China Outlook: Construction and Trade Headwinds v Policy Stimulus

We do see a package of stimulative fiscal policy measures for 2025 including Yuan1-3trn infrastructure spending; Yuan1trn funds to buy completed homes for affordable housing and Yuan1trn capital injection to the big six state banks. Some modest measures for low-income households and to boost social security safety nets are also likely, but we still see stimulus as mainly being production and investment focused. This is stimulus need is based on our view that the U.S. will threaten; then scale in tariffs incrementally, as the Trump administration seeks to get concessions from China (here). The total size of new measures that will likely be announced in H1 2025 are Yuan3-5trn.

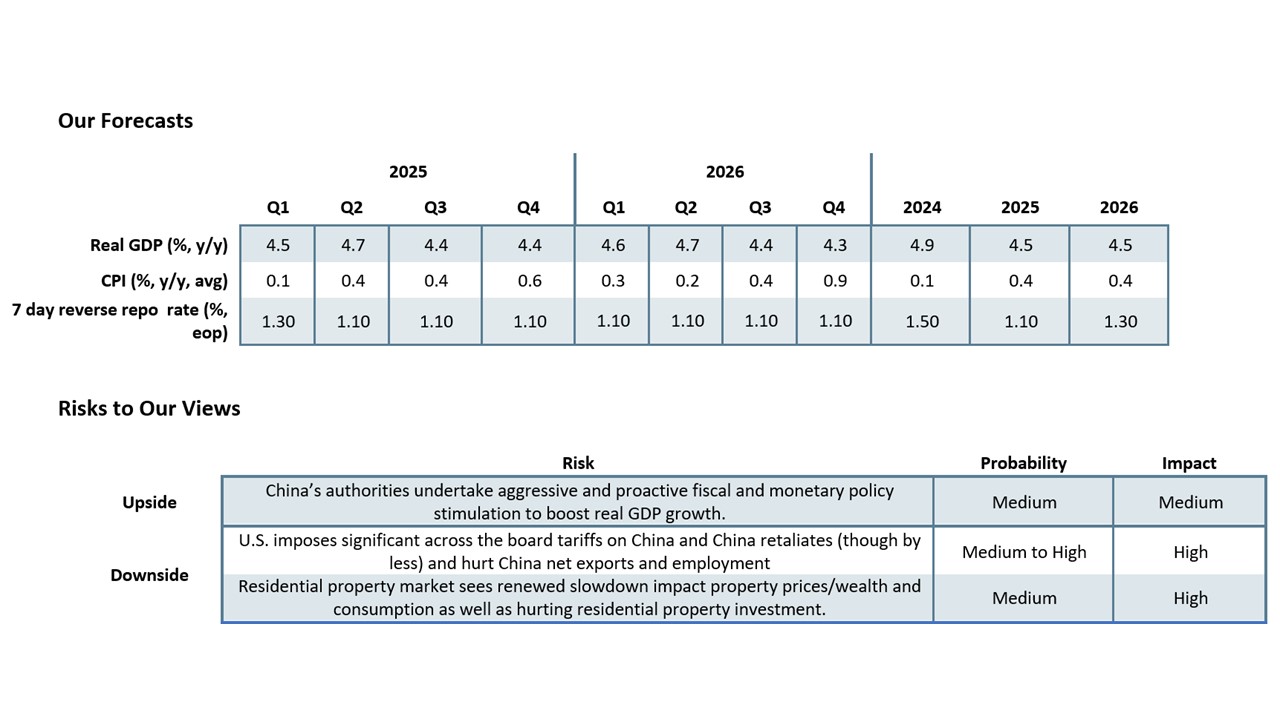

· We see GDP growth of 4.5% in 2025. Though net exports will likely be a drag now due to the threat of tariffs on confidence and the actual implementation of some tariffs, this will likely be counterbalanced by truer fiscal stimulus in 2025 than in 2024. However, the unbalanced nature of the economy will worsen, with growth momentum dominated by the government and SOE sectors; consumption remaining modest and net exports becoming a drag on growth alongside residential investment. This is an economic environment that could see intermittent downside surprises to growth and will likely require new fiscal policy easing in 2026 to meet our projection of 4.5% GDP growth.

