U.S. Tariffs on China: How and When?

The U.S. can put pressure on other countries by starting tariffs at a more moderate scale and country and industry specific and then credibly threatening to increase and broaden tariffs as it did in 2018-19 to get trade concessions from other countries. This also reduce the scale of the adverse inflation and GDP shocks. We would first see China as being at threat from these tactics in 2025, though other countries would face threats in 2026. This transactional approach will likely be supplemented with strategic bans in certain areas to restrain China, given the likely appointment of China hawks Rubio and Waltz. Though this is our current baseline, considerable uncertainty exists over the tactics that the incoming Trump administration will us. If tariffs become structural rather than transactional and formally driven through Congress then it could mean bigger tariffs in 2026, which we feel would boost the inflation trajectory more and then hurt GDP via lower consumption.

Great uncertainty exists of the size and timing of tariffs by the U.S. on China and other countries. What are the options?

Figure 1: Chronology of U.S./China Trade War

| Aug-17 | USTR investigates China trade |

| Jan-18 | US imposes tariffs on China solar panels and washing machines |

| Mar-18 | U.S. imposes tariffs on steel and aluminium tariff across many countries |

| Apr-18 | USTR issues report under 301 report and U.S imposes tariffs and China counters on select goods |

| May-18 | Trump threatens to impose tariffs on extra USD100bln of goods and China agrees to substantially reduce trade deficit with U.S. |

| Jun-18 | U.S. impose 25% tariff on USD50bln on China goods in July/August 2018 and China announces similar counter tariffs |

| Sep-18 | U.S. announces 10% tariff on USD200bln of China goods with threat to increase to 25%. China announces 10% tariff on USD60bln of U.S. Imports |

| Nov-18 | USMCA comes into effect with rules of origin to protect U.S. automobile industry |

| May-19 | U.S. increases tariffs on USD200bln to 25% |

| Jun-19 | Presidents Trump and Xi agree truce at G20 summit |

| Jul-19 | China announces target of reducing U.S. Treasury holdings by 25% |

| Aug-19 | Trump threatens to Impose tariffs on extra USD300bln of goods and USD112bln take effect Sep 1 2019 at 15% |

| Aug-19 | Yuan depreciation accelerates and US declare China a currency manipulator |

| Oct-19 | Trump announces first phase trade deal with China, which comes into effect Feb 2020. |

| End 2020 | 58% of targets meet by first phase deal, due to COVID pandemic |

Source: Continuum Economics

President elect Donald Trump has been aggressive on the campaign trail calling for 60% tariffs against China and 20% rather 10% universal tariffs against other countries. What will Trump do after he takes office in January 2025 on tariffs?

We feel that the top priorities will be reducing immigration and starting the work to renew lapsing 2017 tax cuts and implemented a number of tax cuts promised on the campaign trial. The net fiscal stimulus will also provide support for the U.S. economy going into 2026, as the fiscal package will take time to implement. This is also likely to include the carrot of 15% corporate tax for domestic production to get U.S. companies to switch production and investment back to the U.S. This will then leave economic scope to implement tariff increases in 2026, though threats and then early announcement will likely occur during 2025.

One question is whether tariffs will become structural and formally driven through Congress or transactional to get trade deals and raise some revenue on the side. Ex USTR Lighthizer is reported to favor structural tariffs though Congress. However, Scott Bessent a potential U.S. Treasury secretary candidate wants a less aggressive approach, while Elon Musk would likely favor a transactional approach. Additionally, there is a significant minority of traditional Republicans who believe in free trade and would be uncomfortable with tariffs. Finally, the risk exists of the Republicans losing control of the House in Nov 2026, which would complicate tariff implementation. Thus we see the tariff process not being controlled by Congress but by President Trump and the administration (here), including declaring a national security emergency. This allows Trump to take credit for action, but also to be part of the negotiations for any trade deal. This will be challenged in the courts but we doubt the Supreme Court would rule against Trump, while the Trump administration is likely to overlook WTO protests. The U.S. Treasury secretary will then have to quantify the revenue benefits for the U.S. budget from tariffs.

The 2018-20 U.S./China trade war (Figure 1) provides some clues to the tactics on timing and size. It is also worth noting that Donald Trump took a lot of personal control in 2018-19 in this transactional approach. Trump did announce tariffs that were implemented quickly, but they were not universal and also incremental in percentage terms.

