U.S. Yield Curve Steepens Then Flattening on 2026 Fed Tightening?

We see 10-2yr U.S. Treasury yield curve steepening in 2025, as the Fed keeps easing to 3.75% but the long-end is worried about medium-term issuance and the budget deficit trajectory being excessive. A moderate Fed tightening cycle in 2026 to curtail inflation from fiscal stimulus/tariffs should then produce yield curve flattening, both as 2yr yields rise with Fed Funds and 10yr yields fears are reduced with the Fed leaning against inflation risks.

Though we see a peak for 10yr yields just below 5%, two alternative scenarios could mean a peak of 5.50-5.75% -- maximum tariffs that ignites inflation or huge issuance that causes a jump in real yields to 3%.

We are revising our U.S. Treasury forecasts in the wake of changes to our economic and Fed forecasts after the U.S. elections (here).

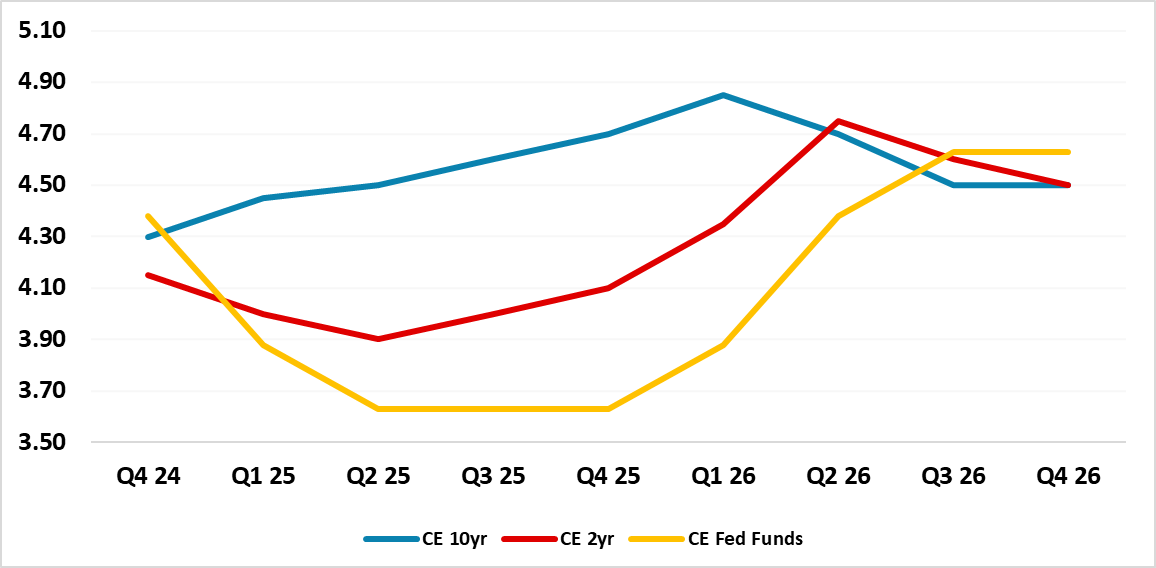

Figure 1: Fed Funds, 2 and 10yr U.S. Treasury Yield Forecasts (%)

Source: Continuum Economics

The level of the U.S. Treasury yield curve has adjusted to expectations that the terminal policy rate could now be 3.75% given the resilience of the economy. However, it also reflects market expectations that president elect Donald Trump economic program will be proactive rather than aggressive. Appointees for the new administration are providing some clues to policy priorities and scale, but fuller details will only become clear into H1. For U.S. Treasuries a couple of points are worth making.

