EMEA Outlook: Inflationary Pressures Remain Strong

· The EMEA economies such as Russia and Turkiye will continue with restrictive monetary policy in H1 2024 due to the desire to control inflation. Meanwhile South Africa has likely halted its tightening cycle at 8.25% and will likely start cutting interest rates in Q2 2024 depending on how soon inflation will return back to target. Domestic factors, geopolitics and global risks like fluctuations in the commodity prices coupled with EU and China slowdown continue to set the scene for EMEA economies. We think EMEA outlook will be dominated by the upcoming elections in 20 The EMEA economies such as Russia and Turkiye will continue with restrictive monetary policy in H1 2024 due to the desire to control inflation. Meanwhile South Africa has likely halted its tightening cycle at 8.25% and will likely start cutting interest rates in Q2 2024 depending on how soon inflation will return back to target. Domestic factors, geopolitics and global risks like fluctuations in the commodity prices coupled with EU and China slowdown continue to set the scene for EMEA economies. We think EMEA outlook will be dominated by the upcoming elections in 2024.

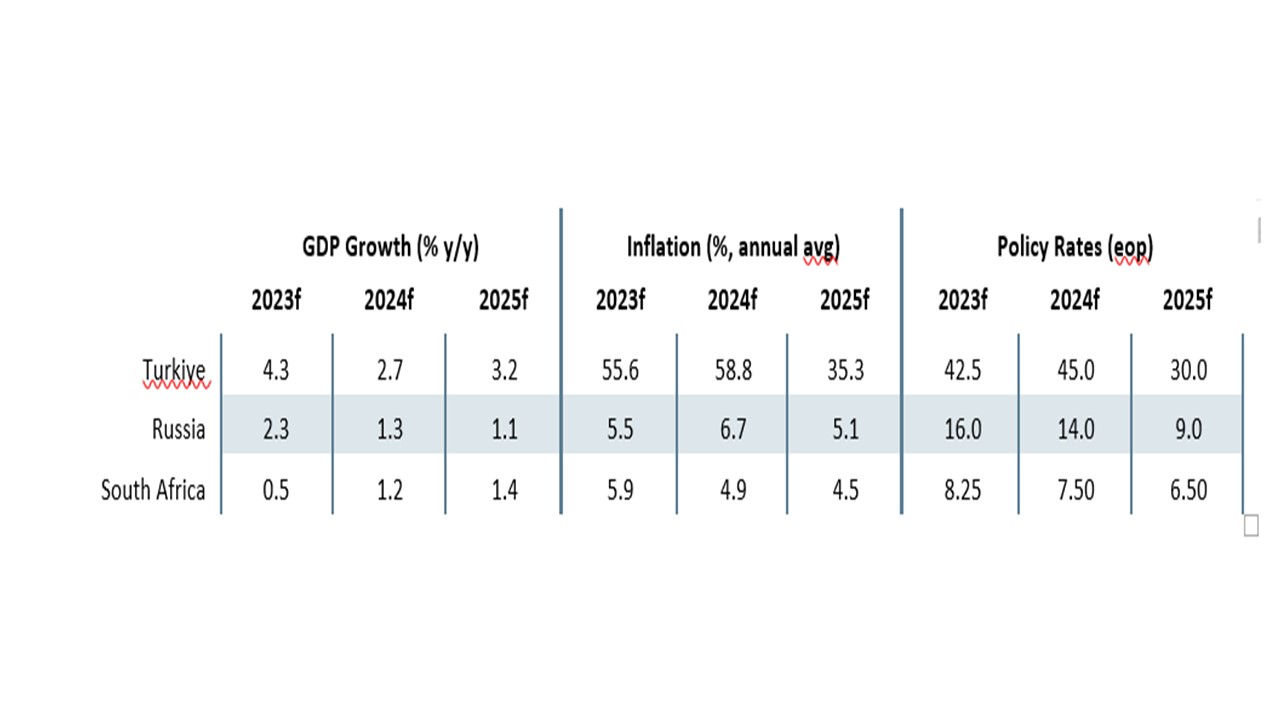

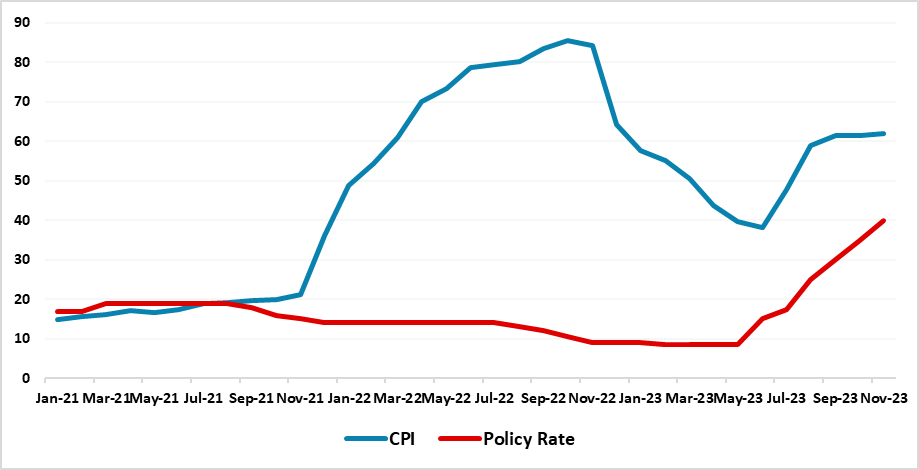

