U.S.-Germany Yield Decoupling

We see scope for 10yr German Bund yields to remain close to current levels in the next 1-2 years, despite our new forecast of rising U.S. Treasury yields (here[MG(1] ). A weak economic recovery; fiscal consolidation rather than easing in the U.S. and less underlying inflation pressures should all allow the ECB to keep on cutting in H2 2025 and Q1 2026 when the Fed are paused. Then 2026 Fed tightening does not have to be followed by the ECB, both given the EZ macro conditions and also as the EUR TWI is elevated and renewed USD strength v EUR would not be a constraint on ECB policy. Higher 10yr U.S. Treasury yields could cause an upward drag effect on 10yr French and Italian government bond yields and causes some spread widening versus 10yr Bunds.

With EZ and U.S fiscal policies likely to be moving in opposite directions into 2026, there is every reason why the respective monetary stances may also diverge!

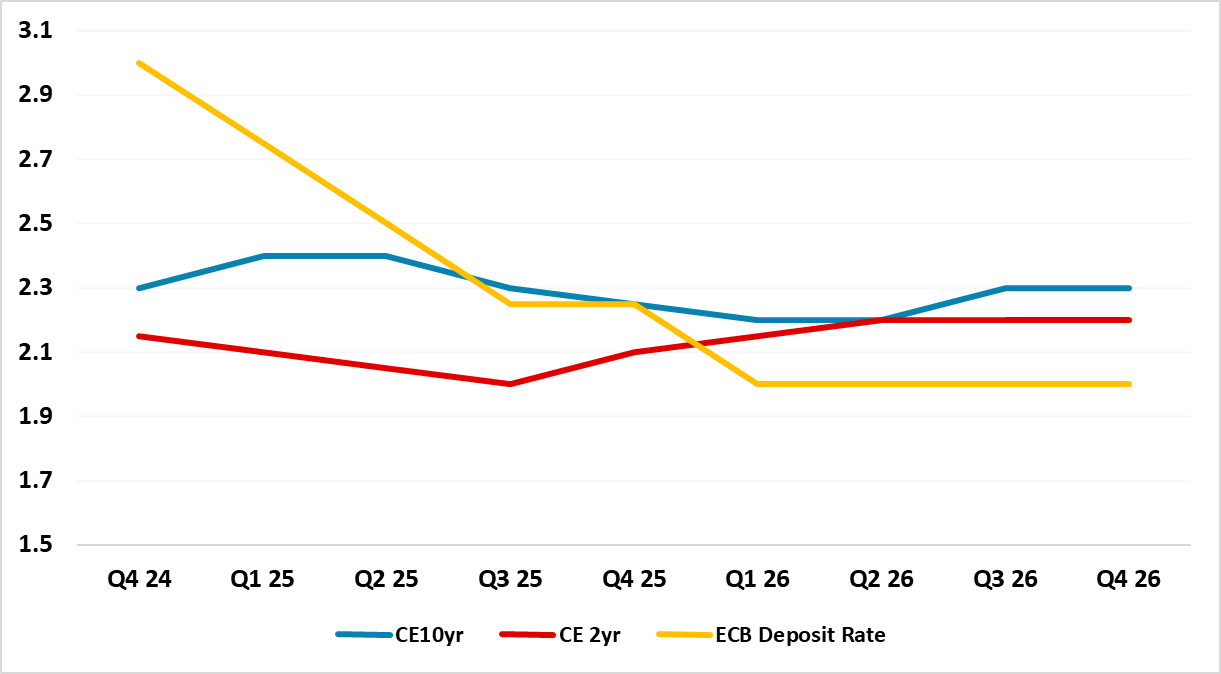

Figure 1: ECB Depo Rate, 2 and 10yr Bund Yield Forecasts (%)

