Europe’s Gas Problem Again?

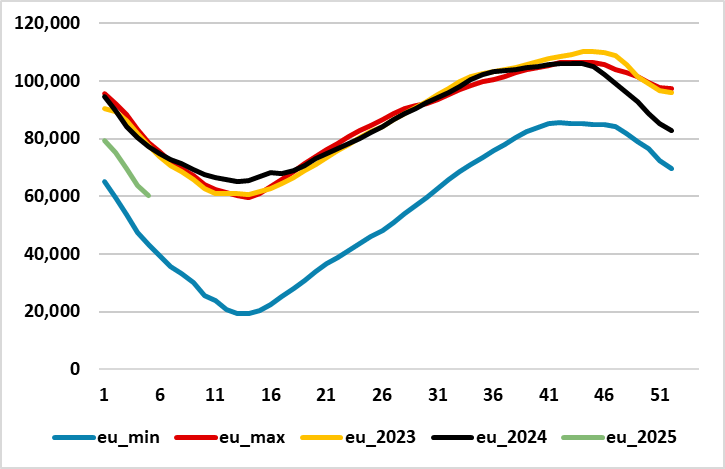

The ECB staff forecasts on March 6 will be revised upwards for 2025 and 2026, due to the surge in wholesale gas prices. However, the ECB will likely take the view that 2 round effects from higher gas prices on balance are unlikely to boost core inflation (especially given wage tracker softness) and thus are not a constraint on further monetary policy easing. The ECB uses gas price futures in their inflation forecasts, but will also know that the rundown in gas inventories is not excessive by historical standards (Figure 2).

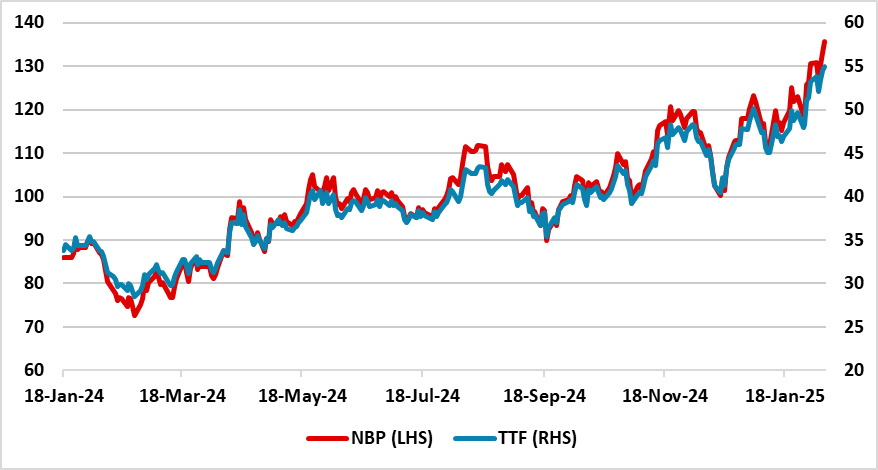

Europe/UK Gas prices have surged through the autumn and winter (Figure 1), as gas inventories have been rundown quicker than 2023/24. What will be the ECB reaction?

Figure 1: European and UK Gas Prices (TTF EUR’s NBP GBP)

Source: Bloomberg/Continuum Economics

Europe and UK gas prices (Figure 1) have moved consistently higher through the past 3-4 months, as EU gas inventory levels have run down quicker than 2023/24 (Figure 2) and produced an expectation in the gas market that Europe/UK will have to pay a premium to consistently get LNG cargoes to help refill inventories before next autumn. Gas prices are likely to remain volatile in the next few months, both as the end of winter could still cause less/more inventory rundown and Europe could try to restock quickly – which would reduce fears and 2025 gas prices.

