Fed Faster Than ECB and BOE?

The Fed will likely ease by more than the ECB and BOE by June 2025, both given pro-activeness from the Fed and also the big gap between the current policy rate and Fed’s assessment of neutral rates. We see a cumulative 175bps of cuts by end June 2025. ECB hawks however are unlikely to stop a consensus on the 21 person governing council from delivering consistent quarterly 25bps rate cuts. Finally, we see the view on the BOE MPC shifting, as disinflation proves to be greater than the BOE consensus. Aside from 25bps cuts in line with the quarterly inflation report we pencil in an extra cut in December 2024 or March 2025.

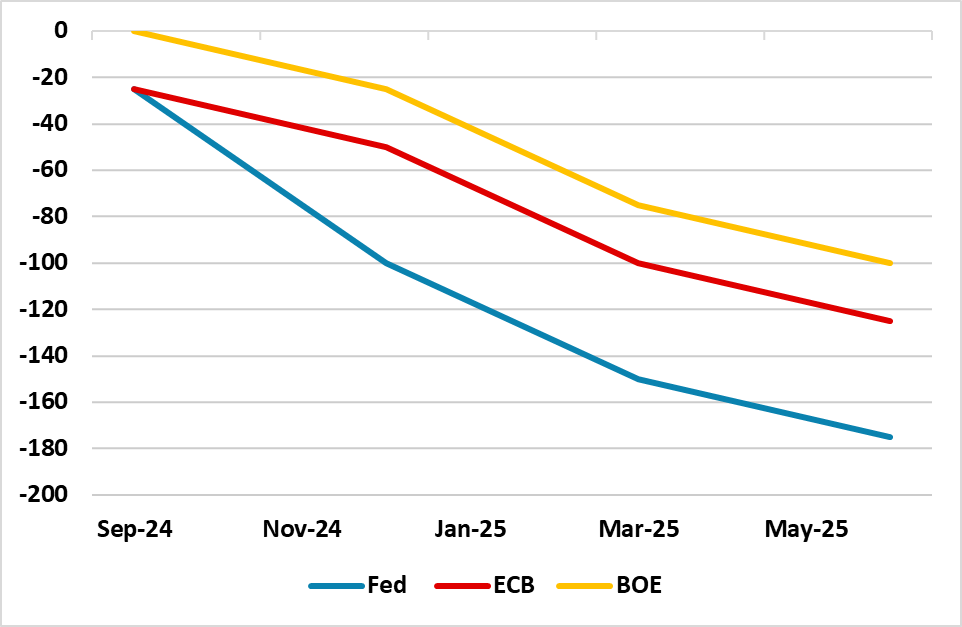

Figure 1: Fed/ECB and BOE Rate Cuts Fully Discounted (%)

Source Bloomberg/Continuum Economics (excludes 25bps ECB and BOE cuts already made)

Financial markets have swung over the summer to discounting a lot more Fed easing by mid-2025, with high confidence that the first move will arrive at the September FOMC and that the Fed Funds target will be down by 175bps to 3.25-3.50% by end June 2025 (Figure 1) – the market is close to discounting an 8 cut but not fully. In contrast, DM central banks in Europe are seen moving at a slower pace than the Fed, with a further 125bps of ECB depo rate cuts fully discounted and 100bps for the BOE bank rate, on top of the existing 25bps cuts already delivered. The contrast is greater in the remainder of 2024, with a 100bps of Fed cuts; 50bps ECB and 25bps BOE policy rates fully discounted.

The Fed has cut more aggressively than ECB or BOE in the past (Figure 2-4), given the more market based finance in the U.S. needs the Fed to be decisive in loosening financial conditions. However, these large rate cuts have come when the U.S. is faced by a recession, with the easing in 1995 and 1998 being more moderate as a soft landing occurred. ECB easing cycles have been less frequent, with June 2001 being the only one excluding a major crisis and the BOE following a different rhythm to the Fed. Of course history is only illustrative and what is key are economic performance and inflation relative to targets or aspirations. Comparisons are more complicated post 2008 when easing cycles were accompanied by QE, but this easing cycle is being accompanied by QT. Though QT may not be as powerful as QE, the current QT from the Fed/ECB/BOE are all tightening liquidity and lending conditions and potentially increasing the scale of interest rate cuts.