· Further monetary policy stimulus will likely be 40bps of 7-day reverse repo rate cuts and 100bps of RRR cuts (here), but the authorities are concerned about bank margins getting squeezed and restraining lending and this likely rules out ultra-low rates and QE unless a hard landing is seen.

· Risks to the Outlook. The trade war could be bigger than we expect causing more adverse effects on China GDP or the residential investment sector shrinkage could worsen rather than getting slightly smaller in 2025.

Source: Continuum Economics

Headwinds versus Policy

China unbalanced economic growth will likely continue to be divergent in 2025/26 for a number of reasons.

· Residential property remains a drag. Though home sales have picked up after the September PBOC easing package, we remain concerned that residential property investment and prices have not reached a bottom. Firstly, the excess of completed homes means that a pick-up in sales does not translate into a pick-up in residential construction. Secondly, the government push to finish uncompleted homes is necessary for confidence and does help residential investment in GDP, but keeps property prices on the defensive and is a substitute for new construction. Thirdly, housing remains expensive with property price/income ratios remaining high and need to fall further. Given low inflation and wage growth this likely means a further 10-15% decline in national house prices over the 2025-27 period. Residential investment is still likely to subtract around 1% from 2025-26 GDP, despite the government efforts and assuming a further Yuan1trn for purchases of complete homes for affordable housing.

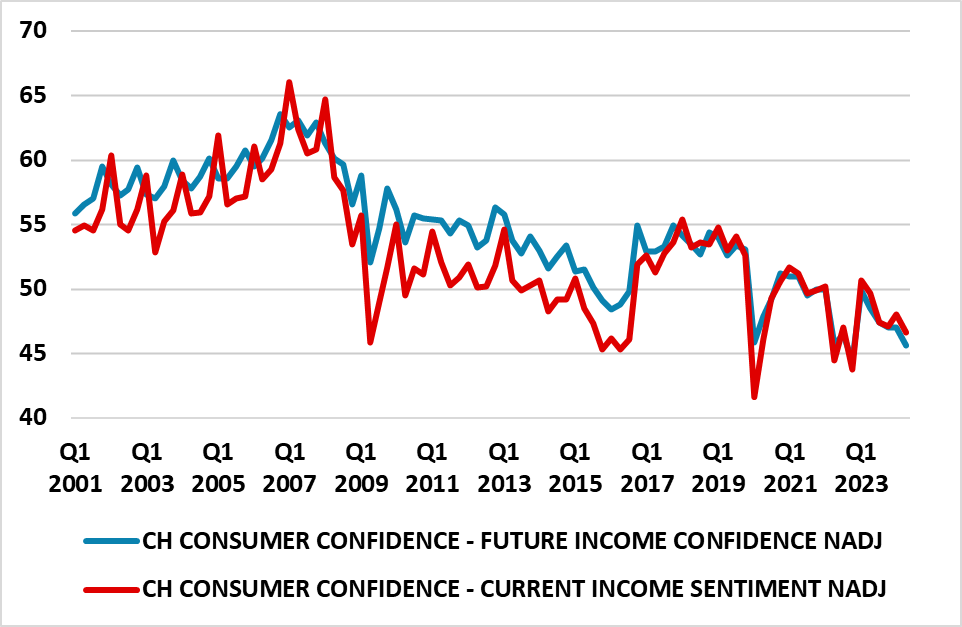

Figure 1: Consumer Income Sentiment (Diffusion Index)

Source: Datastream/Continuum Economics

· Consumer headwinds from housing wealth/slower jobs and income growth. With house prices still likely to fall, this will only increase the perceived reduction in net wealth for households. Additionally, with private sector job growth slow and economy wide wage growth sluggish, household income growth is more subdued than the boom years of 1990-2019. Households are worried about their income (Figure 1). Weak consumer confidence is a function of these cyclical weakness, but also insufficient structural support from the government (health/unemployment and pension safety nets). H2 2024 has seen an increase in home appliance and car purchases with government trade in programs, but new measures are required to support subsectors of consumption. A broad tax cut or vouchers for households remains unlikely. The post COVID rebound in eating out and tourism should still provide some support to consumption in 2025, though less so in 2026.

