Central Bank of Russia

View:

June 24, 2025

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

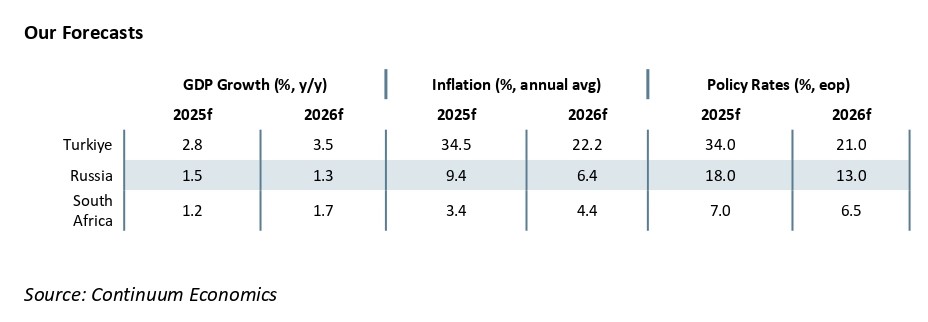

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

March 25, 2025

EMEA Outlook: Mixed Prospects Due to Global Uncertainties and Domestic Dynamics

March 25, 2025 7:00 AM UTC

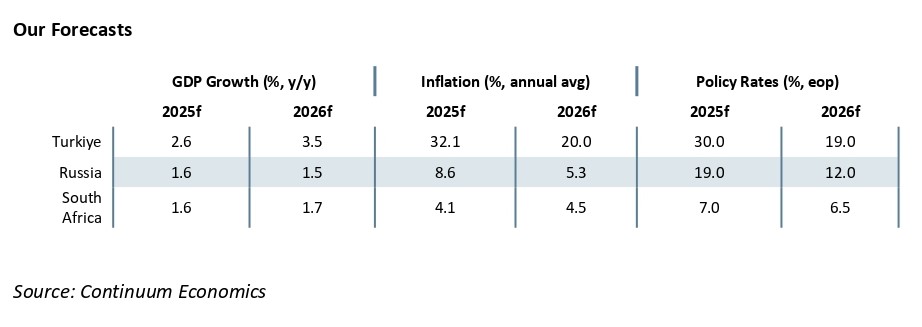

· In South Africa, we foresee average headline inflation will stand at 4.1% and 4.5% in 2025 and 2026, respectively, despite there are upside risks to inflation such as remaining power cuts (loadshedding), tariff hikes by Eskom, spike in food and housing prices, and global uncertainties. We

December 17, 2024

EMEA Outlook: Rate Cuts in 2025 Despite Global Uncertainties

December 17, 2024 8:00 AM UTC

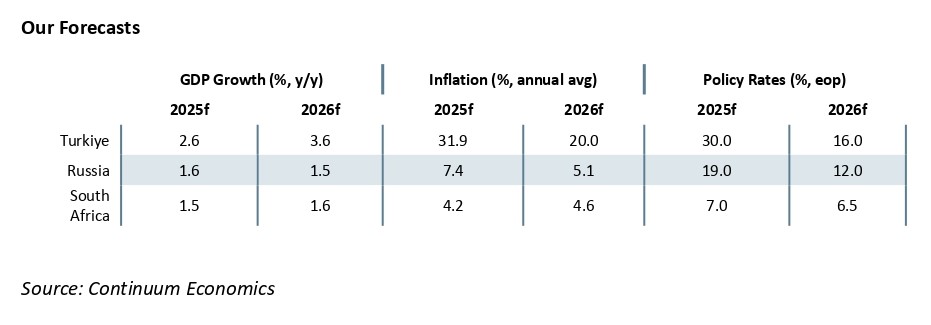

· In South Africa, our end-year policy rate prediction remains at 7.0% for 2025 and 6.5% for 2026. We foresee headline inflation will fall to 4.2% and 4.6% in 2025 and 2026, respectively, considering power cuts (loadshedding) are relieved and the domestic fiscal outlook is moderately stab

October 25, 2024

CBR Hiked Key Rate to Historic 21% Level

October 25, 2024 12:31 PM UTC

Bottom Line: Central Bank of Russia (CBR) announced on October 25 that it increased its policy rate by 200 bps to 21% to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal policy igniting domestic demand. CBR said in a press release that “Over th

