Trump and Markets

Global markets will be driven by policies and current valuation in 2025, especially new Trump administration policies. Trump could jawbone markets for a lower value of the USD and lower oil prices, which could have a temporary modest impact (joint US/Japan FX intervention is possible) but the structural drivers are much more important. Meanwhile, an overvalued U.S. equity market is vulnerable to a 2018 style correction on any major bad news that could then trigger Trump pressure on the Fed to ease more – which in itself could amplify volatility.

Markets have been reacting to President Donald Trump early policy actions, but will Trump try to influence markets?

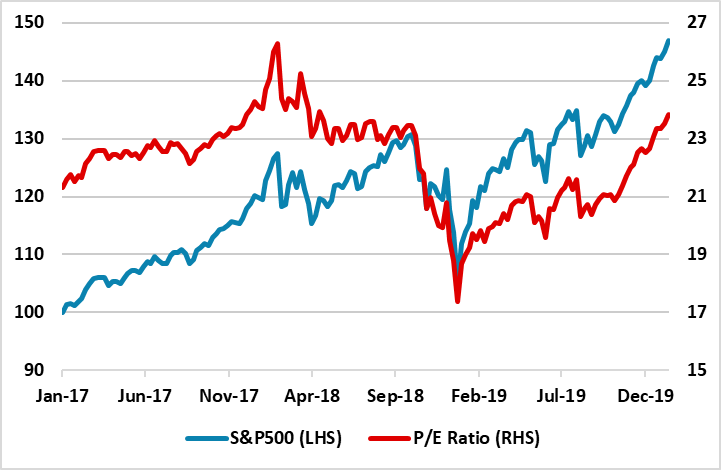

Figure 1: S&P500 and Trailing P/E Ratio (Jan 1 2017 = 100 and ratio)

Source: Datastream/Continuum Economics

Global financial markets have taken on a positive risk tone after Trump’s initial policy announcements and meetings, with tariff policy seen to be transactional. The market hopes that tariffs will not get serious before new trade deals are agreed (see here for our article on U.S./China). For U.S. inflation this is less of a worry than a universal structural tariff scheme. Additionally, the president is already getting annoyed with congressional leaders. Conservative GOP members are reluctant to grant Trump’s wish for a 2yr extension to the debt ceiling and push back is being seen in the House on extra tax cuts beyond renewing lapsing 2017 tax measures. This has helped long-dated U.S. Treasury yields move lower and combined with a controlled core CPI figure has soothed the bond market. Less high bond yields, plus a transactional approach to trade has helped U.S. and global equities. While markets will be dominated by policy this year, will Trump respond to markets and will it matter?

Trump is keen on a rising U.S. equity market as a measure of his success, which worked smoothly in the first 18 months of his 1 term (Figure 1). However, a sharp correction in Q4 2018 prompted Trump first to first blame Fed tightening for hurting the market and subsequently to blame them for not cutting interest rates aggressively. We remain concerned that a sharp correction could occur in U.S. equities in 2025 given that the market is clearly overvalued in equity terms and against bonds and any bad news could trigger a reversal (here for Dec Equity Outlook). Trump’s response could be to blame the Fed for slowing or pausing the easing cycle, which would reopen a battle between Trump and the Fed and this could amplify volatility and a risk off phase in markets. Though the Fed will act independently it is possible it could bend to Trump’s desires, especially if core PCE/CPI are tracking back to 2%. However, the U.S. equity market big picture view is mainly a question of whether the good news keeps coming or bad news arrives.

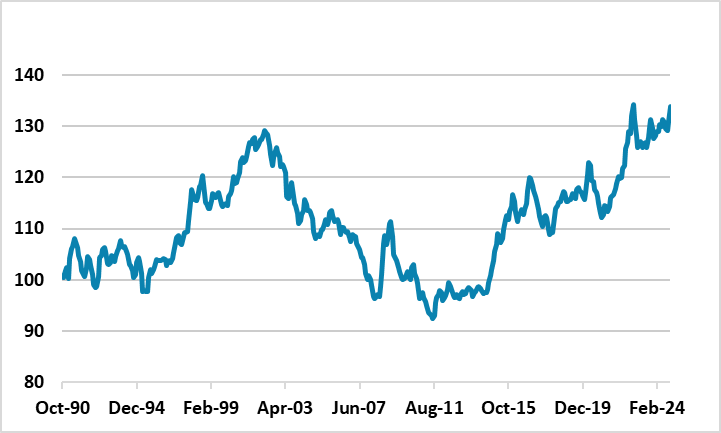

Secondly, Trump has a bias to a lower value for the USD, though he understands the mantra that the US wants a “strong” USD in terms of inflation control. This could produce bilateral exchange rate frustration if a country responds to tariffs with a weaker currency just like China did in 2018 – highly likely again in China’s case (here). Trump could jawbone that the EUR or the JPY are too low and produce a temporary short squeeze. Though relative yield spreads remain the structural support for the USD, it is feasible that the U.S. could agree joint FX intervention with Japan that could produce an extended temporary squeeze on JPY shorts. Trump could also jawbone that the (overall) USD value is currently too high (Figure 2), which could likely have a temporary effect without changing the structural USD picture.

Figure 2: USD Broad Real Effective Exchange Rate

Source: Datastream/Continuum Economics

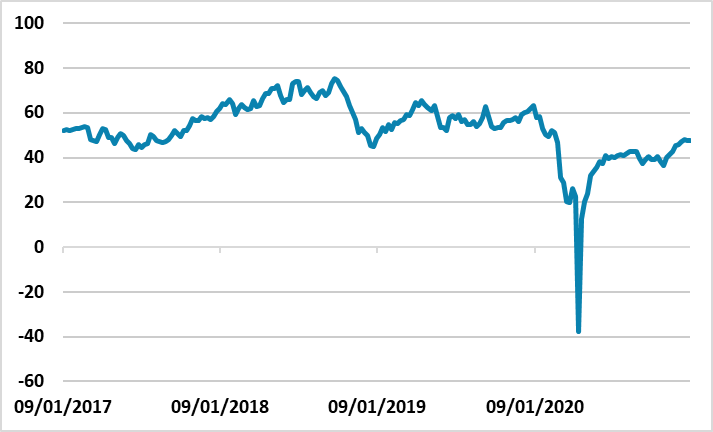

Finally, Trump wants lower oil prices to reduce gasoline prices for U.S. voters and get back to the good old days of 2017-20. Though COVID caused a super spike lower in 2020, WTI still averaged around USD57 in 2017-19. Extra OPEC oil production restraint, plus restriction on Russian oil exports post Ukraine war, are the main reasons behind higher global oil prices. An incremental rise in U.S. oil production could be seen in the coming years, but the U.S. producers are focused on profitability and concerned that OPEC production increases and slower growth in China could hurt profitability in future years. Meanwhile, Saudi do not want ramp up production like 2016 (the new USD600bln of trade and investment promised with the U.S. is likely a substitute). Any Ukraine ceasefire will also likely not impact Russia oil production and exports until a peace deal is eventually agreed, and that could take years. With Trump also wanting to fill up the U.S. strategic oil reserves, a persistent return to oil prices in the 50’s looks highly unlikely and USD60-85 is more likely for the coming years.

Figure 3: WTI Oil Prices (USD)

Source: Datastream/Continuum Economics