FX Daily Strategy: Asia, August 15th

JPY may soften on Q2 Japanese GDP

USD could weaken into the end of the week on soft US retail sales

PPI emphasises that the market is optimistic in pricing aggressive Fed easing

GBP strength unlikely to extend far

JPY may softer on Q2 Japanese GDP

USD could weaken into the end of the week on soft US retail sales

PPI emphasises that the market is optimistic in pricing aggressive Fed easing

GBP strength unlikely to extend far

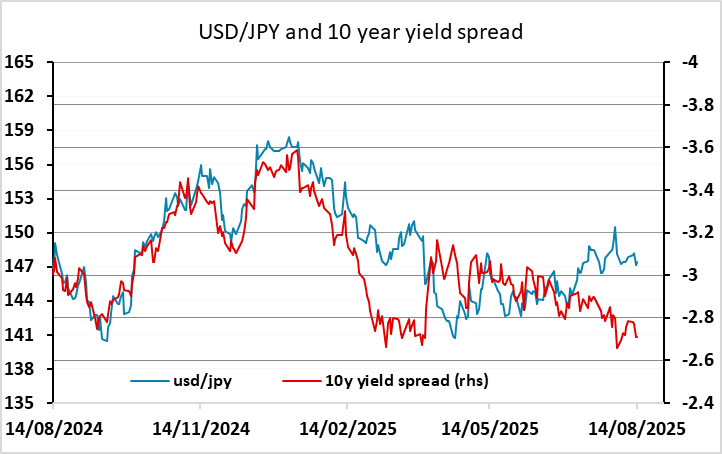

Friday starts with Japanese Q2 GDP data, where the consensus is for a 0.1% q/q gain. This makes a disappointing start to the year after a flat Q1, with the lack of rea wage growth seen as part of the problem. It is this that is holding back the BoJ from hiking rates, as US treasury secretary Bessent said they should on Thursday. There should therefore be some focus on the consumer spending component in Q2 GDP. If this is still weak, the rise in the JPY on Thursday, supported by higher Japanese yields following Bessent’s comments, could be reversed. In any case, 0.1% growth is hardly impressive, and the JPY may struggle to sustain Thursday’s recovery, especially if global equity markets continue to show resilience.

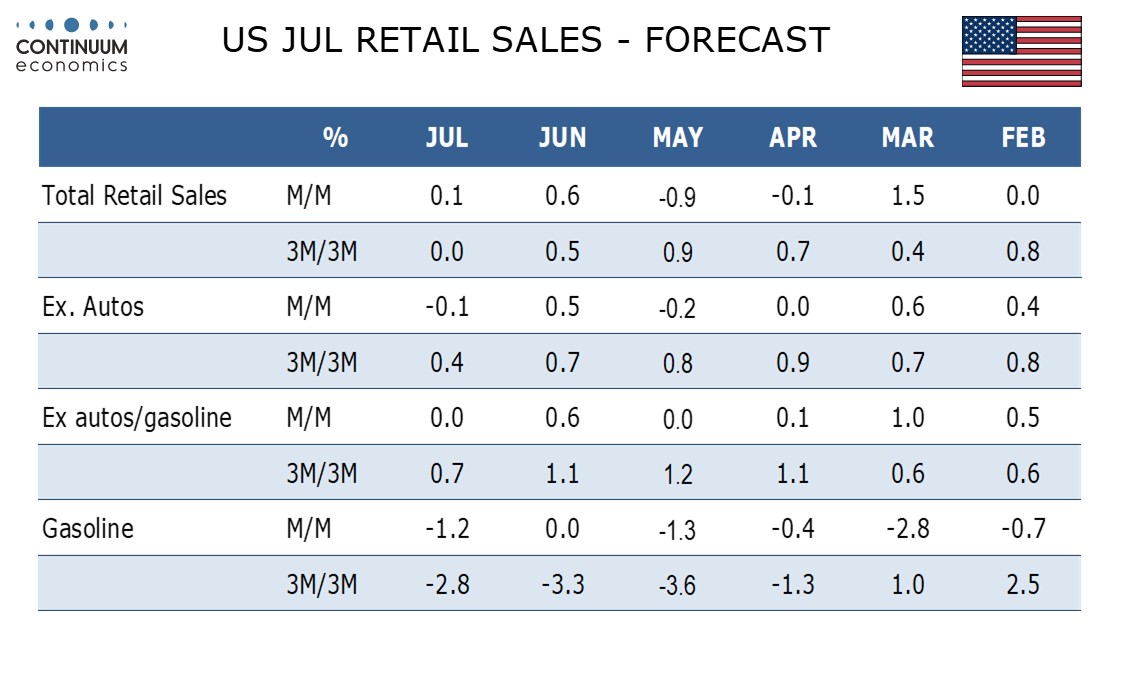

The US retail sales data is the other main release on Friday. We expect a 0.1% increase in July retail sales with a 0.1% decline ex autos and an unchanged outcome ex autos and gasoline. This would restore a slowing trend after June saw a correction from declines in April and May, with July showing the last 3 months as flat over the previous 3. It continues to be hard to justify the strength if the US equity market against this background of slowing demand, in spite of the positive recent earnings results, so we would expect this data to lead to some softening of the USD into the end of the week.