Figure 2: Previous Fed Cutting Cycles (%)

| End of Tightening | 1st Rate Cut | Gap in Months | Cuts in 6 Months | Cut in 12 Months | |

| Feb-89 | Jun-89 | 5 | 125 | 175 | |

| Feb-95 | Jul-95 | 6 | 50 | 75 | |

| Mar-97 | Sep-98 | 7 | 75 | 50 | |

| May-00 | Dec-00 | 8 | 250 | 450 | |

| Jun-06 | Aug-07 | 14 | 225 | 325 | |

| Dec-18 | Aug-19 | 9 | 75 | 225 |

Source Continuum Economics

Figure 3: Previous ECB Cutting Cycles (%)

| End of Tightening | 1st Rate Cut | Gap in Months | Cuts in 6 Months | Cut in 12 Months | |

| Oct-00 | Jun-01 | 9 | 100 | 150 | |

| Aug-08 | Nov-08 | 3 | 275 | 325 | |

| Aug-11 | Dec-11 | 4 | 50 | 75 |

Source Continuum Economics

Figure 4: Previous BOE Cutting Cycles (%)

| End of Tightening | 1st Rate Cut | Gap in Months | Cuts in 6 Months | Cut in 12 Months | |

| Feb-95 | Jan-96 | 11 | 104 | 70 | |

| Jun-98 | Nov-98 | 5 | 200 | 225 | |

| Mar-00 | Mar-01 | 11 | 100 | 200 | |

| Jul-07 | Dec-07 | 5 | 75 | 275 | |

| N/A | Jul-16 | N/A | 25 | 25 | |

| Sep-07 | Mar-20 | 19 | 65 | 65 |

Source Continuum Economics

Fed Powell’s guidance has been that the Fed Funds rate would travel towards neutral interest rates, which the June SEP long term Fed Funds rate median at 2.75%. Other Fed speakers appear to agree with this guidance for two reasons. Firstly, Fed Funds is noticeably above the neutral rate and leaves the Fed nervous that restrictive policy could still come through with a lag. Secondly, Fed officials are highlighting that with inflation coming down, that real rates are rising and policy could end up being more restrictive. Thus the market is looking for a terminal policy rate of 3.00-3.25% with the majority delivered in the next 12 months. Risk management traditions also leaves us more inclined to seeing lot of easing from the Fed by mid-2025. We have been calling for three 25bps cuts in the remainder of 2024 and now look for 25bps cuts in the first four meetings of 2024 (here). Thereafter we pencil in a further 50bps of cuts in H2 2025, but is dependent on the economic and inflation trajectory at that time.

For the ECB we have had a long held view that the ECB will follow a quarterly pace at 25bps each time. While the data backs the market view, the ECB hawks act as brake against 125bps of extra easing by June. Though the hawks may currently be reluctant to see this pace, we feel that the ECB forecasts for growth and inflation are too high. Additionally, the ECB is adding to tightening by scaling up PEPP QT, which ECB Lane noted in Jackson Hole is hurting liquidity and then credit growth (here). This leaves us inclined to stick with our quarterly pace and a cumulative extra 100bps by end June 2025.

For the BOE, we have for some quarters penciled in 125bps of cuts by mid-2025, with 25bps having been delivered at the August MPC meeting. August’s split 5-4 vote, plus lingering service and wage inflation concerns, have caused some MPC members to be very cautious and helps explain why the market is looking for the BOE to be the laggard compared to Fed and ECB. However, services and wage inflation should come down more than the MPC consensus due to a squeeze on profit margins. Additionally, the good H1 GDP number will likely fade noticeably in Q3 (+0.1% qtr/qtr) and Q4 (+0.2%) as restrictive policy rates plus subdued money and credit trends act as a drag on the UK economy. The UK is also undertaking more noticeable fiscal tightening for the household sector than the EZ and in contrast to inaction in the U.S., with additional tax rises to be announced in the October budget. Thus we pencil in 25bps of cuts at the monetary policy meetings in Nov 24, Feb 25 and May 25. However, we also feel that the BOE consensus will become more dovish and deliver a fourth 25bps rate cut by end June 2025. September is possible but unlikely, with December 24 or March 25 more likely.