Figure 2: EU Weekly Gas Inventories (%)

Source: Bruegel/Continuum Economics

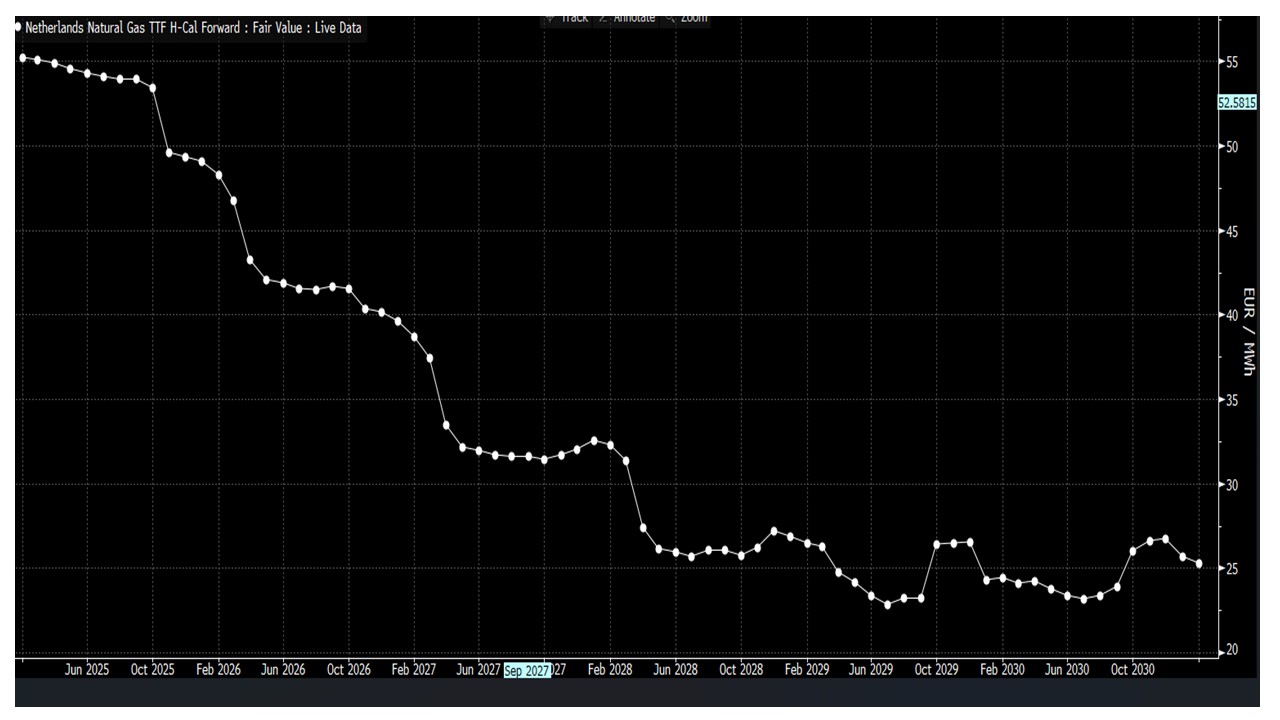

Long-term the gas market see prices coming down consistently (Figure 3), especially in 2027 when the delayed North Qatar gas field and new U.S. LNG export facilities come on line. Some shift can still be seen in gas futures prices in the next few years. On the downside for gas prices, a ceasefire in the Ukraine war would raise speculation about Russia restarting cheap gas supplies to Europe – though the reality is that a peace deal could take years. The 2 swing factor is countries promising to buy more U.S. LNG to avoid President Trump imposing tariffs. Japan/Taiwan/India have already outlined a desire to buy more U.S. LNG, as has the EU. This may not impact the gas market if other gas suppliers, then have excesses that they need to place.

Figure 3: Europe TTF Future Curve (EUR’s)

Source: Bloomberg

In terms of the ECB and BOE, the BOE monetary report has now forecast Q1 2026 headline inflation at 3.0% versus 2.6% previously (plus a near-term peak of 3.7% in Q3, 0.7 ppt higher than envisaged in Nov), partially due to the higher wholesale gas prices that feedthrough to industrial and household bills. On March 6, the latest ECB staff forecasts will also likely see a noticeable upward adjustment to 2025 inflation and to 2026 inflation. The ECB will likely place emphasis on core inflation and the broader disinflation process from slow growth and trade uncertainties. The ECB will also likely take the view that 2 round effects from higher gas prices on balance are unlikely to boost core inflation and thus are not a constraint on further monetary policy easing. They will also likely note that long-term gas futures have risen far less than spot prices. This is the approach that the BOE undertook in the Feb 6 Monetary policy report and press conference (here).