· In Turkiye, we forecast Central Bank of Republic of Turkiye (CBRT) would further increase policy rate to 45% in 2024, basically to cool off galloping inflation, and halt at this level until the end of 2024 which will dent GDP growth. On the growth front, we expect the economy to expand by 2.7% in 2024 and 3.2% in 2025. Taking into account that upside risks emanating from increasing food and energy prices remain high, in addition to expected hike in public spending before the 2024 local elections would likely cause 2024 average inflation to stand at 58.8%.

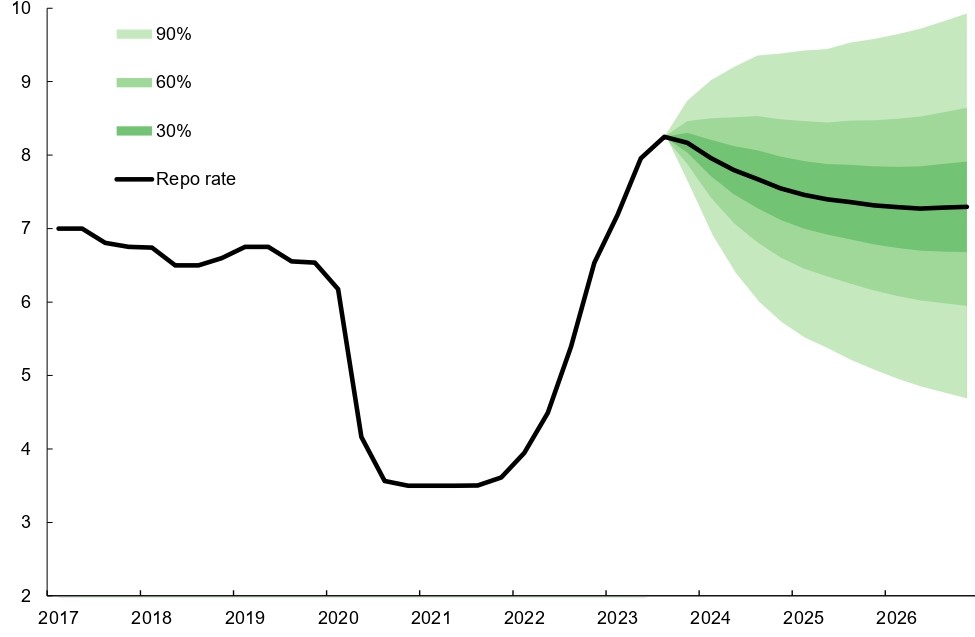

· In South Africa, we foresee headline inflation will fall to 4.9% and 4.5% in 2024 and 2025, respectively, thanks to South Africa Reserve Bank’s (SARB) sensitivity to inflation and as power cuts (loadshedding) will partly relieve. We expect SARB to start cutting interest rates in Q2 2024, but the pace will vary depending on how soon inflation will approach to target levels. We foresee some moderate political volatility in 2024 as South Africa will hold presidential elections in May-August, 2024, followed by a likely decreasing political uncertainty. Less severe loadshedding and long-term electricity production should mean a stronger growth of 1.2% for South Africa in 2024.