September 25, 2024

EMEA Outlook: Rate Cuts Loading in 2025

September 25, 2024 7:00 AM UTC

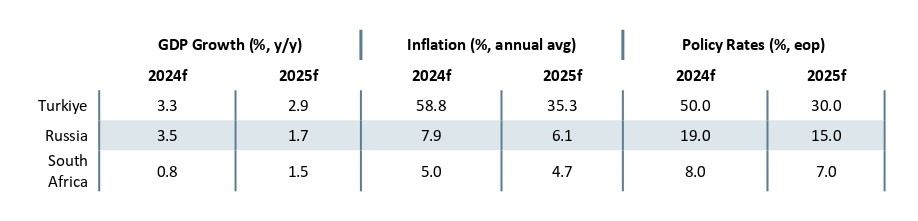

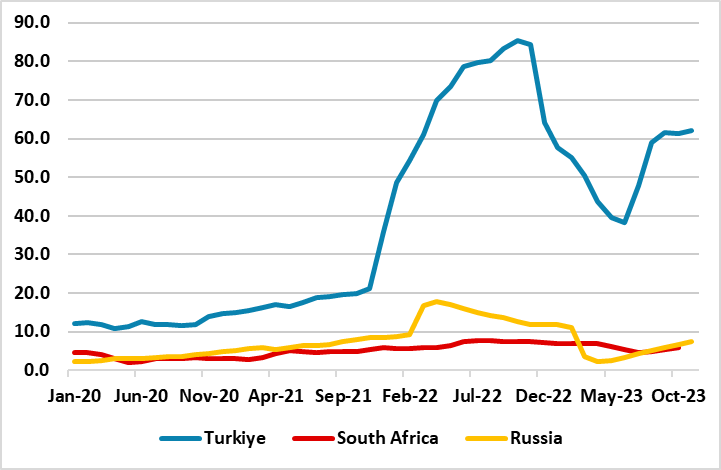

· In Turkiye, we still foresee upside risks emanating from buoyant domestic demand, the stickiness of services inflation, and adverse geopolitical impacts leading average inflation to stand at 58.8% and 35.3% in 2024 and 2025, respectively. We think Central Bank of Republic of Turkiye (CBRT

September 13, 2024

As we Expected, CBR Hiked Key Rate to 19% as Inflation Continues to Soar

September 13, 2024 4:20 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on September 13 that it increased its policy rate by 100 bps to 19% to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal policy igniting domestic demand. CBR said in a press rele

July 26, 2024

CBR Hiked Key Rate to 18% as Inflation Soars

July 26, 2024 2:16 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on July 26 that it increased its policy rate by 200 bps to 18% after four consecutive rate holds, and first time in 2024, to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal pol

June 07, 2024

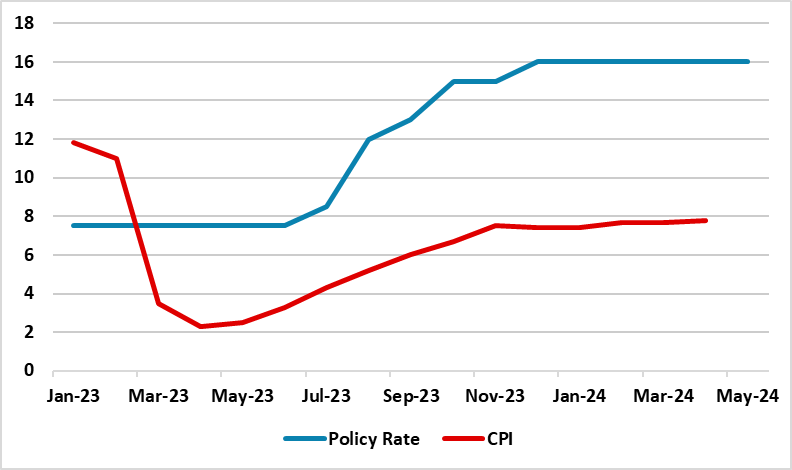

CBR Kept the Key Rate Stable at 16% despite Increasing Inflation

June 7, 2024 12:57 PM UTC

Bottom Line: Central Bank of Russia (CBR) announced on June 7 that it decided to keep the policy rate unchanged at 16% for the fourth meeting in a row, but signalled that a rate hike is possible in the near term to tame the stubborn price pressures stemming from high military spending, tight labour

April 26, 2024

CBR Kept the Key Rate Stable at 16%

April 26, 2024 1:12 PM UTC

Bottom Line: As widely expected, Central Bank of Russia (CBR) announced on April 26 that it decided to keep the policy rate unchanged at 16% for the third meeting in a row. CBR made critical changes in its key rate and inflation forecasts as it lifted its 2024 inflation forecast to 4.3-4.8% from 4-4