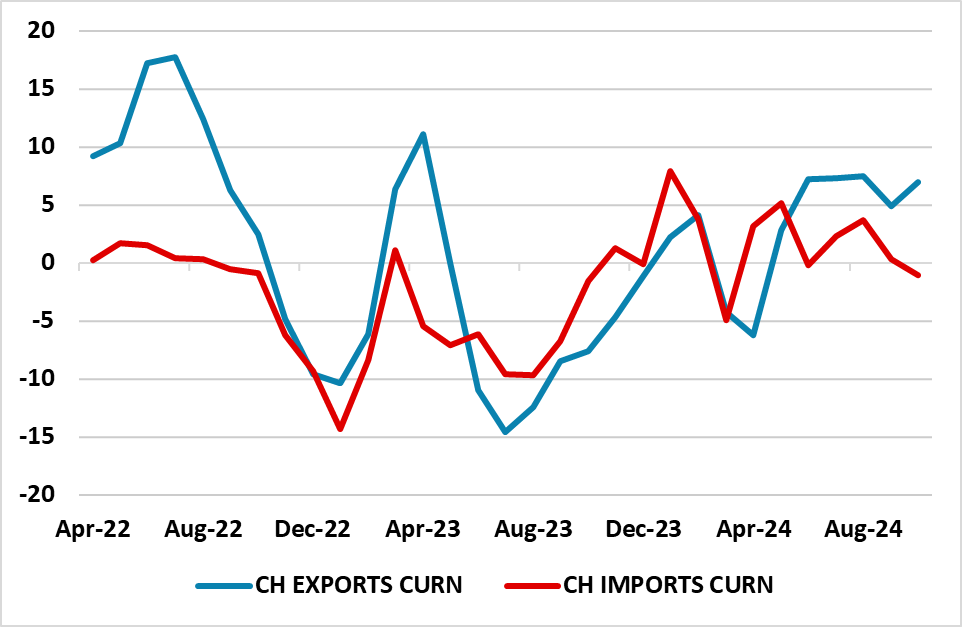

Figure 2: Export and Imports Values USD (12mth % Change 2MMA)

Source: Datastream/Continuum Economics

· Trade tailwind to tariffs. Net exports have been helpful in 2024 (Figure 2), as Chinese companies diverted excess production to exports. However, the outlook for China exports is becoming more difficult in 2025, with President elect Trump already threatening a 10% tariff on all China exports. We feel that the U.S. will be aggressive with China on threats and tariffs, though not the maximum 60% (here). The transactional aim is to get an improved phase 1 trade deal or a phase 2 deal that favors reducing the bilateral deficit for the U.S. We see China authorities agreeing a revised trade deal by Q4 2025, but the direct effects of tariffs will be important. Additionally, China exports to the U.S. and other countries will be impacted adversely by trade policy uncertainty and fears that China could be hurt by more tariffs. This will hurt 2025 exports, but could also impact production/employment and sustain aggressive domestic disinflation. 2026 will likely see less trade uncertainty, but the lagged effects of cancelled export orders will still have an impact and export growth will likely be modest rather than rebound properly.

· More monetary stimulus. We see further monetary stimulus from the PBOC after the December Politburo statement (here), with the 7-day reverse repo rate likely to be reduced by 20bps in Q1 and Q2; two 50bps reductions in the RRR rate and encouragement for the large banks to increase lending (a Yuan 1trn capital injection for the big six banks remains highly likely). However, households and private businesses response to monetary easing is weak, given the debt and housing overhang and this reduces the effectiveness of easy monetary policy. Additionally, banks profitability would be hurt if interest rates fall too far or if the government yield curve remains shallow. These tend to argue against PBOC ultra-low interest rates and/or QE unless the economy sees a hard landing.

