China/U.S. - Trade War or Trade Deal?

· We see the April 1 review of the phase 1 U.S./China trade deal being adverse and President Trump’s carrot and stick approach leading to a 10% rise in tariffs on China imports by the summer. We eventually see a phase 2 U.S./China trade deal being reached in Q4. The main alternative scenario is that China could show goodwill to resolve illegal Fentanyl movements from China to the U.S. and a sale of Tik Tok U.S. sale. This could then lead to spring hopes that a phase 2 U.S./China trade deal can be reached and a trade war avoided.

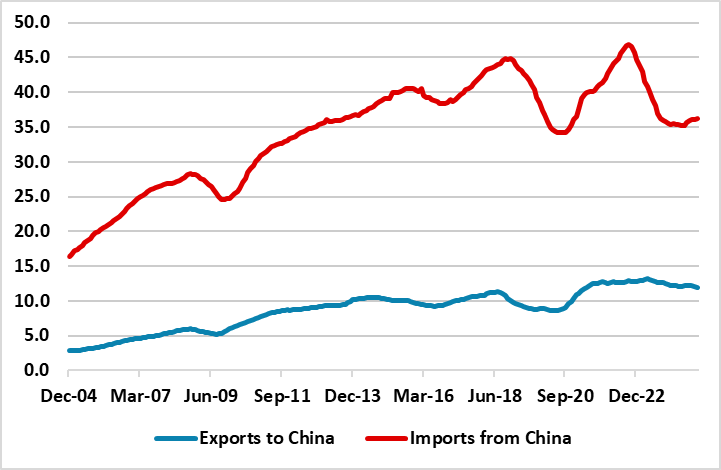

Figure 1: U.S./China Exports and Imports (12mth MA USD Blns)

Source: Datastream

There are mixed signals on China/U.S. trade relations in the early days of the new President Donald Trump administration. The threat of a 10% tariff against China if it does not stop illegal Fentanyl going to the U.S. could now be imposed as early as February says Trump. However, the recent Trump/Xi call appears to have been cordial and reports suggest an invite has been extended for Trump to visit China. China’s VP visit to the inauguration also saw warm briefings afterwards. Is this heading to trade war or trade deal? A number of points are worth making.

· April 1 review deadline under “America First Trade Policy” (here) executive order for the phase 1 2018 U.S./China trade deal will likely judge that it has failed to boost exports to China enough. The memo also cites unfair trade or tax practices or currency manipulation as measures on whether the U.S. is being fairly treated or not and tactical trade access/tax threats will also likely be used against some countries – the China hawks in the U.S. administration will likely sustain the strategic competition restraint on certain exports to China. This review is not just looking at the phase 1 U.S./China deal, but now also includes China diverting exports through third countries such as Mexico and Vietnam. Figure 1 shows that average monthly imports from China are now less than the average in 2017, but crucially exports to China were not boosted by the specified USD200 bln in the 2020-21 period or subsequently (here). The monthly imports from China have also been accompanied by a rise in imports from Mexico and Vietnam since 2017 looking at the U.S. trade figures.

· The Fentanyl related tariff threat is a warning shot to China that although President Trump is open to talks that he wants action favorable to the U.S. and is not open to delay or more talks. The same holds true of the different tariff threat to China relating to the sale of Tik Tok U.S. after the 75-day extension.

· April or Feb tariff risks? The Trump/Xi call touched on all of these issues and China does not want to follow the 2018-19 pattern where the trade war lasted 18 months before a trade deal. This suggests that China could show goodwill to resolve illegal Fentanyl movements from China to the U.S. and Tik Tok U.S. sale. This would argue against February tariff implementation. This could then lead to spring hopes that a phase 2 U.S./China trade deal can be reached and a trade war avoided. This would be a positive development for global risk and reduce fears that Trump trade battles are a stagflationary shock.

· U.S./China tariffs then. While this alternative scenario is feasible, we feel the more likely course of events is that China’s flexibility on Fentanyl and Tik Tok U.S. is followed by an adverse review of U.S./China trade relations on April 1 and threat of trade related tariffs – Trump’s carrot and stick approach. This could upset China diplomatically if as expected they show flexibility on other issues. In a phase 2 trade deal, the U.S. will likely demand more concrete action on reducing the bilateral trade deficit than the phase 1 deal; commitment to buying more U.S. agricultural exports and origin rules through 3 countries such as Mexico and Vietnam. But it is not clear that China will be willing to quickly agree to such terms. China wants to maintain control over food security rather than becoming dependent on U.S. food imports. Also, China internal security control objectives argues against open competition from U.S. tech companies in China. Our baseline remains for a 10% across the board increase in tariffs by the U.S. on China imports by around June. China’s desire to show strength will likely then see a retaliation, though not on the same scale to try and allow a path towards de-escalation. Trump’s 2018-19 tactics were to threaten more tariffs on any counterattack, as part of his art of the deal strategic philosophy. Thus by mid-summer we expect a U.S./China trade war.

· Trade deal in late H2. We only see one major round of U.S./China trade tariffs being implemented and then trade negotiators getting down to business. This will be a volatile, though less negative phase for economic confidence. We see a trade deal being shaped by late H2 between the U.S. and China. A risk exists of this not succeeding and getting dragged into 2026.

We will closely watch developments over the next few months to see if our baseline scenario remains most likely or whether the alternative scenario of a trade deal before Q4 2025 becomes more likely.