1815 Fibonacci retracement gives way to consolidation. Intraday studies are turning down, highlighting room for a pullback. But improving daily readings and positive weekly charts are expected to limit scope in renewed buying interest towards congestion support at 1.1750. A close beneath here, however, will turn sentiment neutral and delay gains, as prices then settle into consolidation above 1.1700. Following cautious trade, fresh gains are looked for. A close above 1.1800/15 is needed to turn sentiment positive and extend November gains initially to the 1.1848 high of 18 September.