· In Russia, macroeconomic instability would likely continue in 2024 taking into account that current account surplus is shrinking, inflation spiking, and ruble weakening. On the war front, we foresee a protracted conflict, coming with varying degrees of intensity into 2024 while the war will likely remain deadlocked and a frozen conflict, unless Donald Trump is elected U.S. president and threatens to curtail Ukraine funding. The inflation projections stay strong particularly due to a weaker Ruble, demand-cost pressures stemming from high demand and lending. Considering that CBR is actively aiming to cool off inflation via restrictive monetary policy, we think this can partly suppress prices in 2024 with lagged impacts, and we envisage annual average inflation to increase to 6.7% in 2024. On the political front, Russia will choose its president in March 2024 as Putin remains as the strongest candidate.

Forecast changes: From our September outlook, we have increased the inflation forecast both for Russia and Turkiye due to higher than expected consumer demand and lending, elevated inflation expectations, weakening domestic currencies coupled with global risks. We lifted key rate forecasts both for Turkiye and Russia as the central banks continue stronger than expected tightening cycles.

Our Forecasts

Source: Continuum Economics

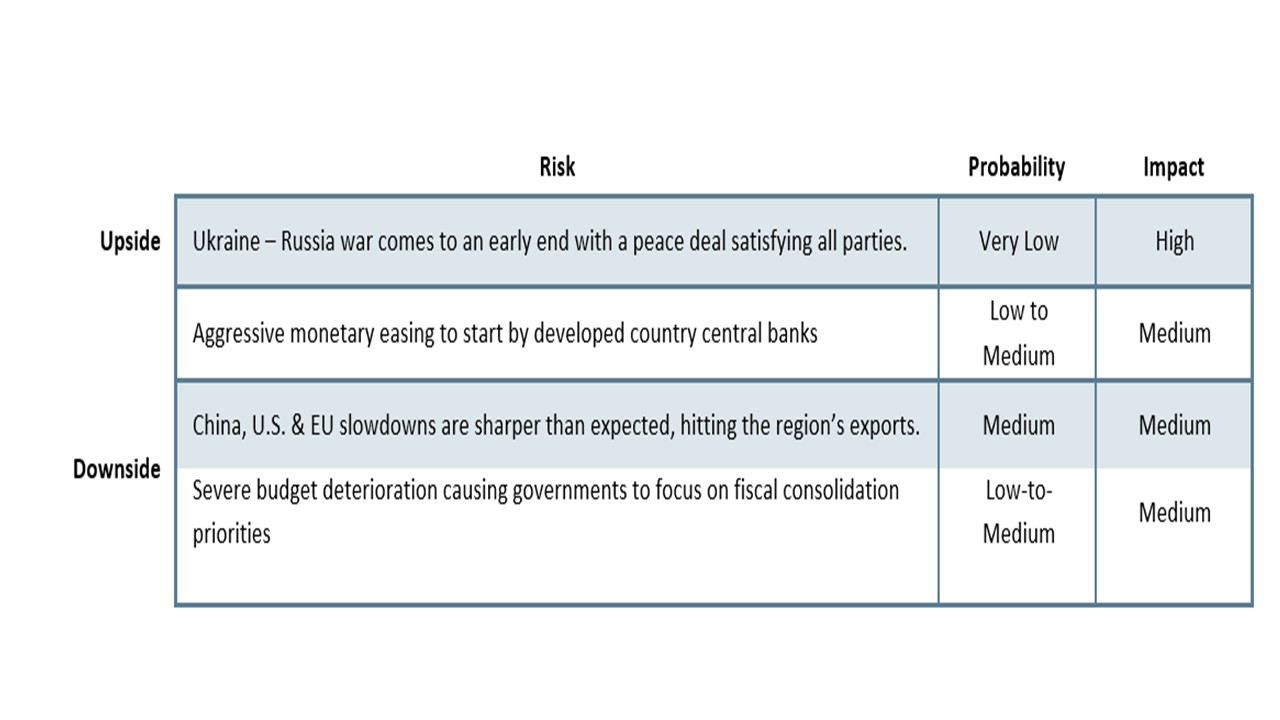

Risks to Our Views

Source: Continuum Economics

EMEA Dynamics: Inflationary Concerns Remain High

EMEA economies continue to be squeezed by macroeconomic problems such as elevated inflation and financial pressures. We think country specific factors, geopolitics, and likely rate cuts by the DM economies will rule the EMEA outlook in 2024.

Inflation is still the major concern for EMEA economies as it remains close or above the targets in three key EMEA countries, triggering restrictive monetary tightening cycles to be prolonged for Russia and Turkiye while South Africa has likely halted the key policy rate at 8.25%. We think a likely fall in food prices can relieve the inflationary pressures in 2024. On the other hand, OPEC+ sustaining production cuts through most of 2024 may also ignite a modest rise in oil prices and could darken the inflation trajectories.