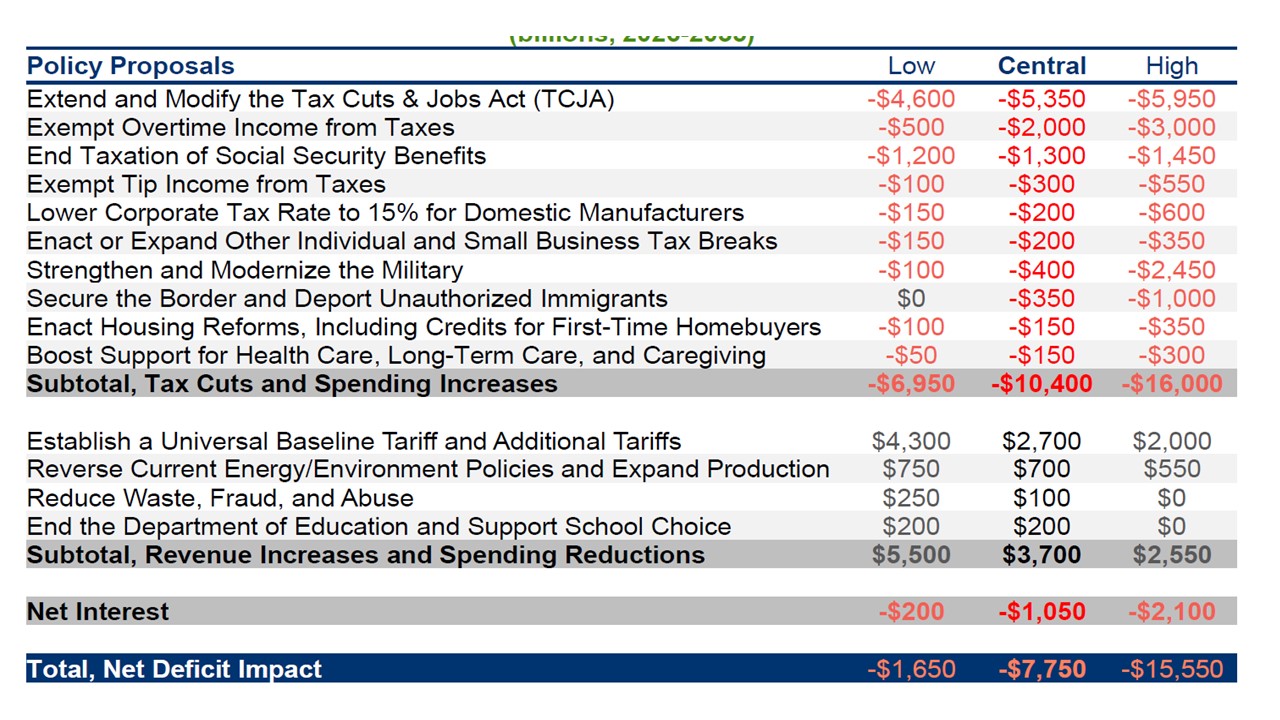

· Deportations and aggressive tax cut priorities. The 4mln deportation target (2025-28) suggest by Vance and Holman is a step-up from the 1.5mln in 2017-20 but with new immigrants is unlikely to led to a large rundown of the 11-20mln estimated illegal workers being deported. This should mean that the adverse tightening on the labor market could be modest rather than large in 2025-26. The other key policy priority will be tax cuts, given the prospect that the GOP has won the House and completed a clean sweep. We are of the view that aggressive tax cuts will be evident (here) and cover most of the tax cuts and spending increases in the central estimates by the committee for a responsible budget (CFRB Figure 2). This is more than currently discounted in U.S. Treasuries. However, we feel that tariff increases will scale up, as president Trump uses them tactically to get trade concessions for the U.S. (here) and this is likely to mean that tariff revenue is more modest than the CFRB estimates. This will mean budget deficits in the 8-9% region, which will also boost 10yr yields from a supply and budget deficit viewpoint. Though the budget measures will likely not pass through Congress until Q4 2025, the scale of the budget will likely be clear by spring-summer 2025.

Figure 2: Estimates of President Elect Trump Budget Plans (USD Blns)

