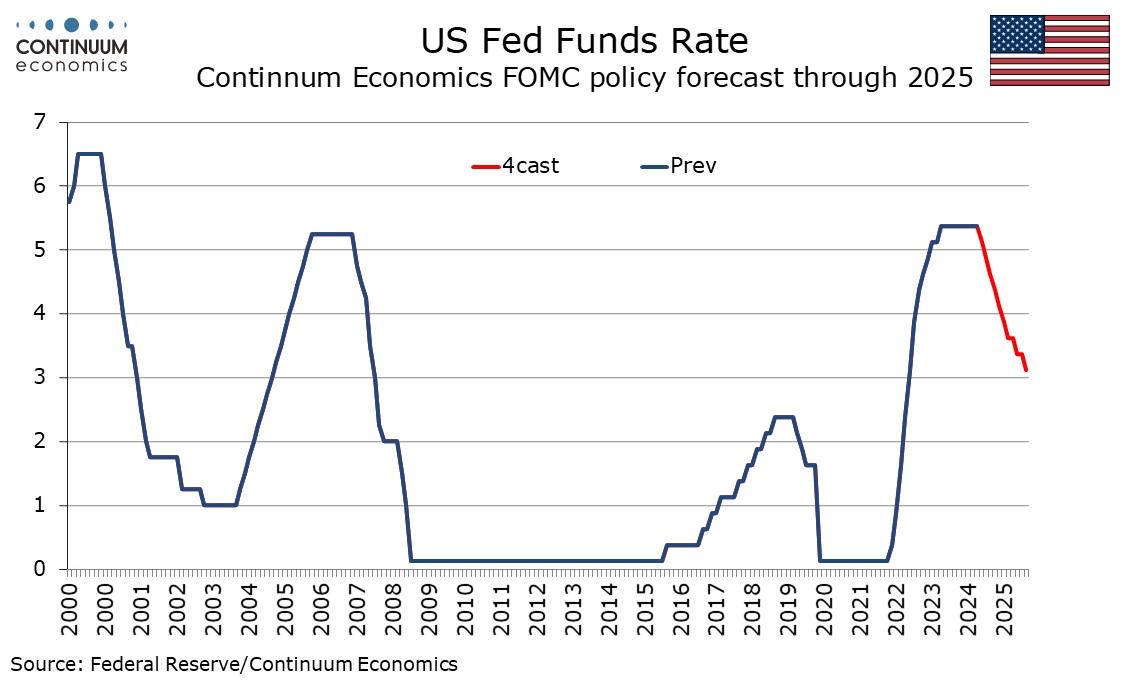

FOMC View Change: 75bps of Easing in 2024, 150bps in 2025

The dovish tone from Fed Chairman Jerome Powell’s Jackson Hole speech on Friday and the FOMC minutes from July 31 on Wednesday suggest the Fed is almost certain to start easing in September, though only if August’s non-farm payroll is surprisingly weak would 50bps become likely. We continue to expect three 25bps easings in the final three meetings of 2024, though we now expect rates to be cut by 150bps in 2025, rather than 100bps.

Increased focus on labor market risks

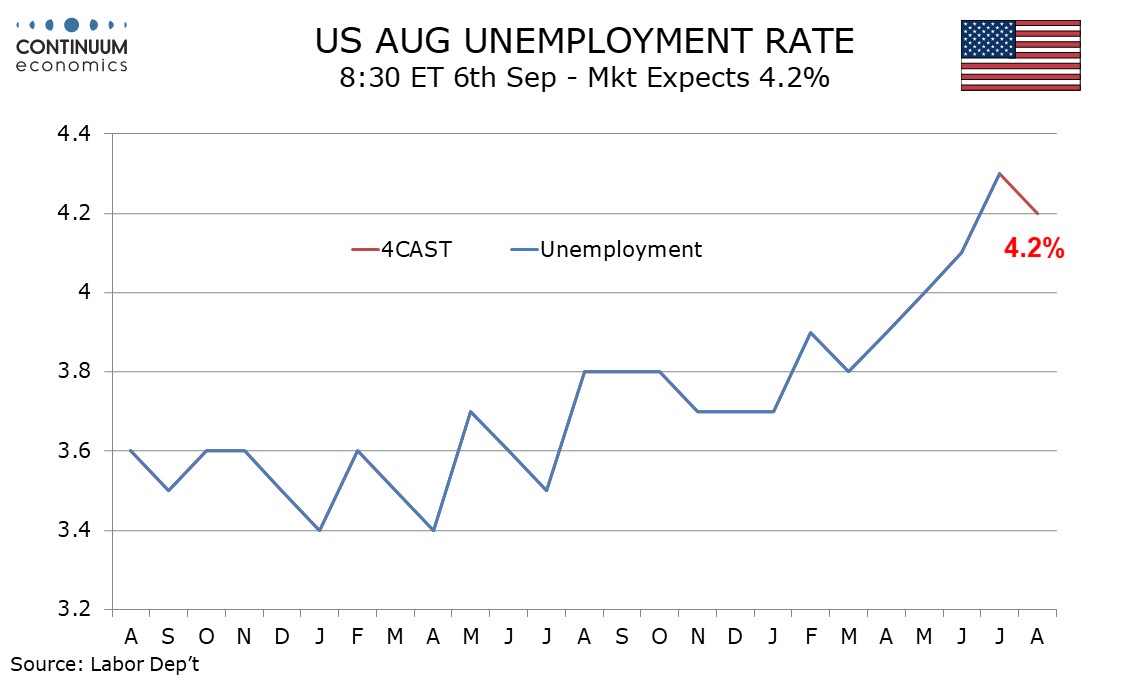

The labor market is clearly getting much more attention, with Powell describing it as less tight than just before the pandemic. This is a slightly more dovish view than expressed in the FOMC minutes, where participants assessed that conditions had returned to about where they were on the eve of the pandemic, strong but not overheated. However the minutes did consider the risk that a further gradual easing in labor market conditions could transition into a more serious deterioration. A significantly weaker than expected August non-farm payroll could have the FOMC seriously considering a 50bps move in September, though our current view is that the softer than expected July employment data was in part influenced by weather, and August data will leave 25bps as the most likely September decision.

