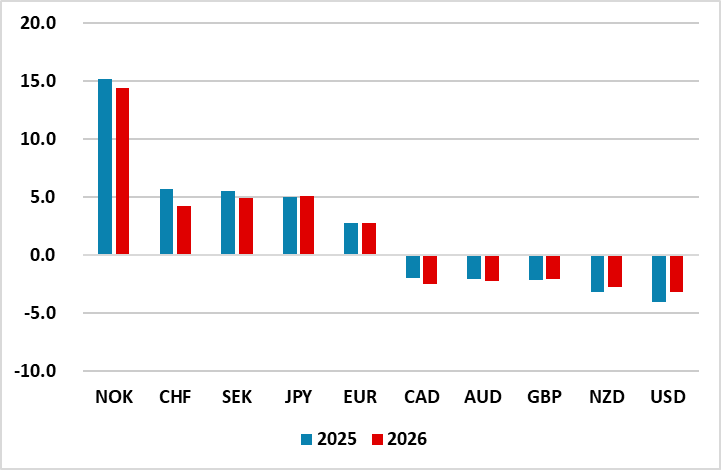

DM FX Outlook: Scope for USD decline against JPY, AUD and NOK

· Bottom Line: We expect some modest USD losses across the board over the next couple of years, but there is much more scope for losses against the JPY, AUD and NOK than the other G10 currencies, as yield spreads have moved dramatically in favour of these currencies, and the currencies have hugely underperformed. Which performs best in any period will likely depend on risk sentiment, but over the longer run all ought to make gains across the board.

· Forecast changes: We have slightly reduced our expectation of JPY strength due to persistent negative sentiment and the likely continuation of negative short-dated real yields, and increased our AUD/USD forecast in response to the strength in the economy and the turn in RBA policy expectations.

· Risks to our views: Equity markets are the biggest uncertainty due to the extremely high U.S. valuations. There is a risk of a sharp correction even on relatively modest disappointments on the U.S. economy. Such moves could have major but temporary negative impacts on riskier currencies, and a positive effect on the JPY.

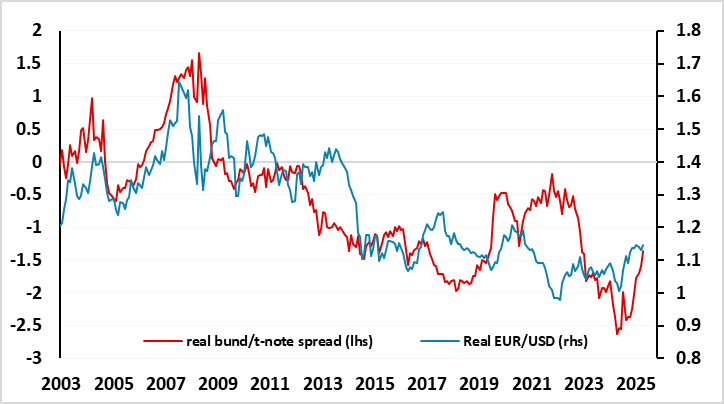

Figure 1: Real EUR/USD and the real 10 year US/Germany yield spread

Source: Datastream, CE

EUR/USD back to near fair levels based on historic relationships

There have been some big swings in EUR/USD in recent years, particularly around the pandemic, which have not necessarily correlated with moves in yield spreads, but have reflected various risks around the sustainability of the Eurozone and the impact of Trump’s tariffs. While the EUR has moved a little ahead of short term yield spreads through 2025, it is now broadly in line with the long term relationship between real yields and the real EUR/USD. From here, we still expect to see some narrowing of real yield spreads between the U.S. and the Eurozone, but relatively little, so scope for EUR gains now looks much more limited. Indeed, if we see some further easing from the ECB there is a risk that the recent EUR strength goes into reverse. But we would expect any ECB easing to come in tandem with some decline in Eurozone inflation, sustaining real EUR yields.