March 25, 2024

EMEA Outlook: Elections Set the Scene in Q2

March 25, 2024 2:00 PM UTC

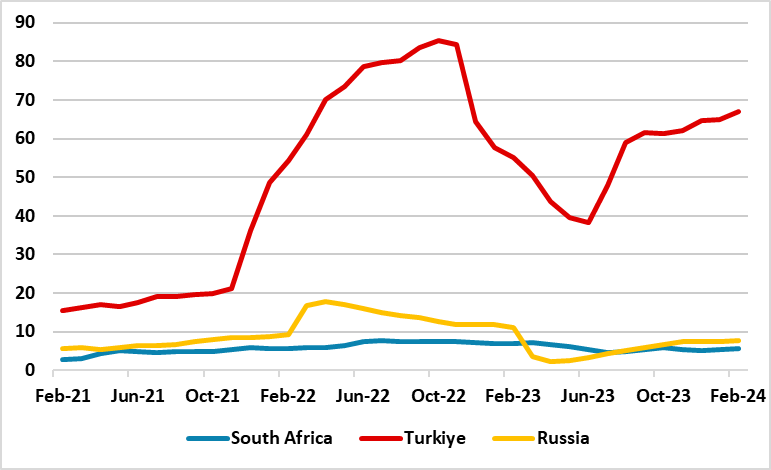

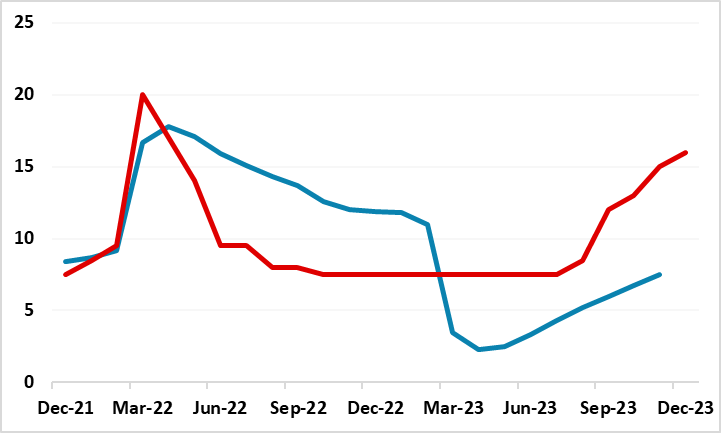

· Unlike South Africa and Russia, Turkiye continued with tightening monetary policy in Q1 due to stubborn inflation, pressure on FX and reserves. Meanwhile, Russia and South Africa halted their tightening cycles as of 2024 and will likely start cutting interest rates in Q3 depending on how

March 22, 2024

CBR Keeps the Key Rate Constant at 16%

March 22, 2024 10:55 AM UTC

Bottom Line: As we envisaged, Central Bank of Russia (CBR) announced on March 22 that it decided to keep the policy rate unchanged at 16% for the second meeting in a row, despite inflationary pressures remaining elevated, and currency weakening continued. We expect the CBR to hold the key rate stab

February 16, 2024

As Expected, CBR Keeps the Key Rate at 16%

February 16, 2024 1:49 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on February 16 that it decided to keep the policy rate unchanged at 16% after lifting the rate in the last five consecutive MPC meetings, despite inflationary pressures and expectations remaining elevated, domestic demand still out

December 18, 2023

EMEA Outlook: Inflationary Pressures Remain Strong

December 18, 2023 10:01 AM UTC

· The EMEA economies such as Russia and Turkiye will continue with restrictive monetary policy in H1 2024 due to the desire to control inflation. Meanwhile South Africa has likely halted its tightening cycle at 8.25% and will likely start cutting interest rates in Q2 2024 depending on how soon in

December 15, 2023

Concerned with Accelerating Inflation, CBR Lifted the Key Rate by 100bps to 16%

December 15, 2023 3:47 PM UTC

As we correctly predicted, Central Bank of Russia (CBR) announced on December 15 that it decided to hike the key rate by 100 bps to 16% as inflationary pressures elevated, government spending and domestic demand remained high, labour shortages especially in manufacturing continued, and households’

December 08, 2023

Russia’s Inflation Accelerates to 7.5% in November

December 8, 2023 7:47 PM UTC

Bottom Line: Russian inflation continued its increasing pattern in November by hitting 7.48% YoY after surging by 6.7% YoY in October. According to the figures announced by Rosstat on December 8, the prices rose by 1.1% on a MoM basis, which marks the fastest MoM pace since April 2022, particularly