China Politburo and CPI Argue For More Easing

China December Politburo statement has signalled a step up in easing, with monetary policy to become “moderately loose” for the 1st time since the GFC. We now look for 40bps of 7-day reverse repo rate cuts across H1 2025, though a surprise move cannot be ruled out for December – we see a 50bps RRR cut in December. On fiscal policy the Politburo guidance of more proactive reinforces our view of Yuan3-5trn of true fiscal stimulus for 2025 to hit a likely 5% GDP growth target.

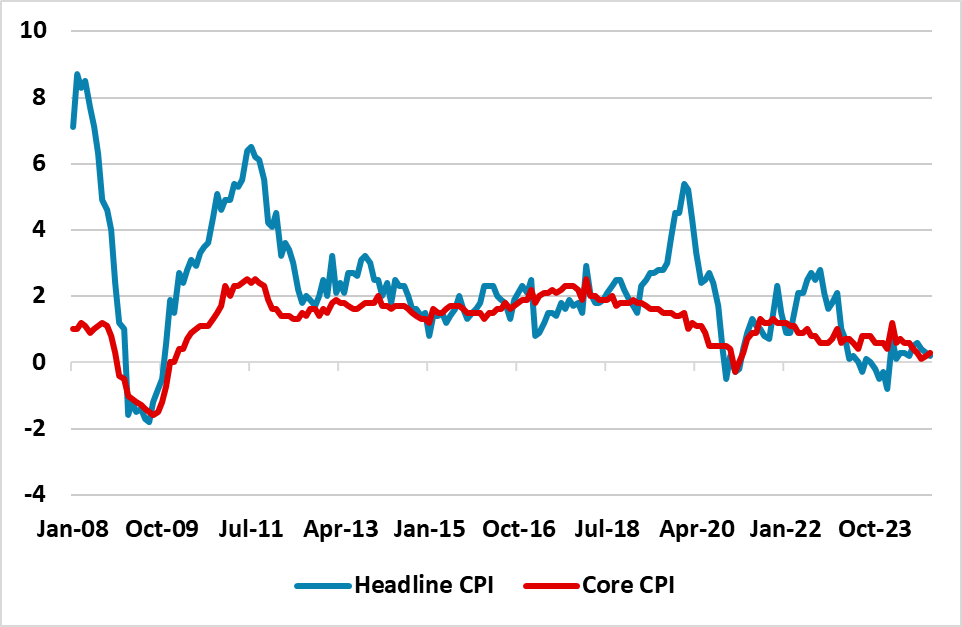

Figure 1: China Headline and Core CPI (Yr/Yr %)  Source: Continuum Economics

Source: Continuum Economics

China’s Politburo has provided important signals in the December statement on fiscal and monetary policy. On fiscal policy “more” has been added to proactive to describe fiscal policy. Some are hoping for announcements as early as next week’s Work Council meeting, but it could come in Q1. We do see a package of stimulative fiscal policy measures for 2025 including Yuan1-3trn infrastructure spending; Yuan1trn funds to buy completed homes for affordable housing and Yuan1trn capital injection to the big six state banks. This is based on our view that the U.S. will threaten; then scale in tariffs incrementally, as the Trump administration seek to get concessions from China. The total size of new measures that will likely be announced in H1 2025 are Yuan3-5trn.

On monetary policy the Politburo statement switched from “prudent” to “moderately loose”, which was the guidance in place from Nov 2008 until 2011 in the aftermath of the GFC. This has prompted speculation of more monetary policy easing. The November CPI at 0.2% Yr/Yr was also lower than expected, with a -0.6% on the month and the breakdown suggesting weakness across the board. We see scope for the Yr/Yr to go negative in the coming months before a bounce in late Q1, but we forecast +0.4% for the year as a whole. We had only looked for a further 20bps cut in the 7-day reverse repo rate (currently 1.5%) in 2025 and the same in the 1yr medium-term lending facility rate, but the politburo statement means we now look for 40bps of cut to 1.1%. This could come in December, but we suspect a 50bps RRR cut is more likely in December to be followed by 20bps 7-day reverse repo rate cuts in Q1 and Q2. The main way this will help the economy however is via a weaker Yuan, as households and private businesses are unlikely to see this as a gamechanger. Meanwhile, banks profitability would be hurt if interest rates fall too far or the government yield curve remains shallow. These tend to argue against PBOC ultra-low interest rates and/or QE unless the economy sees a hard landing.