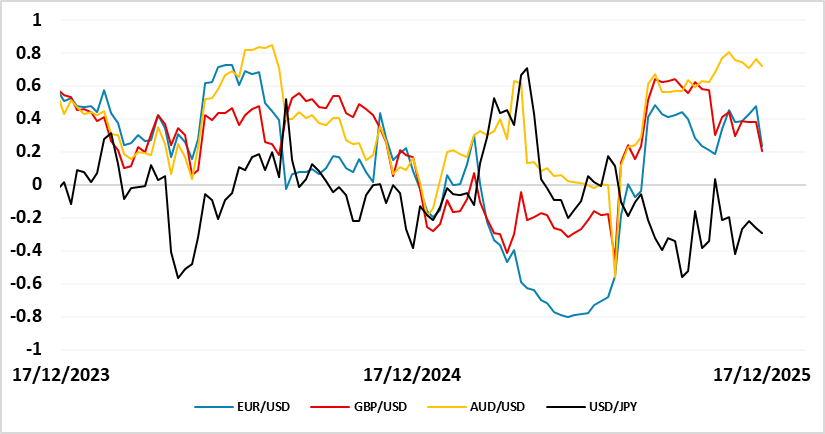

Figure 2: Correlation of one week changes in FX with one week changes in S&P – 3 month rolling

Source: Datastream, CE

There could be some volatility due to any U.S. equity market correction. We do expect to see a significant correction in U.S. equities due to the extended valuations, and the positive correlation of EUR/USD to equity indices suggests this could have some initial negative impact on the EUR. But the EUR also tends to benefit from any outperformance of European equities over the U.S., and there is less case for a major correction in European equity indices, which are more sensibly valued. But any correction in U.S. equities is likely to trigger a similar correction in Europe, at least in the short term, so we would expect to see some short term EUR decline on any equity correction, but one that is unlikely to last.

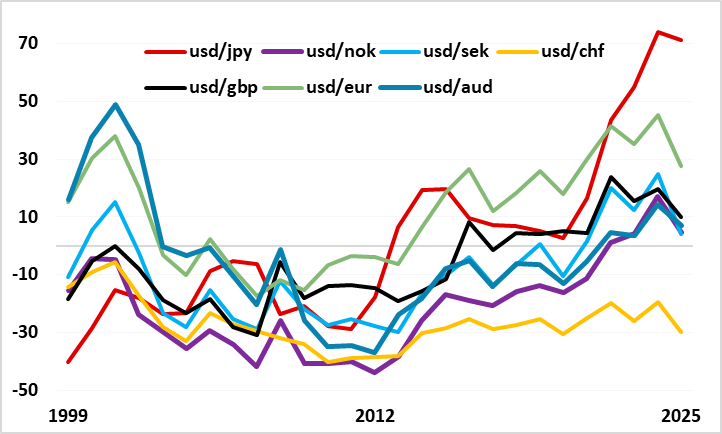

Figure 3: % difference from USD PPP

Source: OECD, CE

From a big picture perspective, it could be argued that the EUR is too weak relative to PPP, and has been for most of its life, and this could contribute to some EUR strengthening in general. Some of this weakness relates to distrust of the structure of the EUR. The concerns around Greece and some of the other peripheral Eurozone countries has faded a little, but budget problems are still significant in many of the Eurozone countries. France is probably the greatest concern, given its size, its debt dynamics and the inability of the government to pass significant budget reforms. For the moment, the can is being kicked down the road, but as long as these concerns persist it will be hard to argue for a structural EUR appreciation.

JPY still has the most scope for gains

Q4 saw the JPY weaken significantly with the election of Takaichi as the LDP leader and Prime Minister being the trigger. There were some concerns expressed about the potential for Takaichi to follow “Abenomics” – involving both easier fiscal and monetary policy. However, while Takaichi has passed an expansionary budget, it is not substantially different from previous budgets, and more importantly, monetary policy and QT is still being left to the BoJ. Typically, expansionary fiscal policy is currency positive if accompanied by independent monetary policy because it will normally lead to higher yields than would otherwise have been the case, and all the indications are that the BoJ will continue on its tightening cycle provided that the economy shows the expected nominal growth. JGB yields have moved significantly higher in recent months, and the historic relationship between yield spreads and USD/JPY suggests USD/JPY should already be a lot lower (Figure 4).

