AUD/USD: AUD Lagging and 2026 Rerating?

AUD has lagged yield differentials and we see upside potential in 2026.

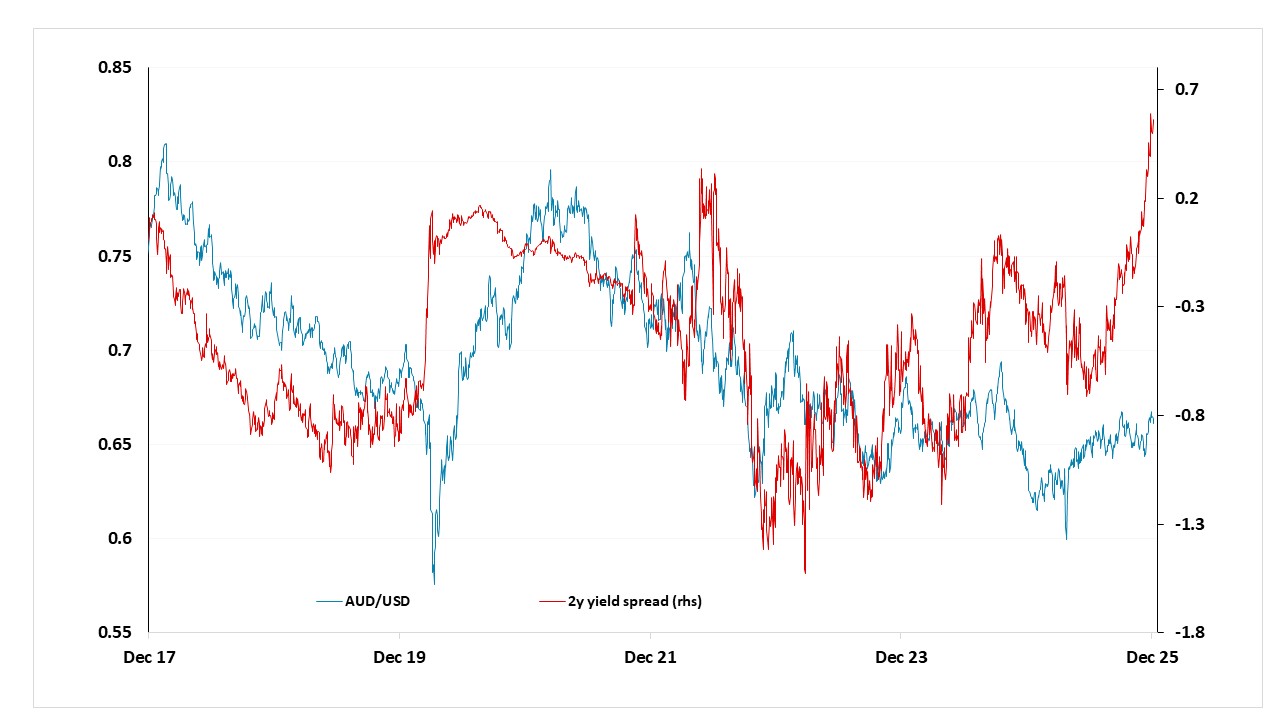

A simple comparison of yield spreads (see below) with the USD shows how the AUD has underperformed in the last year. This does to some extent reflect general USD strength, while AUD has also been dragged down from time to time by concern about China. But in a generally risk positive market the AUD could be expected to have benefited more from the big yield spread move in its favour. The concern going forward is that there could now be some correction to equities in general which could undermine the AUD in the short term, as both tend to suffer initially in periods of risk aversion. But from a big picture perspective we would see any dip in AUD as representing a buying opportunity. For the AUD, yields and the current account are both similar to the UK, but the public finances are much healthier and GDP per capita is higher. Also, the RBA is expected by the market to rise rates over the next year with the BoE is expected to cut rates further. And they seem to be much better at cricket. We forecast 0.6900 for end 2026 for AUD/USD.