CBR Keeps the Key Rate Constant at 16%

Bottom Line: As we envisaged, Central Bank of Russia (CBR) announced on March 22 that it decided to keep the policy rate unchanged at 16% for the second meeting in a row, despite inflationary pressures remaining elevated, and currency weakening continued. We expect the CBR to hold the key rate stable at 16% at the next review meeting on April 26, if April inflation outlook will allow.

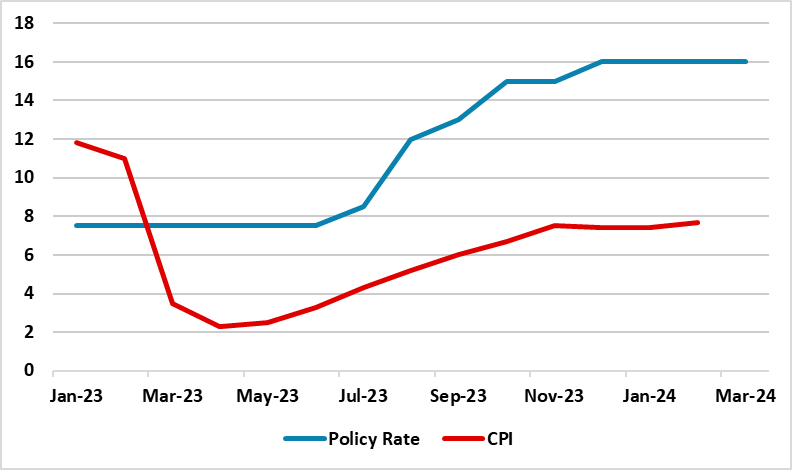

Figure 1: Policy Rate (%) and CPI (YoY, % Change), January 2023 – March 2024

Source: Continuum Economics

On March 22 MPC meeting, CBR decided to halt the policy rate at 16% although February’s 7.7% YoY inflation remained far above the CBR’s 2024 forecast range of 4% - 4.5%, and CBR’s medium term target of 4%, which is worrisome for Russian economy.

CBR noted in its statement on March 22 that current inflationary pressures are gradually easing, and households’ inflation expectations and businesses’ price expectations have continued to decline, but still remain elevated. According to CBR, it is premature to judge the pace of future disinflationary trends as of now. CBR added that the main proinflationary risks are associated with changes in terms of trade (including as a result of geopolitical tensions), persistently high inflation expectations, and higher upward deviation of the Russian economy from a balanced growth path, as well as with a fiscal policy normalization path.

As CBR underlined, we think inflation risks is still tilted to the upside as inflationary pressures and inflation expectations remain high. The domestic demand continues to be stronger than the production of goods and services considering tight labor market restraining the expansion of output. The military spending remains high due to ongoing war in Ukraine. Additionally, the Ruble’s (RUB) weakness continues to cause concerns over the inflation trajectory as RUB weakened by around 20% against the dollar in 2023, and lost 1.3% and 1.4% of its value in January and February, respectively. (Note: According to Bloomberg on March 22, consequences from Ukraine’s recent attacks on Russian regions bordering Ukraine threaten to ignite inflation risks further as fuel and food prices could rise after strikes on border areas).

Russia continues to take actions to restrain the pace of inflation but the impacts remain limited. To illustrate it, the 6-month ban on gasoline exports from March 1 could likely help maintaining fuel prices down in Russia, and this may slightly help relieve the inflationary pressures. Additionally, end-of-month tax payments that usually see exporters convert foreign currency revenues to meet domestic liabilities should also lend limited RUB support. (Note: To monitor largest exporters, CBR stated on March 15 that it has expanded the list of the largest exporters obliged to submit the information on their assets and liabilities to CBR. The list now includes companies whose export earnings or average monthly outstanding liabilities to non-residents exceed $1 billion).

Taking into account CBR’s determination, we continue to foresee demand and imports will be partly squeezed particularly in 2H of 2024, but only gradually with lagged effects. We feel cooling off inflation will not be straightforward as it is likely that the inflation would remain higher than CBR’s expectations particularly in 1H of 2024, partly due to base effects, weakening RUB, tight labor market and high military spending. In line with this, we do not expect any rate cuts in Q2, and we foresee that CBR will likely consider cutting rates in Q3, if the inflation allows.

In case there will be no remarkable improvements in the inflation outlook, and RUB would continue weaken in April, it would not be surprising if CBR would decide to hike the rate further in its next MPC meeting on April 26, which is not our main scenario.