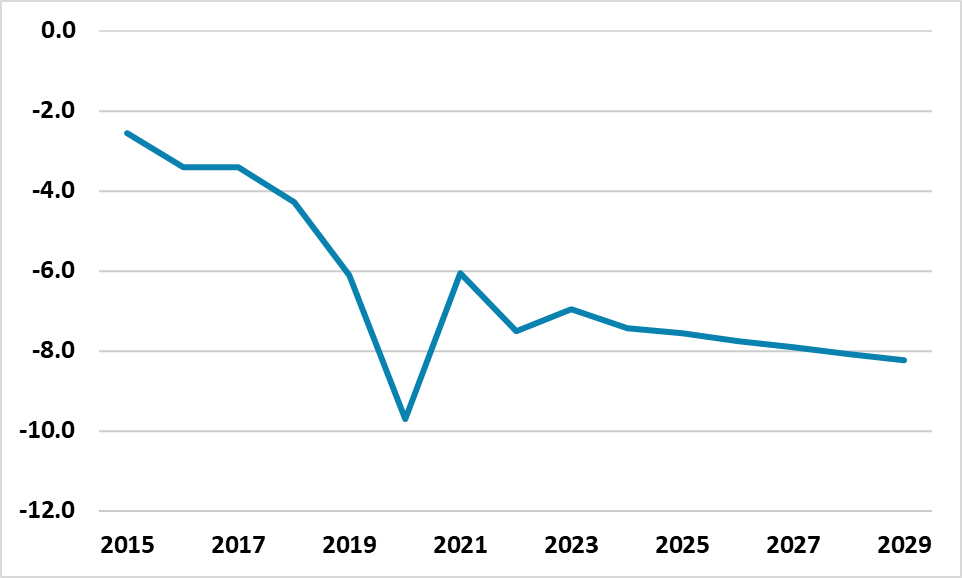

Figure 3: China Government Deficit/GDP (%)

Source: IMF/Continuum Economics

· More fiscal stimulus. We do see a package of stimulative fiscal policy measures for 2025 including Yuan2-3trn infrastructure spending; Yuan1trn funds to buy completed homes for affordable housing and Yuan1trn capital injection to the big six state banks. This is based on our view that the U.S. will threaten; then scale in tariffs incrementally, as the Trump administration seeks to get concessions from China (here). The total size of new measures that will likely be announced in H1 2025 are Yuan3-5trn. The Yuan6trn 2025-27 LGFV debt swap and Yuan4trn of 5 years of unofficial local government debt consolidation will also help growth on the margin (here), as they allow LGFV’s and local government to spend more normally rather than being debt restrained. If the trade war with the U.S. is really bad or the economy surprises significantly on the downside, then further fiscal stimulus could be seen. However, China authorities remain reluctant to repeat the 2009 or 2015 surge in debt growth, with total government/corporate/household debt now higher than the U.S./EZ (here) and the IMF estimate of the budget deficit appearing to impact actions as much as the official estimate from MOF. However, we do not look for a debt crisis in China as a large portion of borrowers (central and local government/LGFV/SOE’s) and lenders (banks/investment companies) are heavily influenced by the authorities. Additionally, though distress among small banks will likely increase through 2025 and 2026 and could cause a mini crisis, we expect forceful action from the authorities and proactive takeovers and mergers (here).

Overall, we see GDP growth of 4.5% in 2025. Though net exports will likely be a drag now due to the threat of tariffs on confidence and the actual implementation of some tariffs, this will likely be counterbalanced by truer fiscal stimulus in 2025 than in 2024. However, the unbalanced nature of the economy will worsen, with growth momentum dominated by the government and SOE sectors; consumption remaining modest and net exports becoming a drag on growth alongside residential investment. This is an economic environment that could see intermittent downside surprise to growth and will likely require new fiscal policy easing in 2026 to meet our projection of 4.5% GDP growth.

We have however revised down our forecast for 2025 CPI inflation from +0.6% to +0.4%, as we feel that aggressive disinflationary pressures will grow with producers restrained on the export front and increasing the level of competition domestically.