Concerned with Accelerating Inflation, CBR Lifted the Key Rate by 100bps to 16%

As we correctly predicted, Central Bank of Russia (CBR) announced on December 15 that it decided to hike the key rate by 100 bps to 16% as inflationary pressures elevated, government spending and domestic demand remained high, labour shortages especially in manufacturing continued, and households’ inflation expectations remained strong. CBR governor Nabiullina hinted that tightening cycle can be over soon, but also underlined that CBR might need to keep the rate higher for longer.

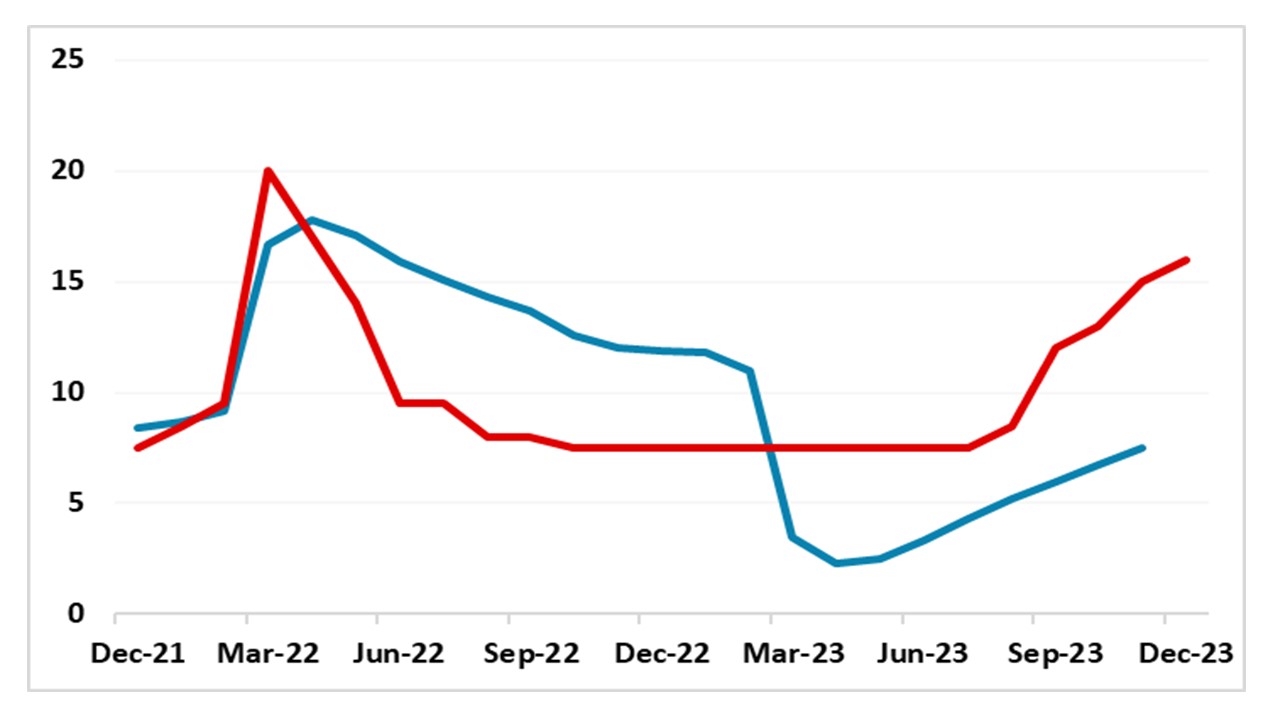

Figure 1: Policy Rate (%) and CPI (YoY, % Change), December 2021 – December 2023

Source: Datastream, Continuum Economics

In order to reduce inflation and inflation expectations, and to anchor inflation at the target level, CBR continued its tightening cycle in the fifth consecutive MPC meeting, and hiked the key rate by 100 bps to 16% on December 15, considering that inflation is quickly deviating from the target in the current framework. November’s 7.48% YoY inflation was very close upper boundary of the CBR’s 2023 forecast range of 7%-7.5%, and it is far above CBR’s medium term target of 4%. (Note: 2024 projection is 4.0%-4.5%). According to CBR calculations, seasonally adjusted price growth in October-November averaged 10.0% in annualised terms (compared to 12.2% in Q3), which is alarming. On this matter, CBR Governor Elvira Nabiullina emphasized on December 15 that the proinflationary risks prevail, particularly high inflation expectations continue to weaken the response of demand to CBR’s decisions. Signaling that the rates can be kept higher for longer, Nabiullina mentioned “Geopolitical risks and risks of a slowdown in the world economy still remain and might adversely impact the demand for commodities and, accordingly, the dynamics of the ruble (RUB) exchange rate. Another proinflationary risk is a possible expansion of the subsidized lending programmes (…) We might need to keep the rate higher for longer.” CBR governer Nabiullina also hinted that tightening cycle can be over soon, and underlined that "Based on our baseline scenario ... we are close to the end of the rate hike cycle, but in many ways everything will depend on the situation."

As CBR remained concerned about multiple issues such as higher inflationary pressure seen across an increasingly broader range of goods and services, growing domestic demand propelled by rising lending and wages, labor shortages, strong military spending, and elevated households’ inflation expectations, we think the increasing trend in the inflation despite resuming tightening process is worrisome. It appears the recent acceleration in the inflation is igniting inflationary expectations further. Buoyant domestic demand continues to contribute to pump up imports triggering the RUB to lose value. The inflation projections stay strong particularly due to a weaker RUB, and demand-cost pressures stemming from high demand and lending. Considering that CBR is actively aiming to cool off inflation via restrictive monetary policy, we think this can partly suppress prices in 2024 with lagged impacts, and we envisage annual average inflation to increase to 6.7% in 2024. Partly agreeing that the inflation is beyond expectations, president Putin said on December 14 annual inflation could approach 8% this year, well above the central bank's 4% target. He even issued a rare apology when a pensioner complained to him about the price of eggs.

Under current conditions, we expect inflation will likely continue to bite, while inflationary expectations and currency volatility are predicted to remain despite the tightening cycle resumes. We foresee that the key rate will be held steady at 16% in the 1H of 2024, and CBR will likely start cutting rates in Q3, if inflation outlook will allow. Our key rate forecasts remain in line with CBR’s policy rate projections, which are 12.5%-14.5% for 2024 and 7%-9% for 2025. Of course, if there will be no remarkable improvements in the inflation outlook, and RUB would continue weaken in the first weeks of 2024, it would not be surprising if CBR would decide to hike the rate further in its next MPC meeting on February 16, 2024, which is not our main scenario.