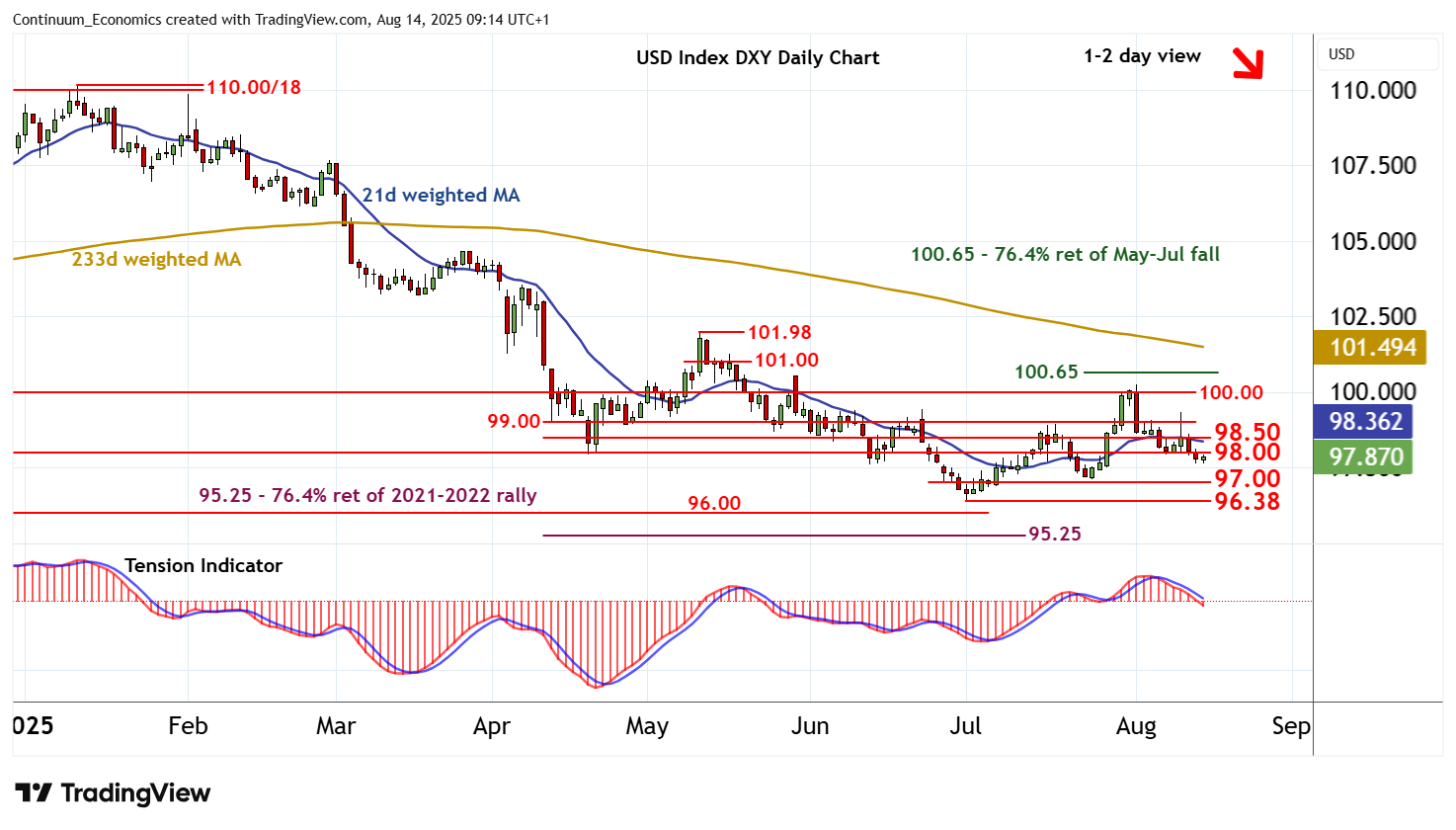

The strength of the USD on Thursday related mostly to the unexpectedly strong rise in PPI. This appeared to be largely unrelated to tariffs, as the gains came primarily in services and goods ex-food and energy rose a comparatively modest 0.4%. The data in part corrects a weak June numbers, and we wouldn’t put too much weight on it at this stage. But we do see the risks to US yields as being on the upside given the aggressive pricing of Fed cuts over the next year. If inflation doesn’t fall and the labour market doesn’t weaken significantly – and Thursday’s claims data showed no sign of significant weakness – the 125bp easing from the Fed priced into the market for the next year looks excessive, and the USD may have scope to recovery across the board. However, the labour market may yet show signs of weakening if consumer demand softens as suggested by the retail sales data, and there is still a risk that tariffs will reduce real demand as well. But for now the risks may be to the USD upside.

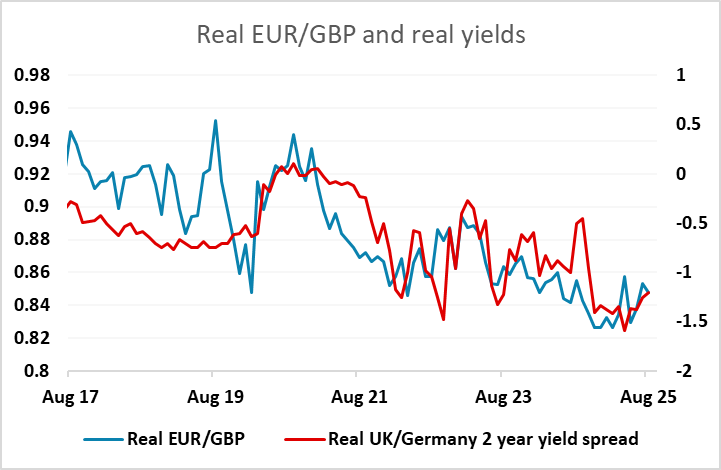

In Europe, GBP was the best performer on Thursday after a stronger than expected Q2 GDP rise of 0.3%. the 1% gain in GDP in H1 is above expectations, but projections are still weak going forward so that there is expected to be a revenue raising Budget in October, which is likely to weigh on growth. While GBP has gained some support from the latest data, in the longer run we are likely to see a gradual convergence in short term real rates with the Eurozone, and this suggests there is very limited downside for EUR/GBP from here.