2024 will be the election year for all three EMEA countries, and we expect election related populist spending will likely put further pressure on already struggling government budgets. We expect fiscal position to deteriorate in 2024, contributing both to the GDP and inflation prospects.

We see slowdown in China to be prolonged in 2024, with risks to the downside and this would risk wider spillover effects over the EMEA economies, fueling even greater uncertainty over the medium-term prospects, particularly considering China remains one of the main trade partners. Taking into account that the EZ economy is probably in recession, albeit a modest one, particularly Turkish exports to the EU can be negatively impacted as the EU remains the major trading partner. We see trade balances in all three countries are expected to deteriorate in 2024.

We think Russia and South Africa will likely start easing in 2024 taking advantage of the global picture and better domestically controlled inflation, while Turkiye will have to keep rates high in 2024 until the galloping inflation is under better control.

Apart from South Africa, the growth trajectories decrease across EMEA countries in 2024 as the growth outlooks remain patchy due to continued hawkish bias by the central banks, fiscal actions suppressing demand and squeeze lending, elevated inflation expectations, and decreasing trade incomes. Geopolitical tensions, supply-chain disruptions and financial problems also remain vivid, which darken the macroeconomic prospects of the EMEA countries.

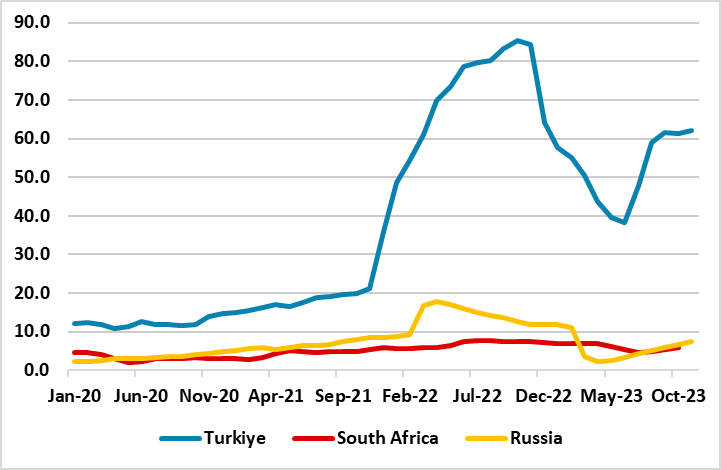

Figure 1: South Africa, Russia and Turkiye Inflation (%, YoY), January 2020 – November 2023

Source: Datastream, Continuum Economics

South Africa

In South Africa, on the inflation front, our headline inflation forecast for 2024 remains at 4.9%, before stabilizing at 4.5% in 2025 thanks to SARB’s previous tightening and as power cuts (loadshedding) will be partly relieve. We foresee private consumption growth to ease and project food price inflation to fall in 2024, which is good news for the country. Despite these, risks to the inflation outlook are still assessed to the upside as the electricity prices continue to present clear inflationary risks, along with logistical constraints, which are likely to have broader effects on the cost of doing business and the cost of living. Housing and utilities price inflation remain as threats for inflation. The weakening currency is another risks for the inflation outlook as its importance extends beyond direct import prices to inflation expectations. (Note: In its communications, SARB also remains seriously concerned over inflation risks, probably due to the pick-up in oil prices and the country is still struggling with ongoing power crisis and a weak Rand as other inflation shocks).

Strong SARB tightening in 2023 will likely feed through during 2024 with lagging impacts. We foresee an end to SARB tightening and likely easing to start in Q2 of 2024 if the CPI trajectory allows, as SARB recently hinted that 2024 rate cuts would likely be smaller. Our end year prediction is 7.5% for 2024 SARB policy rate, and 6.5% for 2025.

We expect the economy will be still supported by a trade surplus in 2024 coupled with probable FED and ECB easing pressure on the South African Rand (ZAR), which can increase investor’s appetite for South Africa, but we expect a moderate fall in trade surplus mostly due to global slowdown, particularly China.