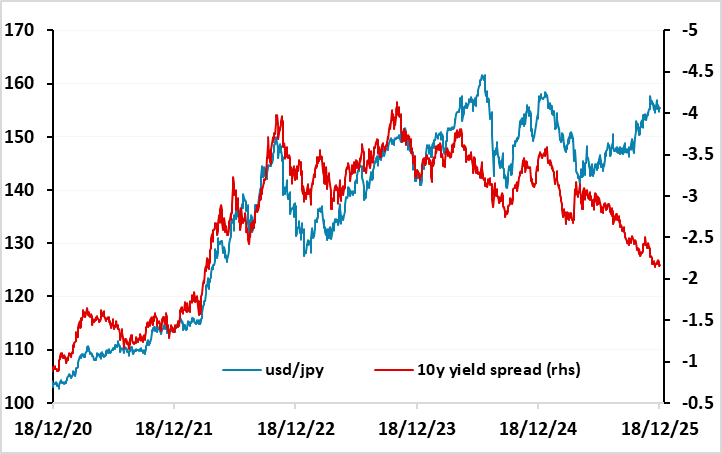

Figure 4: USD/JPY and 10 year yield spread

Source: Datastream, CE

However, the relationship between USD/JPY and yield spreads appears to have broken down for now, although history and theory suggests this will not last indefinitely. There has also been a strong historic relationship between equity risk premia and the JPY, which, though less theoretically sound, has held up better in recent months. This suggests that we will need to see a turn lower in equities or, more precisely, a turn higher in equity risk premia for the JPY to turn. Bigger picture, we would expect USD/JPY to move closer to long term fair value in the next couple of years. Purchasing Power Parity for USD/JPY is below 100, but as long as real yields in the U.S. are relatively high the USD can be expected to trade well above that. Even so, with JGB yields likely to rise significantly in the coming years, we would expect to see USD/JPY close to 130 by the end of 2027. Very rapid JPY gains may be seen in the event of a sharp U.S. equity correction.

