China Yuan10trn Package: Shifting Debt Not Stimulus

Details of the Yuan10trn fiscal package show that it is all directed at a debt swap for LGFV’s and repackaging hidden local government debt. This will have little net fiscal stimulus. True fiscal stimulus will be seen for 2025 GDP growth, but it could be delayed until further details are seen on the Trump administration tariff threats. Unless the fiscal stimulus is large then it would signal that China’s authorities want to avoid worse case GDP outcome and try to meet 5% in 2025 but not really boost GDP growth.

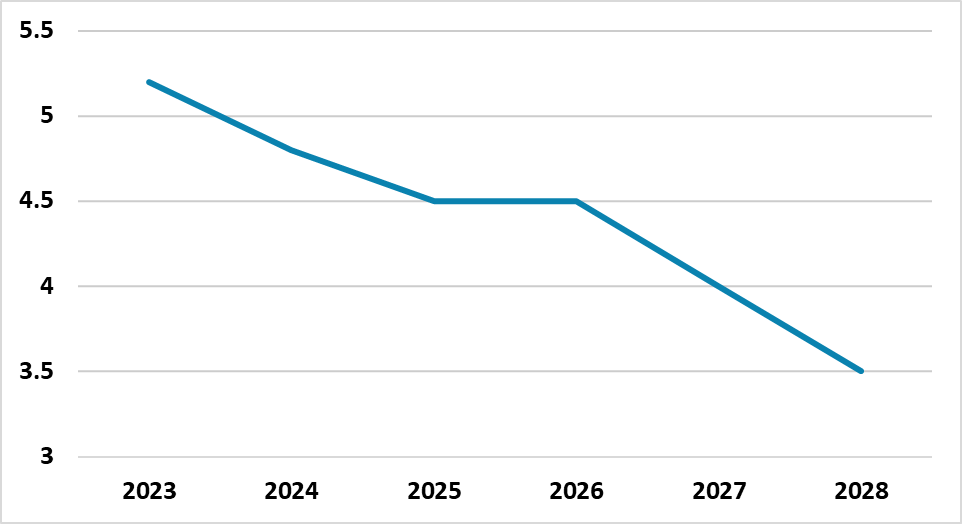

Figure 1: Total Government/Household and Corporate Debt/GDP (%)

Source: BIS/Continuum Economics

The Yuan 10trn fiscal package last week is disappointing on a number of fronts. Firstly, Yuan6trn is the widely expected debt swap of LGFV for local government debt, which removes the worst of LGFV debt over the next 3 years but is unlikely to see a new major expansion of LGFV borrowing to boost the economy. Secondly, Yuan4trn of special bonds will be issued to clean-up hidden local government debt, that have been hurt by lower tax revenue from property in recent years. For some local governments this could mean that less job and wage cuts and reducing a negative but it is unlikely to be fiscally stimulative. The MOF press conference did signal that more fiscal stimulus is coming, but the question is when.

Attention is switch to December central economic work conference (CEWC) meeting or alternatively Q1 once China is clearer on the new Trump administration timing and scale of threatened tariffs against China. Previous reports had suggested four elements were under consideration. Firstly, a scale up of gross lending from Yuan2trn to Yuan4trn to fund the completion of incomplete property, which boosts construction but is adverse to house prices. Secondly, around Yuan1trn to buy complete homes for affordable housing, which reduces inventory but is not large enough to boost new construction. Thirdly, Yuan1trn for a capital boost to the six major state banks lending capacity, though this is partially to fill the shortfall from small and medium sized banks that are restraining credit supply due to weak balance sheets (here). Finally, approximately Yuan1trn of central government infrastructure spending to boost 2025 GDP, which is pure fiscal stimulus.

The first three elements are required now to help support the residential property market, given the depressing forces are so large. Though the monetary stimulus has prompted a bounce in home sales, we are not confident that this will be sustained, as house prices have not bottomed. Delay and deliver of this size of package would signal that China’s authorities want to avoid worse case GDP outcomes; try to meet 5% in 2025 but not really boost GDP growth. The delay and caution reflect not only uncertainty of the Trump administration tariff threats but also the scale of total government/corporate and household debt to GDP (Figure 1), which is higher than the EZ and U.S. (here). We await further details in the coming months.