Source: Committee for a Responsible Budget

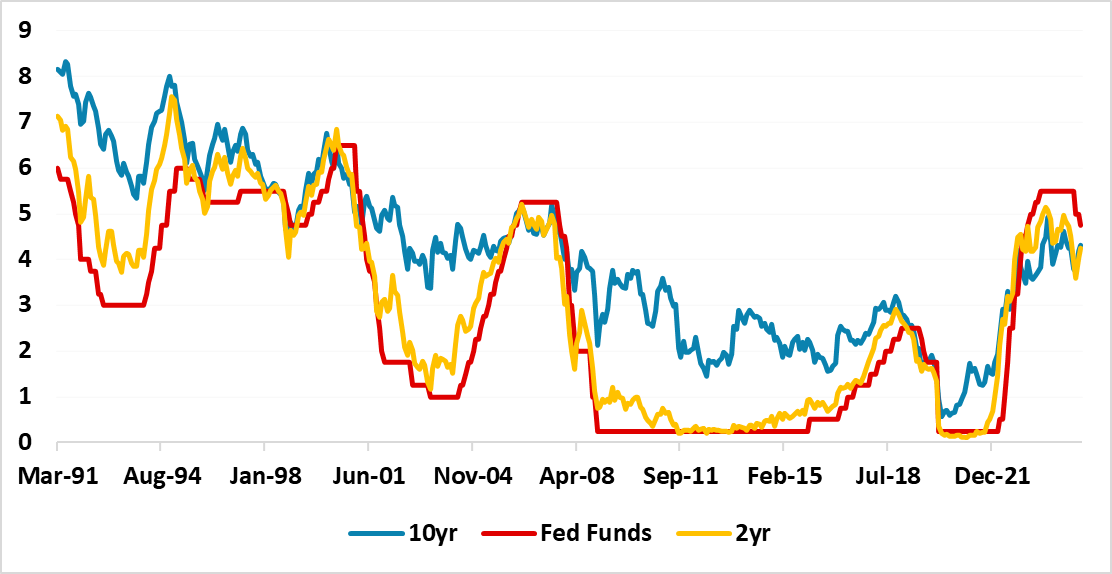

· Fed to 3.75% then 2026 tightening. We look for the Fed to keep on cutting rates until a terminal policy rate of 3.75% in June 2025 and then pause in H2. 2026 should then see a shift towards moderate Fed tightening to offset the fiscal stimulus and guard against the temporary boost to inflation from tariffs becoming ingrained in core inflation. While President Trump will replace Jerome Powell, a replacement is unlikely to stop a moderate 100bps tightening cycle and Trump is unlikely to make radical changes to the Fed mandate or independence. 2yr yields will likely shift to a premia to the Fed Funds rate by mid-2025 in line with previous experience (Figure 3) but that yield premia will likely erode as 2026 tightening turns out to be moderate rather than aggressive (Figure 1).

Figure 3: 2 and 10yr U.S. Treasury Yields in Past Fed Easing and Tightening Cycles (%)

Source: Datastream/Continuum Economics

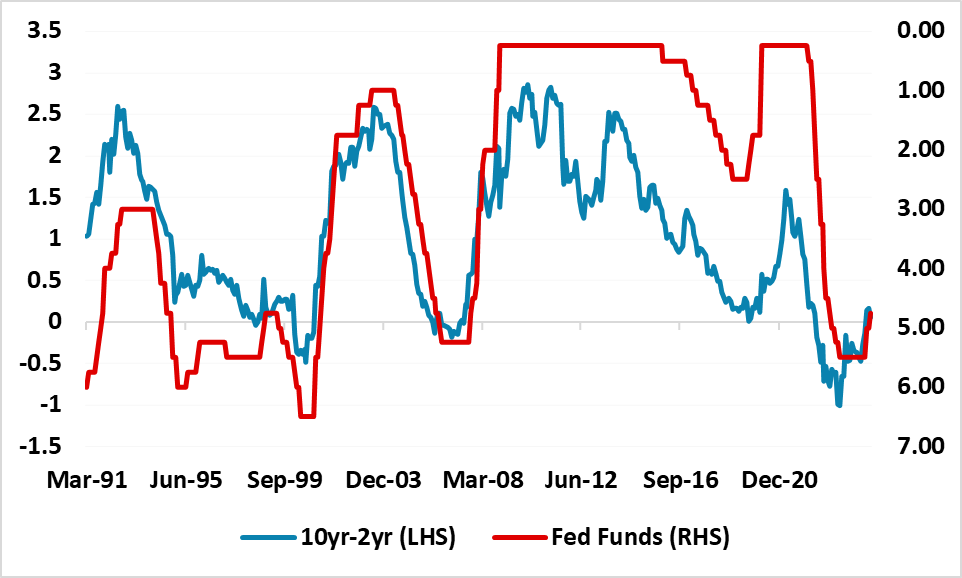

· 10yr yields rise further. We see 10yr U.S. Treasury yields moving higher through 2025, as concerns over high issuance and the budget deficit trajectory in 2026 onwards see a yield premia demanded by end investors. Our revised inflation forecast of 3.0% and 2.6% for 2026 CPI and core PCE inflation also have an impact on our thinking. This also all fits in with the traditional yield curve steepening that occurs in easing cycles (Figure 4). As the Fed starts to tightening in 2026, it should calm fears that the Fed will give up price stability of 2% inflation and this can calm 10yr yields and produce a modest decline in H2 2026 (Figure 1).

Figure 4: 10-2yr U.S. Treasury Yield Curve and Fed Funds (%)

Source: Datastream/Continuum Economics

A high level of uncertainty exists around these new baseline views. For example if tariffs are less transactional to get trade deals and more structural to raise domestic production and budget revenues, then the budget deficit would not be as wide but would still be in the 7-8% range. However, the stagflation shock from bigger structural tariffs would be greater, which would cause the Fed a dilemma. Should the Fed tighten to guard against 2 round effects from a bigger jump in inflation or should the Fed look through a temporary boost to inflation to adverse effects on consumption that can hurt the GDP trajectory. The U.S. Treasury market main difference in this alternative scenario would likely be that 2026 see a steeper yield curve than our baseline scenario on a restrained Fed but worries about inflation.

A 2 alternative scenario is that the market is unable to absorb huge issuance without higher real yields, especially as we fear multiple rating agencies downgrading the U.S. in the next 18-24 months. This could require real yields of 3% as a risk premia. This could be a fiscal shock like the UK in 2022.

Either of these alternative scenarios could mean that 10yr U.S. Treasury yields peak in the 5.50-5.75% region rather than 4.85% in our baseline forecasts.