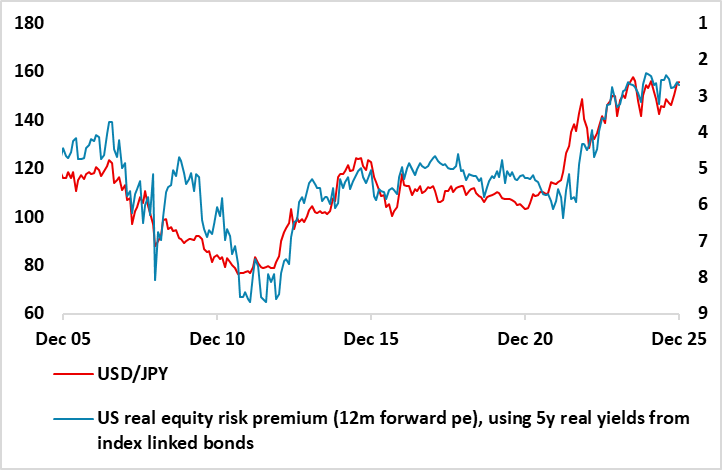

Figure 5: US real equity risk premium and USD/JPY

Source: Datastream, CE, FRED

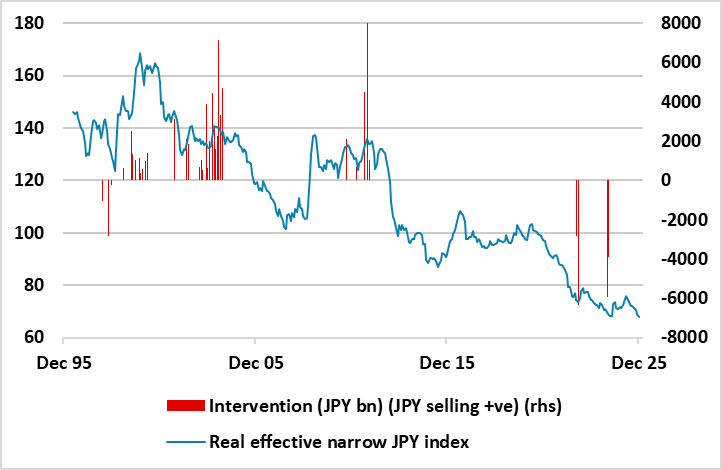

If we don’t see a significant U.S. equity correction the downward pressure on the JPY may persist near term. Trends can be powerful in the FX market, and the JPY downtrend has been persistent in the last few years. Many who have profited form the JPY’s decline will be reluctant to give up on the downtrend. However, there is an extra prop for the JPY at current levels in the form of potential FX intervention. The new Japanese government have verbally protested recent JPY weakness, and the level of the JPY is so weak that intervention to support it would be seen as acceptable. The previous government intervened close to current levels in terms of the real effective JPY, so if we see the JPY threatening new lows, we would expect to see actual FX intervention as we did in 2022 and 2024. Japanese intervention has been historically very effective in marking the long term tops and bottoms for the JPY, so with the JPY so close to all time lows in real terms and the Japanese authorities poised to intervene, it looks dangerous to position for further JPY weakness.

Figure 6: Japanese intervention and real JPY effective exchange rate

Source: Datastream, CE

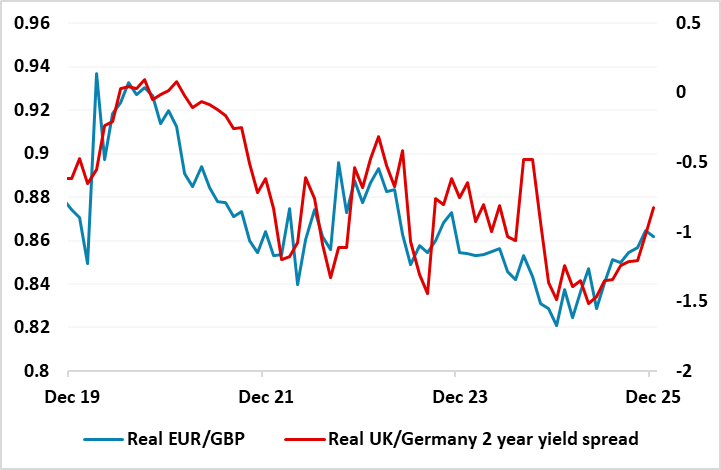

GBP to edge lower

We expected GBP to continue the gradual decline against the EUR seen through this year. We expect the Bank of England to cut rates somewhat more than the market is pricing in, with the latest data on GDP, wages and prices supporting a more dovish stance. While we also see potential for the ECB to ease again, while the market is pricing in no change in policy rates for the next year, there should still be potential for real UK yields to fall slightly relative to the Eurozone. GBP might also suffer form any correction in U.S. equities which causes some general sell off in riskier currencies. Even so, GBP weakness is unlikely to be dramatic, with gains above 0.90 likely to be modest.

Figure 7: Real EUR/GBP and real 2 year yield spread

Source: Datastream, CE

AUD and NOK look significantly undervalued

Despite the broadly risk positive tone in markets in recent years, the AUD and NOK, which are typically two of the most risk positive currencies, have both hugely underperformed movements in yield spreads over the last couple of years. From an absolute valuation perspective, neither look enormously cheap, but both ought to benefit from their relatively high yields, and in Norway’s case, from their substantial budget and current account surplus. Norway’s budget and current account position suggests the NOK ought to be considered a safe haven akin to the CHF, and indeed that was the case 15 years ago when the valuation of the two currencies relative to PPP was similar (see figure 3). However, the NOK has fallen back rapidly in recent years, and started to be seen as a risk currency rather than a safe haven, helped to some extent by the selling of NOK by the government pension fund which neutralizes the direct impact of the current account surplus on the currency.