We predict South African economy to grow by 1.2% in 2024. (Note: Up from September outlook’s of 1.1% to 1.2% as we think electricity supply would increase gradually over the medium-term). We foresee investment in machinery and equipment for energy production remain strong. We still think GDP growth can get hurt by the logistical problems, as the operation of ports and rail has become a serious constraint. In addition, El Nino and China’s slowdown can be problematic for the growth trajectory. Growth can also be restrained via lower household expenditure as households continue struggling with finding spare funds in an environment of high interest rates, and businesses facing with a tough domestic environment including high lending rates and high costs of doing business. Even so, we are of the view this challenging situation will be reversed after SARB would start cutting the policy rate, and lending rates would start coming down in 2H of 2024.

The country had targeted lifting the share of renewable energy in its power generation mix from 11% currently to 41% by 2030, and we think both private and government investments may accelerate in 2024, despite major reforms having to wait on the 2024 election outcome. Taking into account that South Africa and China recently signed agreements on cooperation in clean energy investments and electricity transmission, and Germany’s KFW development bank signed an agreement in November 2023 to lend the country €500 million below market rates to help the country during its transition from the use of coal-fired electricity under the framework of G7 Just Energy Transition Partnership, we think these initiative will likely help the country to increase the supply of electricity.

On the fiscal trajectory front, public finances have weakened in 2023 and the country still has need for large domestic and international financing. (Note: According to the Medium Term Budget Policy Statement, an increase in the budget deficit to 4.9% of GDP is now projected, up from 4% estimated in February 2023, which means that gross debt is expected to rise from in 2024/25). We think the government fiscal balance and debt trajectory would remain cloudy in 2024 as fiscal room remains limited to fund structural reforms, productive investments, social spending needs and renewable energy efforts despite effort enhancing revenue collections, and improving the institutional fiscal framework. The 2024 election will not help the fiscal outlook to improve neither. We expect South Africa’s external financing needs will likely increase as the current account deficit would continue to expand in 2024 and 2025.

On the political front, we think ANC is at risk of losing its majority in 2024 elections as ANC’s popularity is in decline due to power cuts, unemployment, inequality, and the rising cost of living. (Note: Democratic Alliance, the second largest party, together with the Inkatha Freedom Party and other smaller parties recently initiated the Multi-Party Charter). According to recent polls, a coalition government at national level seems probable, for the first time in country’s history, as support to the ANC is below 50% according to most of the polls. We think a clear ANC victory would be a positive surprise if Ramaphosa remained president, but the election outcome is too close to call this far out. We see some moderate and temporary political volatility during the election year.

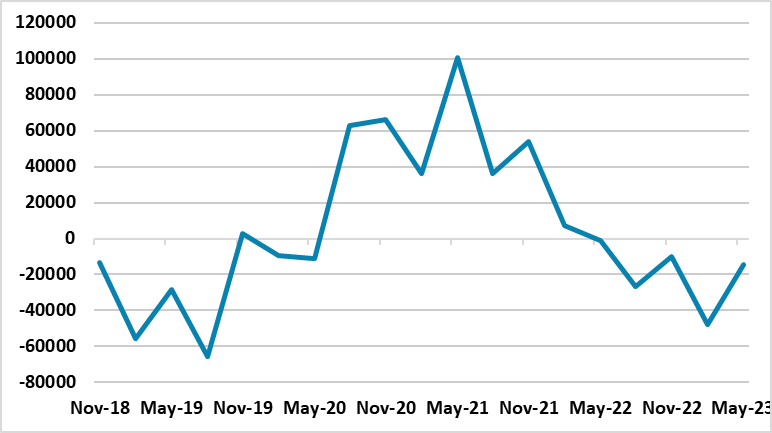

Figure 2: Current Account Balance (Million Rand), November, 2018 – May, 2023

Source: Continuum Economics, Datastream

Figure 3: SARB Interest Rate Forecast (%), 2017 - 2026

Source: SARB November 2023 MPC Statement

Turkiye

Increasing trade and budget deficits, weakening Turkish Lira (TRY) and surging inflation continue to be the major concerns over the Turkish economy, and we expect macroeconomic instability to remain strong in 2024 despite various actions by the government to improve the current outlook.

