FX Daily Strategy: Asia, August 13th

Risk positive tone persists after US CPI

JPY remains under pressure

GBP/JPY reaches highest in a year

CHF weakness can extend further

Risk positive tone persists after US CPI

JPY remains under pressure

GBP/JPY reaches highest in a year

CHF weakness can extend further

There’s very little of note on Wednesday’s calendar, so the focus might return to the equity market, with the S&P 500 once again testing the all time highs after the US CPI data on Tuesday. The data itself was fairly unremarkable. If anything, the core index was marginally stronger than expected at 0.32%, but with the strength concentrated mostly in services, the market may have chosen to view the data as evidence that there isn’t much feedthrough from tariffs. The reaction certainly suggested that the market had been fearing something stronger, with front end US yields and equities both higher after the data.

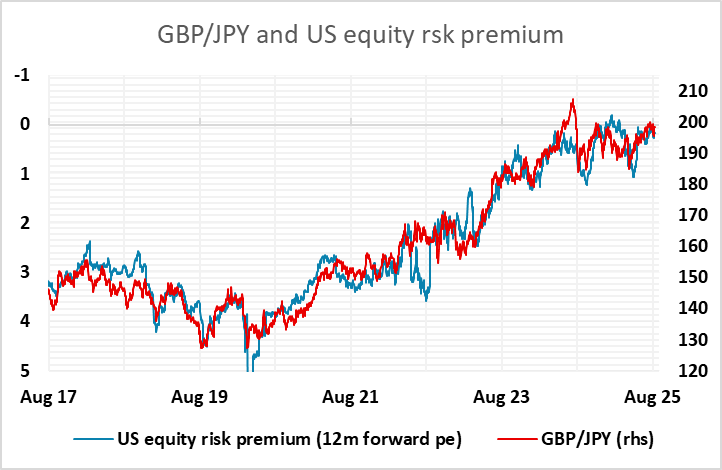

The FX consequence of this was once again more weakness in the JPY, with EUR/JPY at its highest this month and GBP/JPY trading above 200 for the first time in a year. GBP/JPY continues to show the strongest and most consistent correlation of the JPY crosses with measures of the US equity risk premium, and a break to new highs in the S&P 500 would likely see this cross make further gains towards the key retracement level at 201.55. Once again though, we would stress that the current high level of equities looks unjustified by the scope for US growth at current US yields. Nominal equity risk premia remain close to the 23 year lows seen in January, and we continue to see substantial big picture downside risks for equities in an environment where tariffs lead to higher prices and weaker growth. For now though, the market will continue to push the boundaries, especially on a quiet data day, so we may see Tuesday’s trends extend.

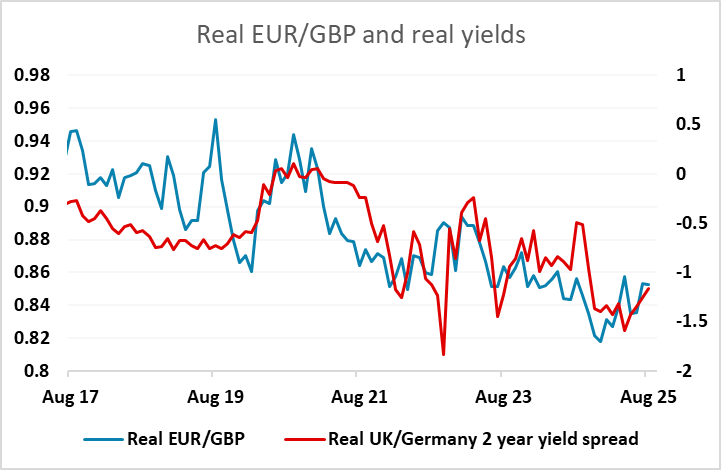

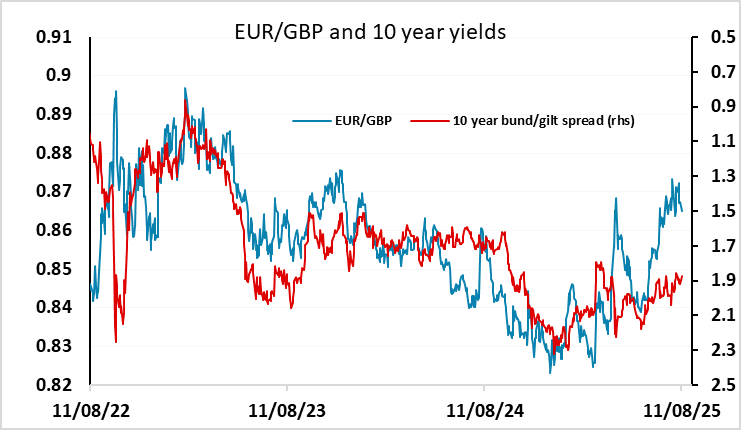

GBP strength was itself a feature on Tuesday, although the UK labour market data that triggered it was far from being strong. While the ONS data for the 3 months to June showed a larger than expected rise in employment, it also showed a rise in unemployment and a decline in total average earnings growth to 4.6% y/y. The more up to data HMRC data also showed a decline in earnings growth in July, although this was still at the relatively high level of 5.6%, and the sixth consecutive decline in payroll employment, albeit a relatively small 8k decline. GBP strength consequently looks a little overdone, but nominal yield spreads still suggest there is scope for short term GBP gains, even though real yield spreads indicate we are close to fair levels.

The risk positive tone has also helped extend CHF weakness, although this is as much due to concern about the high US tariff on Switzerland as it is to a risk positive market. EUR/CHF hit its highest level since April on Tuesday at 0.9440, and may still have further to gain in a risk positive market given the CHF’s high starting point.