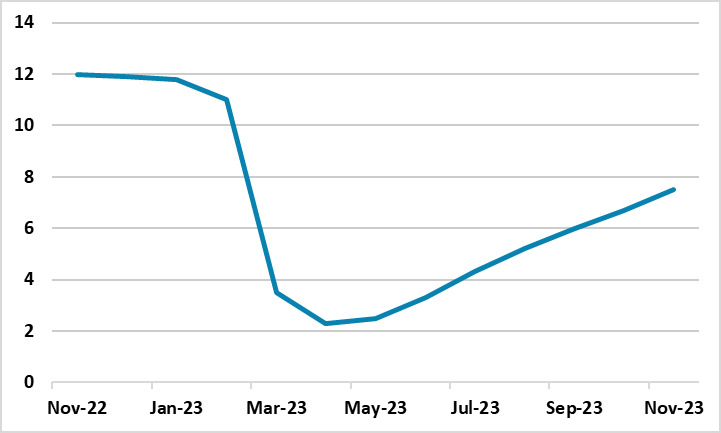

Russia’s Inflation Accelerates to 7.5% in November

Bottom Line: Russian inflation continued its increasing pattern in November by hitting 7.48% YoY after surging by 6.7% YoY in October. According to the figures announced by Rosstat on December 8, the prices rose by 1.1% on a MoM basis, which marks the fastest MoM pace since April 2022, particularly due to strong consumer demand and lending, tight labour market, elevated inflation expectations, coupled with strong military spending.

Figure 1: Inflation Rate (%, YoY), November 2022 - November 2023

Source: Datastream, Continuum Economics

According to Rosstat on December 8, prices of food, non-food products and services rose by 1.55%, 0.53% and 1.23% on a monthly basis in November, respectively. The consumer price index (CPI) edged up by 1.11% on a monthly basis after reaching 0.83% the previous month. Diesel fuel prices gained 0.3%, motor gasoline prices plunged by 0.7% and metal tile prices added 1% on a MoM basis while chipboards and oriented stranded boards saw the price drop by 0.4%.

We think the inflationary pressure stayed strong in November particularly due to growth in domestic demand continued to outpace the supply expansion capacity, coupled with high military spending, lagged feedthrough of the weak RUB and tight labour market. Private and public sector demand continued to stay strong as high investment demand has been triggered by the increased profits of companies and positive business sentiment.

November’s 7.48% YoY inflation is very close upper boundary of the Central Bank of Russia’s (CBR) 2023 forecast range of 7%-7.5% (Note: 2024 projection is 4.0%-4.5%), and it is far above CBR’s medium term target of 4%. The current level of the inflation is igniting inflationary expectations further, and demonstrating deterioration in demand and supply balances.

It is worth mentioning that CBR continues its key rate hiking cycle (Note: Current policy rate is 15% after 200 bps increase on October 27) citing inflationary pressures remaining high triggered by strong demand and lending. Taking into account that CBR’s ongoing tightening cycle, we predict this can suppress demand and imports and squeeze lending in the upcoming quarters, but with lagged effects (here).

Strongly signaling that the tightening process may continue if the inflation will remain sticky despite the rate hikes, CBR underlined in its MPC report on November 7 that “We were raising the key rate sufficiently fast at our recent meetings and will be ready to do this again if there are no signs of a steady deceleration of inflation and a decrease in inflation expectations. Inflation has been persistently deviating from the 4% target beginning from 2021. Such a long-lasting deviation might unanchor inflation expectations and confuse economic agents, and our experience shows that the period of higher interest rates in such conditions should be longer.” In a similar vein, CBR governor Elvira Nabiullina also said on November 9 that CBR will maintain stringent monetary policy for several quarters for returning inflation to the 4% target by the end of 2024 and signaled that the tightening cycle will continue. Under these circumstances, we expect the key rates to be hiked to 16% from 15% as the bank will announce its next rate decision on December 15.

Backing up the recent economic policies by the CBR, president Putin underscored on December 7 that "Direction of the economic policy in Russia is proper." Putin added that "Key rate of the CBR is regularly debated but economic indicators evidence proper direction of the national financial and economic policy."

Despite CBR’s determination, cooling off inflation will not be straightforward as it is very likely that the country would continue to be squeezed by sanctions and the Ukraine war in 2024. Increasing consumer spending seems supported by the expansion of lending and increased real wages. Taking into account that the government spending remains high due to war-related military expenses, and the presidential elections are fast approaching in March 2024, these bring forth the risk of upward inflation pressures staying longer than Russian officials are hoping for. We foresee labour market tightness to remain one of the factors driving up companies’ costs in 2024 contributing to the inflation. Russia would still experience elevated inflation expectations of businesses and households in 2024 until the monetary policy tightening will be in full power. Thus we are of the view that the road to success will be long and painful.