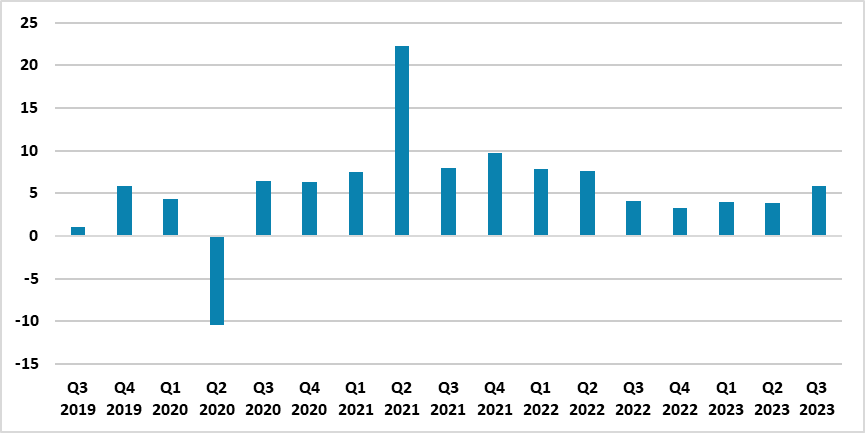

Despite strong Q2 and Q3 figures in 2023, we expect GDP growth to slow down in 2024 mainly due to continued hawkish bias by the Central Bank of Republic of Turkey (CBRT), fiscal actions suppressing demand and squeeze lending, elevated inflation, and ballooning trade deficit. We predict GDP growth will stand at 2.7% in 2024 and 3.2% in 2025 while CBRT’s hawkish bias and stubbornly high inflation will moderate household consumption in 2024. We also think investment growth will remain elevated due to ongoing public investment projects following the earthquakes in February 2023 as the government promised to build temporary residences for earthquake victims, and this is in progress. We foresee that CBRT would likely keep the key policy rate at 45% in 2024. (after a final 2.5% hike in 2024 and 250bps on Dec 21), basically to cool off inflation, and this will also suppress GDP growth.

On the budget front, expenditures and revenues increased by 94% and 78%, respectively, in the first 10 months of 2023 igniting the budget deficit to a record 608 billion TRY ($27.2 billion equivalent). We envisage contractionary fiscal policies such as lifted taxes can help relieve the pressure in 2024, but incessant hikes in the minimum wage and premium payments to retirees continue to complicate the situation. We also foresee the government will start increasing spending before local elections planned for March in 2024, particularly considering the ruling party wants to “win” the big cities back, and this can squeeze the budget but slightly stimulate growth.

Another significant matter worth pondering is the ballooning trade deficit. Export values decreased by 0.5% and imports increased by 1.2% in January-September 2023 when compared with the same period in 2022, as the foreign trade deficit increased by 4.9% to $87.2 billion in the mentioned period. We believe that the decline in export revenues in addition to the country’s heavy dependence on imported inputs for exported goods, -which are increasingly expensive due to TRY devaluation-, would continue to jeopardize GDP expansion in 2024. Energy prices continue to present clear risks coupled with the mild recession in the EU could generate further pressures on the trade balance in 2024.

Inflation remains the core economic problem. Our forecast for the annual average inflation is 58.8% and 35.3% in 2024 and 2025, respectively. Firstly, we think CPI will start declining in second half of 2024 and 2025, but will remain considerably high than 30% until the end of 2025 as the measures to contain inflation have lagged impacts. High inflationary expectations and broken demand-supply balance continue to have broader effects on the cost of living. We anticipate domestic demand, the stickiness in services inflation, and geopolitical risks would keep inflation pressures alive in 2024. We think the road to glory looks bumpy, taking into account that upside risks emanating from increasing food and energy prices remain high for the country in 2024, in addition to the weakening currency, and expected hike in public spending before the 2024 local elections. The deterioration in pricing behavior remain strong as buoyant demand allow companies to pass their cost hikes directly on to consumers, while Turkish households struggle with escalating costs, and this cycle should be broken for a better inflation control.

One important point to underscore about Turkish inflationary outlook is the monetary illusion. First, after the steep hikes in the minimum wage and salaries of the civil servants in 2023, Turkish people have had the tendency to view their wealth and income in nominal terms, rather than recognizing their real value adjusted with galloping inflation, which triggered the consumer demand to increase, as galloping inflation created the public's concern that 'everything will become more expensive'. In addition, as the real interest rates were negative, we think people mostly stopped saving and tended to spend their income as quickly as possible before they would lose their purchasing power. As the real interest rates are not deeply negative anymore following CBRT’s steep rate hikes, we think this vicious cycle (inflation becoming the cause of the increase in demand, and the increase in demand becoming the cause of inflation) would be partly broken in 2024, helping the inflation to cool off.

Slowing the pace of TRY decline is also important in cooling down inflation given FX pass-through from a weak TRY as currency fluctuations continue to prevail. We see losses for TRY in 2024 as imports growing faster than exports, and foreign capital inflow remains weaker. We see the USD/TRY rate at 37.5 by the end of 2024.

