Equities: Growth, Rates and Tariffs

· EZ equities still have further scope to outperform U.S. equities in the remainder of 2025 helped by further ECB easing/hopes of a Ukraine peace deal and U.S. equity market overvaluation restraining the U.S. However, this can be volatile with uncertainty over the scale of U.S. tariffs on the EU and a peace deal in Ukraine.

EZ equities have outperformed the U.S. since the start of the year. What are the prospects going forward?

Figure 1: DM Equities Since Start Nov 24 (%)

Source: Continuum Economics

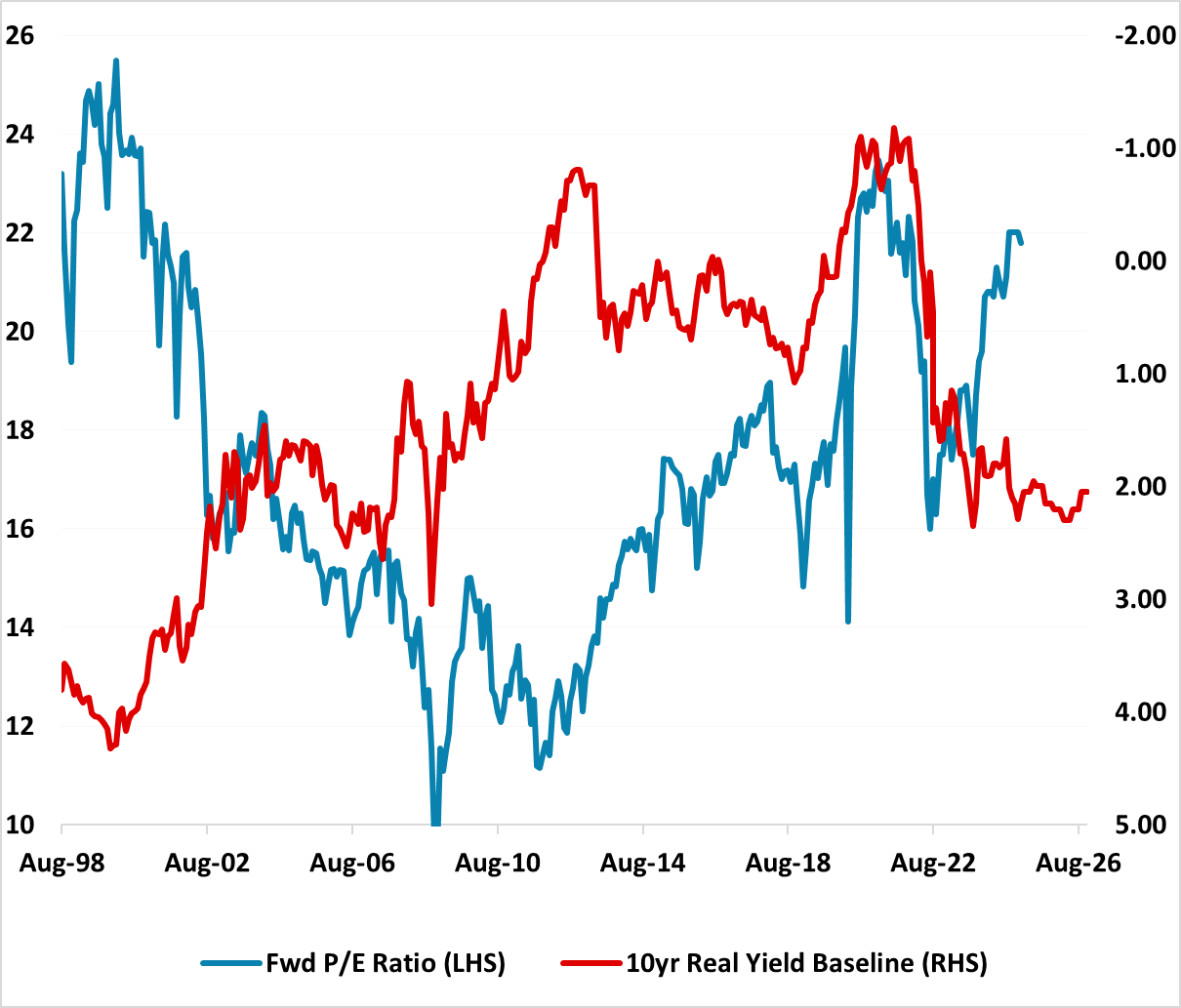

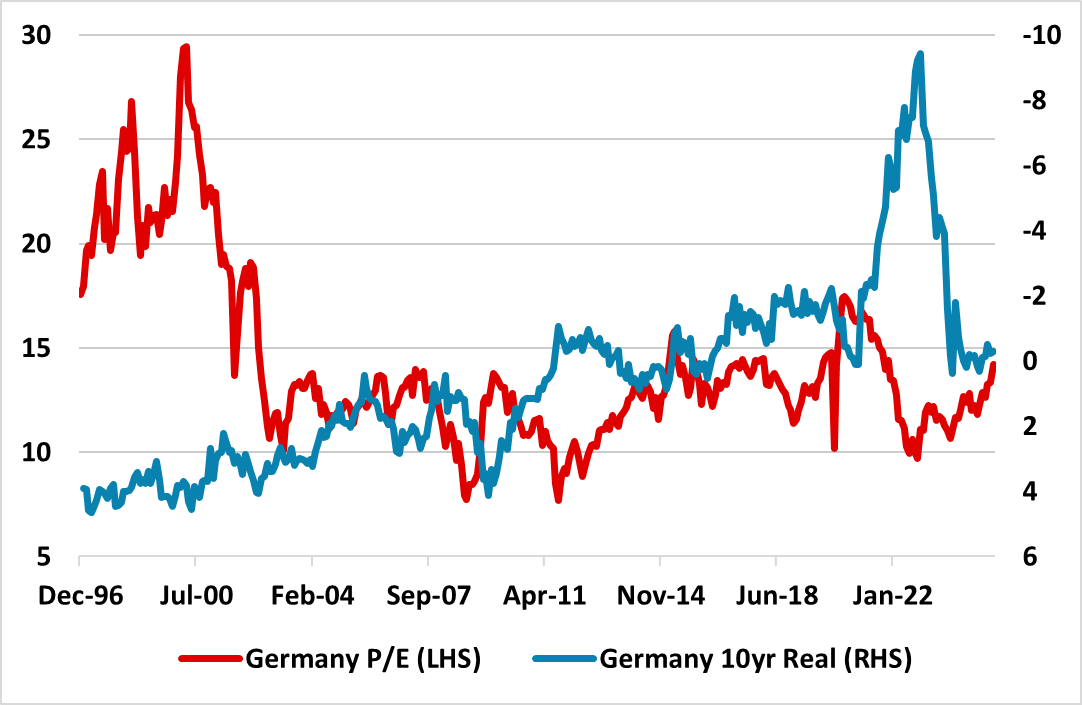

While YTD clearly shows outperformance for EZ equities, it is perhaps better to look at the period from November 1 2024 given the U.S. equity market rally post-election (Figure 1). This still shows outperformance by the EZ Stoxx 60 v S&P500, as the U.S. equity market has consolidated given the high valuation of the U.S. equity market in P/E terms. Bond to Equity valuations (Figure 2) also suggest that the U.S. equity market is overvalued and vulnerable to any materially bad news. In contrast valuations for EZ equities in equity only terms have been fair value and still cheap versus nominal and real government bond yields – Figure 3 shows this for Germany. The European outperformance story has also been a contrast of monetary policy, with the Fed pausing but the ECB still cutting at a 25bps pace per meeting and destined to hit a 2% policy rate that brings down the whole short-dated structure – see here for our recent ECB and Bund view. Thirdly, talks on a ceasefire and peace deal are currently regarded as good news, as it could led to cheap Russian gas bring EZ inflation down in the future and boosting EZ industry competitiveness. Meanwhile, our baseline is that the U.S. will maintain the main NATO commitments as European transition to take on more security, which is supportive for EZ equities – though we see a 20% probability of U.S. weakening NATO commitments, which would be mixed for EZ equities (here). Finally, global equity managers have been underweight EZ and overweight U.S. equities and this gap has been trimmed and helped drive relative performance.

Figure 2: 12mth Fwd S&P500 P/E Ratio and Real 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2025

Figure 3: 12mth Fwd Germany P/E Ratio and Real 10yr Bund Yield Inverted (Ratio and %)