Figure 8: Current accounts as % of GDP

Source: OECD

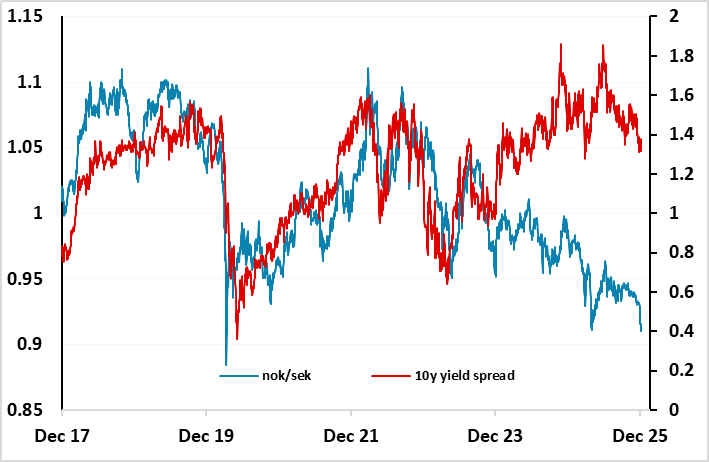

However, both the NOK and the AUD offer yields at or above U.S. levels which suggests they should be trading above their long term equilibrium levels. From a pure valuation perspective, relative to PPP, they trade at a similar level to GBP and the SEK. For the NOK, more attractive yields and a bigger current account surplus relative to Sweden suggests valuation should be above the SEK, but NOK/SEK has fallen to close to all time lows in the last year and has substantially underperformed moves in yield spreads. For the AUD, yields and the current account are both similar to the UK, but the public finances are much healthier and GDP per capita is higher. Also, the RBA is expected by the market to rise rates over the next year with the BoE is expected to cut rates further. And they seem to be much better at cricket.

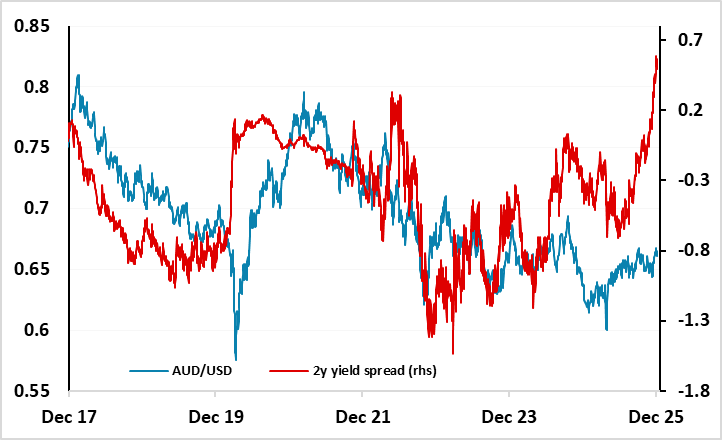

Figure 9: AUD/USD and 2 year yield spreads

Source: Datastream, CE

A simple comparison of yield spreads with the USD shows how the AUD has underperformed in the last year. This does to some extent reflect general USD strength, while AUD has also been dragged down from time to time by concern about China. But in a generally risk positive market the AUD could be expected to have benefited more from the big yield spread move in its favour. The concern going forward is that there could now be some correction to equities in general which could undermine both the AUD and the NOK in the short term, as both tend to suffer initially in periods of risk aversion. But from a big picture perspective we would see any dip in AUD or NOK as representing a buying opportunity.

Figure 10: NOK/SEK and 10 year yield spreads

Source: Datastream, CE