U.S. Economic Outlook under Trump

Uncertainty over how the U.S. election results will impact the economic outlook remains very high, but the evidence at present suggests that incoming President Donald Trump, assuming Republican control of the House is confirmed, will attempt to implement a substantial part of his campaign promises. That means that while business-friendly tax cuts will provide initial support, risks from a large increase in the budget deficit, tariffs and reduced labor supply provide substantial risks in the longer term.

Our revised forecast

It is too early to come up with precise forecast on how much and which taxes will be cut and how much tariffs will be increased, and against who, and when the decisions will be implemented. However we expect that Trump will be aggressive on both, if not reaching the full extent of his campaign commitments. We expect the tax cuts will come before the tariffs, with the scale of the tax cuts likely to add to the case for tariffs as an alternative source of revenue. Our starting point, based on an assumption of little policy change, was that the economy would lose some momentum in 2025 though without threatening recession, before returning to near potential growth with on target inflation in 2026.

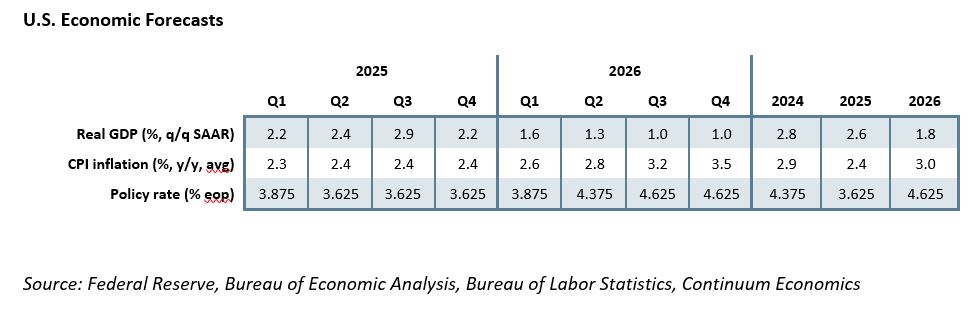

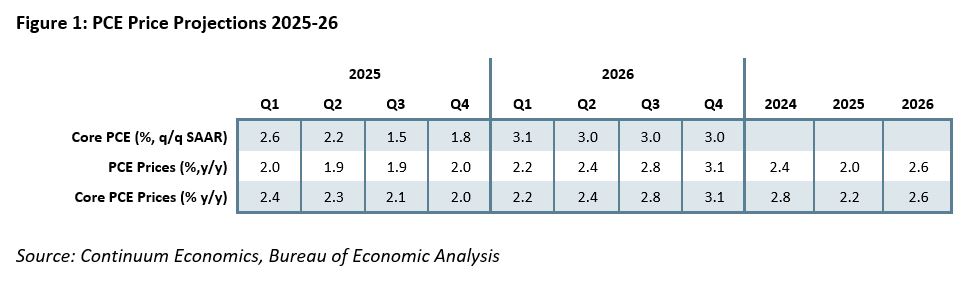

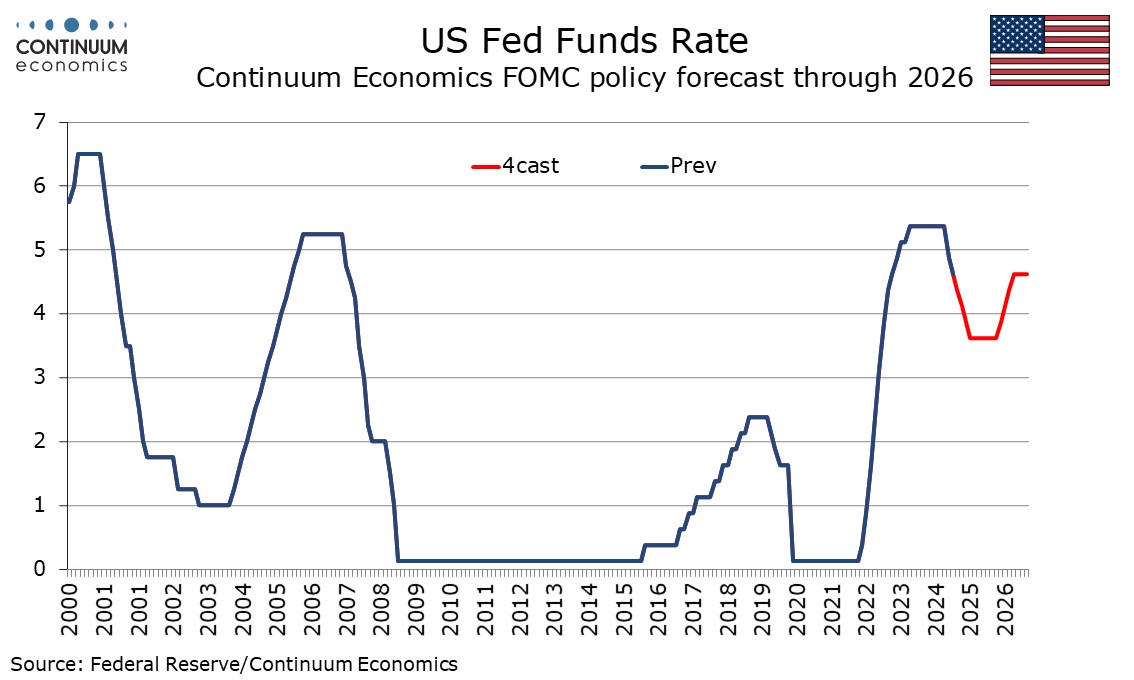

Tax cuts are likely to help sustain GDP near current momentum in 2025, with the strongest quarter coming in Q3 at 2.9% annualized, and we expect 2025 GDP to be up by 2.6% overall, compared with 2.8% in 2024. This is likely to mean less Fed easing, with rates falling to a low of 3.5%-3.75% in Q2 2025, rather than the a low of 3.0-3.25% we had previously expected to be reached in late 2025. In 2026 tariffs, and to a lesser extent, a depleted labor force, are likely to lift inflationary pressure, which we expect to pick up to 3.0% for PCE prices and 3.5% for CPI. This is likely to bring renewed Fed tightening, we expect to a 4.5-4.75% Fed Funds target, and slow GDP growth, we expect to 1.8% in 2026, with annualized growth rates in the second half of the year of only 1.0%.