Source: Continuum Economics

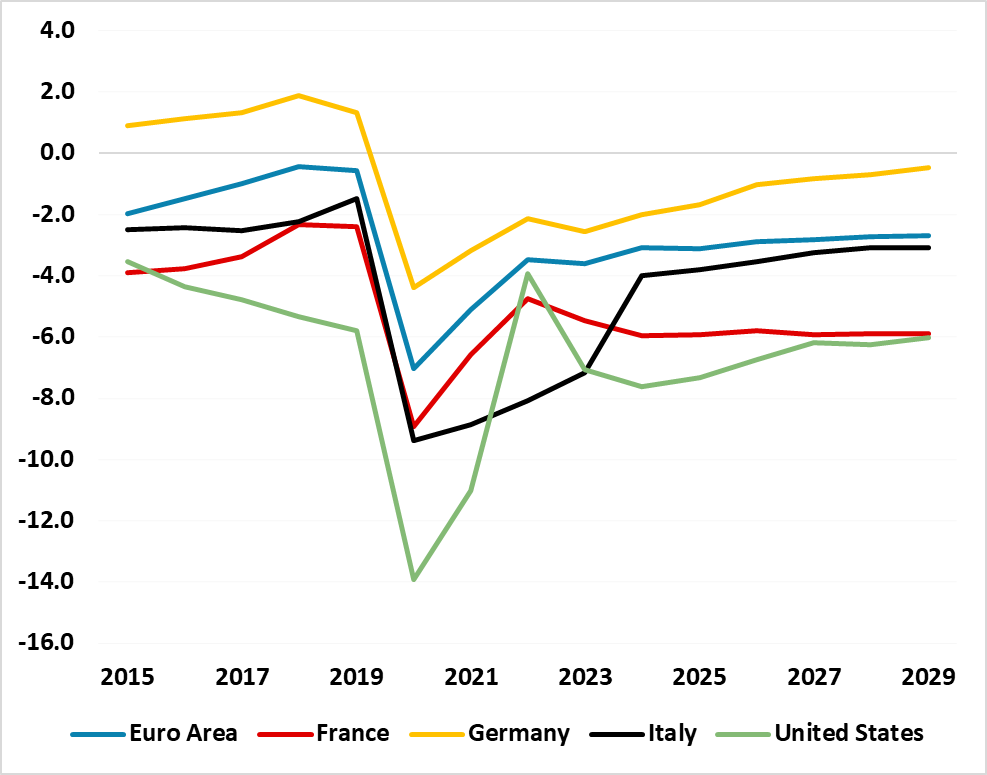

The outlook for the 10yr U.S. Treasury-Germany bond spread depends on the EZ as well as the U.S. economic and policy outlook. 2025 should see Fed and ECB easing continuing in H1 2025, but then the Fed pausing and the ECB continuing to cut to a 2.25% deposit rate given the weak cyclical position in the EZ and softer inflation trajectory (Figure 1). 2026 can see one last 25bps cut from the ECB to guard against undershooting the inflation target, but then the ECB going on hold and not following the 100bps Fed tightening cycle we now expect for 2026 (here). Fiscal policy in Europe will also be modestly contractionary in the EZ compared to the U.S. (Figure 2) -- where the budget deficit will likely be 1-2% larger than the IMF projections. The EZ labor market will also not be as tight as the U.S. labor market, as immigration will be more controlled in the U.S. than the EZ. Finally, the EZ macro trajectory will likely be modest and towards trend growth, while the U.S. will be above trend growth. The EUR is not a constraint for ECB policy, as the EUR TWI is above normal levels and USD strength v EUR would not be issue.

Figure 2: U.S., EZ and Select Countries Budget Deficits (%)

Source: IMF/Continuum Economics

2yr Bund yields would then largely be driven by ECB policy expectations, which would see a pause at a 2% ECB policy rate in early 2026. The market is unlikely to discount an ECB tightening cycle in 2026-27, as EZ has structural headwinds in terms of population aging and industry specific challenges (autos and gas intensive sectors). The new Trump administration is also likely to impose some tariffs on the EZ, but this could be automobiles rather than universal (here) to get trade concessions. The EU would likely impose less in return, but even the threat of a trade war would hurt EZ business confidence/exports and also be disinflationary as domestic production exceeds supply. This could restart the ECB easing cycle in 2026.

