As Expected, CBR Keeps the Key Rate at 16%

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on February 16 that it decided to keep the policy rate unchanged at 16% after lifting the rate in the last five consecutive MPC meetings, despite inflationary pressures and expectations remaining elevated, domestic demand still outpacing capabilities to expand the production of goods and services coupled with labor shortages. We expect the CBR to hold the key rate stable at 16% at the next review meeting on March 22, if February inflation outlook will allow.

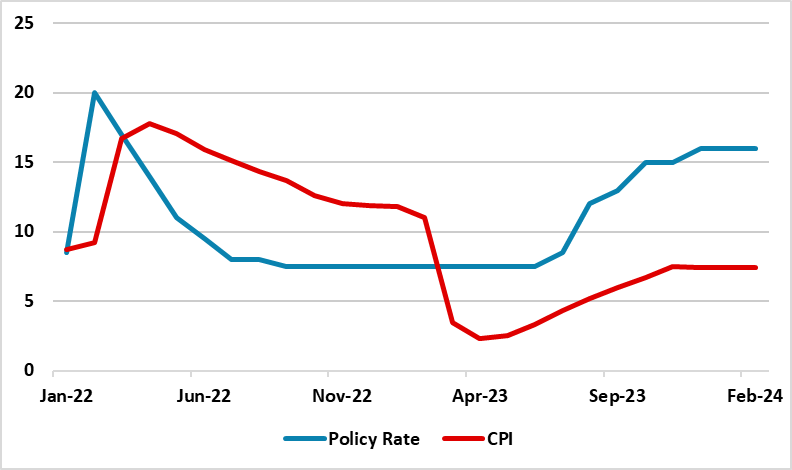

Figure 1: Policy Rate (%) and CPI (YoY, % Change), January 2022 – February 2024

Source: Continuum Economics

After lifting the key rate in the last five consecutive MPC meetings to reduce inflation and inflation expectations, CBR decided to halt the policy rate at 16% although January’s 7.4% YoY inflation remained far above the CBR’s 2024 forecast range of 4%-4.5%, and CBR’s medium term target of 4%.

Despite inflationary concerns, CBR noted in its press release on February 16 that current inflationary pressures have eased compared with the autumn months, both household and businesses’ inflation expectations have declined since the beginning of this year, and there are early signs of slowdown in corporate lending. According to CBR, current seasonally adjusted price growth was down to 6.6% on average in annualized terms in the December to January period, (compared with 11.5% in the autumn months).

Despite CBR’s above mentioned statements, we think inflation risks is still tilted to the upside. We feel that the inflationary pressures and inflation expectations remain elevated. The domestic demand continues to be stronger than the production of goods and services. One factor behind is the tight labor market restraining the expansion of output. (Note: On the labor market end, the average annual unemployment rate stood at 3.2% as of the end of 2023, which was the lowest reading since 1992). Additionally, the Ruble (RUB) weakness continues to cause concerns over the inflation trajectory as RUB weakened by around 20% against the dollar in 2023 while it continued to lose 1.3% of its value against the USD in January.

Referring the risks, CBR stated that the main proinflationary risks are associated with changes in terms of trade (including as a result of geopolitical tensions), persistently high inflation expectations, and higher upward deviation of the Russian economy from a balanced growth path, as well as with a fiscal policy normalization path. (Note: According to the recent announcement by Rosstat, the Russian economy rebounded sharply from a slump in 2022, and expanded by a strong 3.6% in 2023, -more than the expectations-, backed by high military spending, invigorating consumer demand and higher wages).

In a similar vein, CBR Governor Elvira Nabiullina emphasized on February 16 that the "In the current situation, since we are talking about a gradual cooling of inflation after overheating demand, and not about a rapid slowdown of inflation in 2024. (...) We consider it is most likely that lowering the key rate will be in the form of consecutive steps, more smoothly, and the size of steps will be determined by data we receive on the rate of the inflation slowdown, on inflation expectations and on inflation risks. (…) We discussed with colleagues the timing of the first reduction in the key rate, and the majority believe that this will likely happen in the second half of this year."

Under current conditions, we feel cooling off inflation will not be straightforward as it is likely that the inflation would remain high in 1H of 2024, due to high military spending, weakening RUB, tight labor market and the presidential elections on March 17, risking the inflation to stay stronger for a longer period. Taking into account strong monetary tightening in the second half of 2023, we predict this can suppress demand and imports and squeeze lending particularly in 2H of 2024, but only gradually with lagged effects.

In this respect, we expect CBR to hold the key rate stable at 16% at the next review meeting on March 22, and we foresee CBR will likely start cutting rates in Q3, if inflation outlook will allow. (Note: The CBR decided to raise its forecast for its average key rate range to 13.5-15.5% from 12.5-14.5% for 2024, suggesting that easing borrowing costs will take longer than previously thought).

Of course, if there will be no remarkable improvements in the inflation outlook, and RUB would continue weaken in late February and early March, it would not be surprising if CBR would decide to hike the rate further in its next MPC meeting, which is not our main scenario.