A wide range of alternatives

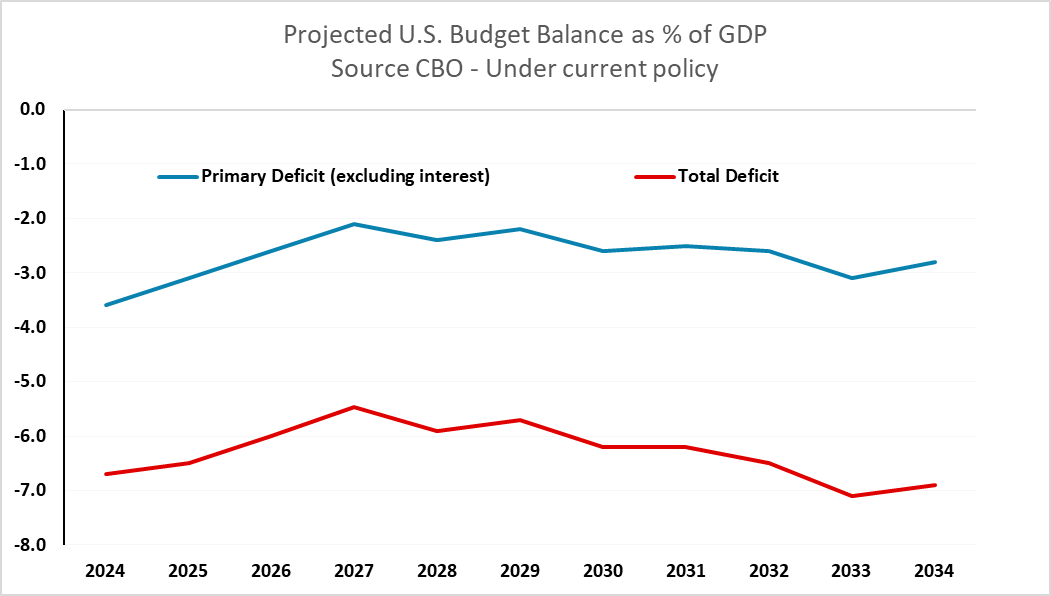

The range of potential outcomes is massive. Extending the 2017 tax cuts would add around $5 trillion to the budget deficit over 10 years, which would increase the deficit from a CBO estimate of 6.3% of GDP to 7.7%. Adding the full extent of Trump’s campaign proposals could add as much again meaning risk for deficits of around 9% of GDP. Tariffs could provide a maximum of around $4tr in revenue over 10 years, though implementing tariffs on this scale suddenly could add around 3% to inflation. Whether it would be a one-time boost or have secondary effects would depend on the strength of the economy. The labor market will be tighter if immigration is reduced and large numbers of undocumented workers expelled, though even with aggressive efforts this will take time to have its full impact.

Ahead of the election we could see two different directions a Trump presidency could head. Firstly there was a moderate scenario, under which Trump relalized he was inheriting a growing economy with inflation well off its highs and a monetary easing cycle underway. If he did little other than extend his 2017 tax cuts public sentiment of the economy would gradually improve under his watch and he could take the credit.

Trump leaning radical

The second scenario would be to fully implement the radical promises of his campaign. That Trump will almost certainly will have the full backing of Congress reduces the obstacles to this scenario. Early signals on Trump’s likely cabinet appointments suggest Trump is favoring the aggressive scenario. Immigration hardliner Tom Homan, is set to be in charge of borders and deportations. Cantor Fitzgerald CEO Howard Lutnick, who looks set to lead the formation of the economic team, at a pre-election rally described the situation in 1900 with no income tax, only tariffs, as a time when the USA was “sufficiently great”. Trump could still be persuaded from aggressive action by the markets, but there is no sign of the major fall in the stock market that would be required, given its current focus on prospect of lower corporate taxes.

This suggests that Trump will go beyond simply extending his 2017 tax cuts and provide some fiscal stimulus through lower taxes early in his second term. Extending the 2017 tax cuts should not be seen as a fiscal stimulus as it would preserve the status quo, but would add to long term projections of the deficit. We assume Trump will go beyond that, but not fully implement his other proposals.

There would be little resistance in a Republican Congress to aggressive tax cuts. However there is a significant minority of traditional Republicans who believe in free trade and would be uncomfortable with tariffs. If tax cuts leave the markets uncomfortable with the size of the budget deficit, Trump, who has never shown the interest in spending cuts that traditional Republicans have, is likely to turn to tariffs, not through a vote in Congress but by declaring a national security emergency. This will be challenged in the courts but we doubt the Supreme Court would rule against Trump. By 2026 most countries are likely to be facing tariffs. China would be the first target but may be able to get a deal to reduce the magnitude. Canada is more likely than most to be spared but far from safe. We assume that tariffs will be substantial but significantly short of Trump’s campaign proposals.