Given forward guidance by the CBRT with disinflation beginning in 2024, and macroeconomic stability forecast beginning in 2025, we are of the view that CBRT has shown determination in monetary tightening by hiking the rate from 8.5% to 40% in the second half of 2023 until November. The most important part of the story is the Central Bank continues to regain credibility as it strongly signals determination in pursuing traditional economic policies until the inflation is under better control, which will probably help attract foreign investments, but restoring full confidence will take time. Our projection is that policy rate will be raised up to 45% in Q1 2024, and stay there in 2024. (Note: In its recent communications, CBRT recently strongly signaled that the pace of monetary tightening will slow down and the tightening cycle will be completed in a short period of time).

We think the minimum wage increase in January 2024 coupled with elevated upward pressures in services and the impact of natural gas prices will push prices up further in Q1 2024. Upside risks like weakening currency, deteriorated pricing behavior and expected hike in public spending before the 2024 local elections remain strong, which would likely also drive inflation in Q1 2024, as the impacts of the strong monetary tightening are still feeding through. We foresee relative slowdown in the inflation trajectory in the second half of 2024 thanks to CBRT’s hawkish bias and contractionary fiscal policies. The rate hikes will help cool off inflation but we think business may experience difficulties in finding potential funding sources in the near future, which may eventually trigger pressure for domestic industries, which may then try to pass on cost increases to the final consumers.

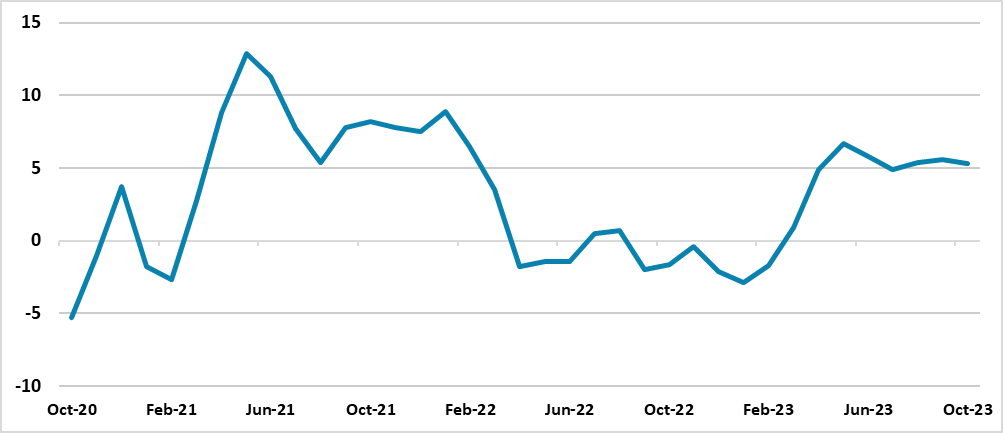

Figure 4: Policy Rate (%) and CPI (YoY, % Change), January 2021 – November 2023

Source: Turkish Statistical Institute, Continuum Economics

Figure 5: GDP Growth (%, YoY), Q3 2019 – Q3 2023

Source: Datastream, Continuum Economics

Russia

Taking into account that the current account surplus is shrinking, inflation spiking, ruble weakening and the Ukraine war dragging on, we foresee macroeconomic instability to remain in 2024 and in 2025, particularly if the Ukraine war would continue as we envisage (here).