The economy continues to show momentum, with July data showing resilience in retail and home sales, with a rising unemployment rate due to reduced hiring and a rising labor force rather than significant job losses, and if that remains the case easings are likely to be by 25bps. We continue to expect 25bps easings in November and December, as we predicted in our June outlook, though now the risk is more rather than less given risk of a further weakening of the labor market, something Powell made clear would not be welcomed.

More easing seen in 2025

Our June view that in 2025 easing would be by only 25bps per quarter however now looks too cautious, and we expect the Fed to ease by 25bps in the first four meetings of the year, taking the Fed Funds target range to 3.5-3.75% in June of 2025. With the economy likely to be regaining momentum in response to lower rates, we expect the Fed move at a slower pace in the second half of the year, with just one 25bps in both Q3 and Q4, leaving the target range at 3.0-3.25%. This may prove the bottom of the easing cycle. While it is marginally above the FOMC’s current median neutral estimate of 2.75%, the dots have an upward skew. We expect that by late 2025 GDP growth will be near the long-run potential and that inflation will be near the 2% target. Additionally, though the labor market will slacken, the last few easings will be dependent on enough labor market slack being evident. The Fed is aware that a soft landing could mean that the labor market is not as slack as after previous recessions and associated easing cycles.

The 2025 view is of course subject to uncertainty over the election result, which remains a very tight call for president. While Kamala Harris may now be the marginal favorite it could come down to one state (most likely Pennsylvania) meaning that the result would probably be disputed, something which could add to downside economic risk late in the year. However we are more comfortable in predicting a Democratic House and a Republican Senate, even if both are close calls, and that would mean that whoever is president would not have a free hand on economic policy. This would reduce risks of excessive fiscal stimulus somewhat, though with neither party showing any interest in fiscal restraint the budget deficit would remain large, above 6% of GDP. Additionally, if Donald Trump is elected and actually reduces immigration significantly, then labor supply will be hit and making the labor market tighter than it should be 2025-28. That would argue against a long-term neutral rate falling below 3%.

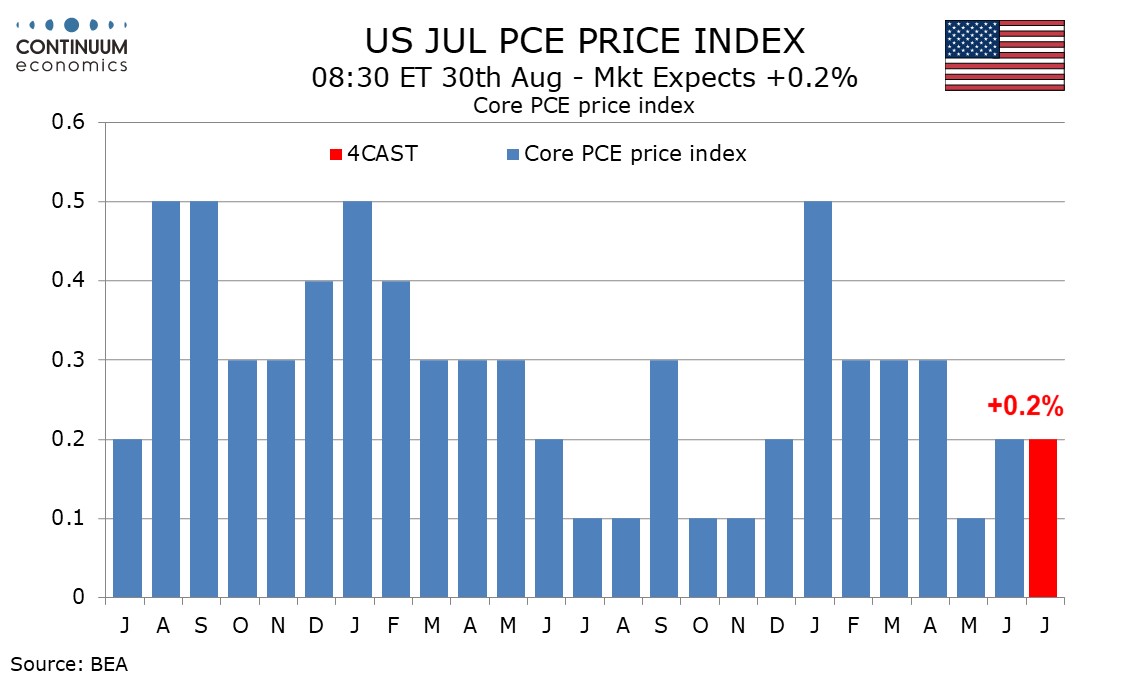

Inflation data seen mostly subdued, but shocks may still happen

While the data focus has tuned increasingly to the labor market easing expectations could take a hit should an upside surprise on inflation appear. We feel the risks of that are generally low, with recent data suggesting the strength in Q1 reflected residual seasonality. Inflation data was generally subdued in the second half of 2023, and we expect a similar picture in the second half of 2024. However, one disappointing month could easily be seen, as was seen from core PCE prices in September of 2023. For 2025 markets may be braced for temporary strength in Q1, and if it is not seen yr/yr rates would then fall significantly.