Source: Continuum Economics

Source: Continuum Economics

Going forward a number of issues are to be considered.

· Tariffs. Trump believes that tariffs can led to trade concessions/deals but also raise revenue for the U.S.. This means that tariff reality will be both trade deals and higher tariffs in certain products and reciprocally. The EU will likely be threatened by reciprocal and 25% car/pharma tariffs in April (here), with some of this being introduced by the U.S. EU counter tariffs will likely be targeted and then it could take months to start negotiations and reach a trade deal – this could come in Q4. A trade war risks hurting business sentiment and the European recovery, though also deepening the ECB easing cycle (here). This can slow/stop EZ equities advances in mid-year. More importantly, if tariffs end the U.S. reasonable growth phase and cause a growth slowdown, then it risks a correction in U.S. equities and spillover initially to global equities.

· Trump macro policies. Optimism about stimulative policies are being tempered with front-loading tariffs and chaotic change in some government departments. Meanwhile, though deportations from the U.S. have not risen, new illegal and legal immigration is reported to be slowed noticeably and this risks slower U.S. employment growth. Finally, the prospect of aggressive tax cuts has also turned into modest tax cuts that are unlikely to be introduced until late 2025/early 2026 – though the risk of a spike in yields beyond 5% is less with a high but controlled budget deficit, which reduced an adverse scenario for U.S. equities.

· Ukraine war. Uncertainty still exists. Though president Trump has suggested that President Putin would accept European troops in Ukraine, Russia foreign secretary Lavrov rejected this idea last week and this has been a red line for Russia. Additionally, though EZ/EU countries could decide to buy more cheap Russian gas, a Russia friendly peace deal could stop Europe politically from becoming dependent on Russia again.

Overall, EZ equities still have further scope to outperform U.S. equities in the remainder of 2025 helped by further ECB easing/hopes of a Ukraine peace deal and U.S. equity market overvaluation restraining the U.S. However, this can be volatile with uncertainty over the scale of U.S. tariffs on the EU and a peace deal in Ukraine.