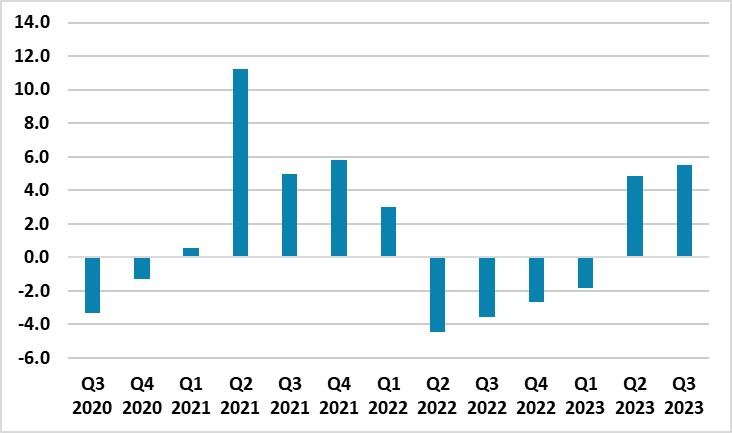

Despite the cloudy macro outlook, our forecast for Russian GDP is to grow by 2.3% in 2023, mostly because household consumption and lending growing faster than potential rates, coupled with increased war related defense spending boosting industrial production amid greater outlays on social support and higher wages in 2023. Despite strong growth, we anticipate a fall in GDP growth in 2024 (1.3%) and in 2025 (1.1%). First, we think the effects of strong monetary tightening in late 2023 would be more explicit in 2024 likely suppressing demand and imports, and offsetting increased fiscal impulses. In addition, sanctions on Russia’s energy sales leading to a steady weakness in export revenues, coupled with growing imports, would continue to jeopardize the GDP expansion in 2024.

According to Central Bank of Russia (CBR) communications, the Bank considers the recovery of economic growth is close to completion as the utilization rates of manufacturing capacities have reached peak levels, and unemployment levels hit the lowest figures, signaling a partial slowdown over the horizon due to staff shortages and a fall in the utilization rates.

Inflation, which started to surge particularly after June, continues its run. CBR’s inflation projections for 2023 severely increased to 7%-7.5% range (2024 projection is 4.0%-4.5%) due to a weaker Ruble, and demand-cost pressures stemming from high demand and lending. Considering that CBR is actively aiming to cool off inflation via key rate hikes, we think this can partly suppress prices in 2024 with lagged impacts, but we predict annual average inflation to increase to 6.7% in 2024. One reason behind our forecast is that we foresee labor market tightness to remain one of the factors driving up companies’ costs in 2024 and 2025. Russia would still experience elevated inflation expectations of businesses and households in 2024 until the monetary policy tightening will be in full power.

We predict that public sector demand would remain at high levels in 2024, while fiscal stimulus is now expected to increase again. Despite our former predictions, it appears the government expenditure, mostly due to military spending, would continue to stay strong as the 2024 budget prospects demonstrated. We expect RUB would remain weak and volatile as the sanctions continue to hurt and the weakness of the currency can still adversely impact inflationary expectations and pressures. Inflation is projected to slow down after Q3 2024 as we expect private consumption growth will decline as the tightening still feeds through.

In order to reduce inflation and inflation expectations, and to anchor inflation at the target level, CBR started a strong tightening cycle in Q3 2023, and this cycle continues. CBR hiked further to 16% on Dec 15 considering that inflation is quickly deviating from the target in the current framework. CBR will likely start cutting rates in Q3 2024 if inflation starts cooling off, ruble will relatively stabilize and expectations would converge to CBR’s forecasts. The CBR recently updated its projections of the key rate to 12.5%-14.5% for 2024 and 7%-9% for 2025. Our forecast is 14% end 2024 and 9% end 2025, as inflation remains sticky.

The fall in the current account surplus remained remarkable in 2023. According to the CBR’s figures in November, Russia's current account surplus dropped 74.3% YoY to $53.8 billion in January-October 2023 from $208.8 billion the previous year, while the country’s foreign trade surplus in goods fell 61.5% YoY to $104 billion in the first 10 months of 2023 from $271.6 billion in the same period of 2022. The fall in the surplus demonstrate the negative impacts of the sanctions. We anticipate further deterioration in the trade balance is likely in 2024 and 2025, particularly if war related sanctions will remain.

On the war front, which we think will be one of the key determinants over the economy in the short run, we foresee a protracted conflict, coming with varying degrees of intensity into 2024. The peace negotiations remain very unlikely, as both Ukraine and Russia perceive the war as existential (here). In 2024, the war will likely remain deadlocked and a frozen conflict, unless Donald Trump is elected U.S. president and threatens to curtail Ukraine funding. The Ukraine war continues to create an increasing financial burden on Russia due to high military spending in addition to aggravation of staff shortages, elevated inflation, and trade income diminishing due to sanctions.

On the political front, Russia will choose its president in March 2024. Putin remains as the strongest candidate according to various polls and we think he would win the elections as he is seen as the most popular political figure in Russia. (Note: Putin announced his presidential candidacy on December 8). As the opposition remains weak, it’s highly likely that Putin will be in office until at least 2030, and could continue his tenure until 2036. We expect election related populist spending may put a moderate pressure on the government budget.

Figure 6: GDP Growth (%, YoY), Q3 2020 – Q3 2023

Source: Datastream, Continuum Economics

Figure 7: Industrial Production (%, YoY), October 2020 – October 2023

Source: Datastream, Continuum Economics