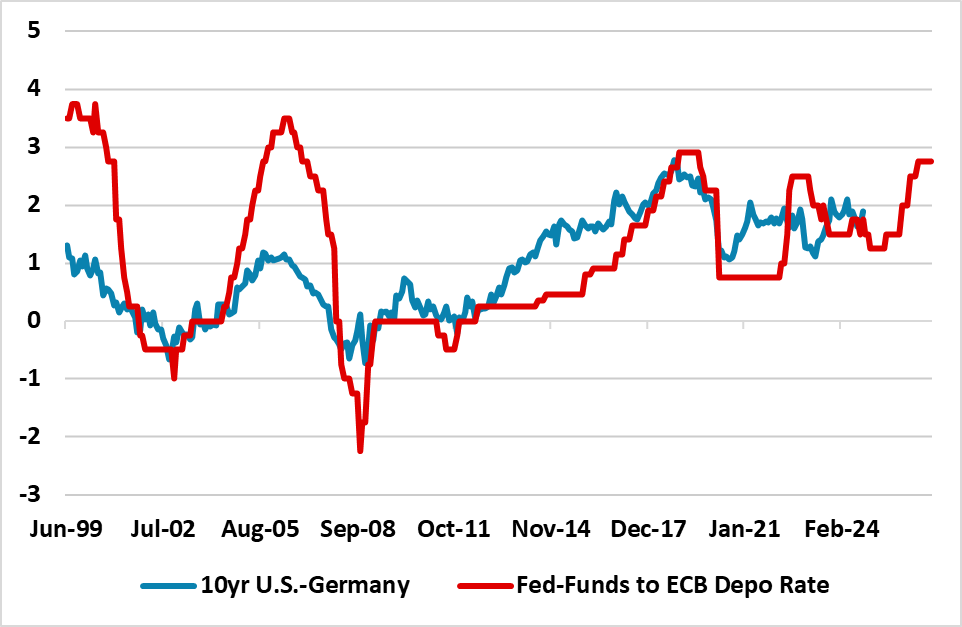

Figure 3: 10yr U.S.-Germany Spread and Fed Funds-ECB Depo rate Spread (%)

Source: Datastream/Continuum Economics

For 10yr Bund yields, we see divergence as we see Bund yields stable, despite 10yr U.S. Treasury yields rising. Even with a possible dilution of the debt-brake under a new German government after early elections in 2025, the budget deficit and supply outlook would be a lot better in EZ than the U.S., as would the growth/inflation and policy viewpoint into 2026. The 10yr U.S. Treasury-Bund spread got to 275bps in 2018 when the Fed were tightening and ECB not, as is our forecast in 2026. However, that was in era of ultra-low ECB policy rates and government bond yields and the ECB were doing QE rather than QT. We can see some widening of the 10yr U.S. Treasury-Bund spread, but this will come from U.S. yields rising and 10yr Bund yields consolidating – it is difficult to see 10yr Bund yields below 2% without EZ recession and significant EZ inflation undershoot.

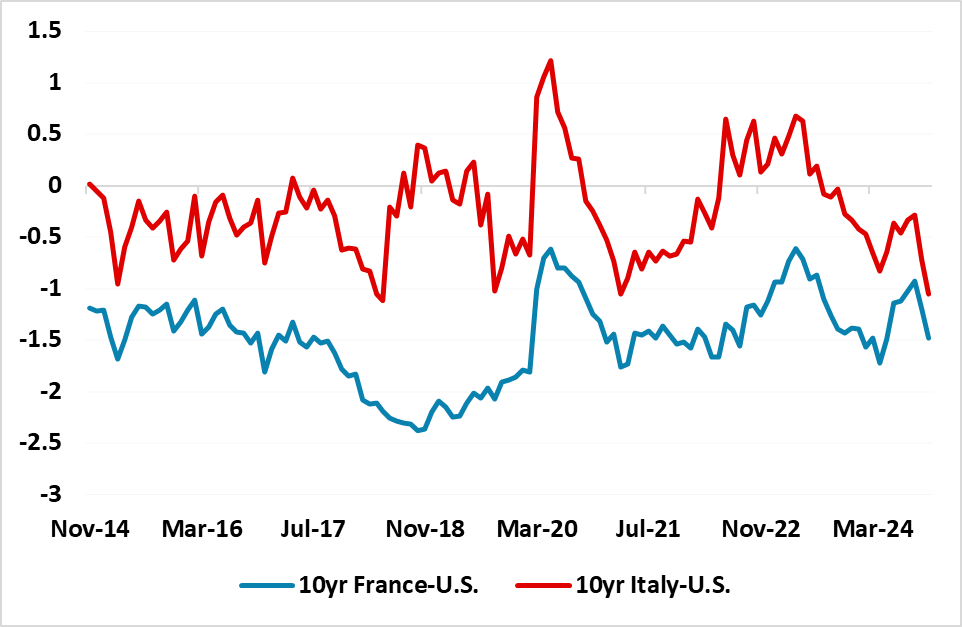

However, Italy and French 10yr yields will not be as unmoved by rising 10yr U.S. Treasury yields. Though Italy is following a budget consolidation path, it is slow and the budget deficit risks the government debt/GDP ratio rising. Italy also has to compete somewhat with 4% plus U.S. 10yr yields for international bond portfolios. For France the situation is potentially worse, as the inability of the government to undertake fiscal consolidation leaves a worse budget deficit situation than Italy (Figure 2), given that the weak government may not be rectified by the widely expected 2025 parliamentary elections. This could mean that rising 10yr U.S. Treasury yields have an upward drag effect on 10yr French and Italian government bond yields and causes some spread widening versus 10yr Bunds.

Figure 4: 10yr U.S. v Italy and France (%)

Source: Datastream/Continuum Economics