Banxico Review: 25bps Cut but not Unanimously

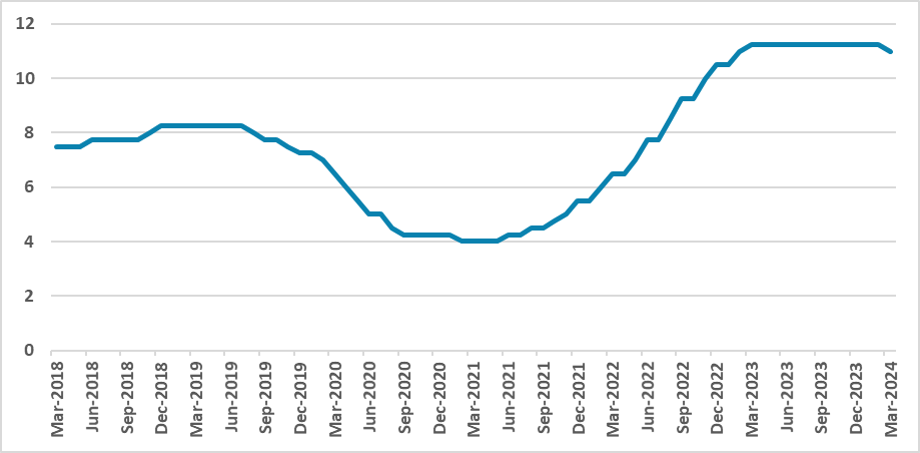

Banxico has cut the policy rate by 25bps to 11% from 11.25%. The board stressed the drop on core inflation although their balance of risks is biased to upside. Banxico has not given any forward-guidance stating the next decision will be data-dependent. We believe Banxico will continue to cut the policy rate at a 25bps pace until they reach 7.5% in 2025.

Figure 1: Mexico’s Policy Rate (%)

Source: Banxico

The Mexico Central Bank (Banxico) has convened to decide the policy rate. As advanced in our preview (here), Banxico has decided to cut the policy rate by 25bps, lowering it from 11.25% to 11.0%. Although the communique has entered into the specific details on the reasons for cutting, Banxico has stressed the magnitude in which inflation has fallen and mostly that despite the cut, the policy rate remains restrictive as it needs to be. Additionally, the board highlighted caution as the inflationary outlook continues to be uncertain and their balance of risk remains biased to the upside. The decision was not unanimous, with one of the board members voting to maintain the policy rate at 11.0%.

Regarding the latest inflation numbers, the board stressed that most of the rise occurred in the non-core groups while core CPI has decreased. Additionally, inflation expectations for 2024 have decreased, while for 2025 they remained generally stable. Regarding domestic activity, Banxico expects the Mexican economy to rebound in the first half of the year, which in general paints a positive outlook. The stability and overall strength of the Mexican Peso were also highlighted by the board members.

However, Banxico gave us little forward guidance about their next moves, indicating that all is going to be data-dependent. We believe we will gather more information about their rationale in the minutes. What we can advance is that once the cutting cycle has started, it is likely to continue with no pause. With a strong labor market and inflation expectations not fully converging, we believe Banxico will be cautious, especially due to the hot labor market and the loose fiscal policy during 2024. This would be in line with our current view that Banxico will cut at a pace of 25bps until they reach neutral rates, with some members wishing for a stronger cut and others advocating for a slower cutting cycle. Our forecast for Mexico's policy rate is that it is likely to end 2024 at 9.5%. Then, cuttings will extend towards the 7.5% level in 2025 as inflation fully converges to its target.