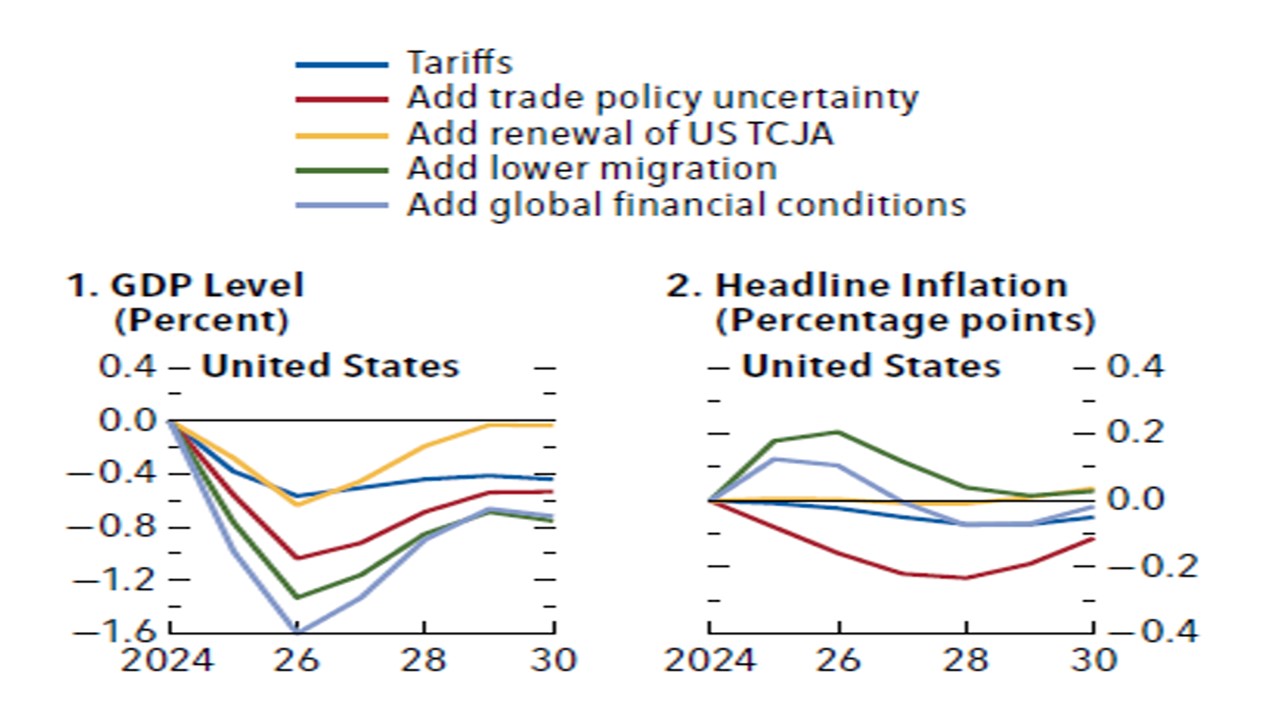

One option for example could be to implement say a 30-40% tariff against China automobiles and the threat to cover more industries or raise the stakes to 50% or 60% at a later date. This poker game with China in 2018-19 prompted retaliation (including reducing U.S. Treasury holdings and Yuan depreciation), but after a while China became less aggressive. After a number of false dawns in 2019, a first phase agreement was eventually agreed between U.S. and China and implemented in Feb 2020, though the COVID pandemic then derailed the deal. This scaled phase in of tariffs also had the economic benefit of less of a temporary inflation shock that reduced the risk of 2 round effects. It also reduces the adverse economic effect on GDP (Figure 2 has the IMF simulation of 10% universal tariffs and 10% retaliation by China/EU).

Figure 2: Effects of 10% Universal Trade Tariffs and Trade Policy Uncertainty

Source: IMF WEO October 2024 (TCJA is 2017 tax cut package).

Trump’s tactics with China will likely be different from 2018-19, but still with the same aim to come to a trade deal with China. Though China has diversified exports away from the U.S. since the 1 Trump term, exports to the U.S. are still important. Additionally, China economy is slower and more unbalanced growth than 2016-19, which provide a dilemma to China’s authorities – given the risk of a major further decline in exports to the U.S. with high tariffs. The Trump administration will also likely ask Mexico and Canada to have tougher rules for China companies assembling in Mexico and Canada and exporting to the U.S., when the USMCA is revised in 2026 – these discussions will likely start in 2025 to indirectly pressure China. This could lead to China agreeing phase two trade deal with the Trump administration quicker than the 18 months in 2018-19, but uncertainty is high on this issue as it is on the wider topic of tariffs for the Trump administration.

Will the Trump administration implement universal tariffs at 20% at the same time as new tariffs on China? The U.S. implemented steel and aluminium tariffs in March 2018, before the U.S./China trade war got underway. However, across the board tariffs on all imports to the U.S. at 20% would produce too large an inflation/GDP shock and is unlikely tactically. Instead, modest tariffs could be seen by the U.S. alongside the threat of higher tariffs later and perhaps on one industry group e.g. automobiles, where Donald Trump has great loathing for the German automobile industry. Combined with the threat to do more at a later date, this could provide pressure to negotiate trade deals that are favourable to the U.S. Reports have already suggested that the EU commission is examining more purchases of U.S. LNG, while Taiwan is looking at a large purchase of U.S. military hardware.

This sketch of likely U.S. tariff tactics are in our new baseline U.S. forecasts (here) and alongside fiscal stimulation sees us forecasting 3.0% CPI and 2.6% core PCE inflation for 2026. This all comes with the large uncertainty surrounding the actual tactics that will be used in 2025 and 2026. This transactional approach will likely be supplemented with strategic bans in certain areas to restrain China, given the likely appointment of China hawks Rubio and Waltz. If tariffs become structural rather than transactional and formally driven through Congress then it could mean bigger tariffs in 2026, which we feel would boost the inflation trajectory more and then hurt GDP via lower consumption. We shall watch progress and revise our thinking in light of further information.